Best CFD Trading Platforms 2024

CFD trading is regulated by FCA in the UK. We have discussed the pros and cons of choosing different CFD trading platfoms in the UK

CFD trading platforms in the UK allow residents in the UK to trade on various financial markets without actually owning the assets. A contract for Deposit (CFD) is a derivative financial instrument in which the price movements of the underlying assets are speculated to book profits or losses.

Forex, indices, commodities, stocks, cryptocurrencies, etc are the commonly traded financial instruments through CFDs.

What are CFD Trading Platforms?

CFD trading can be done online from anywhere through PC, tablet, and smartphone. Traders only need an electronic device, an internet connection, and a trading platform to place trade orders.

A trading platform is a software that connects traders with brokers and liquidity providers. Clients can place trade orders and do various activities associated with online trading through trading platforms. Online CFD trading cannot be done without a trading platform.

Some CFD brokers use their proprietary trading platforms designed by themselves to allow CFD trading. However, most of the CFD brokers in the UK support third-party trading platforms that are quite popular among CFD traders globally. The following are the most popular and best CFD trading platforms in the UK.

1) MetaTrader 4

MetaTrader 4 or MT4 is the most popular CFD trading platform. It was launched in 2005 by MetaQoutes Software Corporation which is a Cyprus-based company. It is the oldest CFD trading platform that is still used by a large number of forex and CFD traders worldwide.

2) MetaTrader 5

MetaTrader 5 or MT5 was launched in 2010 by MetaQuotes Software Corporation. It was designed to do the same job as MT4 but with more advanced features and algorithmic trading.

3) cTrader

cTrader was launched in 2010 by Spotware Systems, a Cyprus-based firm. It offers superior software technology and more advanced trading tools compared to MT4.

