Plus500 Australia Review 2024

Plus500 is an ASIC regulated market maker in Australia. Check out all the pros and cons of choosing Plus500 in Australia before opening your account.

Plus500 is an Israel-based financial service provider that offers online trading services on CFDs. It is a well-regulated company that is also listed on the London Stock Exchange.

Plus500 is a market maker that allows trading through its proprietary trading platform. Check our honest and detailed review of Plus500 with all the pros and cons discussed.

Plus500 Australia Pros

- Plus500 is regulated by ASIC in Australia

- Plus500 is listed on London Stock Exchange and is a part of FTSE 250

- The spreads at Plus500 are lower than many other ASIC-regulated brokers

- AUD is available as base account currency

- Free local bank transfer available

- Trading platform is user-friendly

- Live chat support is available 24/7

Plus500 Australia Cons

- Inactivity fees is high

- MT4, MT5, cTrader, or any other platform is not available

- Minimum deposit amount is high $100

- Local phone support is not available in Australia

- The research and education tools at Plus500 are less than many other brokers

- Plus500 is a market maker

This review of Plus500 has been specifically done for clients residing in Australia. The Australian clients at Plus500 are registered with the legal entity Plus500AU Ltd under ASIC regulation.

Table of Content

Plus500 Australia Summary

| Broker Name | Plus500AU Pty Ltd |

| Website | www.plus500.com |

| Regulation | ASIC,FSCA,FCA |

| Year of Establishment | 2008 |

| Minimum Deposit | AUD 100 |

| Maximum Leverage | 1:30 |

| Trading Platforms | Plus500 Proprietary |

| Trading Instruments | 2000+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

Plus500 Safety and Regulation

The safety of the funds and traders’ information majorly depends on the regulation under which the clients are getting registered. Following are the regulatory authorities that have authorized Plus500 in their respective jurisdiction.

- Australian Securities and Investment Commission

The ASIC is a top-tier financial regulatory authority in the jurisdiction of Australia. Plsu500 is regulated by ASIC in Australia.

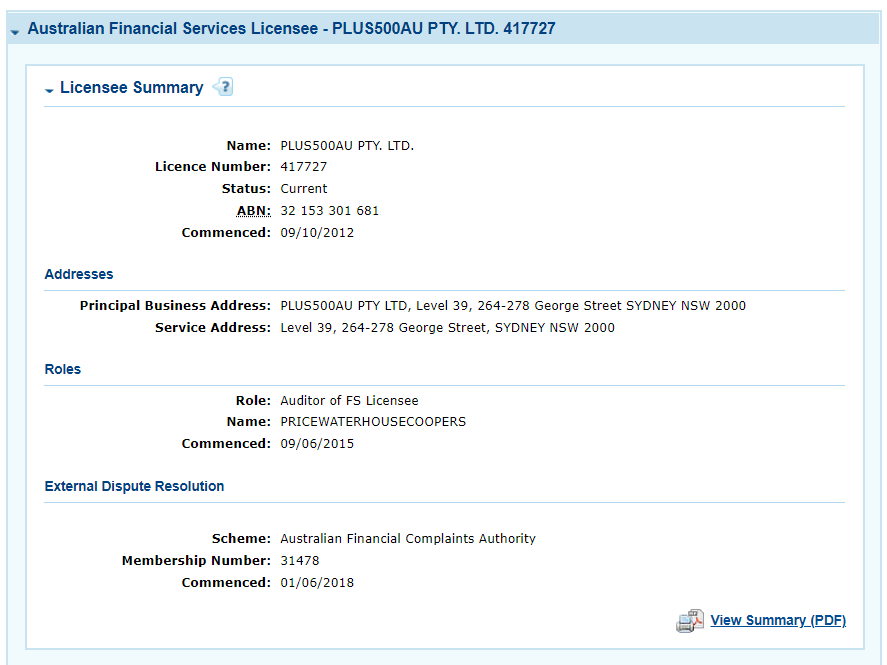

Plus500AU Pty Ltd is the legal entity registered at ASIC with AFSL number 417727. Clients residing in the Australian jurisdiction are registered under ASIC regulation. Plus500 was registered at ASIC in 2011.

The ASIC regulation makes Plus500 safe for traders in Australia. The maximum allowed leverage under ASIC regulation is 1:30 for major pairs and 1:20 for minor pairs.

