OvalX UK Review 2024

OvalX, which was previously known as ETX Capital is an FCA regulated forex and CFD broker in the UK. They offer CFD trading and spread betting services in the UK on more than 5000 instruments. Check all the pros and cons of OvalX before opening your account.

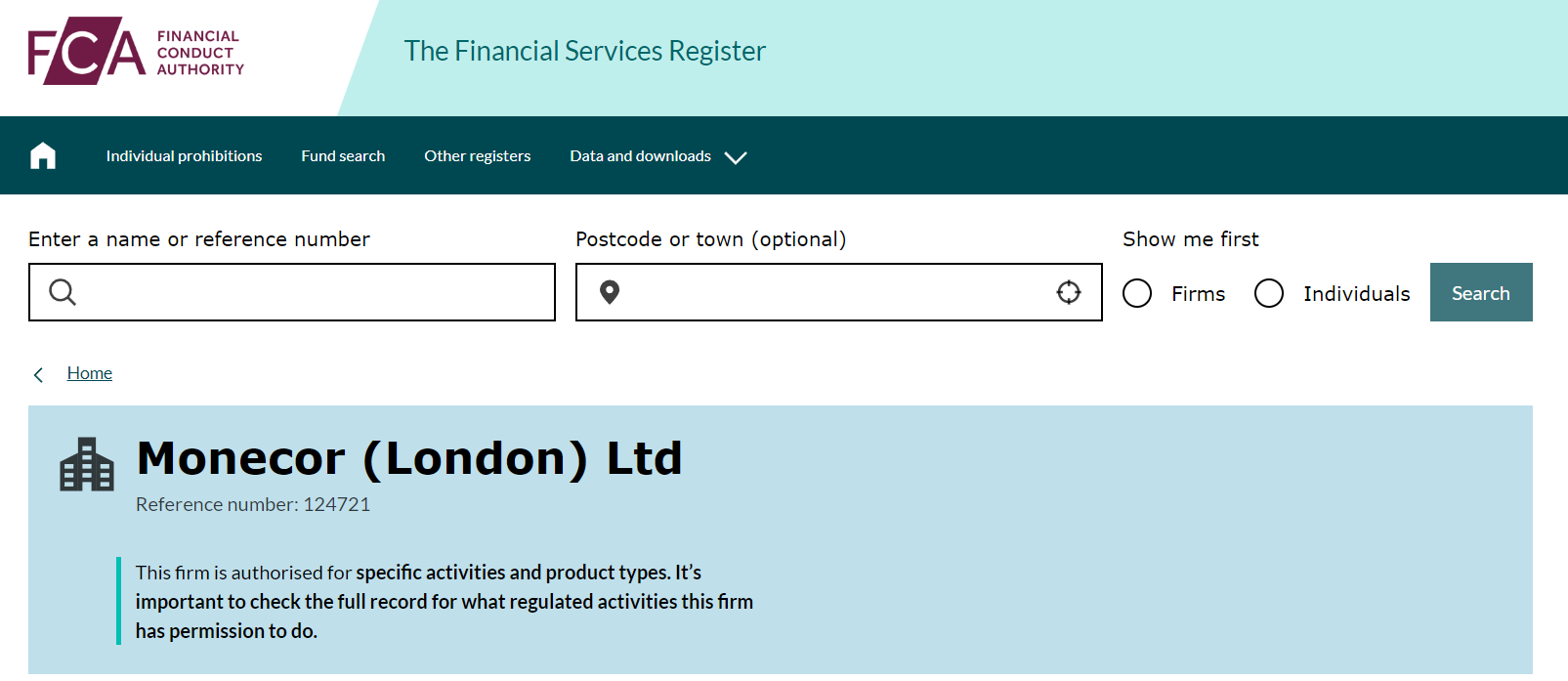

ETX Capital is an FCA-regulated forex and CFD broker registered by the name Monecor Ltd. On 28th May 2022, ETX Capital changed its name to OvalX. OvalX is a UK-based broker that offers forex and CFD trading services in the UK under FCA regulation.

It must be noted that OvalX, previously known as ETX Capital have discontinued their services on 6th September 2023. They have partnered with capital.com and the accounts at OvalX have been shifted to capital.com.

OvalX allows opening an account with GBP as the base currency and offers good quality customer support services in the UK. They support a proprietary trading platform apart from the MT4 platform.

We have reviewed every component in detail of OvalX, previously known as ETX Capital. This review has been done explicitly for clients residing in the UK. We have reviewed OvalX registered at FCA by the name Monecor (London) Ltd.

OvalX UK Pros

- OvalX is regulated and authorized by FCA in the UK

- No non-trading charges exist

- Free deposits and withdrawals through local bank transfer

- No trading commission

- Local phone number available for customer support

- GBP can be Chosen as the base currency of the account

- Multiple trading platforms available

OvalX UK Cons

- Apart from bank transfer and Credit/Debit cards, no other method is available for deposits and withdrawals

- The spreads with the MT4 Trading Platform are higher than OvalX Platform

Table of Content

OvalX UK Summary

| Broker Name | Monecor (London) Ltd |

| Website | www.ovalx.com |

| Regulation | FCA, FSCA, CySEC |

| Year of Establishment | 1995 |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4, OvalX |

| Trading Instruments | 4000+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

OvalX Safety and Regulation

A forex broker can be considered safe if it is regulated by the top-tier financial regulatory authority in the concerned jurisdiction. Following are the regulatory authorities that have authorized and regulated OvalX globally.

- Financial Conduct Authority (FCA)

OvalX is regulated by the FCA of the UK since 2001. Monecor (London) Ltd is the registered legal entity authorized and regulated by the FCA of the UK under license number 124721.

The current trading name of Monecor (London) Ltd is OvalX. The firm has also operated under the trading names Oval, Oval Money, ETX, ETX Capital, and ETX Group.

FCA is a top-tier financial regulatory authority in the jurisdiction of the United Kingdom. Clients registered under FCA are protected by up to GBP 85,000 in case of an unsettled dispute between broker and client.

OvalX can be considered safe for clients residing in the UK due to FCA regulations since 2001. It has been regulated by FCA for more than 20 years now and we couldn’t find any registered dispute against the broker on the FCA website.

We also found 7 cloned firms in the UK that are using the regulation details of Monecor (London) Ltd as their own. Traders must ensure to only open their account at www.ovalx.com.