4) eToro

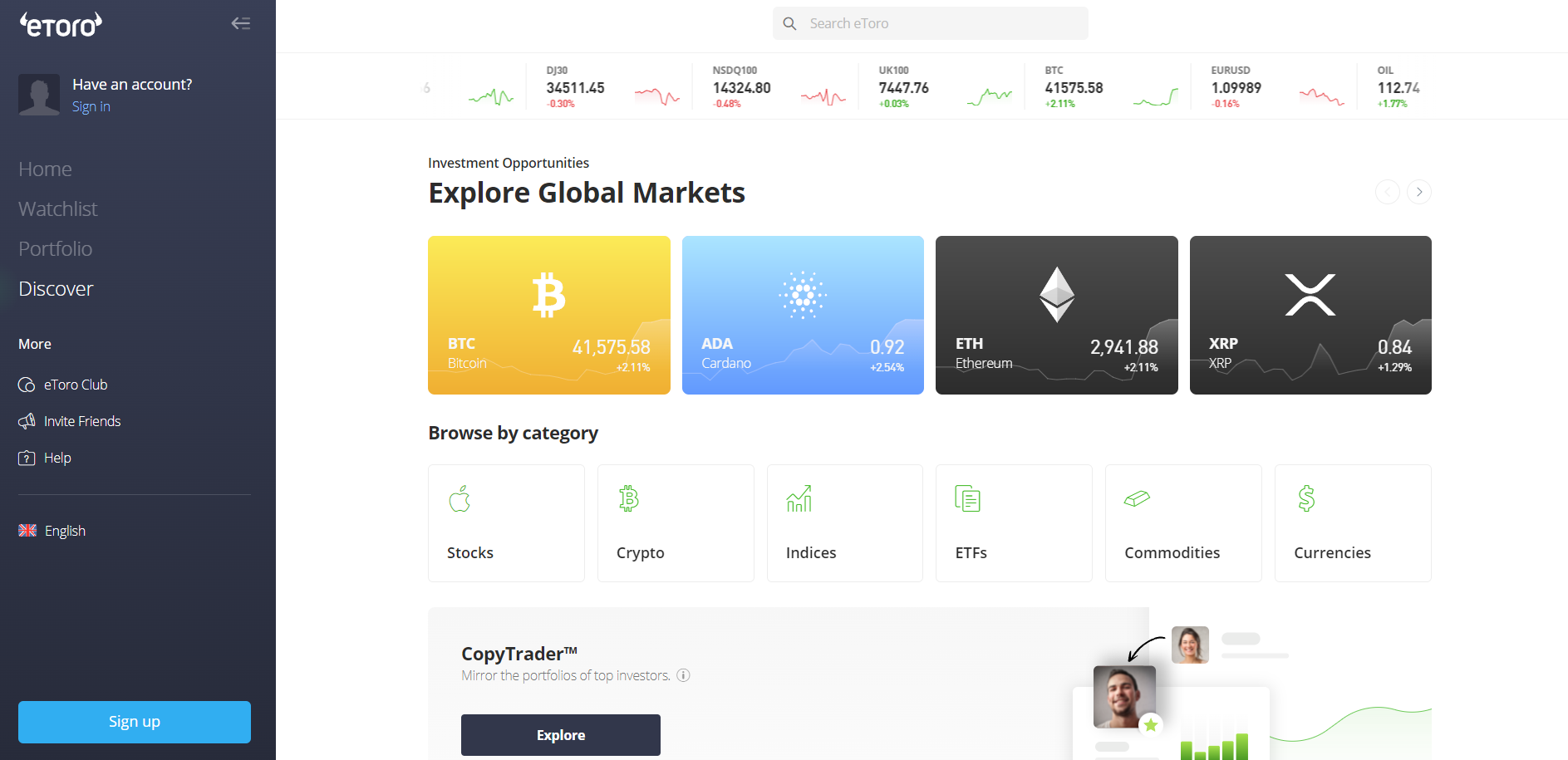

eToro is a proprietary trading platform that is designed by the CFD broker eToro. It offers a more user-friendly interface with an easy copy-trading feature. It is only available with eToro CFD brokers in the UK.

Apart from these, there are several more CFD trading platforms available in the UK. The trading instruments and other features at a trading platform depend on the broker chosen by the trader.

Brokers with Best CFD Trading Platforms in the UK

Following are the brokers in the UK that allow trading on the best CFD trading Platforms.

List of Best CFD Trading Platforms UK for 2024

- eToro – Best Proprietary CFD Trading Platform with Free Copy Trading

- IG Markets – Best MT4 CFD Trading Platform with 12,000 CFD Instruments

- City Index – Best MT4 Trading Platform with Low Fees

- CMC Markets – Best Overall MT4 CFD Trading Platform

- Saxo – Proprietary Trading Platform with USer Friendly Interface

- Plus500 – Best Proprietary CFD Trading Platform

- AvaTrade – Best Trading Platform for Beginners

We have introduced the brokers to the best CFD trading platform in the UK. We have also explained their regulation, fees, trading conditions, and the instruments that can be traded with each broker. To know more about these brokers, read our detailed and comprehensive review.

#1 eToro – Best Proprietary CFD Trading Platform with Free Copy Trading

eToro is an FCA-regulated CFD broker that allows trading on their own trading platform. No other trading platform can be chosen for CFD trading at eToro.

