6 Best CFD Brokers UK 2024

We have listed Regulated CFD Brokers for traders based in UK. We have reviewed 10+ CFD brokers using the key points like trading fees, regulation, trading platforms, trading conditions, trading account types, deposit and withdrawal options & more. Pros & Cons are also covered in this research guide.

CFD Trading allows you to speculate on the value of an underlying asset without actually owning or holding the asset. A CFD can be traded as a leveraged instrument, which allows traders to make high profits but comes with high risk as well.

CFD (Contract for Difference) trading allows you to speculate on the price movements of assets like stocks, commodities, or currencies without owning them. You can profit whether prices rise (going long) or fall (going short). CFDs offer leverage, which magnifies both gains and losses. It’s a short-term, flexible way to trade various assets, but it comes with costs and regulatory considerations. Risk management and a sound strategy are vital for successful CFD trading.

CFD Trading is meant for sophisticated professional traders and is not suitable for beginners, due to the high risk and difficult market environment.

Before you start CFD trading, you need to choose a CFD broker. Not every CFD broker is safe to trade through. For UK-based traders, the best way to ensure that a broker is safe is to check whether it is licensed by the Financial Conduct Authority (or FCA) which is the relevant financial regulator in the UK.

List of Best CFD Brokers UK for 2024 based on our comparison

- eToro – Best CFD Broker in UK

- CMC Markets – One of the Oldest CFD Brokers in the UK

- Pepperstone – Regulated CFD Broker with Fast Trade Execution

- City Index – Best CFD Platform with Spread Betting

- IC Markets – Best for Automated Trading

- FXCM – Best Broker for Educational Resources

In this guide, we’ve covered regulated CFD brokers that are operating in the UK. We’ll also explain what CFD trading is, how to trade CFDs in the UK, and answer some frequently asked questions.

#1 eToro – Best CFD Broker in UK

eToro has been operating since 2007 and is headquartered in Tel-Aviv, Israel. The company has a good reputation and is known for its social trading platform.

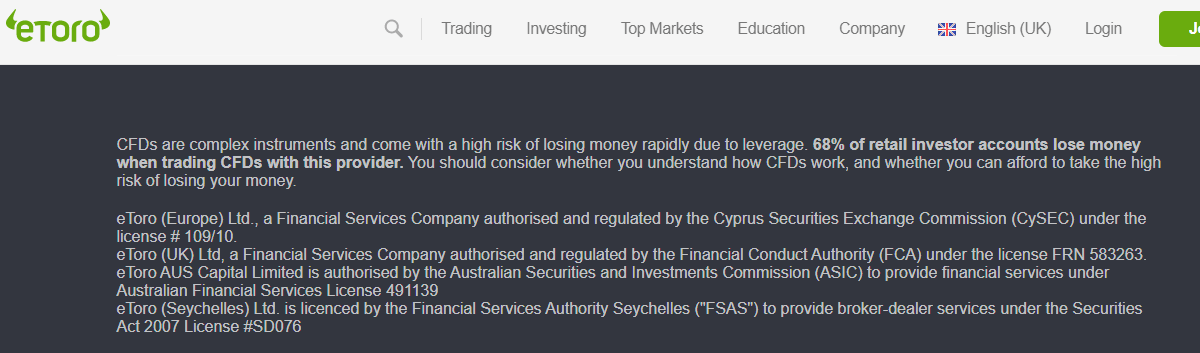

Regulation: eToro is regulated by the FCA and holds license number 583263. The company operates in the UK under the name eToro (UK) Limited. It has held this license since 2013 and has proven reliable.

Additionally, eToro is also licensed in other jurisdictions including Cyprus and Australia. The CySEC of Cyprus and ASIC of Australia are both reputed and highly regarded financial regulators in the world.

Overall, we consider eToro to be safe for traders from the UK.

Overall Fees: eToro charges a variable spread that differs depending on the type of instrument being traded and the timing of the trade.

During peak hours, the average spread charged by eToro for trading the benchmark EURUSD currency pair is 1 pip. This charge is quite low, considering that eToro does not charge a commission.

eToro offers commission-free trading for real stocks as well.