- Financial Sector Conduct Authority (FSCA)

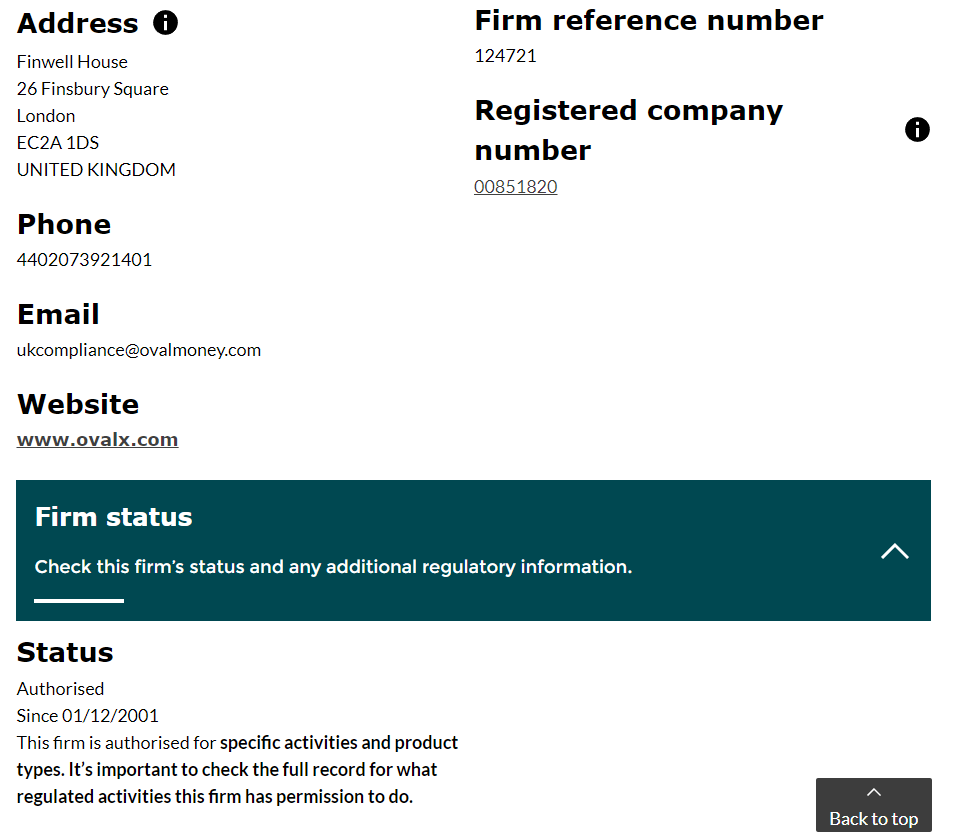

OvalX is regulated by the FSCA of South Africa since July 2021. Monecor (London) Ltd is the registered legal entity of OvalX authorized and regulated by FSCA of South Africa. The FSCA registered entity of OvalX is a privately held entity with FSP number 50246 and registration number 00851820.

The broker is allowed to offer derivative instruments for leveraged trading under FSCA regulation. FSCA is a top-tier regulatory authority in South Africa. Clients residing in the UK are not registered under FSCA regulation but it increases the trust factor of OvalX.

- Cyprus Securities and Exchange Commission (CySEC)

CySEC is a financial regulatory authority in the island nation of Cyprus in the European Union. OvalX is regulated by CySEC with the legal entity Monecor Europe Limited. Clients residing in the European Union are registered under CySEC regulation. These clients are protected by up to GBP 20,000

OvalX is a well-regulated broker that offers spread betting and CFD trading services in the UK under FCA regulation. The legal entity Monecor (London) Ltd was incorporated in 1995 and acquired FCA regulation in 2001. It is among the oldest CFD brokers in the UK.

OvalX Fees

OvalX has a spread-based pricing structure as they do not incur trading commissions on any account configuration. The account type is single but the spreads depend on the trading platform chosen by the traders.

We have thoroughly reviewed the complete pricing structure at OvalX in the UK. We have separately reviewed trading and non-trading fee for easier comparison.

Trading Fees

This includes the fee that is charged while executing trade orders. As OvalX does not charge any trading commission. Spreads and overnight charges are the only two components of trading fees at ETX Capital.

