Best Forex Brokers for Beginners UK 2024

There are multiple forex brokers available in the UK. Not every best forex broker is ideal for the beginners. Check our unbiased opinion and list of best forex brokers for beginners.

If you have already decided to trade in the forex market, the first thing you need is a good forex broker. However, which forex broker is the best is a common query with vague answers over the internet. Each forex broker can have different features, and trading conditions, and is ideal for different types of traders.

In this guide, we have selected some of the best forex brokers that are ideal for beginners. We have also described the trading conditions with each broker along with their pros and cons in the UK.

We’ve detailed why these selected forex brokers are ideal for beginners. Their user-friendly platforms, educational resources, risk management tools, and responsive customer support make them a solid choice for newcomers to the forex market.

List of Best Forex Brokers for Beginners UK for 2024

- eToro – Best User-Friendly Forex Broker for Beginners

- CMC Markets – Forex Broker with Highest Available Instruments

- Capital.com – Best Broker with Multiple Education Tools

- City Index – Best CFD Platform with Spread Betting

- Plus500 – Best Forex Broker with Proprietary Platform

- Pepperstone – Regulated CFD Broker with Fast Trade Execution

- AvaTrade – Best Forex Broker with High Leverage

These brokers are selected after a thorough analysis of more than 12 factors that are important for beginners in forex trading. Clients residing in the UK must only choose a broker according to their suitability after comparing the best forex brokers.

#1 eToro – Best User-Friendly Forex Broker for Beginners

eToro offers a user-friendly proprietary trading platform for trading multiple asset classes. It is a well regulated CFD broker with attractive pricing and useful tools.

Regulation

eToro is regulated by the Financial Conduct Authority of the UK with FRN number 583263. Clients residing in the UK are registered under FCA with the legal entity eToro (UK) Ltd. Clients in the UK are protected by up to £85,000 per client under the FCA regulation.

Apart from FCA, eToro also holds regulatory license from ASIC (491139), CySEC (109/10), and FSAS in other jurisdictions. eToro is a privately held firm founded in 2007 and is not publicly listed on any stock exchange.

Fees

eToro does not incur trading commissions for forex trading. The trading fees is built into spreads that start from 1 pip. The average spread for EUR/USD at eToro is 1 pip.

The overnight swap fee is decent while the inactivity fee is $10 for each month after 1 year of inactivity.

eToro incurs a fixed withdrawal fee of $5 regardless of the methods used. The deposits are free. Clients will also be incurred with a currency conversion fee if the deposit currency is different than USD.

Trading Conditions

eToro is a good choice for beginners due to its unique user-friendly platform. Their proprietary platform allows trading on 49 forex pairs, 2500+ stocks, 127 cryptocurrencies and several other instruments.

The copy trading feature is simple and free of any additional commission. There are no choices of account type with different fees or trading conditions. However, higher equity in the account will allow traders to take advantage of useful services. Depending on the account equity, eToro offers different customer support and additional services.

According to our analysis, eToro can be a great choice for beginners as the trading platform is user-friendly, fee is low, and the minimum deposit requirement is low ($10).

eToro Pros

- Excellent Social trading platform

- Copy trading feature is free and simple to use

- Large selection of cryptocurrencies

- Low fees

- Low minimum deposit

eToro Cons

- Poor customer support

- High non-trading fees

- GBP cannot be chosen as base currency of the account

#2 CMC Markets – Forex Broker with Highest Available Instruments

CMC Markets is a well-regulated CFD broker that is also listed on the London Stock Exchange. It can be a good choice for the beginners who seek multiple trading instruments with low deposits.

Regulation

CMC Markets is regulated by the Financial Conduct Authority of the UK under FRN number 173730. Clients residing in the UK are protected under the FCA regulation.

Apart from FCA, CMC Markets is regulated by BaFin of Germany, IIROC of Canada, ASIC of Australia, FMA of New Zealand, MAS of Singapore, and DFSA of the United Arab Emirates. CMC Markets is a publicly listed company on London Stock Exchange (CMCX) and is very transparent with its financials.

CMC Markets can be considered safe for traders as there is a very low third-party risk.