- Financial Conduct Authority

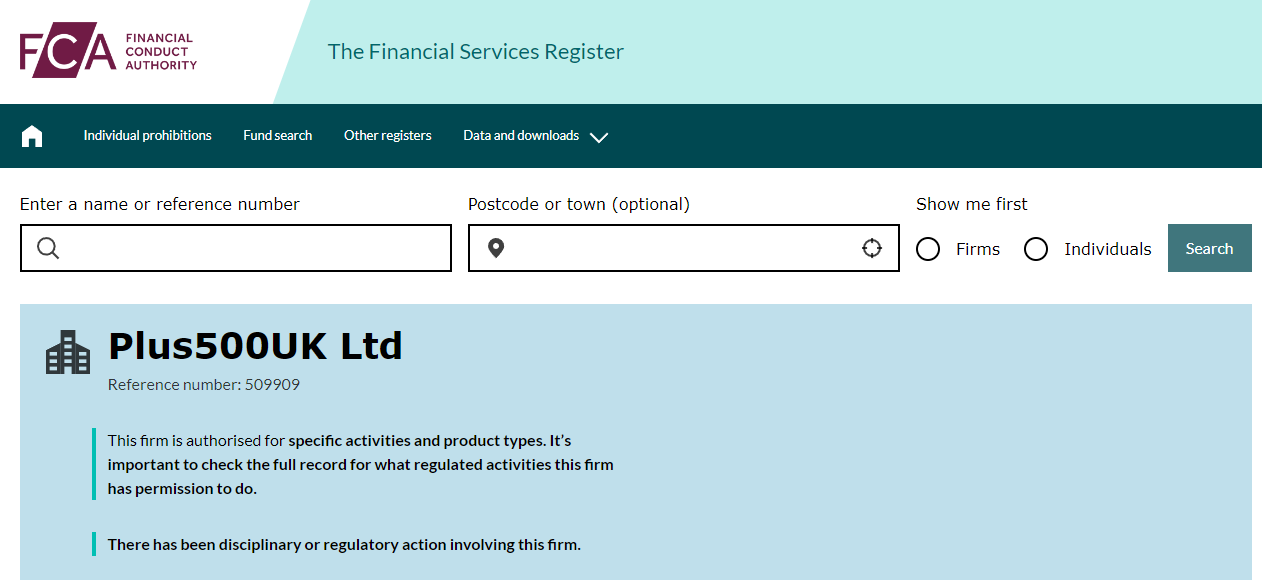

The FCA of the UK is a top-tier financial regulator in the jurisdiction of the United Kingdom. Financial services providers regulated and authorized by the FCA are considered safe to deal with in the UK.

Plus500 is regulated by the FCA with the legal entity Plus500UK Ltd under license number 509909. The license was acquired in 2010 with a registered address in London.

- Financial Sector Conduct Authority

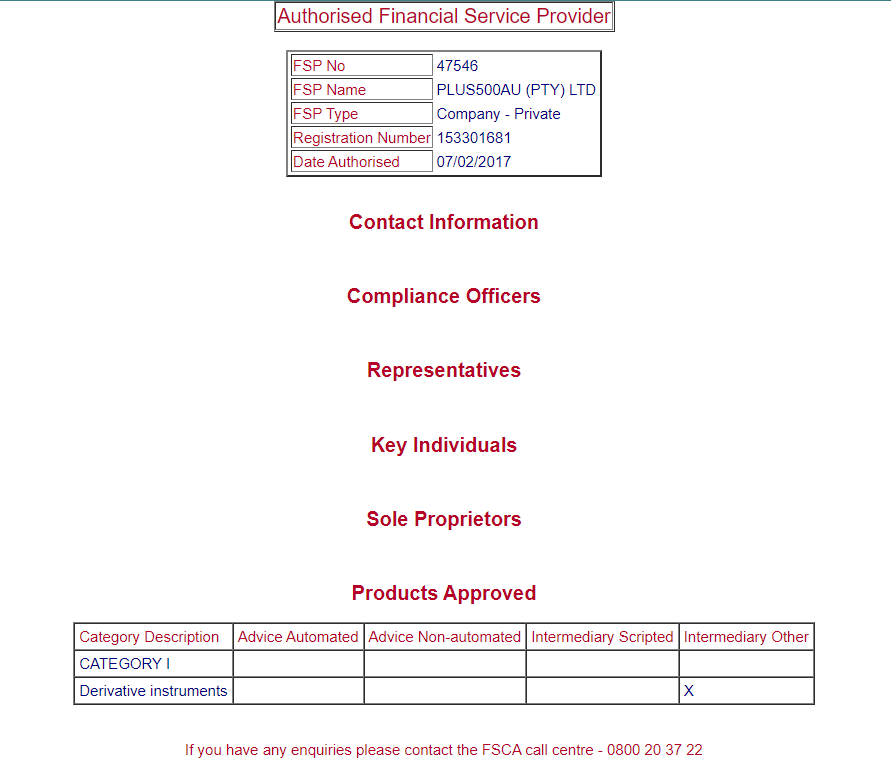

Plus500AU Pty Ltd is regulated by FSCA of South Africa. The same legal entity of Plus500 is also regulated by the ASIC and FMA of New Zealand.

Plus500 is an FSCA-regulated broker with FSP number 47546. The FSCA license allows the broker to offer derivative instruments under FSCA regulatory compliance. This license was acquired by Plus500 in 2017.

- Cyprus Securities and Exchange Commission

CySEC is an independent financial regulatory authority based in the island nation of Cyprus. The CySEC regulatory license allows financial services providers to accept clients from the European Union.

Plus500CY Ltd is regulated by CySEC under license number 250/14. Clients residing in Australia are not registered under CySEC regulation.

Apart from the top financial regulators mentioned above, Plus500 also holds a regulatory license from FMA of New Zealand (486026), FSA of Seychelles (SD039), MAS of Singapore (CMS100648-1), and FSRA of Estonia (4.1/1/18).

The regulatory licenses from the three top-tier regulatory authorities, namely FCA, ASIC, and FSCA make Plus500 fairly safe for traders in Australia.

Plus500 is a listed company on the London Stock Exchange with the ticker symbol PLUS. It is also a member of the FTSE 250 index which includes the top 250 stocks listed on the London Stock Exchange.

Plus500 is a market maker and has a dealing desk. This means that the order execution is done by Plus500 itself with no direct involvement of third-party liquidity providers. This also means that Plus500 can take the opposite side of the trading position and can earn revenue from the losses booked by the traders.

Overall, Plus500 is among the safest market makers available in Australia. They are regulated by multiple top-tier regulatory authorities globally and is also a listed company on London Stock Exchange.

Plus500 Fees

Plus500 offers a single account type and the fee structure will be the same for all types of retail traders. They are quite transparent with the charges they incur. We have reviewed all the components of trading and non-trading fees incurred by traders in Australia.

Trading Fees

This includes the charges that are incurred while trading financial instruments. There is no trading commission on any of the available financial instruments. Spreads and overnight charges are the only components of trading fees at Plus500.