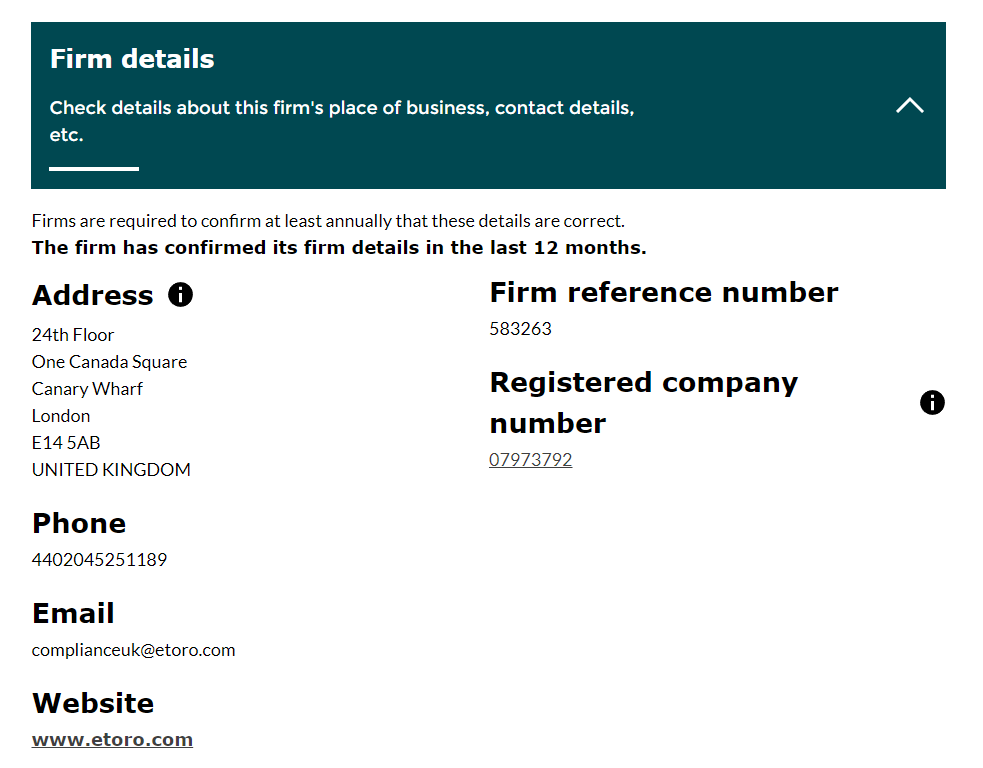

Regulation: eToro holds the regulatory license from top-tier FCA with entity name eToro (UK) Limited and license number 583263. They acquired the FCA license in the year 2013.

eToro is also regulated by the top-tier ASIC and CySEC in the jurisdiction of Australia and the European Union respectively. eToro can be considered safe to trade in the UK as the clients are registered and protected under FCA regulations.

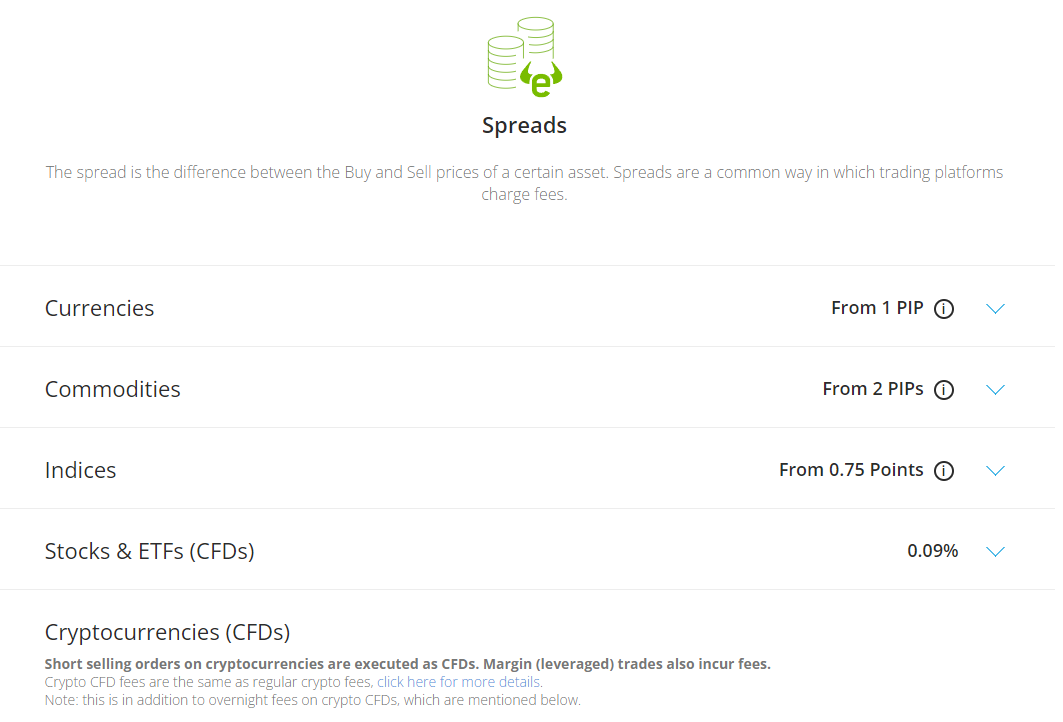

Fees: The trading fees are moderate when compared with other FCA-regulated CFD brokers in the UK. The average typical spread for EUR/USD at eToro is 1 pip. They do not charge any trading commission as there are no choices for account types. All the available CFD instruments can be traded without a trading commission.