Fees

The spreads at CMC Markets are lower than many other FCA-regulated CFD brokers in the UK. The average typical spread for EUR/USD is 0.7 pips at CMC markets with no additional trading commission.

There are no choices of account types with the different pricing structures. Hence, the trading fees are only built into spreads that are lower than many FCA-regulated forex brokers in the UK.

Trading stocks at CMC markets will incur a variable commission starting from $10 per trade. CMC Markets does not incur any deposit or withdrawal fee for all the available methods. The inactivity fee is GBP 10 per month after 12 months of inactivity.

Trading Conditions

Clients residing in the UK can open their trading accounts with GBP as the base currency. This means that no currency conversion fee will be applicable if deposits and withdrawals are done in GBP.

CMC markets do not have a minimum deposit requirement. This makes it ideal for beginners who wish to start with a low initial deposit.

Clients can trade through MetaTrader 4 trading platform at CMC markets and a mobile trading app that is also based on the MetaTrader platform. MT4 is considered an ideal choice for beginners and is also the most popular forex trading platform globally.

More than 10,000 financial instruments can be traded including 338 forex pairs. The number of instruments at CMC markets is the highest among all the FCA-regulated forex brokers in the UK.

Those who wish to trade on the MT4 trading platform with a wide range of trading instruments at low fees will find CMC markets ideal for themselves.

CMC Market Pros

- Highest number of available instruments in the UK

- CMC Markets is listed on London Stock Exchange

- Low fees

- No minimum deposit amount

CMC Market Cons

- Customer support services are not available on weekends

- MT5, cTrader, or any other platform apart from MT4 is not available

#3 Capital.com – Best Broker with Multiple Education Tools

Capital.com is a well regulated CFD broker with low fees and useful tools for research and education.

Regulation

Capital Com (UK) Ltd is the legal entity that is regulated by the Financial Conduct Authority under license number 793714. Clients residing in the UK are protected under FCA regulation and Financial Services Compensation Scheme (FSCS).

Apart from this, Capital.com is also regulated by ASIC in Australia and CySEC in the European Union. The broker is not listed on any stock exchange but is fairly transparent with their statements and sheet.

Fees

The fees at Capital.com are lower compared to many other FCA-regulated forex brokers in the UK. There are no choices for account types with different pricing patterns. The trading fee is built into spreads as no commission is incurred from the traders.

The spreads start from 0.7 pips while the average typical spread for EUR/USD is 0.8 pips. The overnight rollover charges are also lower than many other brokers in the UK.

We didn’t find any trading or non-trading commission at Capital.com. There is no deposit/withdrawal fee, account opening, maintenance, or inactivity fee at Capital.com. This can be advantageous for beginners.

Trading Conditions

Capital.com supports the MetaTrader 4 and TradingView Trading Platforms for trading all the available instruments. They also provide mobile apps and webtrader for trading. A total of 140 forex pairs can be traded along with several other CFD instruments.

Capital.com offers multiple tools for research and education making it easier to learn forex trading for beginners. There are multiple guides and courses that can assist beginners in gaining knowledge and experience regarding forex trading.

Capital.com Pros

- Wide range of trading instruments available

- Training and learning tools are excellent

- Low fees

- Low minimum deposit amount

- Excellent customer support services through multiple methods

- Support services also available on weekends in the UK

Capital.com Cons

- MT5 is not available

- Not listed on any stock exchange

#4 City Index – Best Forex Broker with Spread Betting

City Index is one of the oldest forex brokers in the UK as it was incorporated in 1983. It is a well-regulated broker with useful training tools helpful for the beginners.

Regulation

Clients residing in the UK are registered under FCA regulation at City Index. StoneX Financial Ltd is the legal entity of City Index that is regulated by the Financial Conduct Authority under license number 446717.

Apart from FCA, City Index is also regulated by the ASIC in Australia, DFSA in UAE, and MAS in Singapore. City Index is a member of Stonex Group INC which is publicly traded on NASDAQ. The third-party risk of choosing City Index in the UK is very low as clients are protected under FSCS.

Fees

The spreads for major pairs at City Index start from 0.5 pips. However, the average typical spread for EUR/USD at City Index is 0.8 pips which are lower than many FCA regulated brokers in the UK.