Spread

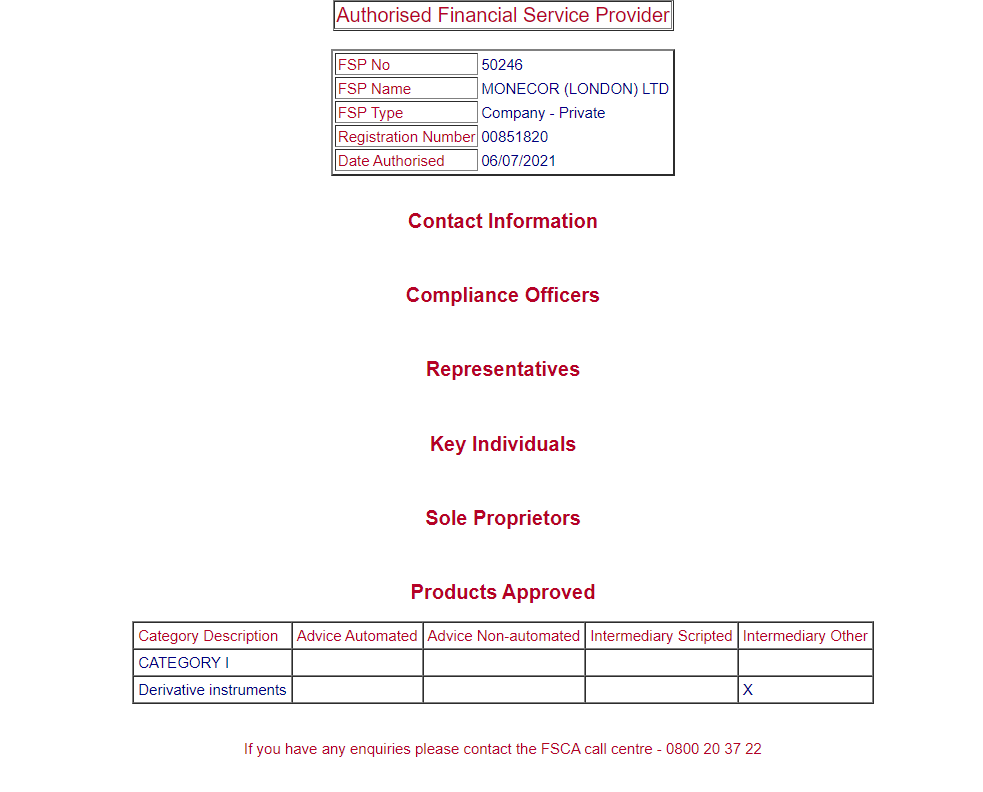

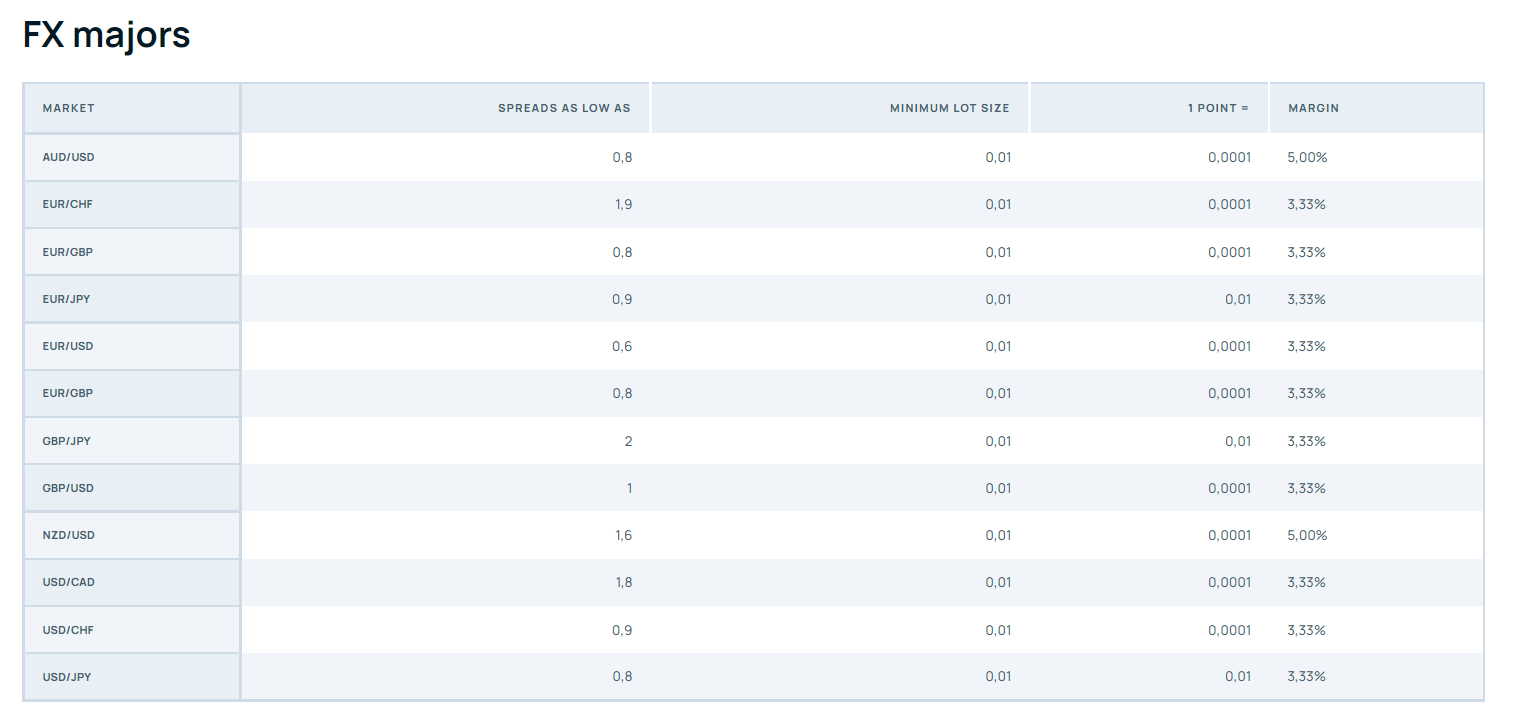

Spreads at OvalX are the same for CFD trading and spread betting. However, choosing a different trading platform can change the spread to a great extent. The spreads for the MT4 platform at OvalX start from 0.8 pips while the same with the OvalX proprietary platform is 0.6 pips.

All the spreads at OvalX are variable and depend on the market conditions and liquidity in the market.

The table below compares the spread with MT4 and OValX platforms on most traded instruments at OvalX.

| Trading Instrument | OvalX | FXTM | eToro | CMC Markets | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 0.6 | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 1 | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 0.8 | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 1.2 | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 1.3 | 2.5 | 1.7 | 1.3 | 1.07 |

The spreads with the OvalX proprietary trading platform are much lesser than that with the MT4 platform. Traders can save a lot on trading fees by choosing the proprietary trading platform instead of MT4.

Overnight Charges: The overnight fee at OvalX is slightly higher than average among FCA-regulated brokers in the UK. Apart from the interbank market ‘tom-next’ rates, a standard fee of 1.35% per annum is incurred at OvalX. For positions kept open at the end of each Wednesday, the swap fee of three days will be incurred.

Trading Commission: Most brokers charge trading commissions with low spreads. However, no such commission is incurred with any account configuration at OvalX.