- Spread

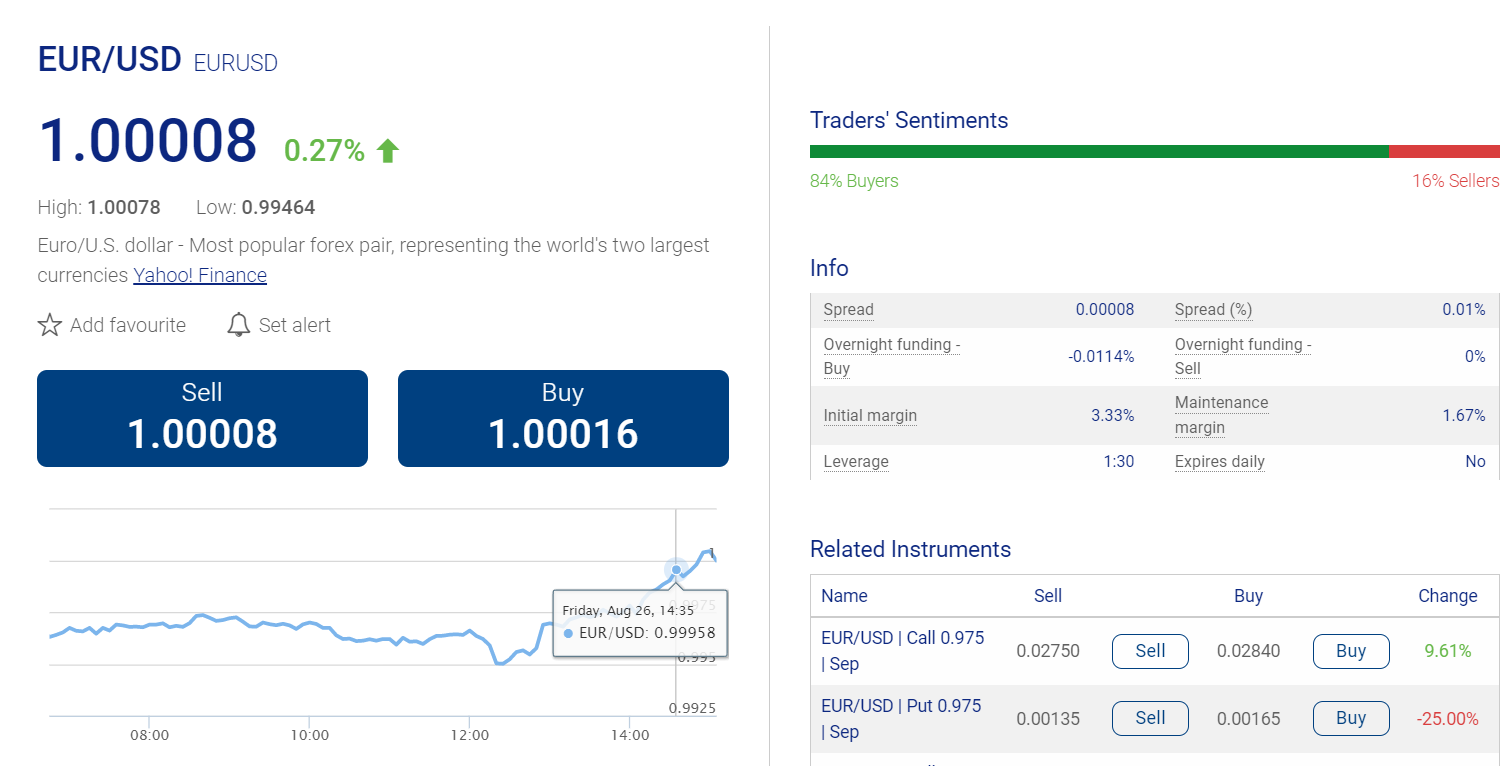

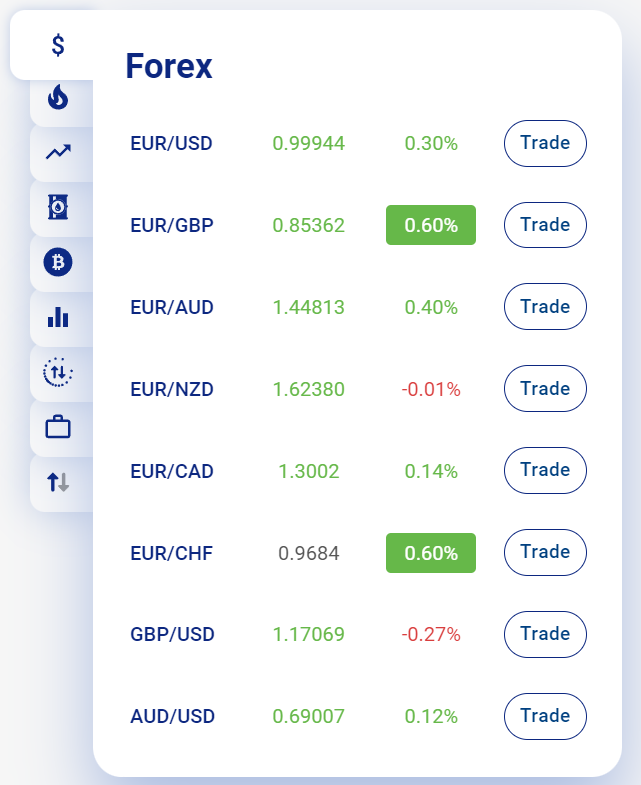

The spreads at Plus500 are lower than many other forex and CFD brokers in Australia. The spreads start from 0.6 pips. For EUR/USD currency pair, the average typical spread at Plus500 is 0.8 pips.The table below describes the average spread in pips incurred by Plus500 in Australia.

Trading Instrument Average Spread EUR/USD 0.8 EUR/GBP 1.5 Gold 0.34 US Crude Oil 0.04 US Tech 100 1.9 BTC/USD 60.53 Tesla 2.16 For a better comparison of spreads at Plus500, we have compared the average spreads charged by various other brokers in the UK. It must be noted that the spreads mentioned in the following table is with the standard account type with no trading commission involved.