However, on the flip side, the non-trading fees charged by eToro are high. They charge a $5 withdrawal fee and also an inactivity fee. The inactivity fee is $10 if you’re inactive for a period of more than one year.

Trading Conditions: Traders need to make a minimum deposit $200 to open an account with eToro. This is quite high when compared to other similar brokers.

eToro only offers one type of account to all its users. This is called the Live account.

In addition, for beginners and those who want to try out eToro’s services, a demo account is available as well. Through this account, you can make trades under real conditions without using money.

eToro is primarily focused on CFDs and forex trading, however, you can trade real stocks as well. eToro offers a decent selection of 49 currency pairs, 12 stock index CFDs, around 2000 stock CFDs, 256 ETF CFDs, and so on. They also offer 37 cryptocurrencies, which is one of the highest numbers compared to other brokers.

eToro provides a maximum leverage of 1:30 for trading major currency pairs. For minor and exotic pairs, the leverage falls to 1:20.

eToro only accepts USD as a base currency, so if you’re depositing money in pounds then it will be converted to USD before you can trade through eToro.

Residents of the UK can deposit money into their trading accounts through bank transfers, credit cards, debit cards, and payment wallets such as PayPal, Neteller, and Skrill.

Customer Support: eToro’s customer support is quite poor compared to its competitors. eToro does not accept customer queries through live, email, or phone calls. You can contact them through a ticketing system available on their website, however, responses are quite slow.

eToro Pros

- Social trading platform available

- Large selection of cryptocurrencies

- Low fees

eToro Cons

- Poor customer support

- High non-trading fees

#2 CMC Markets – One of the Oldest CFD Brokers in the UK

CMC Markets was founded in 1989 and has been the recipient of several industry awards since then. The company leverages the latest technology to provide best-in-class services to traders.

Regulation: CMC Markets is regulated by the FCA and holds the license number 173730. The company has been authorized by the FCA since 2001 under the name CMC Markets UK PLC.

CMC Markets also holds licenses from the BaFin of Germany, IIROC of Canada, ASIC of Australia, FMA of New Zealand, MAS of Singapore, and DFSA of the United Arab Emirates.

CMC Markets is also a publicly listed company, listed on the London Stock Exchange.

Overall, we consider CMC Markets to be highly safe for traders from the UK.

The broker also provides negative balance protection and segregates its funds, which ensures the high safety of funds.

Overall Fees: CMC primarily charges a variable spread from its traders. It charges an average spread of 0.7 pips for trading the benchmark EURUSD currency pair during peak hours.

CMC Markets also charges a commission for trading any stock CFDs. They charge a minimum commission of $10 for such trades, which is quite high.

With a few exceptions, CMC Markets does not charge any deposit fee, withdrawal fee, or account fee.

However, they do charge an inactivity fee of GBP 10 per month after 12 months of inactivity.

Trading Conditions: CMC Markets does not require a minimum deposit in order to open an account with them.

CMC Markets offers two types of accounts. One account is for CFD trading while the other is for spread betting.

They offer a wide range of trading instruments including 338 currency pairs, 88 indices, 10000-plus stock CFDs, 15 cryptocurrencies, 1,000 ETFs, 123 commodity CFDs, and so on. The number of currency pairs offered is one of the highest compared to other brokers operating in the UK.

CMC Markets offers a leverage of 1:30. However, the drawback is that users cannot change the amount of leverage that they want to use. If you’re trading forex, then you need to use a leverage of 1:30.

CMC Markets offers GBP as a base currency for their accounts. This means that UK residents can trade without having to convert their currency to USD.

You can deposit money into your account using local bank transfers, credit cards, debit cards, or a selected number of payment wallets. They do not charge a deposit fee.

Customer Support: CMC Market’s customer support team is available through live chat, phone call, and email.

They only offer customer support on weekdays and aren’t available on weekends.

Their response time is very fast and they provide helpful answers. Overall, we are satisfied with their customer support.