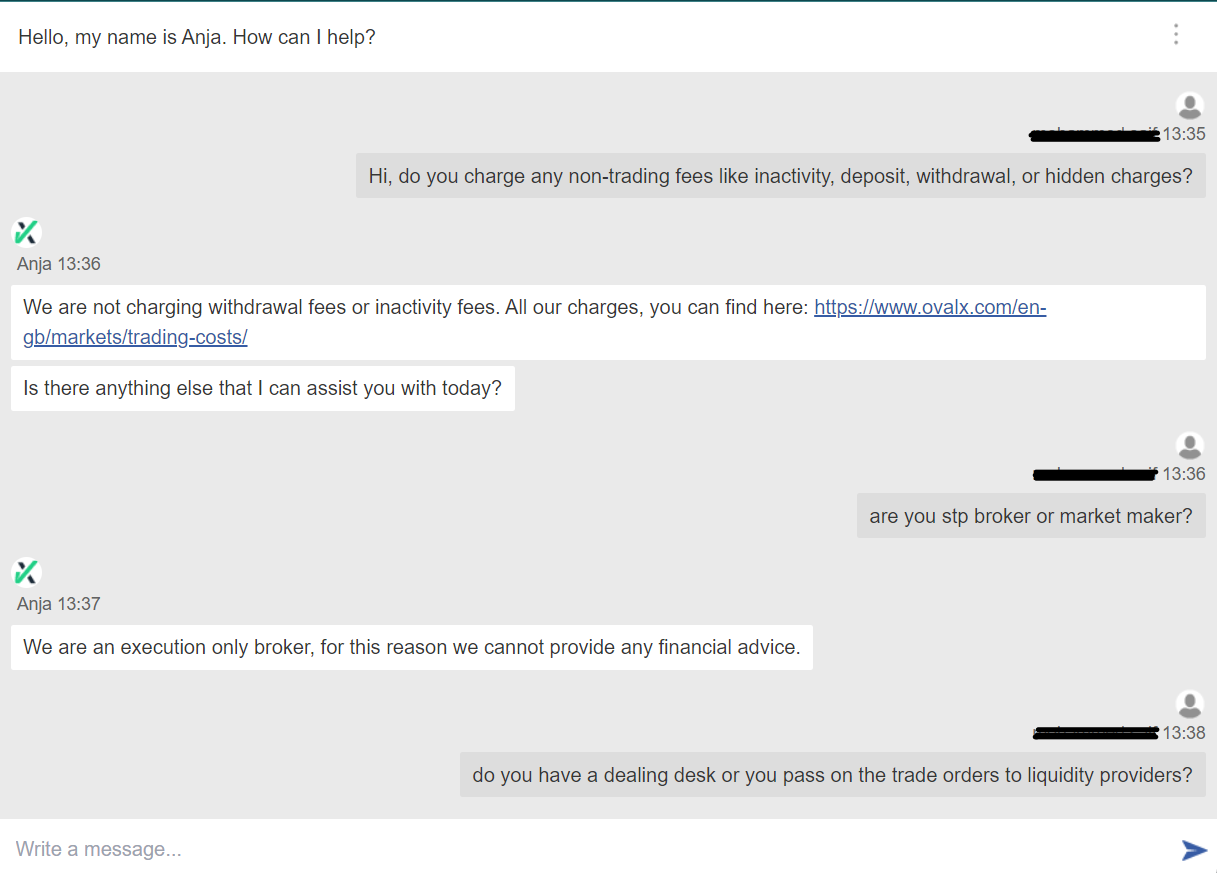

NonTrading Fees

Non-trading fee includes the charges incurred without placing trade orders. Most brokers incur deposit/withdrawal fees, inactivity fees, currency conversion fees, and other charges as non-trading fees.

However, no such charges are incurred at OvalX in the UK. Deposits and withdrawals are free and no inactivity charges are incurred.

Compared to other FCA-regulated forex brokers, OvalX is cost-effective and overall trading and non-trading charges are low. No non-trading fee exists while the spreads with the OvalX trading platform are lower than many other FCA-regulated brokers in the UK.

OvalX Account Types

At OvalX, there are no choices of account types with different features and pricing structures. However, the single available account can be configured according to the traders.

GBP, USD, and EUR are the three choices for base account currency. Traders can open spread betting as well as CFD trading account with GBP as the base currency. This is advantageous for the clients in the UK as no currency conversion is required if the account currency, as well as deposit currency, are the same.

OvalX offers two trading platforms namely OvalX and MetaTrader 4. As discussed under the Fees section, the spreads with both trading platforms are different. The OvalX platform is available for web and mobile devices. It cannot be downloaded on desktop devices. The MT4 platform can be used either through the web, mobile, or desktop devices.

How to Open Account at ETX Capital or OvalX?

The account opening process at OvalX is simple and can be completed online within a few minutes. Following are the steps to open an account at OvalX in the UK.

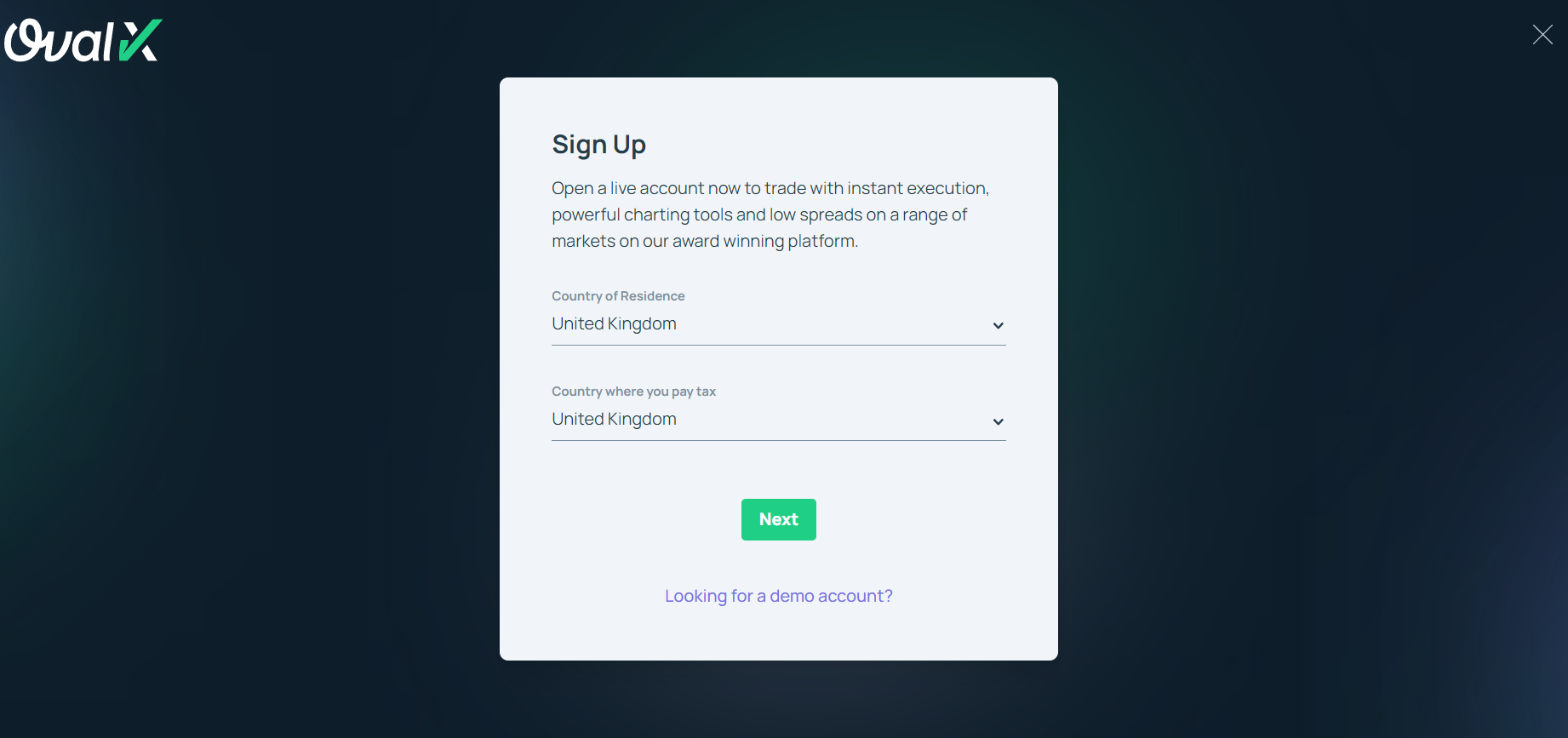

Step 1

To open a live or demo trading account at OvalX, clients need to visit the official website of OvalX and click on the open account tab. In the first step, traders need to select their country of residence and the country where they pay their taxes.

