XM Australia Review 2024

XM is an ASIC regulated forex and CFD broker in Australia. They offer tight spreads on more than 1300 instruments with AUD accounts and local phone support. Check review before opening your trading account at XM.

XM is an ASIC-regulated market maker that offers low-cost trading services on various forex and CFD instruments. The Australian clients are registered under the legal entity Trading Point of Financial Instruments Pty Ltd which is regulated by the Australian Securities and Exchange Commission.

Australian traders can open forex and CFD trading accounts with AUD as a base currency. Deposits and withdrawals can be done in AUD but there is a limited number of accepted methods. Clients can choose the most suitable account type for trading.

XM Australia Pros

- XM is regulated and authorized by ASIC in Australia

- The minimum deposit is $5

- Free deposits and withdrawals through local bank transfer

- Local phone number available for customer support

- AUD can be Chosen as the base currency of the account

- Multiple account types and trading platforms available

XM Australia Cons

- XM is a market maker

- cTrader trading platform are not available

- Inactivity fees ($5/month) are charged after 3 months of inactivity

Table of Content

We have thoroughly reviewed every aspect of XM for Australian clients. Read our review to know whether it is safe to trade with XM in Australia or not, what are the trading costs that can be incurred at XM in Australia? Which account type is best at XM? All such common queries have been considered in this review.

XM Australia Summary

| Broker Name | Trading Point of Financial Instruments Pty Limited |

| Website | www.xm.com/au |

| Regulation | ASIC, IFSC, CySEC |

| Year of Establishment | 2009 |

| Minimum Deposit | $5 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4 & MT5 |

| Trading Instruments | Forex, CFDs on Metals, Energy, Indices, Shares, Commodities. |

Is XM Safe?

XM Safety Pros

- The parent company of XM is regulated by top-tier regulatory authorities

- XM is regulated by CySEC and IFSC of Belize

XM Safety Cons

- XM is not regulated by ASIC of Australia

- XM is not regulated by any top-tier regulatory authority

- XM is a market maker and can make revenues on the losses booked by traders

The safety of traders and their funds largely depends on the regulatory authority that has authorized the business in their jurisdiction.

Following are the details of the regulatory license of XM.

- ASIC of Australia

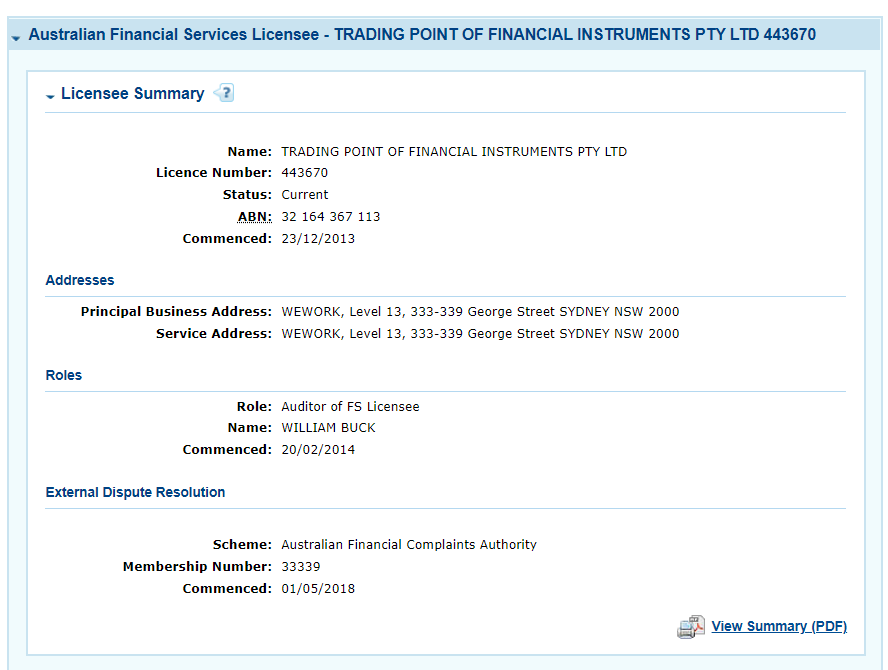

The Australian Securities and Exchange Commission (ASIC) is the financial regulatory authority in Australia that authorizes and regulates financial services providers in Australia.XM is regulated by the ASIC with the legal entity Trading Point of Financial Instruments Pty Ltd under license number 443670 and ABN number 32 164 367 113. The ASIC license was acquired by XM in 2013. Australian clients at XM are registered under ASIC regulation.

Australian clients are protected at XM due to ASIC regulations. The broker has to keep clients’ funds in a segregated bank account. The maximum leverage that can be offered to retail clients is 1:30 as per ASIC compliance. They also offer negative balance protection.

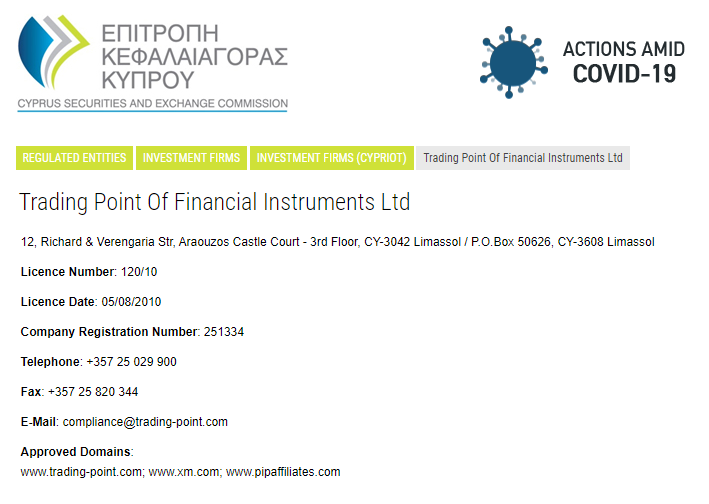

- CySEC of European Union

The Cyprus Securities and Exchange Commission (CySEC) of Cyprus is a renowned financial regulator based in European Union. XM holds the CySEC license by the name of Trading Point of Financial Instruments Limited as it is a member of Trading Point Group. The CySEC regulatory license is held by XM under license number 120/10.

CySEC is a tier 2 regulatory authority that grants Financial Service Providers (FSPs) permission to operate their business in the European Union. Australian clients are not registered under CySEC regulation.

- IFSC of Belize

XM international is under the regulation of the International Financial Services Commission (IFSC). The license is registered by the name of XM Global Limited under license number 000261/158 with the registered company address at No. 5 Cork Street, Belize City, Belize, CA.Most international clients at XM are registered under IFSC regulation but Australian clients are not registered under ASIC regulation.

The ASIC regulation makes XM safe for Australian clients. XM has been in the forex and CFD trading business since 2009. It is a member of Trading Point Group which is a group of financial services providers and holds multiple regulatory licenses. XM is a subsidiary of Trading Point Holdings Limited.

Trading Point Holdings Limited is regulated by the FCA of UK (705428) under the name Trading Point of Financial Instruments UK Limited. The parent company of XM is regulated by top-tier offshore regulatory authorities.