Trading Instrument Plus500 FXTM eToro CMC Markets Pepperstone EUR/USD 0.8 1.9 1.1 0.70 0.77 GBP/USD 2 2 2.3 0.9 1.19 EUR/GBP 1.5 2.4 2.8 1.10 1.40 USD/JPY 1.5 2.2 1.2 0.7 0.86 USD/CAD 0.85 2.5 1.7 1.3 1.07 - Overnight Charges

Swap fees or overnight charges or rollover rates are the fees that are incurred when a leveraged position is kept open overnight.

According to our analysis and comparison with other ASIC-regulated CFD brokers, the overnight charges at Plus500 are very low. The swap fees depend on the leverage ratio chosen by the trader. For EUR/USD with a leverage of 1:30, the swap rate for the long position is -0.0114% and 0% for a short position.

Non-Trading Fees

Non-trading fees are the charges that the broker will incur from the traders on some conditions without executing trade orders.

- Inactivity Fees

Most brokers deduct money from the live trading account if no trading positions are opened for a prolonged period. The inactivity fee at Plus500 is higher than many other CFD brokers in Australia.The inactivity fee at Plus500 is 10 USD or 10 AUD (depending on the base account currency) per month if no trades are executed for 90 days. Most CFD brokers charge inactivity fees while some do not.

- Currency Conversion Fees

The currency conversion fees will be applicable if the deposit currency is different from the base account currency. If the account currency is chosen as AUD and the deposits are also made in AUD, then no currency conversion rates will be applicable. For other currencies, the deposits and withdrawals will be converted according to prevailing rates and conversion fees.

- No Deposit and Withdrawal Fees

Plus500 does not incur any deposit and withdrawal fees from traders in Australia. For all the available methods to deposit and withdraw, no commission is incurred from the broker’s side. The third-party payment issuer or bank might incur additional charges for transactions.

Overall, Plus500 is a very cost-effective broker in Australia. There are no hidden fees and they are quite transparent with the charges incurred. The spreads are major components of fees and revenue for the broker. The spreads at Plus500 are lower than the average of ASIC-regulated brokers in Australia.

Plus500 Account Specification

Plus500 offers a single account type for all types of retail traders in Australia. Professional traders can apply for professional accounts with higher leverage if they meet the criteria.

Plus500 allows opening accounts in different currencies depending on the country. For clients residing in Australia, USD, EUR, and AUD can be chosen as the base currency of the account.

The maximum leverage is 1:30 for major pairs and 1:20 for minor pairs and other CFDs. This can be increased up to 1:400 if the traders qualify to be professional traders. The following are conditions that need to be met to become eligible for a professional account at Plus500.

- Traders must own net assets worth AUD 2.5 million in capital markets.

- The gross income for the last two financial years should be at-least AUD 250,000.

- Traders must have relevant experience working in the financial sector for a minimum of 2 years.

Any one of the three above-mentioned criteria will qualify traders to open a professional account at Plus500.

How to Open Account at Plus500?

The account opening process at Plus500 is simple and can be completed within few minutes. The verification can be completed within 24 hours. Following are the steps to open an account with Plus500 in Australia.

Step 1: Email and Password

Visit the official website of Plus500 to begin the account opening process at Plus500. After clicking on the ‘Start trading’ tab, clients need to enter their email and choose a password. This will redirect you to the personal area which is also the web trading platform at Plus500.