Spread is the only component of the fee that is incurred from the retail traders. Overnight rollover charges are average and are only incurred when a position is kept open overnight.

The commission is only incurred while trading shares. Deposits and withdrawals through all the available methods are free. A currency conversion fee will be applicable if the deposit currency is different from the base account currency.

The inactivity fees for the GBP-based account are GBP 12 per month and $15 per month for the USD-based account. This will be incurred every month if no trades are executed for 12 consecutive months.

Trading Conditions

City Index support MetaTrader 4 trading platform for all the devices. They also have a mobile trading app and webtrader that are based on MetaTrader platforms.

Clients can trade more than 4500 financial instruments including 84 currency pairs. All instruments can only be traded via CFDs. The deposit and withdrawal through local banks are free and GBP can be chosen as the base currency of the account.

City Index offers excellent training tools that can greatly enhance the trading techniques and strategies of beginners in the UK.

City Index Pros

- Training and learning tools are excellent

- Wide range of financial instruments available

- Excellent customer support services through multiple methods

City Index Cons

- MT5 trading platform is not available

- Support services not available on weekends in the UK

#5 Plus500 – Best Forex Broker with Proprietary Platform

Plus500 is a top-tier regulated CFD broker that offers proprietary trading platform for all types of devices. The trading platform at Plus500 is user friendly for the beginners.

Regulation

Plus500UK Ltd is the legal entity regulated under FCA under which clients in the UK are registered and protected. Plus500 holds a regulatory license from FCA (509909) of the UK, CySEC of the European Union, ASIC of Australia, FSCA of South Africa, FMA of New Zealand, and MAS of Singapore.

Plus500 was launched in 2008 and is a publicly listed company on the London Stock Exchange (PLUS.L). It is an Israel-based financial services provider that is globally regulated by multiple top-tier financial regulatory authorities.

Fees

The pricing structure is the same at Plus500 for every retail client. The trading fee is built into spreads and overnight charges (if a leveraged trade order is kept open overnight). No commission is incurred for deposits, withdrawals, opening, or closing a position.

The average typical spread for EUR/USD at Plus500 is 0.8 pips. The overnight rollover fees at Plus500 are comparatively higher than other FCA-regulated CFD brokers in the UK.

Plus500 incurs an inactivity fee of $10 per month if no trades are executed for three months. The inactivity period at Plus500 is much shorter compared to other brokers in the UK.

Trading Conditions

Plus500 has its own proprietary trading platform that is simple and easy to use. The look and feel of the platform are more user-friendly. This makes it an ideal choice for beginners. No other trading platform can be chosen to trade at Plus500.

The platform allows trading on more than 2000 financial instruments including 67 currency pairs. The research and education tools are limited and lower than other brokers.

Plus500 Pros

- Well regulated firm publically listed on LSE

- Excellent customer support services through multiple methods

- No withdrawal commission

Plus500 Cons

- MT4,MT5, or any other trading platform not available

- Support services not available on weekends in the UK

- High minimum deposit requirement

#6 Pepperstone – Regulated CFD Broker with Fast Trade Execution

Pepperstone is a top-tier regulated forex broker that supports multiple trading platforms. The minimum deposit requirement is also low making it a good choice for the beginners.

Regulation

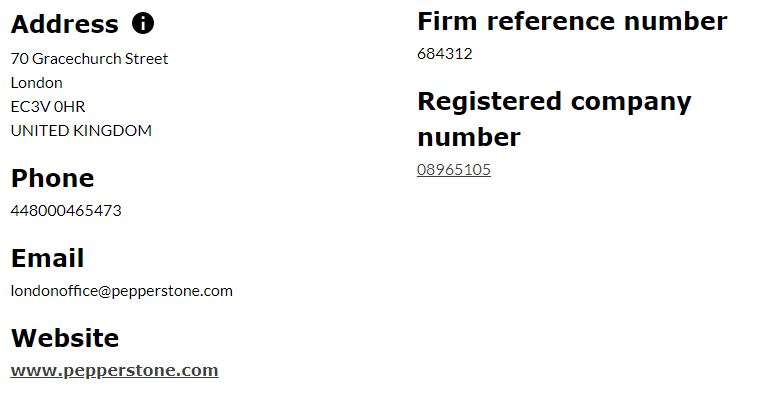

Pepperstone in the UK is regulated by the Financial Conduct Authority. Pepperstone Limited is the legal entity that is regulated by FCA under license number 684312. Clients residing in the UK are registered under FCA regulation and are protected under FSCS.