The clients at XM in Australia are registered under the ASIC regulatory license held by Trading Point Holdings Limited.

XM Trading Fees

XM Fees Pros

- The spreads with Ultra Low Account are low

- Trading commission only exists on shares CFD trading

- No commission for deposit and withdrawal

XM Fees Cons

- XM is not regulated by FSCA of South Africa

- Average spread with the Standard account is high

- XM deducts inactivity fees if no trades are placed for 90 days

XM charges a tight spread on various trading instruments and offers cost-efficient trading on Forex and CFDs. We have separately reviewed every component of the fee structure that is incurred from Australian traders.

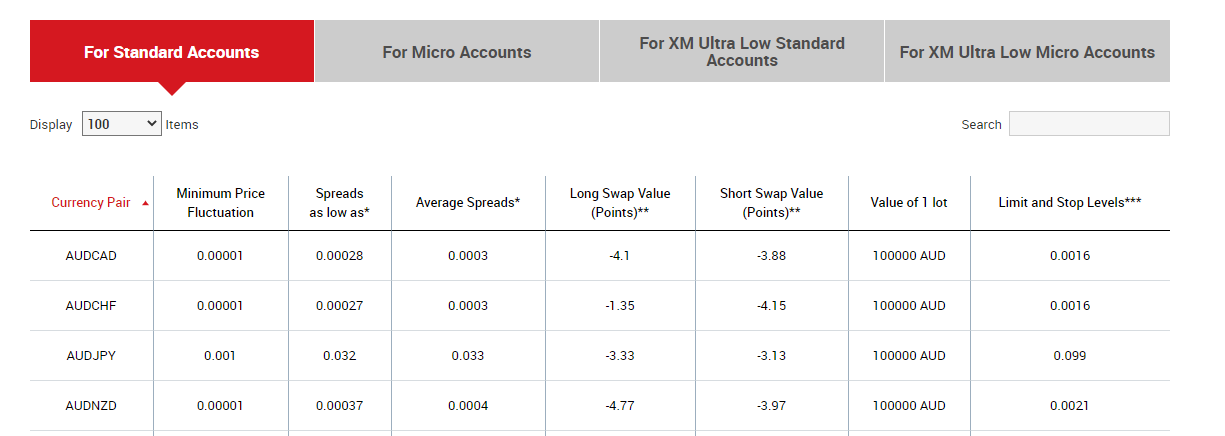

- Spread: The spreads at XM are variable and depend on liquidity and market conditions. The spreads also differ based on the account type chosen by the trader. XM offers 3 live trading account types for trading forex and CFDs while 1 account is exclusively structured for trading stocks.

The spreads with the Micro and Standard account type are similar as they only differ based on lot size. The Ultra-Low account type at XM offers the best spreads on all instruments starting from 0.6 pips. The table below describes the average typical spreads associated with all the account types at XM in Australia.

- Swap Fees: This is the fee that is incurred to the trader if a position is kept open overnight. Swap fees are also called overnight charges. Each trading instrument has different swap fees for long and short positions. The choice of account type does not affect the swap fees at XM as all the accounts have the same swap fees for every instrument.

- Trading Commission: XM does not charge a trading commission on any of the live trading accounts for forex and CFD instruments. Trading commissions are only incurred on shares account. The commission on trading shares of the US, UK, and Germany without CFD involves a commission.

The commission for US shares is 0.04$ per share, UK shares are 0.10% per transaction, and German shares are 0.10% per transaction. The minimum commission per transaction for shares in the USA is 5 USD, the UK is 9 USD, and Germany is 5 USD.

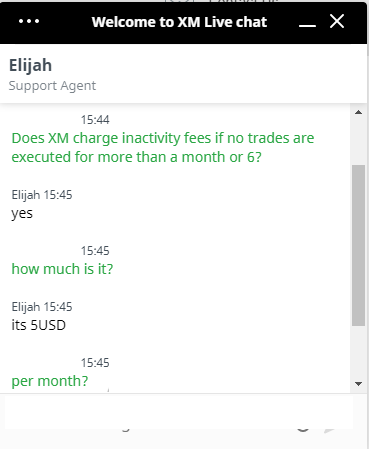

- Other Charges: XM does not charge any additional commission for deposit and withdrawal. The account opening is free and no hidden commission is involved. The only non-trading fee at XM is the inactivity charge.

Inactivity fees of 5$ or equivalent are charged each month after 90 days of inactivity. The inactivity period at XM is defined as 90 consecutive days with no order execution, deposit, withdrawal, or internal transfer. This fee of 5$ is charged each month until the account balance reaches 0. No charge is imposed if the account balance reaches zero.

| Trading Instrument | Average Spread with Standard Account (pips) | Average Spread with Ultra Low Account (pips) |

|---|---|---|

| EUR/USD | 1.7 | 0.8 |

| GBP/USD | 2.1 | 1 |

| Gold/USD | 3.5 | 2.5 |

| US Crude Oil | 3 | 3 |

| US Tech 100 | 1 | 1 |

We have compared the average spreads incurred at XM with the spreads incurred by various brokers in Australia. It must be noted that the spreads mentioned in the following table are with the Standard accounts with no commission involved.

| Trading Instrument | XM | FXTM | eToro | Exness | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 1.7 | 1.9 | 1.1 | 1 | 0.77 |

| GBP/USD | 2.1 | 2 | 2.3 | 1.2 | 1.19 |

| EUR/GBP | 2 | 2.4 | 2.8 | 1.60 | 1.40 |

| USD/JPY | 1.6 | 2.2 | 1.2 | 1.1 | 0.86 |

| USD/CAD | 2.2 | 2.5 | 1.7 | 2.1 | 1.07 |

According to our review, the spreads at XM are slightly above average with the Standard and Micro account types. The spreads with the Ultra-Low account are much lesser without any added commission or higher deposit requirement.

Hence, if you are choosing the Ultra-Low account type while opening the account, XM is among the most affordable forex and CFD brokers in Australia. If you choose the Standard or Micro account at XM, you might be paying higher than average spreads on forex and CFD instruments in Australia.

There is no trading commission involved in trading forex and CFDs. The swap fees are slightly higher than average in Australia. Inactivity fees are the only non-trading fees that can be incurred by traders.