CMC Markets Pros

- High range of trading instruments

- Highly regulated and reputable

- Low trading fees

CMC Markets Cons

- Leverage cannot be changed

- Customer support isn’t available on weekends

#3 Pepperstone – Regulated CFD Broker with Fast Trade Execution

Pepperstone was founded in 2010 and provides ECN type trading account. But they are not an ECN Broker.

Regulation: Pepperstone holds license number 684312 from the FCA of the UK. The broker is registered under the name Pepperstone Limited.

Pepperstone is also licensed by the BaFin of Germany, ASIC of Australia, CySEC of Cyprus, DFSA of the United Arab Emirates, CMA of Kenya, and the SCB of The Bahamas.

Pepperstone also segregates its funds in accordance with FCA rules.

Overall, Pepperstone is a safe broker for traders from the UK.

Overall Fees: Pepperstone charges low trading and non-trading fees.

The fees charged by Pepperstone depend on the type of account held by the trader.

If you’re using an MT4 Razer account, then you’ll need to pay a commission of $3.76 per lot per trade to trade the benchmark EURUSD currency pair. However, the spread will be as low as 0.1 pips.

Pepperstone does not charge any deposit fee, withdrawal fee, or account fee. They also do not charge an inactivity fee.

Trading Conditions: Pepperstone does not require any minimum deposit at the time of account opening. Pepperstone offers two types of accounts: Standard and Razer.

The Standard account is meant for beginners, whereas, the Razer account is meant for high-volume traders.

Pepperstone offers a wide range of instruments including 62 currency pairs, 23 indices, 950 stock CFDs, 25 commodity CFDs, and 12 cryptocurrencies.

The maximum leverage offered by Pepperstone to UK traders is 1:30. However, some asset classes may have lower leverages. You can change the amount of leverage that you want to use.

Traders from the UK can use GBP as the base currency of their accounts. They can deposit and withdraw funds using local bank transfers, debit cards, credit cards, and through certain payment wallets.

Customer Support: Pepperstone can be contacted through phone calls, live chat, and email. They provide quick and helpful responses and their customer support team has been found to be reliable.

The customer support team is available 24 hours on all weekdays; however, they are not available at all on weekends.

Pepperstone Pros

- Good customer support

- Highly regulated and solid reputation

- Low overall fees

Pepperstone Cons

- High cost for holding positions overnight

- No customer support on weekends

#4 City Index – Best CFD Platform with Spread Betting

City Index was founded in 1983 in the UK. Since then, the broker has gone from strength to strength and is now one of the biggest names in spread betting and CFD trading.

Regulation: City Index is registered with the FCA under the name StoneX Financials Limited. The broker holds license number 446717 and has been authorized to provide its services in the UK since 2006.

City Index is also regulated under other jurisdictions such as Australia (ASIC) and Singapore (MAS).

Overall, we consider City Index to be a highly safe broker for UK residents thanks to its strong reputation and regulated nature.

Overall Fees: City Index charges a variable spread and commission. The commission is charged only when trading stock CFDs. The minimum commission for such trades is GBP 10.

The spread charged by City Index depends on the type of instrument being traded and the timing of the trade. The broker charges an average spread of 0.9 pips for trading the EURUSD currency pair.

Overall, the trading fees charged by City Index are low compared to other similar brokers.

City Index also charges non-trading fees in the form of an inactivity fee after 12 months of inactivity. This fee is GBP 12 per month.

However, City Index does not charge any deposit fee, withdrawal fee, or account maintenance fee.

Trading Conditions: City Index requires a minimum deposit of $100 at the time of opening an account. It takes around one or two days for a new account to go live and allow you to make trades.

City Index offers three different types of accounts. These types are called Trader, Premium Trader, and Professional. Each account differs in terms of leverage, minimum balance required, and additional services provided.

The maximum leverage offered by City Index on its Trader account is 1:30, in accordance with FCA rules.

City Index offers a large number of trading instruments that include 84 currency pairs, 20 stock index CFDs, 4500 stock CFDs, 690 ETF CFDs, 29 commodity CFDs, 12 bond CFDs, and a few cryptocurrencies.