Apart from FCA, Pepperstone is also regulated by ASIC in Australia, BaFIN of Germany, and CySEC of the European Union. It was launched in 2008 and can be considered safe for clients residing in the UK.

Fees

Pepperstone offers two account types with different pricing structures. The Razor account type is a commission-based account with low spreads. The standard account is a spread-only pricing structure. The Standard account is ideal for beginners.

The average typical spread for EUR/USD currency pairs is 0.12 pips and 1.12 pips with the Razor and Standard accounts respectively.

The trading commission with the Razor account depends on the trading platform and account currency that has been chosen. For USD-based accounts, the trading commission is $7 for a round trade of a standard lot with MetaTrader platforms. The same with the GBP-based account is GBP 4.50.

The trading commission with the cTrader trading platform is $6 equivalent to a round trade of a standard lot. The overnight fees are slightly higher than some of the FCA-regulated brokers in the UK.

There is no deposit/withdrawal fee, inactivity fee, or any other non-trading fee at Pepperstone.

Trading Conditions

Clients can start trading at Pepperstone with a deposit of as low as $1. GBP can be chosen as the base currency apart from USD, EUR, and CHF.

Pepperstone supports all the 3 most chosen forex trading platforms in the world namely MT4, MT5, and cTrader. Any one of the three platforms can be chosen with any account configuration. MT4 is ideal for beginners.

Pepperstone offers trading on 1200+ instruments including 63 currency pairs. There is an average number of research and education tools that can assist beginners in forex trading.

Pepperstone Pros

- Multiple trading platforms are supported

- Low minimum deposit

- low fees

- No inactivity fees

Pepperstone Cons

- Limited research and education tools available

- Support services not available on weekends in the UK

#7 AvaTrade – Best Forex Broker with High Leverage

AvaTrade is a CFD broker with multiple trading platforms supported. AvaTrade is not regulated by FCA in the UK but holds multiple top-tier regulation in other jurisdictions.

Regulation

AvaTrade is not regulated by FCA in the UK. However, it is regulated by ASIC in Australia, FSCA in South Africa, CySEC in the European Union, and several other financial regulatory authorities.

Clients residing in the UK are registered under the legal entity Ava Trade Markets Ltd under the regulation of the B.V.I Financial Services Commission.

Pepperstone was launched in 2007 and is not listed on any stock exchange. Clients in the UK are not protected under FCA or FSCS. The third-party risk of choosing Pepperstone in the UK is slightly high compared to FCA-regulated forex brokers in the UK.

Fees

AvaTrade offers a single account type where the trading fees are built into spreads and overnight charges. No trading commission is incurred for opening and closing any position.

The average typical spread for EUR/USD is 0.9 pips. This is average when compared with other brokers in the UK.

AvaTrade does not incur any non-trading commission apart from inactivity fees. An inactivity fine of $50 is incurred for three months of inactivity and $100 for a year of inactivity.

Trading Conditions

As AvaTrade is not regulated under FCA, the maximum leverage cap is higher than other brokers that are regulated under FCA. Clients can trade with max leverage of 1:400 instead of 1:30. However, high leverage is not good for beginners as it may lead to severe losses.

AvaTrade offers MT4 and MT5 trading platforms and a proprietary platform called AvaTradeGo. They also offer a separate platform for copy trading and automated trading named DupliTrade and ZuluTrade respectively.

AvaTrade allows trading on 65 currency pairs and several other financial instruments as CFDs.

AvaTrade Pros

- Multiple trading platforms are supported

- Convenient copytrading feature

- High maximum leverage can be chosen

AvaTrade Cons

- Inactivity fee is very high

- AvaTrade is not regulated by FCA in the UK

How to choose a Forex broker for Beginners?