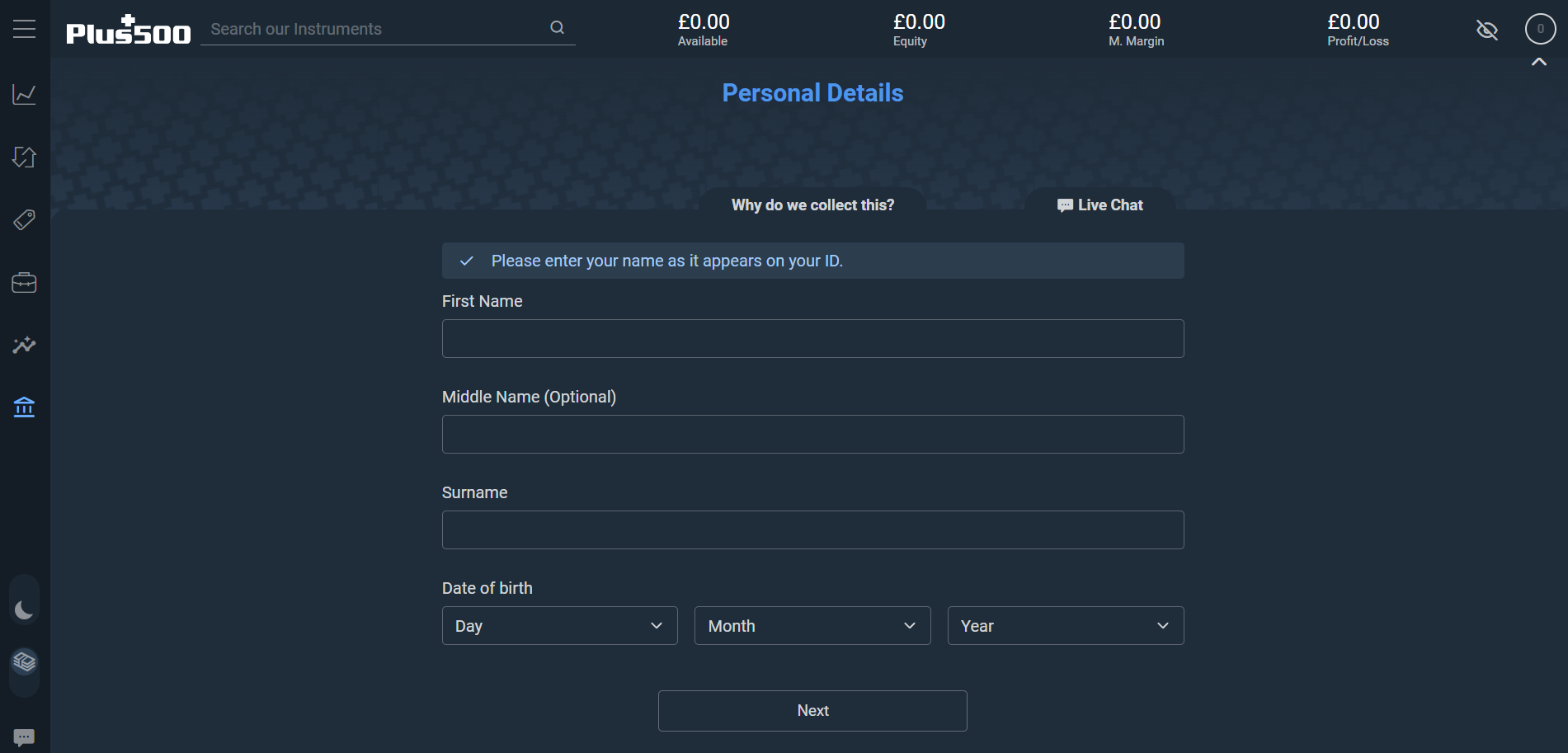

Step 2: Account Registration

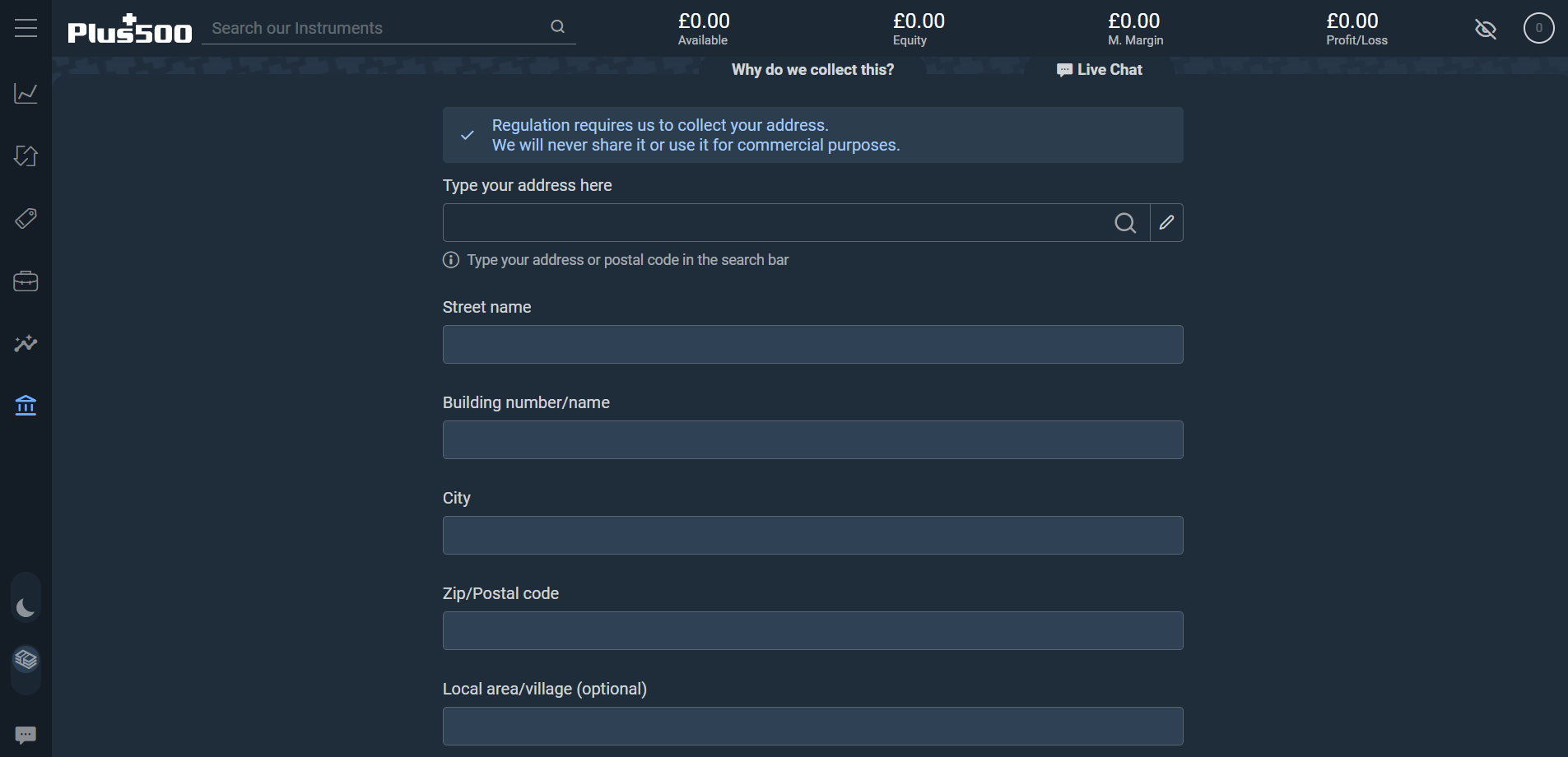

In the personal area, clients need to register themselves to begin trading. Once you click on deposit funds, you will be redirected to the account registration screen where various details are to be provided. Clients need to provide basic details like name, date of birth, country of residence, city, and postal code.

Step 3: Investment Knowledge and Personal Details

Plus500 takes a short survey of the financial knowledge of the clients to offer better services. This will include some basic questions related to leverage and trading. Clients will also need to tell about their trading experience in the capital markets. In the next step, clients will need to provide basic financial details like annual income, etc.

Step 4: Deposit Funds

After completing step 3, clients will need to deposit funds to begin trading. The available deposit methods will be visible with limits of minimum deposit. Select the amount and enter the required details to deposit funds.

Step 5: Account Verification

To open a live trading position at Plus500, the account needs to be verified. The account verification process can be completed before or after making the deposit. Clients need to separately verify their identity, address, phone number, and email.