XM Account Types

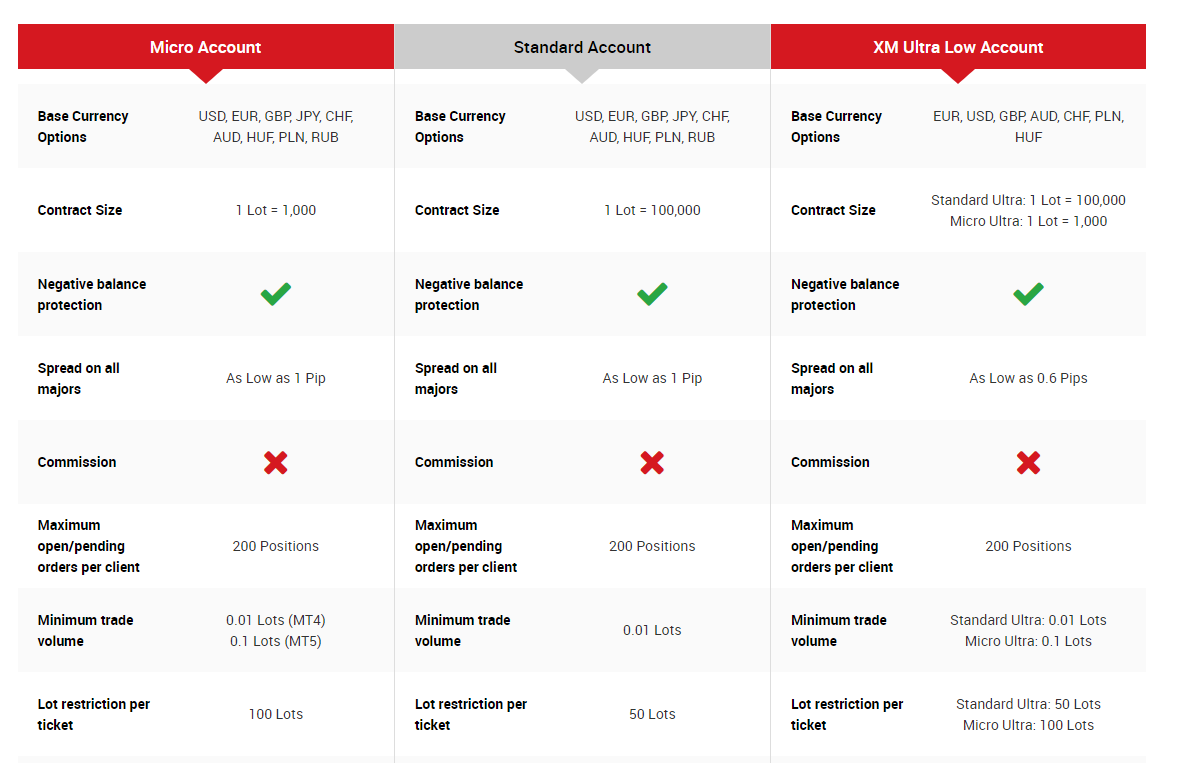

XM allows traders to choose between 4 different account types. 3 of them offer forex and CFD trading and can be opened with AUD as the base currency. The shares account can only be used to trade available shares and must be opened only with USD as a base currency. Our detailed review of each account type can assist you in choosing the most suitable account type for yourself with consequences.

- Standard Account: This is the basic account type at XM that can be opened with AUD and 11 other currencies as the base currency of the account. It allows trading on standard lots of all the available trading instruments at XM. One standard lot in the forex pair has 1,00,000 units of the quote currency. The spreads are higher than that with the Ultra-Low Account.

- Micro Account: The only difference between the Standard account and the Micro account is the lot size. The Micro account allows trading on all the available trading instruments with micro-lots. The micro lot denotes 1000 units of the quote currency.

- Ultra-Low Account: This is the most suitable account type at XM for a majority of the traders in Australia. The spreads are very low without any trading commission. All the other features are the same as the Standard account.

All the 3 account types described above can be opened with AUD as the base currency and allow access to all the available trading instruments on MT4 and MT5 trading platforms. The MT4 trading platform does not support CFD trading on stocks.

The minimum deposit with each of these accounts is $5 for USD-based accounts and AUD 5 for AUD-based accounts. The maximum leverage is 1:30 for all the account types in Australia.

XM has a separate shares trading account that can only be opened with USD as the base currency and a minimum deposit of $10,000. This account is structured to trade shares on a commission basis.

Overall, there are 3 choices of trading accounts for CFDs and currency pairs. However, there is only a slight difference between them. The Ultra Low Account at XM is the best account type as it offers trading at tight spreads. The availability of each account type with AUD as the base currency and $5 minimum deposit is a major advantage for Australian traders.

How to Open an Account at XM

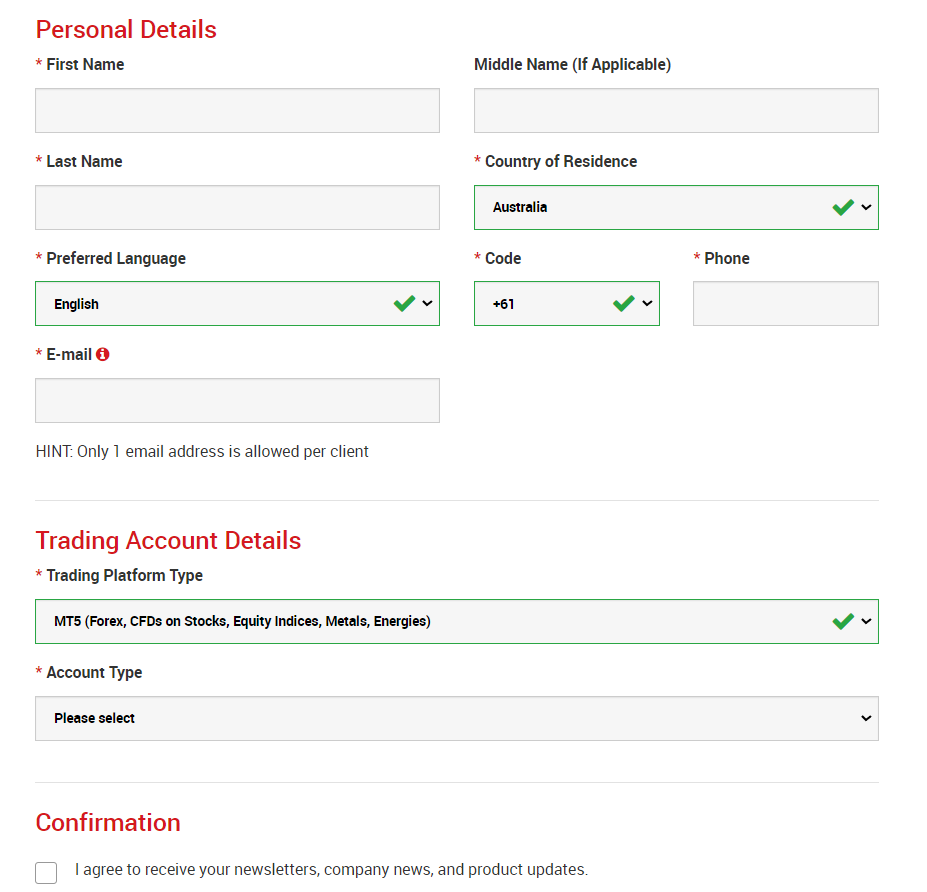

The account opening process at XM is simple and fast. Clients can start trading the same day they open their accounts after completing the whole process. To open the account at XM you will need an address and identity proof to be submitted for verification.