Choosing the best forex broker for beginners can be a complex task as there are many things that need to be considered. Experienced traders know the features they want and conditions that suit their trading strategy. On the other hand, beginners in the forex market are not familiar with most of the features and strategies.

We have highlighted some of the most important aspects that must be considered before a newbie selects a forex broker.

- Safety of your Funds

The safety of the deposited amount should be the top priority. The safety depends on the regulation and reputation of the brokers.

Clients residing in the UK must always prefer a broker that is regulated by the FCA. If registered under FCA regulation, each client gets the protection of up to GBP 85,000 in case of an unsettled dispute between a broker and client.

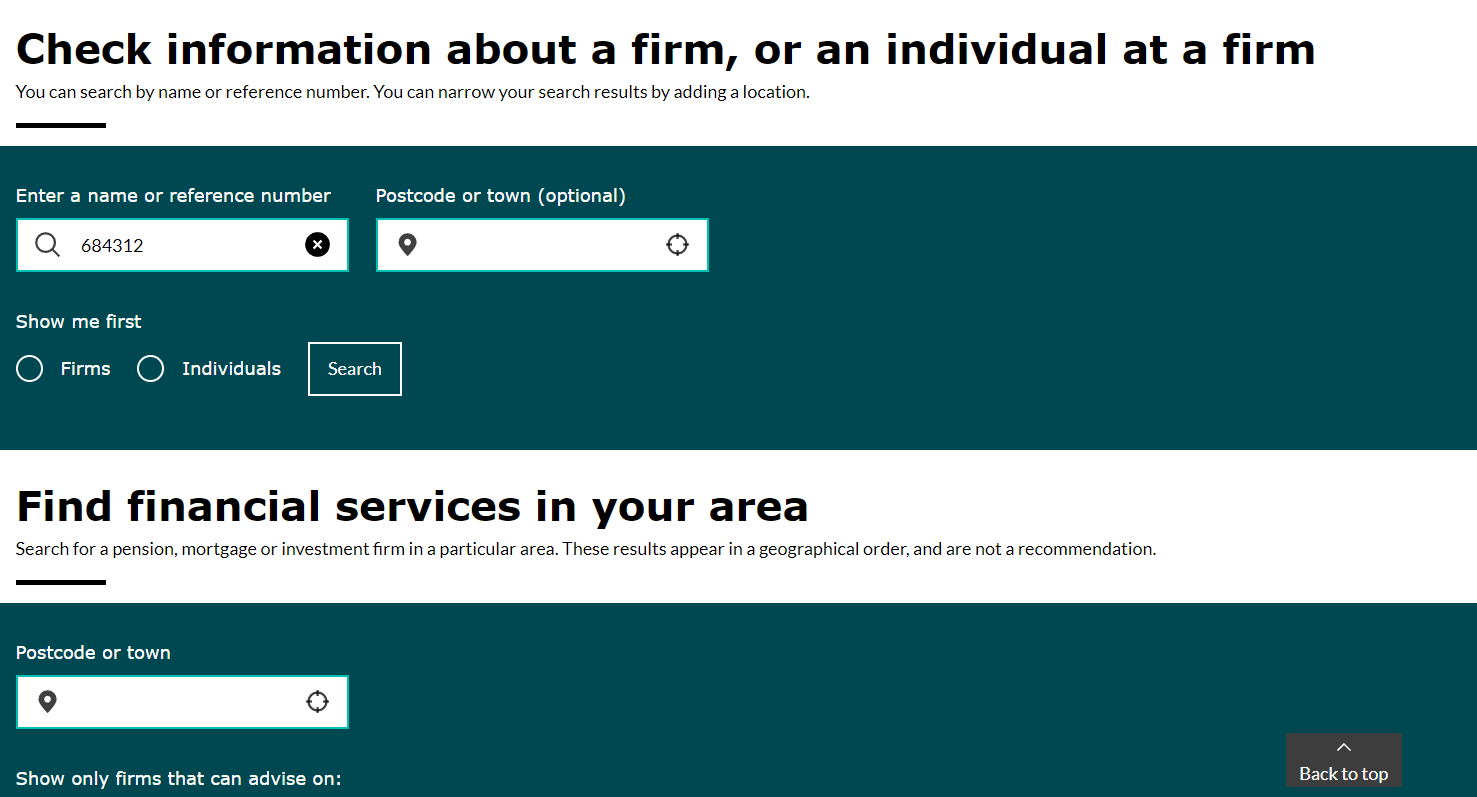

Clients should also check for other regulatory licenses held by the broker in other jurisdictions. Multiple licenses from regulated financial regulations enhance the trust factor. This becomes more important if the broker is not regulated by the FCA. The FCA website can be accessed to cross-check the current details of the brokers.