City Index accepts deposits through local bank transfers, debit cards, credit cards, and certain payment wallets. The deposit process is easy and fast and they do not charge any deposit fee, as mentioned earlier.

Customer Support: City Index’s customer support team can be contacted via phone call, live chat, or email.

The phone call option and live chat option are great if you want quick and helpful responses. You can also use the email option; however, the responses are slower.

Customer support is available at all times during weekdays.

Overall, we consider City Index to provide better than average customer support.

City Index Pros

- Wide range of stock CFDs

- Low fees

- Quick and smooth account opening

City Index Cons

- No user-friendly desktop trading platform

- No 24/7 customer support

#5 IC Markets – Best for Automated Trading

IC Markets was founded in 2007. The broker is based in Australia and specializes in CFD and forex trading.

Regulation: IC Markets is not regulated by the FCA, which is a major drawback for UK-based traders. However, the broker is regulated by reputed financial authorities such as the ASIC of Australia (Tier-1 regulator) and the CySEC of Cyprus (Tier-2 regulator).

The broker is also regulated by the Seychelles Financial Supervisory Authority (SFSA).

We consider IC Markets to be safe for traders based in the UK thanks to its strong reputation and global presence.

Overall Fees: IC Markets charge low trading and non-trading fees. The fees charged depend on the type of account held by the trader.

For those holding a MetaTrader 4 Raw account, IC Markets charges a commission of $3.5 per lot per trade and a typical spread of 0 pips for trading the benchmark EURUSD currency pair.

The MetaTrader 4 Raw account is ideal for high-volume traders who need a tight spread.

IC Markets does not charge any non-trading fees. This means that they do not have a fee for making deposits, withdrawals, account maintenance, or inactivity.

Trading Conditions: In order to open an account with IC Markets, you need to make a minimum deposit of $200 in your trading account.

IC Markets offers three different types of accounts. Each type differs in terms of the trading platform that you can use and the overall fees that you are charged. The three account types are True ECN with cTrader, True ECN with MetaTrader, and Standard accounts.

The maximum leverage that they offer is 1:500. Additionally, traders can change the amount of leverage that they want to use subject to the maximum. The amount of maximum leverage depends on the type of instrument being traded.

IC Markets offers a decent range of instruments including 61 currency pairs, 25 indices, 1600 stocks, 30 ETFs, 20 commodities, 9 bonds, and 10 cryptocurrencies.

You can make a deposit into your trading account through local bank transfers, debit and credit cards, and certain payment wallets. As mentioned earlier, they do not charge a deposit fee.

Customer Support: IC Markets allows traders to reach them through live chat, phone calls, or email.

We contacted them through the live chat option available on their website and received a prompt response within two minutes. The response was helpful and reliable.

Their customer support team is available 24/7 which is a huge point in their favour since most brokers only offer 24/5 customer support.

IC Markets Pros

- Low trading and non-trading fees

- Good customer service

- Offers MetaTrader as well as cTrader

- ECN broker

IC Markets Cons

- No investor protection for non-EU clients

- Not regulated by the FCA

#6 FXCM – Best Broker for Educational Resources

FXCM was founded in 1999 and is headquartered in London. The company prides itself on being a global CFD and forex broker and having a strong international presence.

Regulation: FXCM is regulated by the FCA under the name FXCM Limited. FXCM holds registration number 217689 from the FCA.

In addition, FXCM is also regulated by the FSCA of South Africa, the CySEC of Cyprus, and the ASIC of Australia.

Overall, we consider FXCM to be highly safe for traders from the UK due to its long history, its headquarters in London, and its license from reputed regulators including the FCA.

Overall Fees: FXCM’s trading and non-trading fees are average when compared to other similar brokers.

The typical spread for trading the benchmark EURUSD currency pair is 1.2 pips, which is higher than most other brokers on this list. However, FXCM does not charge a commission.

FXCM charges an inactivity fee of $50 after twelve months of dormancy. However, it does not charge any account maintenance or deposit fee. It may charge a withdrawal fee if you’re using a local bank transfer to make your withdrawal in the UK.

Trading Conditions: FXCM requires you to make a minimum deposit of $50 at the time of opening an account. Their account opening process can take longer than usual (more than one or two days).