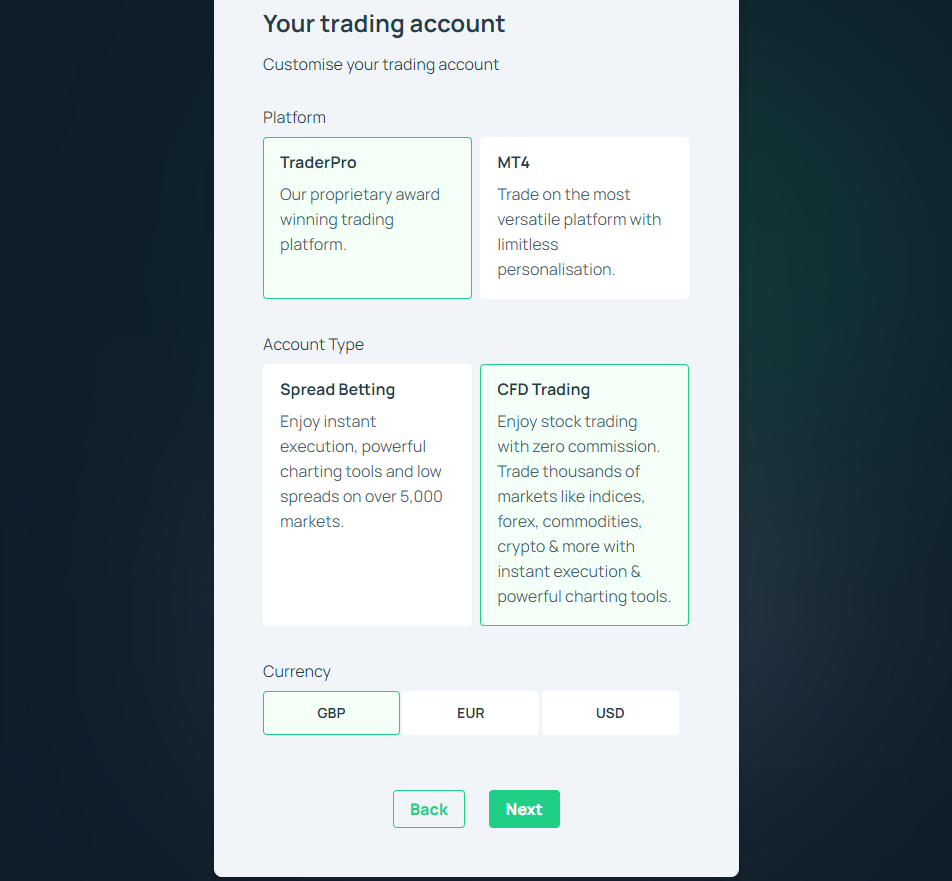

Step 2

In the next step, traders need to configure the account by making 3 choices. The first choice is between trading platforms. OvalX TraderPro and MT4 are the two choices for trading platforms.

Traders also need to select between the Spread betting account and the CFD Trading account at this step. The base account currency also needs to be chosen at this step. GBP, EUR, and USD are the available choices for base account currency at OvalX in the UK.

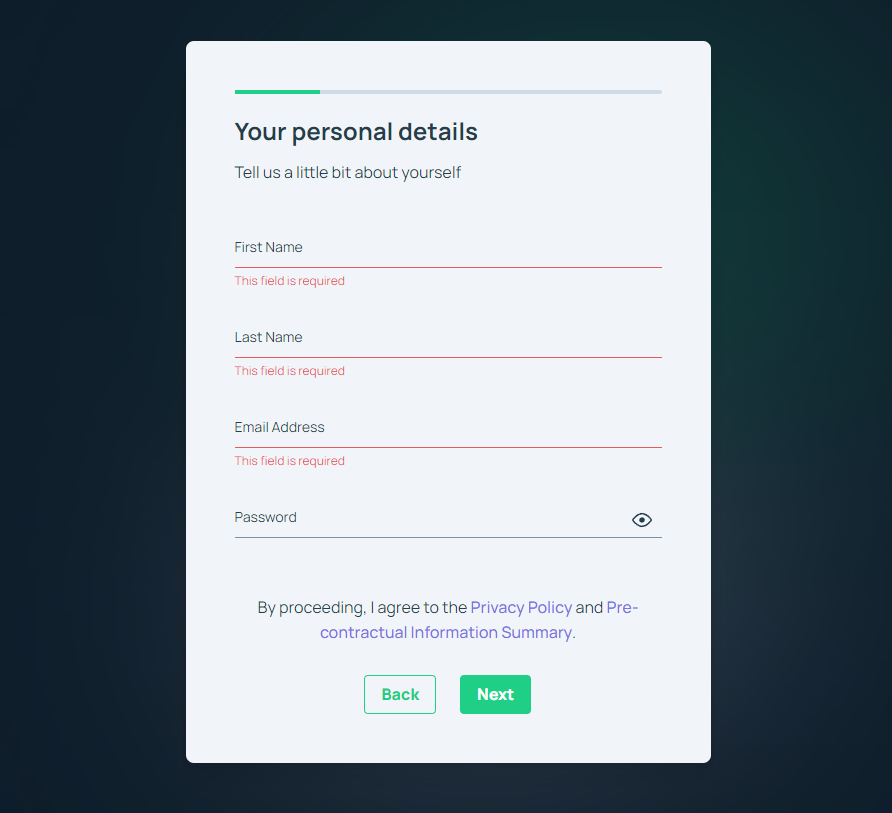

Step 3

In the next step, traders need to enter their basic details like name, email, and address and choose a password to log in.