The past records, user reviews, expert reviews, years in the industry, ownership, auditing, etc can also assist in measuring the safety of your funds with the concerned broker. If a broker is publicly listed on any stock exchange, it greatly enhances the trust and lowers the third-party risk.

- Trading Cost

Most beginners always go for the broker that charges the lowest fees. Lower fees can help in increasing gains and decreasing losses but it should not be the only aspect of choosing a broker. Some fake brokers try to lure new traders by offering very low or negligible fees.Clients must understand every component of the fee to avoid inconvenience in the future. Some brokers incur low spreads but take commissions. Some have low trading fees but high non-trading fees.

Hence, all the components of fees should be thoroughly understood, checked, and compared before choosing a broker. - Learning Tools

Beginners in the forex market require more tools for research and education. Hence, they must always try to choose a broker that offers a rich variety of educational materials. Beginners should also spend more time and effort on learning strategies and price movement.

Some brokers offer a wide range of educational materials that are regularly published. Beginners in the forex market must avoid choosing brokers with lesser learning tools. - Demo Accounts

The forex market involves high risk. Beginners should always gain experience before trading with real money. A demo account can be used to trade with virtual currencies. This allows beginners to get familiar with terminologies and the basics of the forex market.

Spending more time on the demo account can help beginners understand the risk and price movements. This can also help in creating and testing the forex trading strategies without risking real money.

Most brokers offer demo accounts while some may not. Beginners must always start their journey in forex trading with a demo account. - Customer Support

Since you are new and lack experience, customer support services will be needed more often. Easy availability of the support executives through chat or phone can change the trading experience for beginners.

You can check the support services before opening the account by raising random queries to the support executives. Professional and experienced traders require customer support services less frequently than beginners. Hence, it is important for a broker to have user-friendly customer support service to become ideal for beginners. - Trading Platforms

All the trade orders are placed and executed through trading platforms. The platforms are used in electronic devices and are supported by brokers. Some brokers have their own proprietary trading platform while many use third-party trading platforms.

Some trading platforms can be user-friendly while others can be complex to understand for beginners. It is important to understand the terminologies and features of the trading platform before opening positions.Beginners must ensure whether the trading platform supported by the chosen broker is ideal for them or not. A demo account can be used to get familiar with the trading platform.

Points to Consider for Beginners in Forex Trading

Beginners in forex trading lack experience of the price movements in the forex market. There are several factors that must be considered by forex traders before they start trading with live accounts:

What is Moving the Price?

The forex market is active 24 hours a day 5 days a week. The majority of trading activities are done during active hours of the day but prices can move at any time of the day due to multiple reasons. Beginners in the forex market must identify the reason behind price movements in the past to predict the impact of any national and international event on the price movement and trends in the future.

What Currency are you Trading With?

There are more than 300 currency pairs in the forex market but most of the trading is done only on 7 major pairs. In the initial phase, it is better to trade on a pair with high liquidity. Beginners in the forex market must only trade with forex pairs that are familiar or whose price movements can be predicted. Trading with unknown pairs in the initial phase can be a huge risk.

Leverage

The leverage allows traders to open bigger positions with smaller initial deposits. This sounds attractive to most beginners in trading but it also involves high leverage risk. Traders can lose the whole amount in their account if they have used high leverage. It is always recommended to use safe leverage of 1:10 or lower and make lower deposits in the initial phase of trading.

Risk to Reward

Risk to reward is the ratio that depicts the risk taken to generate unit profits. If you set the stop loss limit and take the profit limit, the ratio of profit to loss will denote the risk-to-reward ratio of the trade order. A risk-to-reward ratio of more than 1 is considered ideal to place a trade order.