FXCM offers two account types which are Standard and Active Trader. The Active Trader is suitable for those who trade with high volumes.

FXCM offers a leverage of up to 1:400 for both CFD and forex trading. This high leverage is suitable for professional traders. You can also change the amount of leverage that you want to use subject to the maximum.

FXCM offers a low range of trading instruments. The available instruments are 45 currency pairs, 15 indices, 219 stock CFDs, 12 commodities, and 7 cryptocurrencies. They do not offer any ETFs.

You can use GBP as the base currency of your account. This means that you do not have to pay conversion fees for converting your money into another currency before you can trade.

FXCM accepts deposits through local bank transfers, debit or credit cards, and certain payment wallets. The payment wallets available are Neteller and Skrill for UK residents.

Customer Support: You can contact FXCM through live chat, phone call, or email. They also have an extensive FAQs section that answers a lot of common questions.

We contacted their customer support team through live chat and found their responses to be helpful and quick.

Customer support is not available on weekends but is available at all times on weekdays.

FXCM Pros

- Great educational content

- Good technical research tools

FXCM Cons

- Narrow range of trading instruments

- No customer support on weekends

What is CFD Trading?

CFDs are derivative instruments that get their value from the movement of an underlying asset. For example, a gold CFD will get its value from the changes in the price of gold. Buying or selling CFDs does not mean that you own and sell the underlying asset. Instead, you are just betting on the price movement of gold as a speculator.

For example, suppose you buy 5 lots of a Gold CFD at a price of GBP 100 per lot with leverage of 1:10. The price of Gold increases to GBP 110 per lot and then you sell all 5 lots. You will receive a total of GBP 5,500 from an initial investment of GBP 500. This means a profit of GBP 5,000.

The high profit is due to the leverage of 1:10 on the instrument provided by the broker. The higher the leverage, the greater your chances of profit. However, leverage is a double-edged sword and similarly amplifies your loss as well.

You should be very careful when trading a leveraged instrument because the amount of loss can be very high. Only professional traders who understand leverage and the risk involved should use leverage while trading CFDs. More than 70% of traders lose money when trading CFDs due to the high risk involved.

How to Trade CFDs in the UK?

Starting to trade CFDs is a simple process.

The first step is to learn everything you can about CFDs, how to perform technical analysis, how to manage risk, and how to formulate trading strategies. You should do all this through a demo trading account that mimics real-world trading conditions.

Once you’re well-versed with CFD trading, it’s time to open a real money account through which you can trade using real money.

The second step is to find a good CFD broker that is safe to trade through. If you’re a UK resident, then you should only register with a broker that is licensed by the FCA.

Be warned, there are several mimic websites out there that mimic the website of real brokers. These websites are meant to scam you and steal your money.

When you’re registering with a broker, you should make sure that the website is genuine.

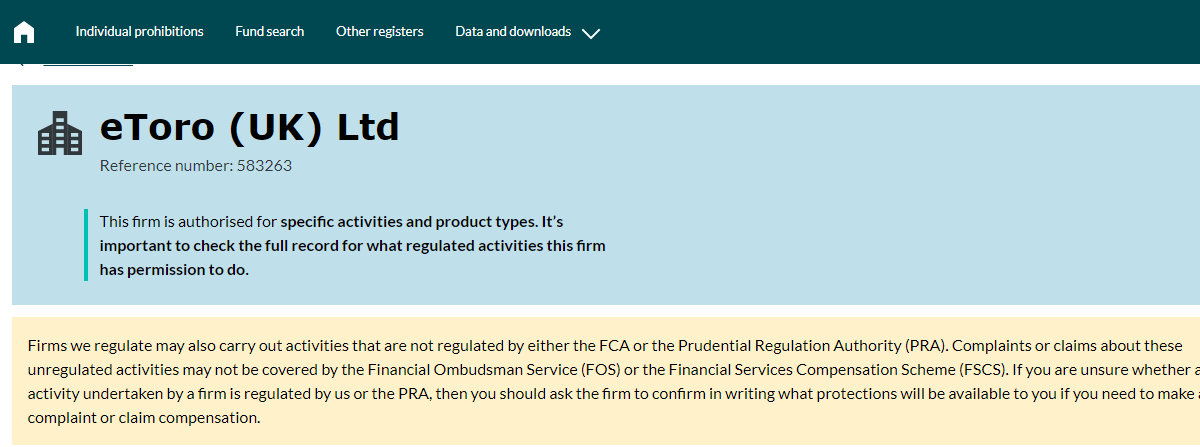

Further, you should also cross-check the FCA license number provided on their website with the license number on FCA’s register.