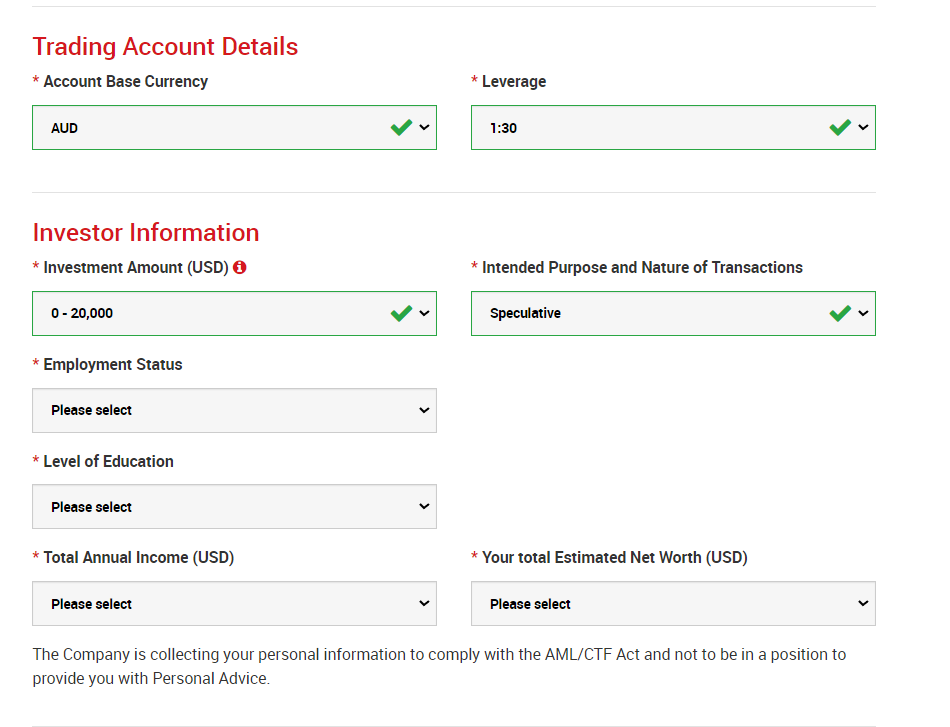

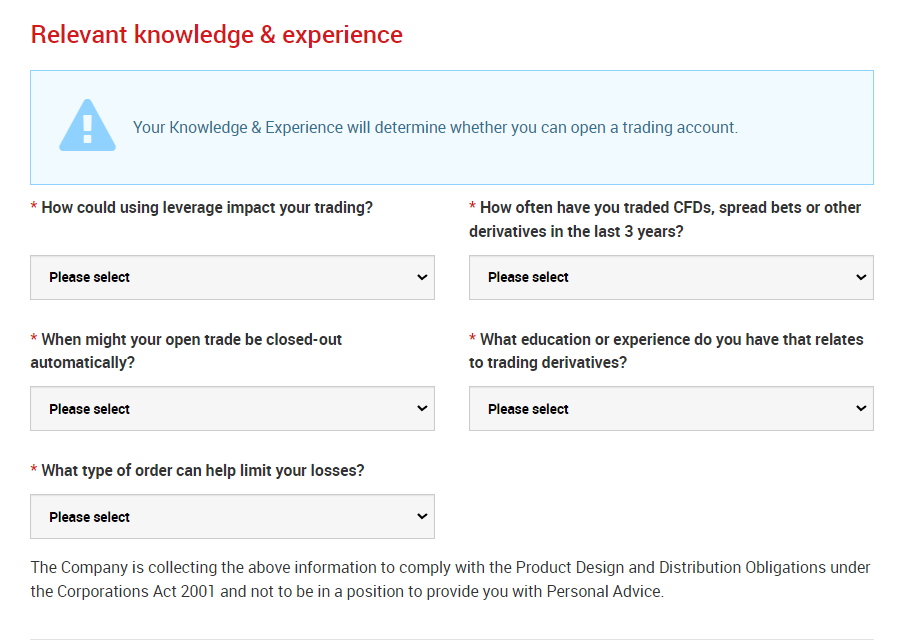

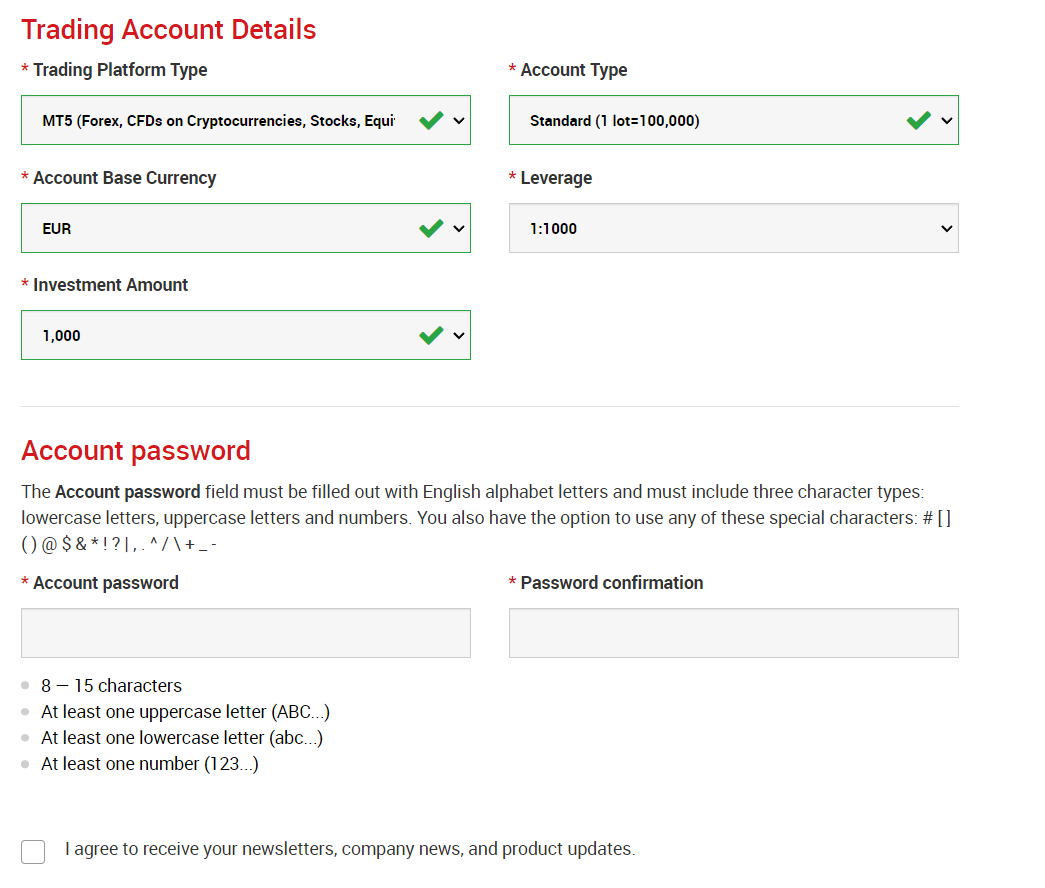

The first step is to enter the basic details like name address, email, phone number, etc. A verification link is sent to the email after this. Upon following the link, clients will land on another form where other details are to be entered. The account type, base currency, and trading platform are selected by the client. XM also requires clients to enter basic employment and financial background.

After this, the account needs to be validated by submitting the address and identity proof. In general, it takes less than a day for executives at XM to verify the documents and allow clients to start trading. After verification, a confirmation mail is sent to the client. Trading can be started after making a deposit through any of the available methods.