Always go With a Plan

Trading in the forex market without a plan is similar to searching for treasure without a map. Forex trading should always be done according to a plan and suitable strategies. Traders must follow a preset strategy or create their own to get better results from forex trading.

Emotions

Trading decisions based on emotions are very likely to fail as they lack fundamental reasoning. New traders often make wrong trading decisions during substantial price movements driven by emotions.

Use Learning Tools

AI-enhanced educational platforms offer personalized Forex trading learning experiences, adapting content to match each learner’s pace and areas for improvement. This targeted approach helps beginners grasp complex concepts more efficiently by focusing on individual needs, thereby accelerating the learning process.

AI-driven trading simulators provide a risk-free environment to apply theoretical knowledge in real-time market scenarios. These platforms simulate market conditions, allowing for hands-on practice and strategy testing without financial risk. Feedback mechanisms within these simulators help refine decision-making skills, making them essential for practical learning in Forex trading.

How to Open an Account with Forex Broker?

After choosing a broker, the forex trading account can be opened online through the official website and app of the broker. Following are the steps that need to be followed to open a forex trading account in the UK. However, each broker can have a different account opening process.

Step 1: Basic Details

The first step to open an account is the provide basic details to the broker on their account opening page. This includes name, email, phone number, etc. The details entered should be the same as that on the documents.

Step 2: Financial Details and Experience

Forex Brokers will need your financial information like annual income and trading experience to provide better services. Each broker may ask different questions to check the trading experience of the client.

Step 3: Document Verification

The details provided by the clients need to be cross-checked and verified by the broker. Clients need to upload a soft copy of their identity and address proofs. The executives at brokerage firms check them manually so the time in this step depends on the broker. Some brokers verify the documents within a few hours while others can take a day.

Step 4: Deposit

Once the account the verified, you will be notified by the broker. The next step is to deposit funds into the trading account. This can be done through available methods at the broker. Traders must check the deposit and withdrawal methods and the minimum amount before opening the account.

Once the deposits are made, traders can start trading forex and CFDs through trading platforms. Desktop trading platforms need to be downloaded while web trading platforms can be used on web browsers.

Risk Involved in Forex Trading

As a beginner, it is important to understand that the forex market is a very high-risk market. Taking precautionary measures can mitigate the risk factors up to some extent but there is always a risk of losing the deposited amount in forex trading. More than 70% of the traders face losses in forex trading.

The following are the major components of risk involved in forex trading:

- Market Risk

The forex market remains active 24 hours a day for 5 days a week. The prices of each currency pair can move at any time of the day due to numerous reasons. Expertise in fundamental and technical analysis can mitigate this risk but volatility will always be there in the forex market. - Country Risk

Each currency pair involves two different currencies. Both currencies are from different nations or jurisdictions. Affairs in either nation can potentially affect the price of the currency pair in either direction. Even most experienced traders also fail to predict sudden movement in price due to country risk. - Leverage Risk

Forex trading won’t be feasible for retail traders without leverage. Higher leverage leads to a higher percentage of profits as well as losses on the opened positions. Hence, using high leverage will increase the leverage risk. Leverage is capped at 1:30 for major pairs and 1:20 for minor pairs by FCA in the UK. - Third-Party Risk

The risk of choosing a fake broker is called as third-party risk. Many fake brokers in the UK falsely pretend to be regulated by the FCA. This is done to gain the trust of the traders. These fake brokers may use the client’s funds for self-interest or might even run away with the deposits of traders.

Choosing an FCA-regulated forex broker will substantially decrease the third-party risk in the UK. - Interest Rate Influence: Central bank rate decisions can cause rapid price changes. Unanticipated interest rate shifts impact currency values.

- Economic Data Impact: Economic indicators like GDP and inflation can trigger sudden market shifts. Unforeseen data releases drive unpredictable price movements.

- Political and Geopolitical Factors: Political events and geopolitical tensions affect currency values. Sudden changes or instability can lead to currency fluctuations.

- Country-Specific Factors: Economic health, fiscal policies, and trade relations affect currency values. Policy changes or economic downturns influence currency performance.

Common Mistakes That Beginners Make in Forex Trading

Common mistakes made by beginners in forex trading include:

- Insufficient education and knowledge.