Documents like passports and other documents need to be uploaded on the Plus500 platform to verify the account. The verification can take up to 24 hours on a business day. Clients will be notified once the account is verified successfully.

Plus500 Deposits and Withdrawals

The minimum deposit amount at Plus500 is AUD 500 in Australia. There are various accepted methods for deposit and withdrawal. To avoid money laundering, withdrawals can only be made with the methods used for deposits.

Following are the available methods for deposits and withdrawals in Australia.

- Bank Transfer: Local bank transfers can be used to deposit and withdraw at Plus500 in Australia. The minimum deposit amount for this method is AUD 500. No commission is incurred from the broker’s side but the banks may charge a commission to process the transaction.

- Debit/Credit Card: The debit or credit cards of Visa, MasterCard, and Maestro can be used to deposit and withdraw at Plus500. The minimum deposit amount for this method is AUD 100.

- E-Wallets: Apple Pay, Trustly, and Skrill can be used to deposit and withdraw at Plus500 in Australia. The minimum deposit amount is AUD 100 for each of the e-wallets. Skrill cannot be used first deposit while Apple Pay and Trustly can be used for the first deposit.

The availability of local bank transfers is a major advantage for clients residing in Australia. The minimum deposit and withdrawal amount are higher than many other ASIC-regulated brokers in Australia.

Plus500 Trading Platforms

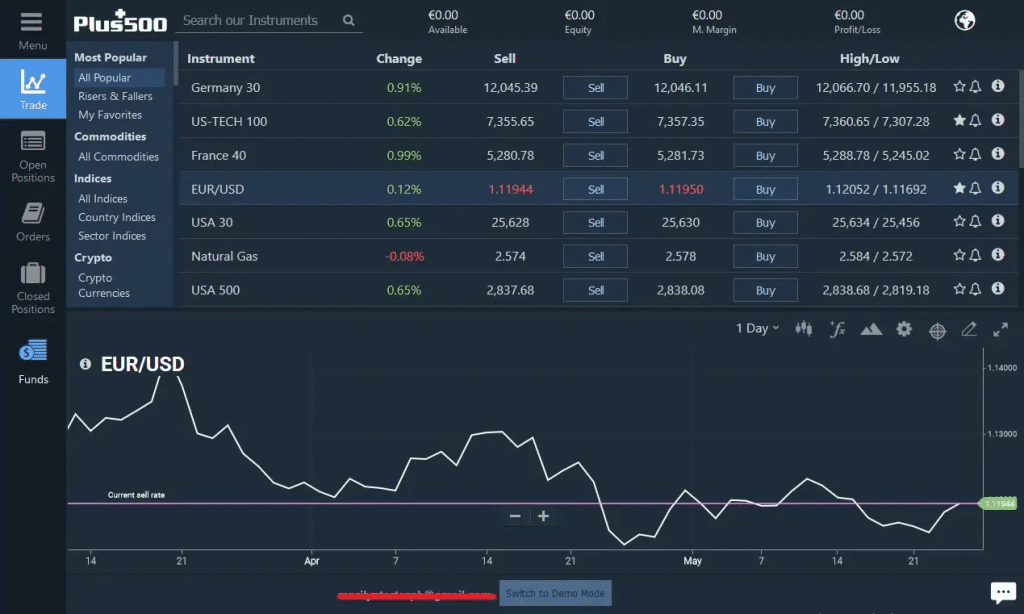

Plus500 offers a proprietary trading platform that is quite simple to use with a modern-looking interface. However, the trading platform at Plus500 is only available on the web and mobile app. It cannot be downloaded on desktop and PC.

Web Trading Platform

The web trading platform at Plus500 looks very good and is simple to use but it cannot be customized according to traders’ preferences.

The Plus500 trading platform has a secure two-step login apart from google and Facebook login. There are various indicators and patterns that can help in the analysis. The position of the charts and tabs cannot be changed according to the preference of the traders.

Plus500 web trading platform allows market, limit, stop loss, trailing stop loss, and guaranteed stop-loss orders. There will be an extra fee for the guaranteed stop loss orders but this will allow traders to close position even if there is a significant price movement beyond stop loss.

Plus500 web trading platform also offers free trading reports and portfolio analysis with clear mentions of the fees incurred. Traders can work on up to 9 different charts simultaneously.