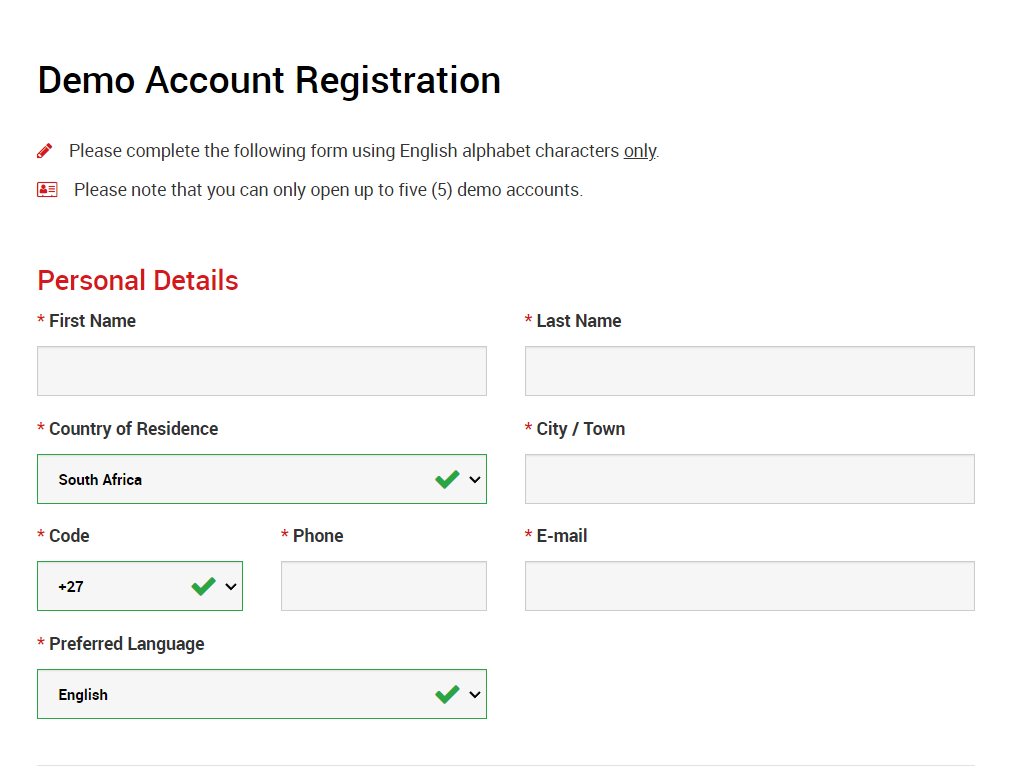

XM Demo Account Review

To open a demo account at XM, traders need to visit the official website of XM and click on “Open a demo account”. Clients need to enter their basic details like first name, last name, country of residence, city, phone number, and email address. XM also allows traders to choose between 22 languages for the demo account.

Each client can open up to 5 demo accounts. The demo account at XM is very useful for beginners as well as experienced traders as each demo account can be configured according to the requirements of the clients.

Clients can choose between MT4 and MT5 as trading platforms for the demo account. The pricing structure can also be chosen between Standard and XM Ultra Low Standard account types. 10 currencies can be chosen as the base currency of the account including USD, EUR, GBP, ZAR, AUD, etc.

The maximum leverage of the demo account can be chosen from 1:1 to 1:1000 for major forex pairs. The investment amount can be chosen from 1000 to 5,000,000 units of the base currency. For the best use of the demo account, traders must choose the amount that will be deposited by them in future. Traders must also choose the account password that will be used to login into the demo account.

Once the demo account is configured, the login details of the demo account will be available in the personal area. This detail can be used to log in on the chosen trading platforms on the web, desktop, and mobile.

According to our analysis, the demo account at XM is very useful as it can be configured in multiple ways according to the suitability of the traders.

XM Deposits and Withdrawals

XM Deposit/Withdrwal Pros

- Multiple Withdrawal Options: XM allows withdrawals via bank transfer, credit/debit cards, and electronic wallets like Skrill and Neteller, providing flexibility for users.

- Low Minimum Deposit: The minimum deposit at XM is just $5, making it accessible for traders with limited capital.

- No Deposit Fee: XM does not charge a deposit fee, which means the full amount of your deposit can be used for trading.

- No Withdrawal Fee for Most Transactions: Basic withdrawals at XM are generally free of charge, except for some specific conditions like bank wire transfers below $200.

- Fast Account Opening: XM is known for its user-friendly and fast account opening process.

XM Deposit/Withdrawal Cons

- Fee for Small Bank Wire Withdrawals: There’s a fee for bank wire withdrawals less than $200, which might be a downside for small-scale traders.

- Inactivity Fee: XM charges an inactivity fee, which could be a drawback for traders who do not trade regularly.

- Deposit Complexity: Although XM does not charge for deposits, the process might not be as straightforward compared to similar brokers, which could be a minor inconvenience for some users.

The deposit and withdrawal methods depend on the country from which you are trading with XM. For the clients residing in Australia, there are 3 methods to fund the account and withdraw. The withdrawal method has to be the same as the deposit method at XM.

- Bank Transfer: This is the most convenient method to deposit and withdraw at XM in Australia. The AUD deposit does not need to be converted if the base account currency is also AUD. The minimum deposit amount is $5. Withdrawals through bank transfer will incur a commission if the amount is less than $200.

If less than $200 is withdrawn, $15 will be charged as a withdrawal commission. For more than $200, no commission will be charged from the Australian clients.

- Debit/Credit Card: The debit and credit cards of VISA and Mastercard are accepted as funding and withdrawal methods at XM. The deposit can be made in AUD with no added commission. The card must be registered with the same name as that of the account.

The minimum deposit amount through this method is $5 while the maximum amount per transaction. The deposits are processed instantly while the withdrawals can take up to 3 business days to reflect in the bank account.

- e-Wallets: Skrill and Neteller are the only e-wallet transaction method that is currently accepted at XM for Australian traders. Skrill incurs third-party transaction fees but that is covered by XM as all the charges are added back to the account balance.

The Skrill and Neteller account should be registered with the same name as the account at XM. The deposits, as well as withdrawals, are reflected instantly via Skrill. The minimum amount that can be deposited at XM is $5.

XM Trading Platforms

All the trading positions are opened, closed, and modified through the trading platforms. Hence, the trading platform is one of the most important aspects of a forex broker. XM offers multiple trading platforms for different devices. We have separately reviewed the available trading platforms at XM in Australia for desktop, mobile, and web.

Web Trading Platform

MT4 WebTrader and MT5 WebTrader are two options as web trading platforms at XM. These platforms can be used through any web browser from desktop, mobile, and tablets. MT4 and MT5 webtrader have single-step login and are available in more than 40 languages.

The web trader at XM is highly customisable and can be linked with online trading tools and plugins. The research and analysis tools are limited when compared with MT4 and MT5 for desktop devices.