For example, as you can see in the screenshot provided below from eToro’s website, eToro claims that its FCA license number is 583263.

You don’t need to take their word for it.

You can check the license number on the FCA website and see whether the license number belongs to eToro as claimed. The screenshot provided below is from the FCA website.

As you can see, the license number does belong to eToro, hence you can conclude that eToro is a safe broker to trade through for UK-based traders.

Next, you can go to eToro’s website and open a live trading account. The registration process is simple, but you will need to provide some KYC documents which will be verified by the broker. Usually, it takes up to three days for an account to be verified and go live.

Once you have a live trading account from a safe broker, you can download the trading platform and start trading.

Fees Charged by CFD Brokers in the UK

Before opening a CFD trading account, clients must check each component of fees associated with CFD trading. Following are the components of fees that are commonly incurred by CFD traders.

Trading Fees

The trading fees involve all the charges that are incurred while executing trade orders.

- Spread: The difference between the bid and ask price of an instrument is called a spread. spreads are commonly denoted in pips and are the most basic fees involved in CFD trading. Narrow spreads are beneficial for the traders while wider spreads denote higher revenue for the brokers.

- Trading Commission: Some brokers charge a fixed or variable commission on each CFD trade order. The commission is charged along with spreads. However, brokers that incur trading commissions offer much lower spreads.

- Overnight Charges: These are the charges that will be incurred only when a leveraged CFD trading position is kept open overnight. It is also denoted as a swap fee or rollover rate. No overnight charges will be incurred if a position is opened and closed on the same day.

Non-Trading Fees

Non-trading fees can be charged even without placing any trade orders. Such fees include:

- Inactivity Fees: It is the predefined charge that is incurred every month after no trade orders are executed for a certain inactivity period. Each broker can have different inactivity fees for different inactivity periods.

- Deposit/Withdrawal Fees: There are multiple methods for deposits and withdrawals and each method can have a different commission associated with processing the transaction. Most brokers do not charge transaction fees for local bank transfers in the UK.

- Currency Conversion Fees: If the deposit currency is different from the base account currency, the currency will be converted according to prevailing conversion rates. Clients must ensure that the deposit currency is the same as the deposit currency to avoid conversion charges.

Trading Conditions

Each trader will have different trading experiences with each broker. There can be slight differences in the trading conditions that the traders should always look upon while choosing a CFD broker.

- Trading Platform: All the trades will be executed through the trading platform offered by the broker. MT4, MT5, and cTrader are the most chosen CFD trading platforms globally but some broker may also offer their proprietary platforms.

Traders must ensure that they are comfortable with the trading platform they are using for trading CFDs. The trading platform is where traders spend most of their time while trading hence, you need to acknowledge the features, tabs, and terminologies associated with the trading platform.

If you are already familiar with a CFD trading platform, make sure the chosen CFD broker supports that platform.

- Leverage: The maximum leverage that an FCA-regulated CFD broker can offer in the UK is 1:30 on major pairs for retail clients. Leverage is a debt that is taken from the broker and liquidity providers to open bigger positions with smaller deposits.

However, if a broker is not regulated under FCA and accepts clients from the UK, it can offer higher leverage. This will be very risky for the traders as high leverage will increase leverage risk and no FCA regulation will increase the third-party risk.

- Trading Instruments: Each broker allows trading on different numbers of trading instruments. However, major currency pairs and commonly traded commodities are generally offered by all CFD brokers.

Before opening your account, you must check if the broker offers the instrument that you prefer to trade with. The contract specification on your preferred instrument can be checked and compared with different brokers.