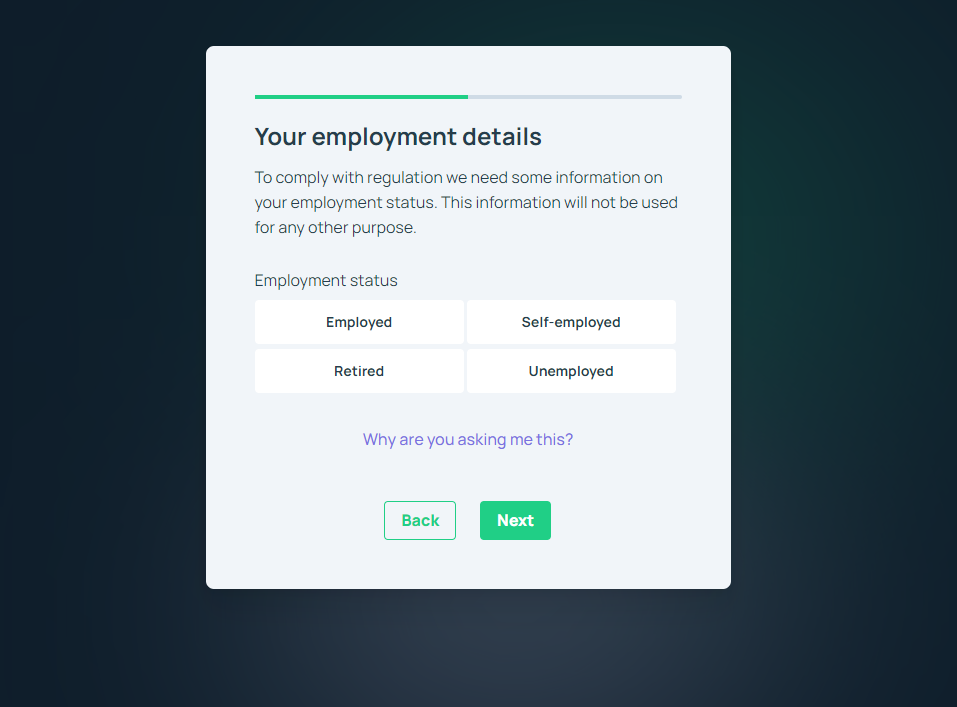

Step 4

Clients also need to provide employment details and answer a few basic questions associated with CFD trading and spread betting. OvalX does this only to know how much the trader knows about the capital markets.

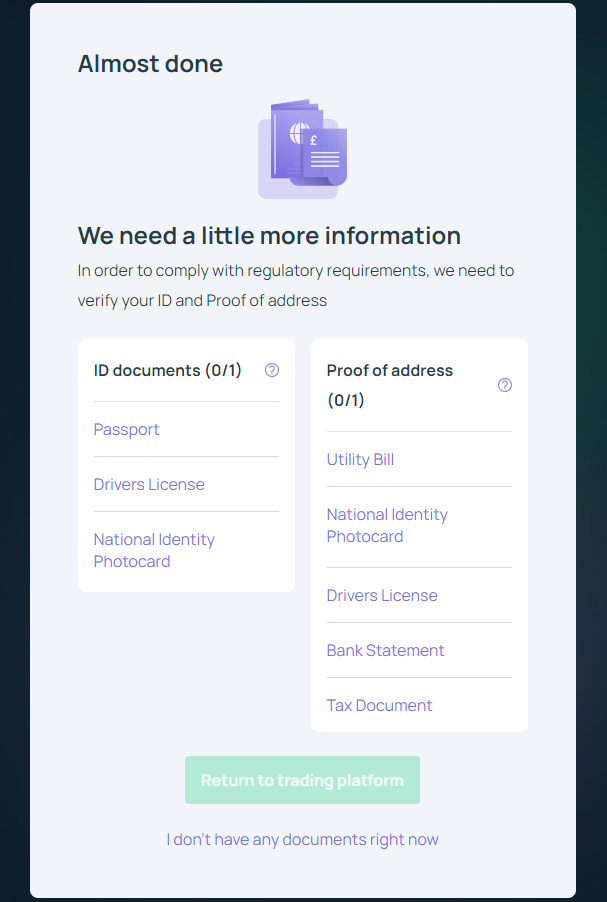

Step 5

In the next step, traders need to submit soft copies of their documents for identity and address proof. Passports, driving licenses, national identity photocard, utility bills, bank statements, and tax documents can be submitted to complete this step.

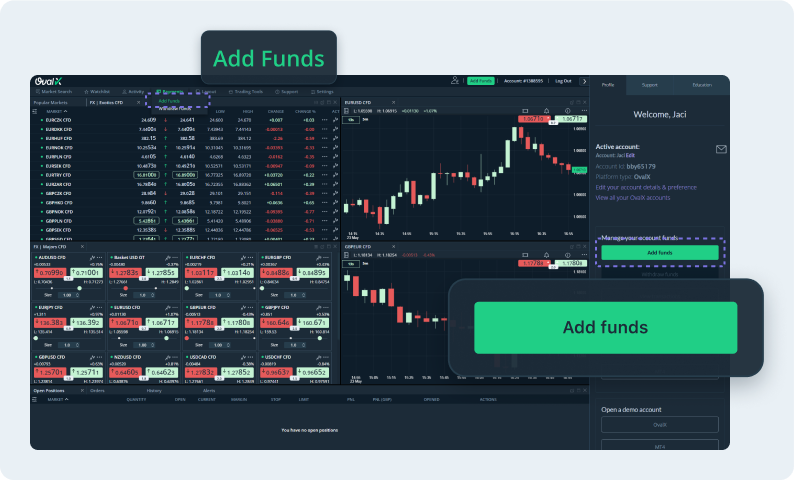

Step 6

The last step is to make a deposit. Once the deposits are reflected in the account balance, the trading positions can be opened on the available instrument through the trading platform.

To make the most out of CFD trading and spread betting, it is better to learn about trading strategies, price movements, and trading terminologies. It is always better to start with a demo account and gain experience by trading with virtual currency before opening a live account.

OvalX Deposits and Withdrawals

OvalX Deposit/Withdrwal Pros

- No Deposit or Withdrawal Fees: OvalX doesn’t impose any charges for depositing or withdrawing funds, which enhances cost efficiency for traders.

- Simple and Convenient: The processes for both deposits and withdrawals are designed to be straightforward and user-friendly, facilitating a hassle-free financial transaction experience.

- Local Bank Transfer Supported:OvalX supports deposits and withdrawals through local bank accounts in the UK.

OvalX Deposit/Withdrawal Cons

- Limited Payment Methods: The options available for deposits and withdrawals at OvalX are somewhat restricted, mainly to local bank transfers and credit/debit cards, which might not cater to all users’ preferences.

- KYC Verification Requirement: There’s a mandatory ‘Know Your Customer’ verification process for all clients, which is essential for compliance but could potentially delay the initial transactions for new clients.