Mobile Trading Platform

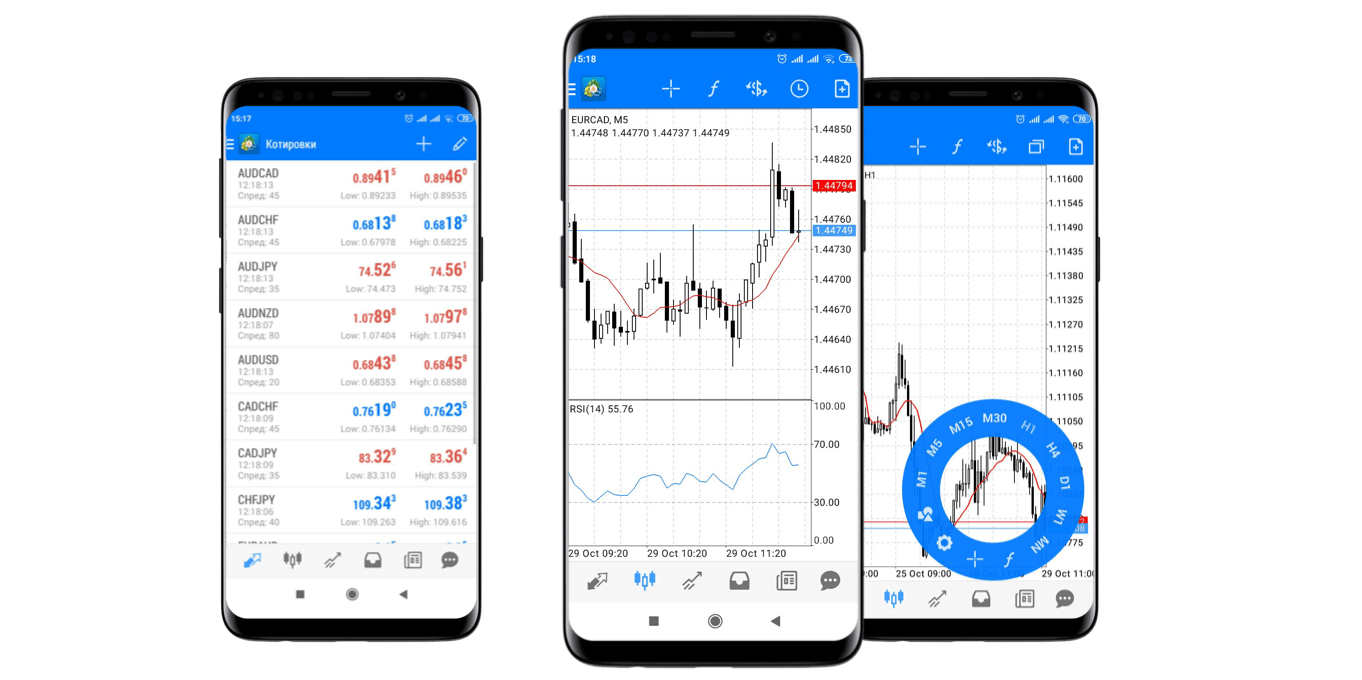

Traders who prefer to trade on the go through mobile and tablet devices have 3 options to choose from for trading platforms. XM offers MT4, MT5, and a proprietary trading application called XM App. All these mobile trading platforms are available for Android and iOS devices.

MT4 and MT5 mobile trading apps are quite common among forex traders. These apps can be downloaded and linked with an XM account to trade through mobile and tablets. Both these trading platforms are very simple to use. They are fast and all the features are easily accessible. Alerts and notifications can also be set so traders do not miss out on trading opportunities.

The XM Trader App is a proprietary trading platform of XM designed only for mobile and tablet devices for Android and iOS devices. Apart from trading, the XM app can also be used for account management and accessing the latest news. The trading area is similar to MT5 but looks better. 90 indicators are available with the XM app.

Desktop Trading Platform

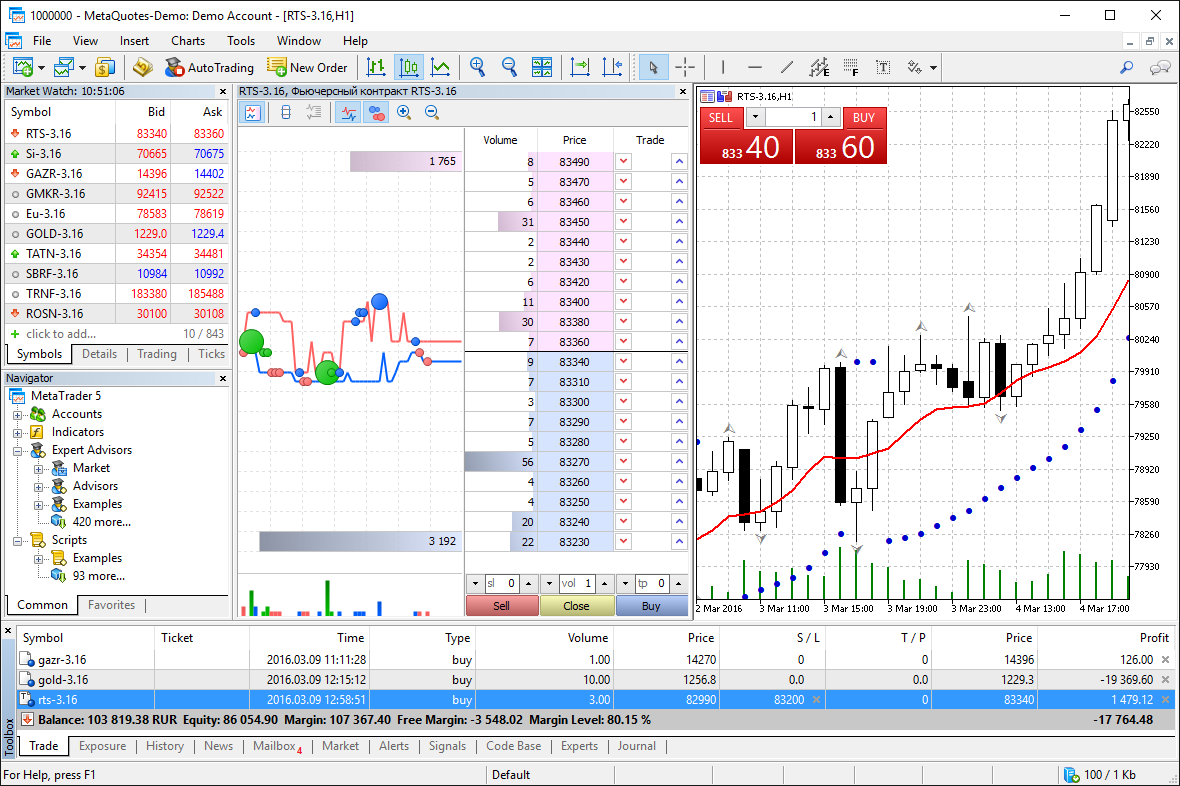

For desktop devices, XM offers the two most widely used trading platforms for forex and CFD trading. MT4 and MT5 trading platforms can be downloaded on desktop devices and linked with an XM account to trade online.

MetaTrader 4 or MT4 is the most basic trading platform designed in 2005 with a very simple interface and basic features. The look and feel of the interface are similar to Windows 98. It is considered an ideal platform for beginners and is the most chosen trading platform globally.