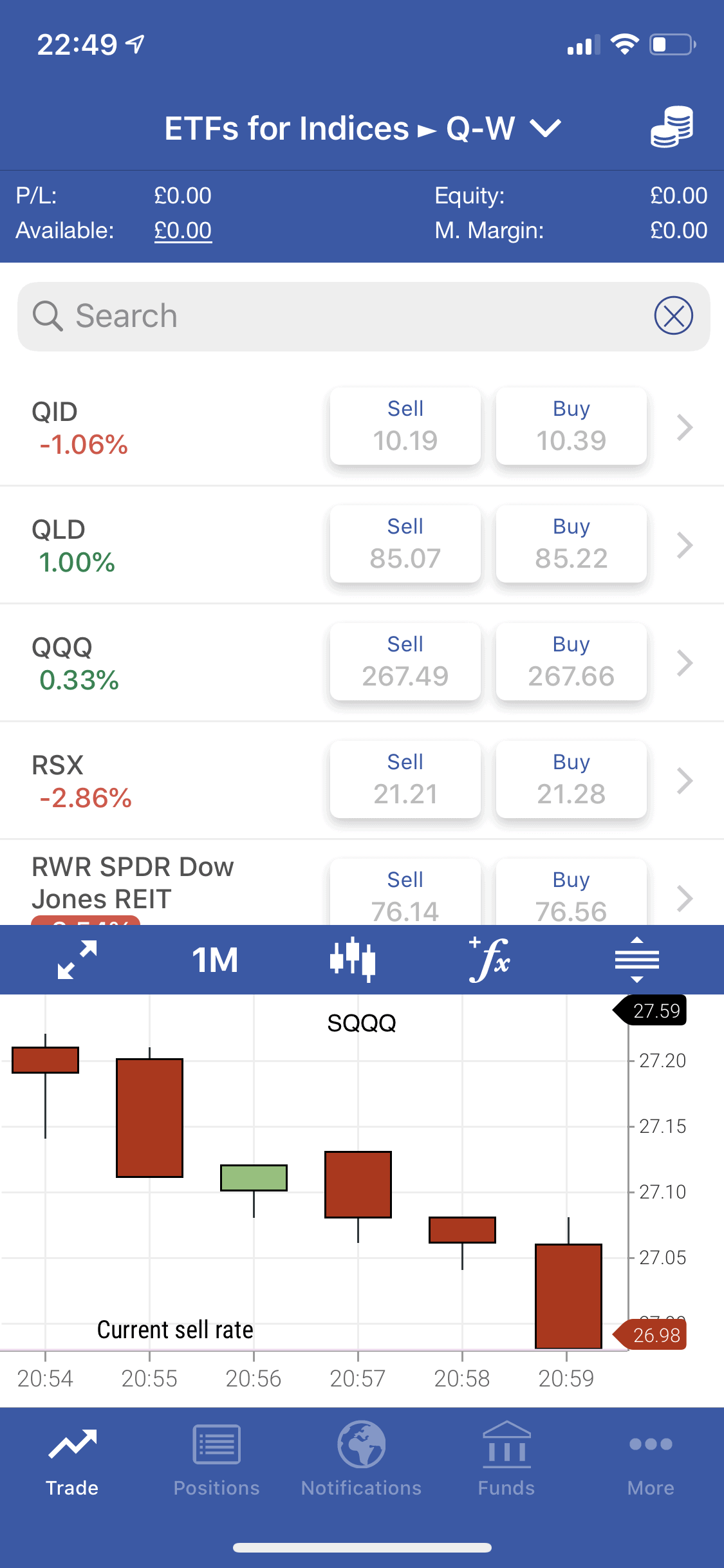

Mobile Trading Platform

The Plus500 mobile trading app can be used to trade all the available instruments at Plus500 through smartphones. The mobile app is similar to the web trading platform with the same features, charts, and indicators. Biometric authentication can also be used to login into the trading account.

Overall, the proprietary trading platform at Plus500 is simple to use with useful features. However, this platform cannot be downloaded on the desktop.

Apart from this platform, there are no other trading platforms available like MT4, MT5, or cTrader. No other trading platform can be paired with the Plus500 trading platform. Third-party trading tools cannot be paired with the Plus500 trading platform.

Plus500 Research and Education Tools

While Plus500 offers a user-friendly trading interface, its research and educational tools are not as extensive compared to some other platforms. Here are the research and educational resources available on Plus500:

Trading Academy

The Plus500 Trading Academy offers a range of educational resources designed for traders. It includes ‘how-to’ videos, an eBook, and FAQs to help users understand the platform’s essentials and improve their trading skills. The Academy is aimed at providing informative, comprehensive, and intuitive learning materials to make users wiser traders, covering topics from risk management to market insights and trading alerts.

The Plus500 Trading Academy provides a variety of educational videos designed to cater to traders at different levels of experience. These videos cover fundamental trading concepts, platform tutorials, advanced trading strategies, risk management techniques, and analysis methods. Each video is structured to offer practical insights and step-by-step guidance to help traders make informed decisions and improve their trading skills.

Economic Calendar: Plus500 provides an economic calendar that displays upcoming economic events such as central bank meetings, economic data releases, and corporate earnings announcements. Traders can use this tool to stay informed about potential market-moving events.

Price Alerts: Traders can set price alerts within the Plus500 platform. These alerts notify users when a specific instrument reaches a specified price level, enabling traders to react promptly to price movements.

Charting Tools: Plus500 offers basic charting tools that include various chart types, timeframes, and technical indicators. These tools assist traders in analyzing price trends and patterns.

Risk Management Tools: Plus500 provides risk management features such as stop-loss and take-profit orders. Traders can utilize these tools to set predefined price levels at which their positions will be automatically closed, thus limiting potential losses or securing profits.

Demo Account: Plus500 offers a free demo account that allows users to practice trading with virtual funds. This resource is particularly beneficial for beginners as it enables them to familiarize themselves with the platform and test their trading strategies without risking real money.

While Plus500’s research and education tools are relatively limited, traders can supplement their knowledge and trading skills by accessing external sources and educational materials available online. Exploring additional trusted resources can provide a more comprehensive understanding of trading concepts, strategies, and market analysis techniques.

Plus500 Trade Execution Method

Plus500 is a market maker broker, which means it can either match the orders with with other clients or can also take the other side of the trade placed by the client. Following are the details of trade execution method at Plus500:

Market Maker Approach: Plus500 acts as a market maker, creating an internal market for the instruments they provide. This means they take the opposing side of your trades, enabling immediate execution.

Instant Trade Execution: Trades are usually executed instantly at the prevailing market price when initiated on the Plus500 platform. This ensures swift exposure to the chosen asset.

Price Sources: Plus500 compiles price feeds from diverse sources and employs them to establish an internal market. This can result in marginal variations in prices compared to other platforms.

Liquidity Basis: Since Plus500 follows the market maker model, liquidity for the available instruments originates from their internal system. This often leads to narrower spreads but might have limitations during intense market volatility.

Plus500 Customer Support

The customer support services are decent at Plus500. We raised random queries to the support staff to review their services. Traders can reach out to customer support executives through the following methods.