- Customer Support: The support services can have a major impact on the trading experience with any CFD broker in the UK. The quality of customer support services will be different for each broker. Most CFD brokers in the UK offer live chat support.

The availability of local phone support services in the UK is an advantage as queries can be resolved quickly. Some brokers do not provide any support services at all. Such brokers should be avoided as there will be no direct connectivity between trader and broker.

Traders can raise random queries through support services at CFD brokers to test the availability and quality of customer support services in the UK.

- Base Currency: Some ASIC-regulated CFD brokers in Australia offer AUD-based accounts while others do not. Most Australian clients prefer to trade with AUD as the base currency. The deposit and withdrawal do not involve currency conversion if the account currency and deposit currency are the same. Hence, this needs to be checked before opening the account.

- Deposit and Withdrawal Methods: You cannot trade with real money without deposits. Each broker allows deposits and withdrawals through different methods. Each trader might prefer to deposit through different methods. Traders must always check the accepted methods for deposit and withdrawal before opening an account. The processing time and commission (if applicable) should also be checked.

Risk Involved in CFD Trading

- Leverage Risk: Leverage is a type of debt that is taken from brokers and liquidity providers to open bigger positions with smaller deposits. Leverage is an important factor in CFD trading as it increases the profit amount but also increases the amount of loss on a given position. The increase in risk due to an increase in leverage is called leverage risk. This can be mitigated by keeping safe leverage.

- Market Risk: The prices of CFDs depend entirely on the prices of the underlying asset. These prices are always exposed to market risk. The volatility in the prices occurs due to demand, supply, and several other factors. The market risk can be mitigated by effective fundamental and technical analysis of the prices of the underlying instrument.

- Counterparty Risk: Counterparty risk is also known as third-party risk. It is the risk of choosing a fake broker. Since CFD trading is not centralised, brokers, market makers, and liquidity providers must be regulated. The trade orders are not executed through an exchange and are less transparent, hence traders must always ensure that the chosen broker is regulated by the financial regulatory authority in their jurisdiction. FCA is the financial regulatory authority in the UK that overlooks the activities of authorised brokers and market makers.

- Position Close Out: In CFD trading, if you open a large position with a small amount left in the account balance, it is very likely that your position will be closed when prices move against the anticipation. This is because the liquidity provider will not face losses for positions opened by traders. When the loss amount is greater than the account balance, the position will be closed even when traders don’t want it.

- Psychological and Emotional Risks: CFD trading requires discipline, emotional control, and the ability to manage stress. Traders may face psychological challenges such as fear, greed, and overtrading, which can lead to poor decision-making and increased risk exposure.

- Liquidity Risk: CFDs are traded in an over-the-counter (OTC) market, which means there may be instances where there is limited liquidity for certain assets or during certain market conditions. This can result in wider spreads, slippage, or difficulties in executing trades at desired prices.

Tips For Trading CFDs

- Know CFD Basics: Understand how CFDs work.

- Learn the Market: Educate yourself about the asset you’re trading.

- Choose a Trusted Broker: Pick a regulated and reliable broker.

- Manage Risk: Develop a strong risk management strategy.

- Diversify: Spread your trades across different assets.

- Demo Practice: Practice on demo accounts before using real money.

- Stay Informed: Keep up with relevant news and events.

- Use Analysis: Employ both technical and fundamental analysis.

- Mind Leverage: Be cautious with leverage; comprehend its impact.

- Short-Term Focus: Use CFDs for short-term trading due to leverage.

- Stay Disciplined: Control emotions and adhere to your plan.

- Continuous Learning: Stay updated on strategies and trends.

- Cost Awareness: Consider broker fees and transaction costs.

- Monitor Trades: Keep an eye on open positions, especially leveraged ones.

- Regulations and Taxes: Understand local regulations and tax implications.