MT5 is an upgraded version of MT4 with more indicators, time frames, and patterns. MT5 has a modern-looking window with better features for automated trading. MT5 is preferred by experienced traders but is ideal for all types of traders.

Apart from MT4 and MT5, no other trading is available at XM. Both platforms are available with all account types.

XM Available Instruments

XM allows trading on currency pairs and CFDs of stocks, indices, commodities, and energies. Following are the details of each asset class that can be traded by opening an account with XM.

- 57 currency pairs: All the 3 forex trading accounts give access to trade on 57 currency pairs. Each pair has a different variable spread and different swap values. The number of currency pairs is higher than a few regulated brokers but many of the peers offer more currency pairs than XM. The forex pairs are available on MT4 as well as the MT5 trading platform.

- 1286 Stock CFDs: XM allows trading stocks through CFDs but they are only available with the MT5 trading platforms and not on MT4 platforms. Major stocks on the exchanges of the USA, UK, France, Germany, Netherlands, Spain, Switzerland, Belgium, Italy, Greece, Portugal, Sweden, Finland, Norway, Austria, Russia, Brazil, and Canada can be traded at XM. The minimum and maximum trade sizes (number of shares) that can be traded in a single position are different for each stock.

- 8 Commodities CFD: 8 CFDs on commodities can be traded with the maximum leverage of 1:10. CFDs of cocoa, coffee, corn, cotton, copper, and soybeans, sugar, and wheat are available to trade.

- 14 Stock Indices CFDs: Trading on stock indices can be done at XM as CFDs. The maximum leverage is 1:20 for indices.

- 4 Precious Metal: Gold and Silver can be traded at XM via CFDs with a maximum leverage ratio of 1:20 and 1:10 respectively. Palladium and Platinum are available to trade as futures CFDs with a margin of 10%.

- 5 Energy CFDs: Brent Crude Oil, London Gas Oil, Natural Gas, WTI Oil, and WTI Oil Mini can be traded at XM through CFDs with a maximum margin of 10%.

- 100 Shares: Shares of the USA, UK, and Germany can also be traded at XM directly without CFDs. There is a fixed commission involved in trading each share. Holding these shares will also generate dividends after the deduction of Tax.

XM does not offer trading on cryptocurrencies. The number of instruments available to trade is higher than many of the regulated forex and CFD brokers in Australia.

XM Trade Execution Method

Each forex and CFD broker can use different trade execution methods. Following are the details of trade execution methods followed by XM.

No Dealing Desk (NDD) Model: XM operates primarily as a No Dealing Desk (NDD) broker. This means that it does not take the opposite side of clients’ trades, reducing potential conflicts of interest. Instead, XM aggregates liquidity from various liquidity providers, including banks and financial institutions, and passes clients’ orders directly to these liquidity providers.

Straight Through Processing (STP): XM’s STP execution model involves electronically transmitting clients’ orders to liquidity providers without any manual intervention. This helps to ensure quick and accurate execution of trades, as well as minimizing the possibility of requotes.

Market Execution: For most account types, XM offers market execution, where orders are executed at the best available market price. When you place a trade, the order is executed at the prevailing market price without any price manipulation. This execution method aims to provide traders with transparent and fair pricing.

Brokers with no dealing desk (NDD) and Straight Through Processing (STP) of trade orders are considered safer compared to market makers. XM broker does not take part in the trade orders placed by the clients.

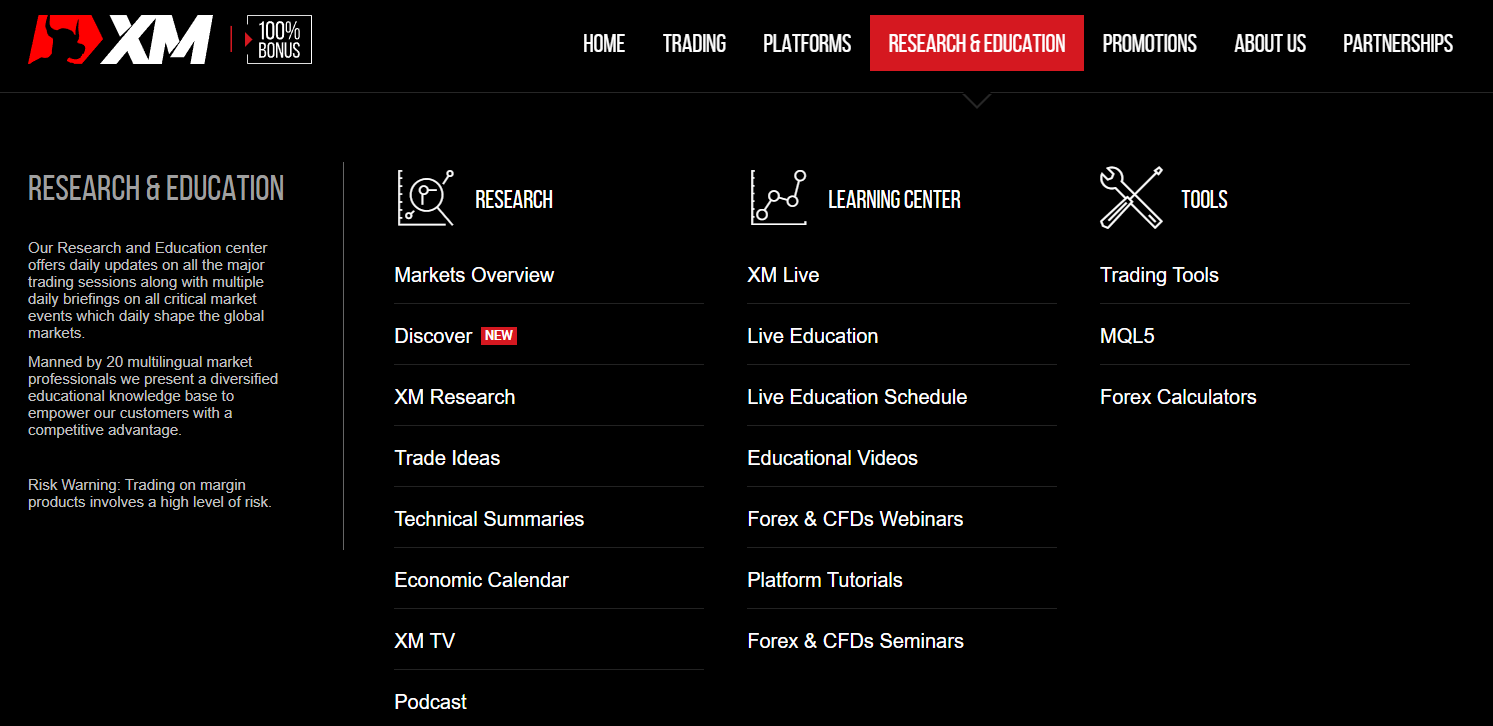

XM Research and Education Tools

XM Broker offers a comprehensive suite of research and educational tools aimed at empowering traders with the knowledge and insights necessary to make informed trading decisions. Here are the research and education resources provided by XM:

- Webinars: XM conducts frequent webinars led by seasoned traders and industry experts. These interactive sessions cover a wide range of topics, such as technical analysis, fundamental analysis, risk management, and trading strategies. Traders have the opportunity to engage with the presenters, ask questions, and gain valuable insights.