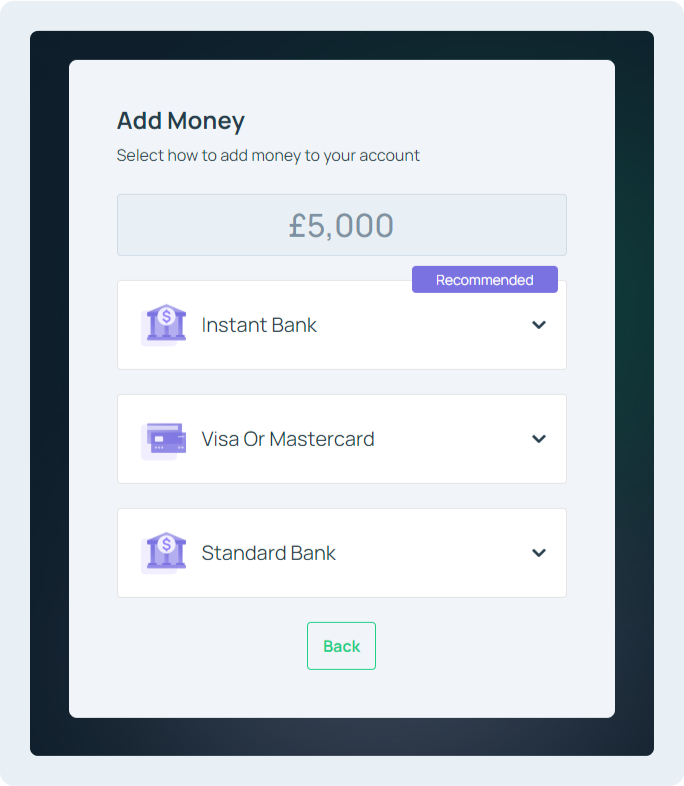

The deposits and withdrawals at OvalX are fast and convenient through local bank transfers. However, only 2 options are available currently at OvalX for deposit and withdrawal.

No deposit or withdrawal fee is incurred from traders at OvalX. The banks processing the payment may charge a third-party fees. The following are the two methods to deposit and withdraw at OvalX in the UK.

Local Bank Transfer

Clients residing in the UK can transfer the desired deposit amount to the bank account of OvalX. The minimum deposit amount is $100 or £100. Traders depositing through bank transfer need to manually enter the bank details of OvalX. They need to make sure that their account number and user ID are mentioned in the reference of payment. This will process the deposit faster.

The bank transfer may take 2-24 hours to process and reflect in the account balance. Withdrawals will only be made through the bank account used for making the deposit. Traders also need to ensure that the bank account is registered with the same name as provided to OvalX for account opening.

Credit/Debit Cards

Credit or debit cards can also be used to deposit and withdraw at OvalX. The card transaction is faster and more convenient for traders in the UK. The deposits through cards can be made through trading platforms.

The minimum deposit and withdrawal amount are 100 units of the base currency. For the first deposit, traders need to enter details of the card through the ‘add a card’ tab. Subsequent deposits can be made faster through the saved cards as the details need not be entered every time.

According to our analysis and comparison, the minimum deposit amount at OvalX is high. The number of available methods to transact is also less. Most FCA-regulated brokers in the UK support e-wallets, cryptocurrencies, and various other methods to deposit and withdraw. Bank transfers and cards are the only available methods to deposit and withdraw at OvalX in the UK.

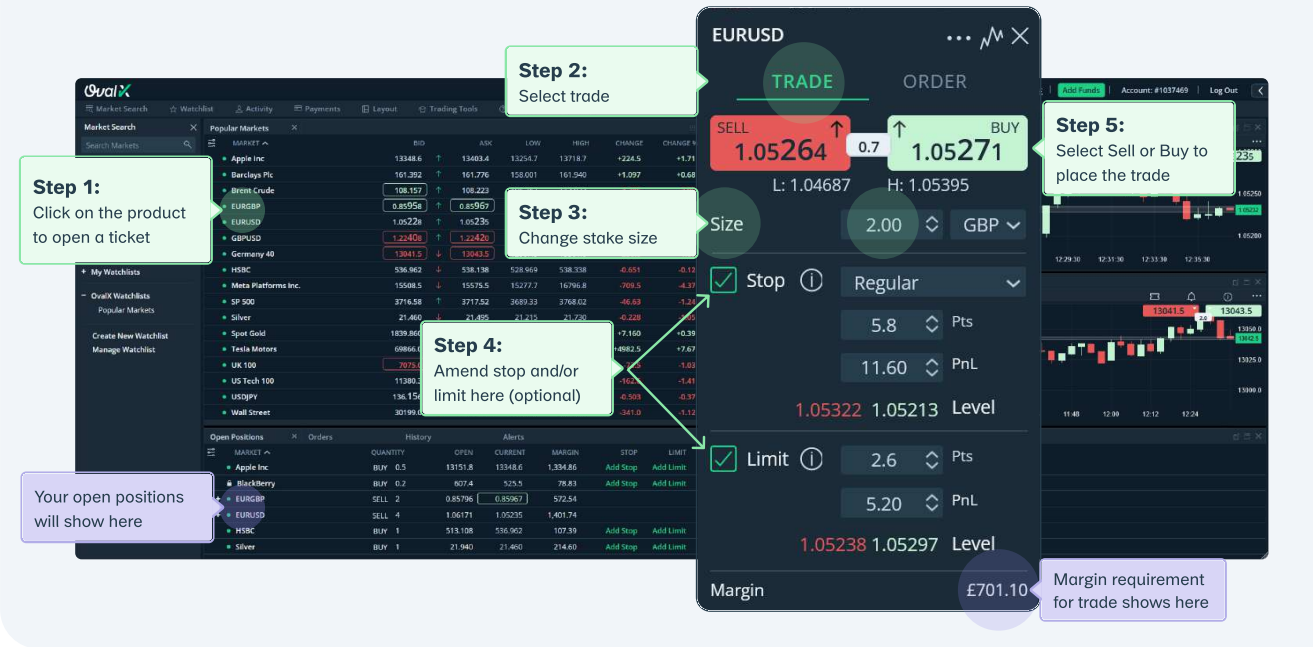

OvalX Trading Platform

OvalX offers 2 trading platforms namely Ovalx and MT4 for desktop, mobile, and tablet devices. Both platforms can also be used through web browsers. The OValX proprietary trading platform is a user-friendly platform with a modern-looking interface. The mobile trading application offers useful features to allow trading on the go.

The MT4 is the most widely used trading platform developed by MetaQuotes Software in 2005. It is among the oldest forex and CFD trading platform that is still used by a large number of traders. It has a simple interface that looks like windows 98 but it is good compatibility with all types of devices. The mobile application of MT4 has lesser features compared to OvalX proprietary platform but can still be very useful for traders.

OvalX Customer Support

The customer support service at OvalX is good and is available through multiple methods. Following are the methods to connect with the customer support services at OvalX in the UK.

- Live Chat

The live chat support is fast as it takes less than a minute to connect with the executives. We tried connecting them through a live chat window multiple times to check their services. We were connected to the staff within a minute. The response to our random queries was fairly relevant.

Live chat support is also available through the Facebook messenger app on the web, mobile, and desktop devices. The live chat support at OvalX is available 24/5 through live chat.