The non-trading fees at eToro are slightly higher when compared with other FCA-regulated CFD brokers in the UK. $5 is incurred on each withdrawal regardless of the withdrawal method or amount. The inactivity fee is $10 per month after a consecutive inactive period of 1 year.

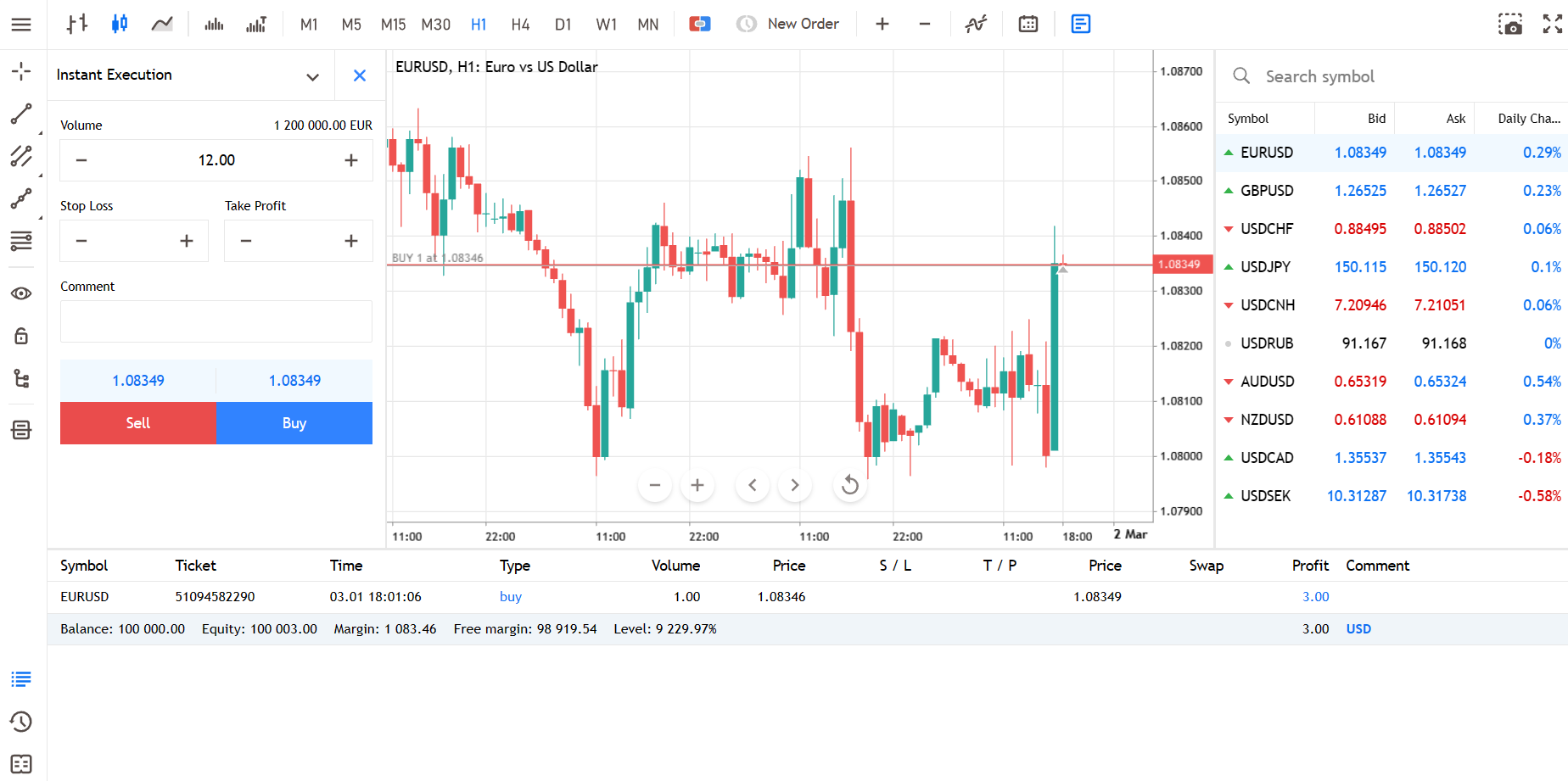

Trading Conditions: The look and feel of the eToro trading platform are much better compared to MT4, MT5, or cTrader. The platform is very user-friendly and is ideal for beginners. The copy trading feature is free and easy to access. Any public trading account on the eToro trading platform can be copied without any additional commission.