- Seminars: In addition to webinars, XM organizes in-person seminars in various locations globally. These seminars provide traders with in-depth knowledge on different aspects of trading. By attending these seminars, traders can learn from professionals, expand their network, and acquire practical trading tips.

- Video Tutorials: XM Broker offers an extensive library of video tutorials that cater to traders of all skill levels. These tutorials cover a diverse range of topics, including platform tutorials, trading strategies, technical analysis indicators, and more. The videos are designed to be educational, accessible, and easy to comprehend.

- Market Analysis: XM provides daily market analysis reports encompassing technical analysis, fundamental analysis, and market news. These reports cover major financial markets, including forex, stocks, commodities, and indices. Traders can stay up-to-date with the latest market trends, news events, and potential trading opportunities.

- Economic Calendar: XM features an economic calendar that displays upcoming economic events, news releases, and significant indicators. This calendar allows traders to stay informed about scheduled economic data releases that may impact the financial markets. By utilizing the economic calendar, traders can effectively plan their trades and manage their risk.

- Trading Tools: XM Broker offers a variety of trading tools to enhance the trading experience. These tools include real-time market charts, technical analysis indicators, trading calculators, and risk management tools. By utilizing these tools, traders can analyze price movements, identify trends, and manage their trades more efficiently.

Please note that the availability of specific research and education tools may vary depending on the trader’s account type and geographical location. Traders can access these resources through the XM Broker website or the trading platforms provided by the broker.

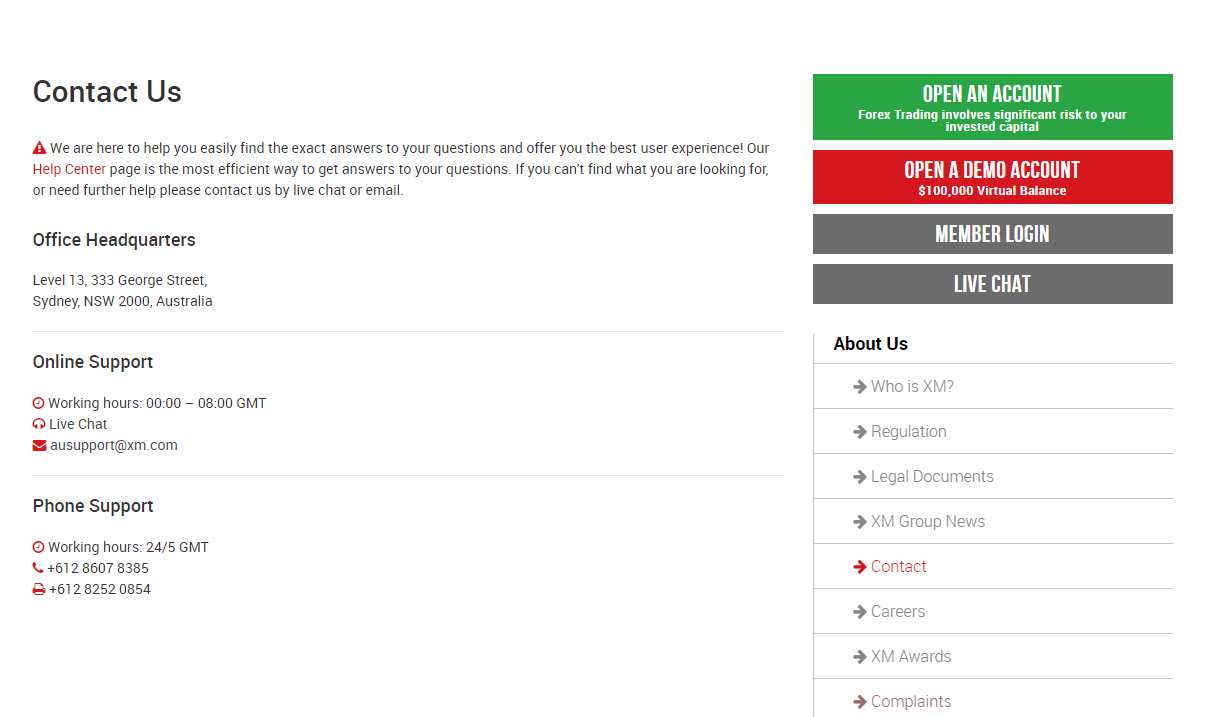

XM Customer Support & Contact

The customer support service at XM is available via the live chat window and email. We tried to raise several queries at different times of the day to provide an honest review for Australian clients.

- Live Chat: The live chat support at XM is very useful and user-friendly. We tried to connect multiple times and got connected with the executives within 1-2 minutes. Most of our queries were resolved with direct answers. This is the best method to connect with support executives at XM in Australia.

- E-mail Support: Australian clients can also raise their queries through e-mail at [email protected]. We mailed them multiple times with different queries but the reply was late (2-3 hours on average) and less relevant.

- Local Phone Support: Australian clients can also reach out for the support services at XM through local phone numbers. Clients can connect through +612 8607 8385 and +612 8252 0854. The support services are available on all business days from 00:00 – 08:00 GMT.

The live chat window can help Australian traders to resolve any queries. The availability of a local phone number for customer support is a major advantage for Australian clients at XM.

Do We Recommend XM?

Yes, XM registers Australian clients under ASIC regulation which makes it safe for Australian clients. XM offers tight spreads with the Ultra Low account and allows traders to choose between MT4 and MT5 trading platforms.

XM is a market maker but allows opening trading accounts with AUD as the base currency. Free deposits and withdrawals through local bank transfer is advantageous. They also have a local phone number in Australia for customer support which is an advantage for Australian clients.

XM Australia FAQs

Is XM a genuine broker?

Yes, XM is an ASIC-regulated market maker with registered legal entity Trading Point of Financial Instruments Pty Limited under license number 443670. Australian clients at XM are registered under ASIC regulation.

Does XM have NASDAQ?

Yes. XM offers trading on US100, US30, and US500 indices of NASDAQ with cash CFDs as well as Futures CFDs.

What is the minimum deposit for XM?

$5 is the minimum deposit amount at XM for all the account types. Local bank transfers, credit/debit cards, and wallets can be used to deposit and withdraw at XM in Australia.

How long does it take to withdraw from XM?

XM allows withdrawal through multiple methods. The withdrawal time can be different for each of the available method. Bank transfers at XM can take up to 5 working days to reflect in the bank account. Withdrawals through e-wallets are completed within few minutes.

Can I withdraw profit from XM?

Yes, XM allows withdrawal through multiple methods without any additional commission. Clients residing in Australia are registered under ASIC regulation. In case of an unsettled dispute or if the broker refuses to withdraw, clients can reach out to customer support services for a solution.

Is XM a genuine broker?

XM is a market maker and can take the other side of the trade to generate revenue. However, it is an ASIC-regulated broker and can be trusted due to strict regulatory compliance. They offer tight spreads with AUD accounts and free local bank transfers.