Pros and Cons of Trading CFDs

| Aspect | Pros | Cons |

|---|---|---|

| Leverage | High leverage increases potential returns | High leverage also increases potential losses |

| Market Access | Access to a wide range of markets | Complexity in managing trades across markets |

| Short Selling | Easy to short sell without borrowing stocks | Short selling can lead to significant losses |

| Trading Costs | Lower transaction costs than traditional trading | Financing costs can be high for long-term positions |

| No Ownership | No need to own the underlying asset | No rights as an asset holder (like dividends) |

| Profit Opportunities | Profit potential in both rising and falling markets | Requires accurate market predictions |

| Regulation | Subject to regulatory oversight | Not available in some countries due to regulation |

| Risk Management Tools | Stop-loss and other risk management tools available | Requires discipline to manage risks effectively |

| Capital Requirements | Lower capital requirement to start | Risk of losing more than the initial investment |

| Trading Flexibility | Trade anytime during market hours | Market volatility can impact trade execution |

Comparison of Best Forex Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| eToro |

3 pips

|

$200

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| Pepperstone |

0.09 pips

|

£0

|

1:500

|

Visit Broker |

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| IC Markets |

1 pip

|

$200

|

1:500

|

Visit Broker |

| FXCM |

1.3 pips

|

$50

|

1:200

|

Visit Broker |

FAQs on Best CFD Brokers UK

Is CFD Trading Profitable?

CFD trading is usually not profitable. It can be profitable if you are an expert CFD trader, however, most traders lose money from CFD trading. The risk is also very high and you can lose all your deposited money since CFD trading usually involves high amounts of leverage.

Is CFD Trading a Good Idea?

CFD trading is only meant for sophisticated and expert traders who understand price movements in the market and are well-versed with the risks involved. If you’re new to CFD trading, you should spend years practising and learning about CFD trading before you invest real money into this activity.

Can I trade CFD in UK?

Yes. Contract for deposit or CFDs can be traded in the UK with leverage under FCA regulation. Traders registered under FCA regulated brokers are protected by up to GBP 85,000 per client and strict regulatory compliance.

Can you be rich from CFD trading?

No, CFD trading is not a scheme to get rich quickly. CFD trading involves significant financial risk and may not be ideal for all traders. It is better to start with a demo account and gain decent experience before starting with a live account.

Is CFD trading taxable UK?

Yes, CFD trading is legal in the UK and is regulated under the Financial Conduct Authority of the UK. The profits made on CFD trading are taxable as per the prevailing tax rates of the UK.

Do CFD brokers lose money?

CFD brokers can either use STP/ECN method for trade execution or market maker with a dealing desk. Brokers with STP/ECN execution method pass on the trade orders to liquidity providers and have no involvement in trade orders placed by the clients. Such brokers do not face losses on profits made by clients.

Market makers can take other side of the trade and can make revenue on the losses incurred by traders. Similarly, market makers will lose money if more traders book profits.

How do I choose a CFD broker?

Most importantly, make sure the CFD broker chosen in the UK is regulated by FCA. Additionally, traders must check and compare the fees, available instruments, trading platform, customer support services, etc through reviews by existing clients and experts.

Why do most CFD traders lose money?

CFD trading involves high risk and traders can lose the whole deposited amount within a few trades due to high leverage. More than 70% of beginners lose money in forex and CFD trading. To mitigate the risk, traders must spend time and effort on research and analysis and put limits on opened positions. It is better to gain experience through a demo account before opening live account.

Is CFD trading legal in the UK?

Yes, CFD trading is legal in the jurisdiction of the UK. The trader must ensure that the chosen broker is regulated and authorised by the FCA of the UK. Profits booked on CFD trading are taxable as per the prevailing tax rates on capital gains in the UK. In case of an unsettled dispute between the client and an FCA-regulated broker, each trader is protected by up to GBP 85,000.

Which is the best CFD broker?

According to our analysis and comparison, Pepperstone, eToro, CMC Market, and City Index are among the best CFD brokers in the UK. Each broker can be suitable for different traders hence each trader must spend time and effort to check and compare the pros and cons of choosing any broker in the UK.

Which CFD Brokers Are Good?

You should only trade with brokers that are licensed by the FCA. Apart from that, each broker has its own pros and cons, and you should check out the list of brokers provided above and compare them to see which one suits you best.