Clients require a minimum deposit of $200 to trade at eToro. The maximum leverage for the UK clients is 1:30 for the major currency pairs. GBP or any other currency cannot be chosen as the base currency of the account. USD is the only available account currency at eToro.

Deposits and withdrawals can be done through bank transfers, credit/debit cards, and e-wallets like Neteller, Paypal, and Skrill.

Available Instruments: eToro allows trading on more than 2300 CFD instruments on their proprietary trading platform. This includes 49 currency pairs, 12 stock indices, 2000 stocks, 256 ETFs, and 37 cryptocurrencies.

#2 IG Markets – Best MT4 CFD Trading Platform with 12,000 CFD Instruments

IG is one of the oldest CFD brokers in the UK. They allow CFD trading through MetaTrader 4 and a proprietary trading platform called ProRealTime.

Regulation: IG Markets can be considered very safe to trade CFDs in the UK. IG Markets Limited is the legal entity that is regulated by the FCA under license number 124721. IG Markets is also regulated by the top tier regulators ASIC in Australia, FSCA in South Africa, and NFA, and CFTC in the USA.

The incorporation of IG Markets dates back to 1974 but they started providing CFD trading services in 2003. They are regulated by all the strictest financial regulators in the world. Hence, the third-party risk of choosing IG is very low.

Fees: Spreads and overnight charges are the only trading fees at IG Markets. The commission is only incurred on trading shares. The average typical spread on EUR/USD at IG markets is 1 pip.

The inactivity fee is high ($12 per month) but it is only incurred after 2 years of inactivity.

Trading Conditions: IG Markets offer only a single type of account for all traders. This account can also be opened with GBP as the base currency. The trading platforms available to choose from with the CFD trading account are MT4, ProRealTime, and L2 Trader.

MT4 is the most chosen platform at IG Markets. The ProRealTime offers a more user-friendly interface with the availability of several advanced charting and research tools.

Available Instruments: IG Markets allow traders to trade on more than 12,000 CFD instruments. Apart from more than 11,000 shares of CFD, IG Markets offer 90 currency pairs, 25 commodities, 10 cryptocurrencies, and 70 indices. All the available instruments can only be traded as CFDs.

#3 City Index – Best MT4 Trading Platform with Low Fees

City Index is an FCA-regulated broker that allows trading on the MT4 trading platform on all devices.

Regulation: StoneX Financials Ltd is the legal entity of the trading name City Index that is regulated by the FCA under license number 446717. Clients residing in the UK are registered under FCA regulations.

City Index is also regulated by the ASIC of Australia and MAS of Singapore. The parent company of City Index, Stonex Group is also publicly listed on the NASDAQ with the ticker symbol SNEX. This further increases the trust factor and reduces the third-party risk.

Fees: Spreads are the major constituent of the trading fee as no commission is charged for trading any of the CFDs excluding stock CFDs. The average typical spread for EUR/USD is 0.8 pips but depends on the active hours and market conditions.

The fixed trading commission is only incurred on stock CFDs and is GBP 10 for each trade. No other non-trading fees are charged from clients in the UK as deposits and withdrawals are free. No inactivity fees are charged from traders at City Index.

Trading Conditions: MT4 is the only trading platform available to trade at City Index. There are three choices of account types with slight differences in the services offered. The pricing remains the same.

Clients can open a CFD trading account with GBP as the base currency at City Index. The broker accepts multiple deposit and withdrawal methods including local bank transfers in the UK.

Available Instruments: City Index allows trading on more than 4500 financial instruments as CFDs. This includes more than 4000 shares, 600 ETFs, 84 currency pairs, 20 indices, and 6 cryptocurrencies.

#4 CMC Markets – Best Overall MT4 CFD Trading Platform

CMC Markets is an FCA-regulated CFD broker that allows trading on MT4 and an upgraded version of MT4 called as Next Generation Trading Platform.