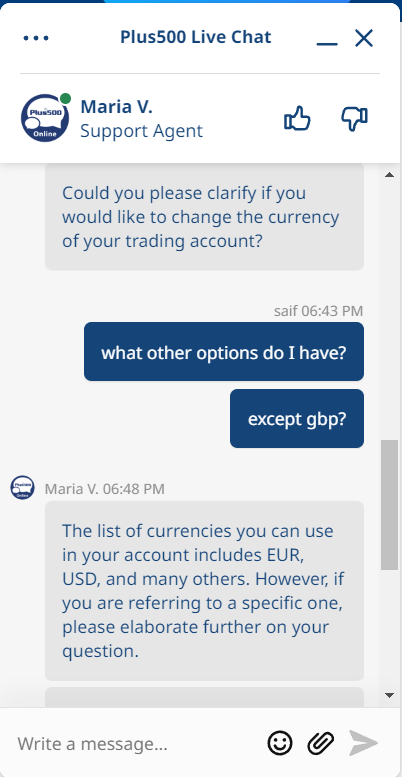

- Live Chat: Live chat support is available 24/7 at Plus500 in Australia. The live chat feature is also available with WhatsApp and the services are the same. We were connected within a few seconds with no delay. The response time for each query is 2-5 minutes and the answers were relevant to our queries. Live chat support is the best method to connect with support executives in Australia.

- Email: The email support services at Plus500 can be used to clear any queries. They have a separate page to raise queries through email. Pictures can also be attached to the email. They generally take less than an hour to revert back with relevant answers.

- No Local Phone Support: Plus500 does not offer a local phone number for customer support. We also didn’t find any international phone number that can be used to connect with the support staff at Plus500.

Overall, the support services are good with the live chat and are available 24/7 even on the weekends. The unavailability of local phone support is a drawback as most CFD brokers in Australia offer local phone support.

Available Instruments

Plus500 offers a wide range of trading instruments on its trading platform. All the available instruments are traded as Contract for Deposits (CFDs).

CFDs are derivative instruments in which only the price difference between the opening and closing of positions is cash settled. There are no physical buying and selling of the assets.

Following are the details of available instruments at Plus500.

- 66 Currency Pairs: A total of 66 currency pairs are available to trade at Plus500 including major, minor, and exotic pairs. The maximum leverage for forex pairs is 1:30 on major pairs and 1:20 on other pairs according to ASIC regulatory compliance.

- 22 Commodities CFD: The available commodities at Plus500 include Oil, Copper, Gold, Silver, Wheat, Sugar, etc. The maximum leverage on gold CFD is 1:20 while for all the other commodities, the maximum leverage is 1:10.

- 32 Index CFD: Indices can be traded as CFDs from various stock markets of the world. Plus500 offers country indices as well as sectoral indices. The maximum leverage is 1:10 for the indices.

- 1900+ Shares CFD: Stocks from various stock markets of the world can be traded at Plus500. The maximum leverage is 1:5 on popular stocks while stocks with low liquidity can be traded with 1:2 maximum leverage.

Stock CFD trading at Plus500 does not include a trading commission. Only a few CFD brokers in Australia offer commission-free spread-based stock CFD trading in Australia.

- 18 Cryptocurrency CFD: Popular cryptocurrencies with high liquidity can be traded as CFD with a maximum leverage of 1:2.

- 96 ETF CFD: Exchange Traded Funds can be traded at Plus500 with a maximum leverage of 1:5.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 66 | 1:30 for majors, 1:20 for Minors |

| Indices | 32 | 1:20 |

| Commodities | 22 | 1:20 for Gold, 1:10 for others |

| Shares | 1900+ | 1:5 |

| Cryptocurrencies | 18 | 1:2 |

| ETFs | 96 | 1:5 |

Plus500 offers a wide range of trading instruments. More than 2000 instruments are available to trade at Plus500.

Do We Recommend AxiTrader?

Yes, Plus500 is an ASIC-regulated market maker in Australia. They are also regulated by several other top-tier financial regulatory authorities and are also listed on the London Stock Exchange. Hence can be considered fairly safe for CFD trading.

The trading platform is ideal for beginners but might not suit experienced traders who require additional trading tools to be paired with the platform. AUD can be chosen as the base currency and free local bank transfers make it convenient for the traders to transact.

A wide range of trading instruments is available. Customer support is available 24/7 through live chat but local phone support is not available in Australia.

Plus500 Australia FAQs

Is Plus500 good for beginners?

Yes, Plus500 allows trading at low spread with no commission on various instruments. Their trading platform is user-friendly and simple to use for the beginners. It is better to start with a demo account in forex trading.

Is Plus500 trusted?

Yes, Plus500 is an ASIC regulated market maker in Australia. It allows trading on more than 2000 instruments through its trading platform as CFD. Plus500 is also a listed company on London Stock Exchange and can be trusted.

Which is better Plus500 or eToro?

Plus500 and eToro both are FCA regulated forex and CFD brokers with proprietary trading platforms. The trading fee at Plus500 is slightly lower than that at eToro but the trading platform of eToro is better. Plus500 allows opening accounts with AUD as the base currency while eToro has USD as the base currency.

Is Plus500 good for stocks?

Yes, stocks can be traded at Plus500 through their proprietary trading platform without any commission. Traders must note that the stocks at Plus500 can only be traded as CFD and not from any stock exchange. In CFD trading, there is no physical buying and selling of underlying assets, only the price difference between opening and closing the position is speculated to book profits/losses.

Can you withdraw all your money from Plus500?

Yes, the whole amount held in the account equity of the live trading account can be withdrawn at Plus500. The withdrawal method should be the same as the one used for the deposit.

How long can you hold a position in Plus500?

If a leveraged position is kept open overnight, a swap fee or overnight charge is incurred depending on the volume of position. If a position is kept open for longer periods, the overnight charges will keep on adding per day to the losses on the opened positions. This will keep on until the account equity gets over and the position is closed automatically.

What is the minimum deposit for Plus500?

AUD 100 is the minimum deposit amount at Plus500 in Australia. For bank transfers, the minimum deposit amount is AUD 500.