- Failure to use stop loss orders for risk management.

- Overtrading without a solid strategy.

- Lack of proper risk management.

- Emotional trading based on fear or greed.

- Neglecting market analysis and trends.

- Following unverified advice or tips.

- Lack of patience and discipline.

To avoid these mistakes, beginners should prioritize education, implement risk management strategies, trade with a plan, conduct market analysis, and exercise discipline in their trading decisions.

Comparison of Best Forex Brokers for Beginners UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| eToro |

1 pip

|

$10

|

1:30

|

Visit Broker |

| CMC Markets |

0.7 pips

|

£10

|

1:30

|

Visit Broker |

| Pepperstone |

1.12 pips

|

£0

|

1:30

|

Visit Broker |

| City Index |

0.8 pips

|

£100

|

1:30

|

Visit Broker |

| Capital.com |

0.7 pip

|

$1

|

1:30

|

Visit Broker |

| Plus500 |

0.8 pips

|

$100

|

1:30

|

Visit Broker |

| AvaTrade |

0.9 pips

|

$100

|

1:30

|

Visit Broker |

FAQs on Best Forex Brokers for Beginners UK

Which forex broker is best for beginners?

Each broker has different features and conditions and charges differently for it. The best brokers for beginners can be different for each trader. According to our analysis, eToro, CMC Markets, City Index, Capital.com, Plus500, Pepperstone, and AvaTrade are the best forex brokers for beginners in the UK.

Is forex trading good for beginners?

No, forex trading involves high risk. It is not suitable for those who are not familiar with leveraged trading on CFDs. Beginners should spend time and effort learning about forex before starting.

Disciplined traders with decent experience of short-term trading in financial markets will find the forex market ideal for themselves.

Who is the cheapest forex broker?

According to our analysis and comparison, Pepperstone, CMC Markets, and Capital.com are the brokers with least spread without trading commission. These brokers are regulated by FCA in the UK and can be considered cheapest regulated brokers in the UK.

Can I trade forex without a broker?

No, you cannot trade on forex and CFD instruments without opening an account with a broker. Demo accounts can be opened on trading platforms without a broker where traders can practice and learn through virtual currencies but live accounts cannot be opened without a broker.

Do you pay tax on forex trading UK?

Yes, gain earned through CFD trading in the UK are taxed at the standard prevailing capital gains tax in the UK. According to the 2022/2023 capital gain tax rates, gains up to £12,300 are taxed free and no tax is to be paid if the annual gain is less than £12,300. For gains more than £12,300 and below £50,270, 10% is deducted as capital gains tax and for more than £50,270 gained within a year, 20% will be deducted.

How to trade forex for beginners UK?

Beginners in the forex market must spend time and effort learning the basic terminologies, strategies, and price movements of currency pairs. Beginners must always start with low leverage and familiar instruments with small deposits. Beginners should not make trading decisions driven by emotions. It is always advisable for beginners to gain experience through demo accounts before trading with real money.

What is the best forex trading platform for beginners in the UK?

Beginners should look for a platform that is user-friendly, easy to learn and has good compatibility with their devices. eToro is one the best forex trading platforms for beginners in the UK but some traders also find MT4 to be more suitable for them.

What broker do most traders use?

Each broker is ideal for different types of traders. Most traders in the UK trade with eToro, Pepperstone, CMC Markets, City Index, and other FCA-regulated brokers in the UK.

Can you really make money with Forex?

Yes, forex trading involves significant financial risk and the majority of forex traders face losses. However, experienced traders tend to make consistent gains in forex trading as they do adequate research and analysis on price movements. Beginners must learn about the forex trading strategies and start with a demo account in forex.

Is $100 enough to start forex?

Yes, $100 is enough to start forex trading as a beginner. Many brokers allow starting with an even lower amount but very low account equity can lead to a position close out due to leverage. However, as a beginner, it is always safe to start with a small amount.

What is the safest forex broker?

Forex trading in the UK is regulated by the Financial Conduct Authority (FCA). Any broker that is regulated by FCA and registers clients residing in the UK under FCA regulation can be considered safe for trading forex and CFD in the UK.