Regulation: CMC Markets is regulated by the FCA with legal entity CMC Markets UK PLC under license number 173730. It is a UK-based company that started financial services in 1989. It acquired an FCA license to offer CFD trading in 2001. CMC Markets is listed on the

London Stock Exchange and is quite transparent with its financials and holdings.

Apart from FCA, CMC Markets is regulated by ASIC in Australia, MAS in Singapore, BaFIN in Germany, etc. CMC Markets is among the least risky CFD brokers in the United Kingdom.

Fees: CMC Markets only incur spread and overnight charges as trading fees. The trading commission is only incurred on stock CFDs. The average typical spread for EUR/USD at CMC Markets is 0.7 pips.

The deposit and withdrawals are free through bank transfer. Monthly inactivity fees of $10 are incurred each month after 12 months of inactivity.

Trading Conditions: There is no minimum requirement for deposit amount at CMC Markets. They do not offer any option for CFD account types but allow you to choose between two trading platforms namely MT4 and the Next Generation trading platform.

GBP can be chosen as the base currency of the account.

Available Instruments: CMC Markets offer the highest number of forex pairs among FCA-regulated CFD brokers in the UK. More than 11000 CFD instruments are available to trade at CMC Markets. This includes 338 forex pairs, 88 indices, 15 cryptocurrencies, 1000 ETFs, 123, commodities, and 10,000+ stocks. All the available instruments can only be traded as CFDs.

#5 Saxo – Proprietary Trading Platform with USer Friendly Interface

Saxo Market is an FCA-regulated forex and CFD broker and is a subsidiary of Saxo Bank based in Denmark.

Regulation: Saxo Markets is a well-regulated broker as it holds regulatory licenses from various top-tier regulatory authorities globally. Saxo Capital Markets UK Ltd is the legal entity of Saxo Markets that is regulated by the FCA of the UK. Apart from this, Saxo is also regulated by ASIC of Australia and other regulatory authorities. Saxo Market can be considered safe for trading forex and CFDs in the UK.

Fees: The fee structure on forex and CFD trading is built into spreads. No trading commission is incurred from the traders on forex CFD instruments at Saxo. The 3 account types differ on the basis of minimum deposit requirement starting from $2000 for the standard account. The minimum deposit amount for the Platinum and VIP account are $200,000 and $1,00,000 respectively.

The average typical spread on EUR/USD is 0.9 pips with the standard account and the same with the Platinum and VIP accounts are 0.8 and 0.7 pips respectively. The spreads at Saxo are lower than many FCA-regulated brokers in the UK.

Trading Platform: Saxo Market allows trading through their proprietary trading platforms called as SaxoTraderGo and SaxoTraderPro. Both the trading platforms are available for mobile, desktop, and tablet devices. The SaxoTraderGo trading platform is ideal for all types of traders while the SaxoTraderPro trading platform is ideal for advanced traders.

#6 Plus500 – Best Proprietary CFD Trading Platform for Beginners

Plus500 is an FCA-regulated forex and CFD broker that allows trading through their proprietary trading platform.

Regulation: Plus500 can be considered safe for trading in the UK as it is regulated by FCA in the UK. Apart from FCA, Plus500 is also regulated by top-tier regulatory authorities like FSCA of the South Africa and ASIC of Australia.

Plus500 is an Israel-based company that is also listed on London Stock Exchange. The company is transparent with its financials and revenue generation. Hence, it can be considered safe for trading forex and CFD in the UK.

Fees: The fee structure at Plus500 is simple as they only offer a single account type for all traders. The trading fee is built into spreads starting from 0.6 pips. The average typical spread for EUR/USD currency pair is 0.8 pips at Plus500.

Trading Platform: Plus500 offers a user-friendly trading platform with a simple and modern interface. The platform is easy to comprehend for beginners as well as experienced traders. It is available on the web, mobile, tablet, and desktop devices.

#7 AvaTrade – Best Trading Platform for Beginners

AvaTrade offers a variety of trading platform including MT4, MT5, and a proprietary trading platform AvaTradeGo.

AvaTrade is not regulated by FCA in the UK but can still be used for trading as it is regulated by ASIC in Australia, FSCA of South Africa, and CySEC of the European Union. The third-party risk of choosing AvaTrade in the UK is higher than for FCA-regulated brokers. Clients residing in the UK are registered under B.V.I Financial Services Commission at AvaTrade.