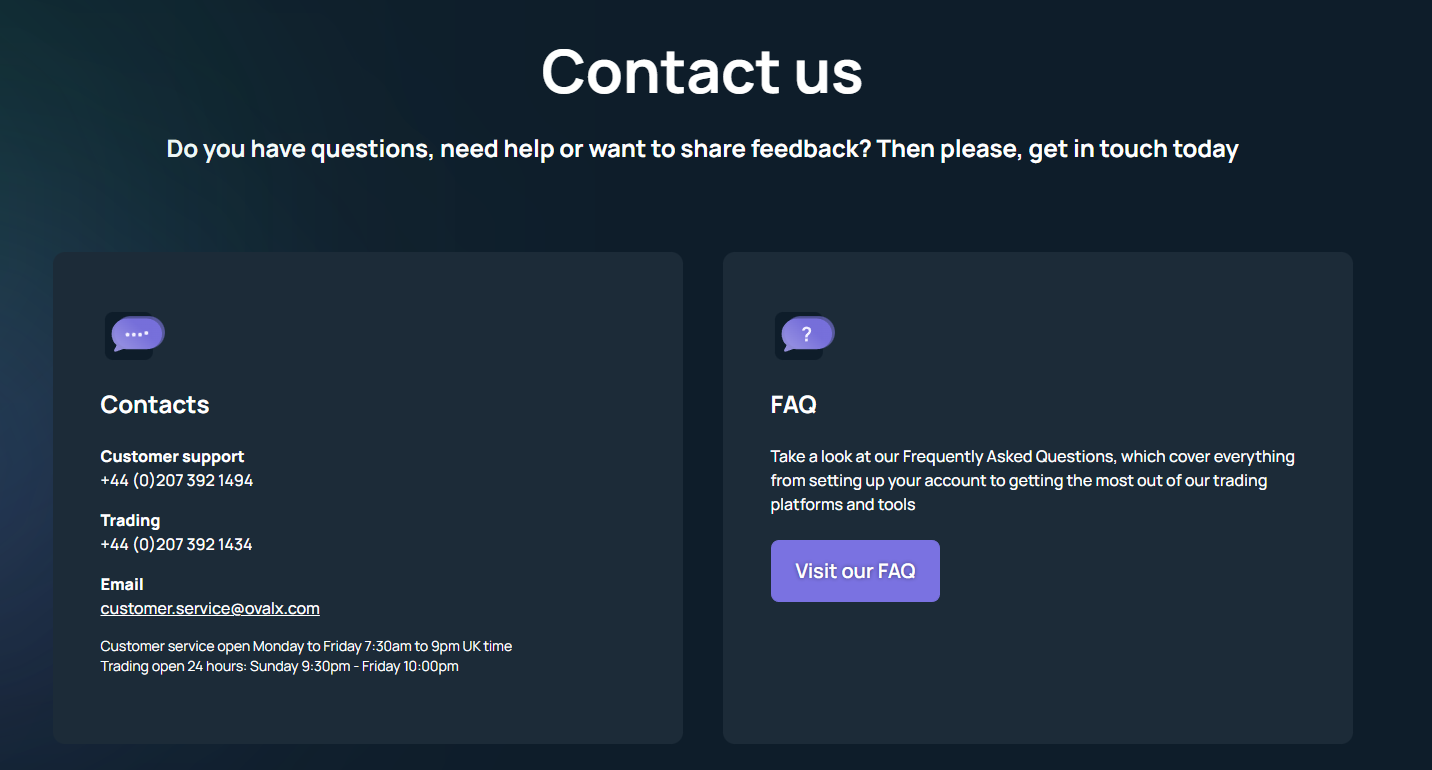

- Email

Queries can also be raised through email if traders require written proof or require a document. The email support services are available through [email protected] 24 hours from Monday to Friday. - Local Phone Support

Two different local phone numbers are available in the UK to connect with the executives at OvalX. Customer support services can be reached at +44 (0)207 392 1494 in the UK. These numbers are available from 7:30 am to 9 pm UK time.

Clients can also place trade orders by phone +44 (0)207 392 1434 from Sunday 9:30pm to Friday 10:00pm UK Time. Calls must be made through registered phone numbers with the account.

Overall, the support services are excellent as executives are helpful and fast. The availability of local phone numbers for customer support and trading is a major advantage for clients residing in the UK.

Available Instruments

OvalX offers CFD trading and spread betting services on more than 5000 instruments. It must be noted that CFD trading does not include the actual buying and selling of the underlying asset. Only the price difference of the instrument between opening and closing of the position is speculated to book profits and losses.

In Spread betting, a preferred amount is placed as a bet on financial instruments. A change of each pip multiplies the profits and losses.

As per the regulatory compliance of FCA, the maximum leverage that can be offered to retail traders is 1:400. The profits made on CFD trading are taxable but profits on spread betting are tax-free.

Following are the available instruments at OvalX for CFD trading and Spread betting.

- 47 Currency Pairs: OvalX offers CFD trading and spread betting on a total of 47currency pairs. The maximum leverage for forex pairs as per FCA regulation is 1:30.

- 12 Indices: Stock indices of major stock markets in the world are available to trade at OvalX with max leverage of 1:10.

- 4000+ Stocks: Shares can be traded as CFD without trading commission at OvalX. More than 4000 stocks from UK, US, Eurozone and 8 other countries.

- 12 crypto: Cryptocurrencies with high trading volume can be traded as CFD at OvalX with a maximum leverage of 1:2.

- 20 Commodities: 4 metals, 4 energies, and 12 soft commodities can be traded at OvalX with a maximum leverage of 1:10 (except gold i.e. 1:20).

- 9 Bonds: Majorly traded bonds in the US and Europe are available to trade as CFD at OvalX with a maximum leverage of 1:5.

Do We Recommend OvalX?

Yes, OvalX which was previously known as ETX Capital, is an FCA-regulated CFD broker and spread betting service provider. They support GBP as the base currency of the account and also have local phone support.

Clients can choose between OvalX TraderPro and MT4 as a trading platforms. The spreads with the MT4 trading platform are higher than the OvalX platform. Deposits and withdrawals cannot be done through e-wallets.

OvalX UK FAQs

Is ETX Capital legit?

Yes, OvalX is an FCA regulated CFD broker in the UK. They are non-dealing desk broker that allows trading through multiple trading platforms. OvalX can be considered safe for trading in the UK.

Who owns OvalX?

OvalX is the trading name of legal entity Monecor (London) Ltd and Monecor (Europe) Ltd. It is a privately held firm that offers financial services like CFD trading and spread betting through electronic trading platforms.

Are OvalX and ETX Capital Same?

Yes, ETX Capital is now known as OvalX. The FCA-regulated CFD broker changed its trading name from ETX Capital to OvalX on 28th May 2022. The FCA registered legal name of the firm is the same i.e. Monecor (London) Ltd.