AvaTrade does not offer choices for account types as they only offer a single account type. The trading fees at AvaTrade are built into spreads with no trading commission. The spreads at AvaTrade start from 0.9 pips for EUR/USD currency pair. Among non-trading charges, inactivity fees are the only charge applicable if no trades are executed for 90 days.

The maximum leverage at AvaTrade is 1:400 as it is not regulated by FCA in the UK. AvaTrade allows trading through multiple trading platforms. Traders can choose between MT4, MT5, and their proprietary platform AvaTradeGo. All these platforms are available on mobile, tablets, and desktop devices.

How to Choose the Best CFD Trading Platform in the UK?

Clients residing in the UK must only choose a CFD trading platform that is ideal for them. However, the trading experience with the same platform could be different with different brokers.

Each broker supports different trading platforms with different trading conditions. Before you open an account with any of the CFD brokers in the UK, it is essential to check and compare several other aspects.

1) Regulation

CFD trading in the United Kingdom is regulated by the Financial Conduct Authority (FCA). Whenever a UK resident opens an account with FCA regulated broker, they are registered under FCA regulation. Such clients are protected by up to GBP 85,000 per client in case of an unsettled dispute between broker and client.

Clients residing in the UK must only open their accounts with an FCA-regulated broker. A CFD broker in the UK that is not regulated by the FCA is very likely to be fake and carries a high third-party risk.

The FCA regulation of a broker can be checked through the Firm Registration Number (FRN) which is mostly mentioned in the footnote of their official website. If not found, clients can inquire about the FRN number of FCA regulations through the customer support services.

The FRN number can be cross-checked through the official website of FCA (www.fca.org.uk). Traders must check for spelling errors, clones, addresses, and other information of the brokers on the FCA website.

2) Fees

Fees can greatly influence the profits and losses booked while trading CFDs. Trading, as well as non-trading fees, needs to be checked before opening an account with any CFD trading platform.

Trading fees include spreads, trading commission, and overnight charges. Spread is the difference between the bid and ask price of a CFD instrument. The commission is a fixed charge that depends on the trading volume and is incurred on each trade order.

Non-trading fees include deposit/withdrawal fees, inactivity fees, account opening fees, currency conversion fees, etc. Most brokers do not disclose all the components of fees involved in CFD trading. Hence, it is important to inquire about the fee structure before opening the account.

3) Trading Conditions

Your trading account at any trading platform is managed by the chosen broker. Hence, the trading conditions at a particular trading platform can be different with each linked broker account.

The account currency, leverage, margin, and several other factors need to be checked before opening an account. The availability of deposit and withdrawal methods should be checked along with the time taken in the processing of transactions.

4) Available Instruments

Clients must always choose a CFD trading platform that allows trading on their preferred financial instrument. No matter what trading platform you choose, the number of available instruments will be different and depend on the broker chosen by the trader.

Forex, indices, commodities, stocks, ETFs, bonds, cryptocurrencies, and stocks are the most common instruments offered by CFD brokers in the UK. It is always recommended to trade only on familiar instruments as CFD trading involves high risk. However, the availability of more instruments gives more opportunities to the trader.

5) Customer Service

The quality of customer support services can greatly affect the trading experience regardless of the trading platform you choose. Each broker offers different quality customer support services with different methods to reach out to the executives.

The time taken by the support staff to resolve a query with a resourceful reply must be checked by the client in their respective region. This can be checked by raising random queries through the available customer support methods before opening the account.

Common Mitakes that Traders Make While Trading CFD

Following are the common mistakes that traders make while choosing CFD trading platforms in the UK.

- Regulation Verification: It’s essential to confirm that your chosen CFD trading platform adheres to regulatory standards for security and oversight.

- Thorough Research: Avoid the mistake of not researching and comparing CFD platforms based on factors like fees, markets, tools, and customer support.

- Fee Awareness: Be mindful of various charges like spreads, commissions, and overnight costs that can impact your profits.

- Risk Management Oversight: Don’t overlook risk management features, such as stop-loss orders, as they play a crucial role in CFD trading.

- Customer Support Value: Adequate customer support is vital for resolving issues and seeking guidance in your trading journey.

- Platform Testing: Always assess the platform with a demo account before committing real funds to ensure it meets your needs.

- Diverse Assets: Choose platforms offering a wide range of CFDs that match your trading interests.

- User-Friendly Design: Opt for a user-friendly platform, particularly if you’re a beginner, to avoid trading errors.

- Education and Research: Utilize the platform’s educational and research resources to enhance your trading skills.

- Trading Tools Importance: Consider platforms that provide essential trading tools like technical indicators, charting, and news feeds for informed decision-making.

- Security Priority: Prioritize platforms with robust security measures to protect your account and financial information.

- User Feedback: Pay attention to user reviews for insights into a platform’s performance and customer satisfaction.

- Promotions Caution: Be cautious when choosing a platform based on promotions, as they often come with conditions attached.

Comparison Between MT4, MT5, and cTrader Trading Platform

| Aspect | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader |

|---|---|---|---|

| User Interface | Simple and user-friendly | More advanced with additional features | Modern and highly intuitive |

| Market Access | Forex-focused | Broader, including stocks and commodities | Forex-focused with varied instruments depending on broker |

| Trading Tools | Extensive trading tools and indicators | More timeframes, indicators, and graphical objects than MT4 | Advanced charting tools and order types |

| Algorithmic Trading | Uses MQL4 for Expert Advisors | Uses MQL5 for more complex strategies | Uses C# for cAlgo, catering to experienced developers |

| Execution Type | Instant and market execution (broker-dependent) | Instant and market execution (broker-dependent) | Known for ECN execution with direct market access |

Risk of Trading CFDs

Leverage Risk: With CFDs, you can control a big trade with a small amount of your own money. But this can also mean bigger losses if the trade goes bad.

Market Risk: CFDs follow the real prices of assets, and these can jump around a lot. So, you might make or lose a lot of money quickly.

Broker Risk: Your CFD trades are made through a broker. If the broker goes bankrupt, you could have trouble getting your money back.

No Ownership: When you trade CFDs, you don’t really own the things you’re trading. For example, with CFDs on stocks, you can’t vote at company meetings.

Comparison of Best CFD Trading Platforms UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| eToro |

3 pips

|

$200

|

1:30

|

Visit Broker |

| IG Markets |

1 pip

|

$300

|

1:30

|

Visit Broker |

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

FAQs on Best CFD Trading Platforms UK

Is CFD Trading Profitable?

Yes, CFD trading is profitable but not for everyone. It involves financial risk and the traders are always at the risk of losing the invested capital. More than 70% of the beginners lose money while trading CFDs.

What is the Best CFD Trading Platform in the UK?

Each CFD trading platform has its pros and cons. However, MT4 is the oldest, most chosen, and most popular CFD trading platform. It is user-friendly and simple to use with fast order execution. Most professional traders prefer MT5 while proprietary trading platforms are ideal for beginners.

Is CFD trading legal in UK?

Yes, CFD trading in the UK is legal and is regulated by the Financial Conduct Authority (FCA) of the UK. Clients residing in the UK must only trade with a broker that is regulated by FCA of the UK.

Do you pay tax on CFD profits in UK?

Yes, profits booked on CFD trading in are taxable in the UK. Traders have to pay tax depending on the prevailing tax slab of the UK.

Is CFD good for beginners?

CFD trading involves high risk and might not be ideal for the beginners who do not have any experiene of trading in capital markets. It is always advisable for the beginners to start with a demo account and trade with virtual currency before trading with a live account.

Why do so many people lose money on CFD?

More than 70% CFD traders lose money while trading CFDs in the UK. CFD trading is very risky and requires proper research and strategy to make profits. Out of those who make profits in CFD trading, majority are experienced traders with several years of experience.

Can you make millions on CFD?

No, CFD trading is involves financial risk and is not a get-rich -quick scheme. CFD trading is done on regulated financial markets however, the lot size and involvement of leverage can greatly affect the profit and loss amount. It is advisable to use a demo CFD trading account with realistic deposit and leverage to know how much profit you can make trading forex.

How can Beginners Trade CFD in the UK?

Beginners can start trading CFDs in the UK by opening a CFD trading account with an FCA regulated broker. They will need to submit the documents, complete KYC, and make a deposit in order to start trading CFDs in the UK. Choosing the broker is the most important step involved in starting CFD trading.