Best MT4 Brokers UK 2024

MetaTrader 4 is the most widely used forex and CFD trading platform in the world. Multiple brokers support MT4 for trading. Choose from the best MT4 brokers in the UK.

Metatrader 4 is the most widely used online trading platform for forex and CFD trading globally. It was launched in 2005 by MetaQuotes Software and is still used by thousands of traders worldwide.

If you wish to trade with MT4 trading platform in the UK, you will need to register with a broker that supports MT4 trading platform. The trading conditions, instruments availability, and contract specification at the MT4 trading platform will be different with each broker.

We have listed the best forex brokers in the UK that allow trading on the MT4 trading platform. We have listed the brokers that will be best suited to trade on MT4 trading platform.

List of Best MT4 Brokers in the UK

- Pepperstone – Best MT4 Broker with Multiple Platforms

- CMC Markets – Best MT4 Broker in UK with Highest Instrument Availability

- City Index – Best Low Cost MT4 Broker in UK

- FXTM – Best STP/ECN Broker with MT4 Trading Platform

- IG Markets – Oldest FCA Regulated MT4 Broker in the UK

Following are the brokers that are the best choice if you want to trade on the MT4 trading platform. These brokers are listed in unranked order with an honest short description. Traders must choose MT4 brokers in the UK according to their suitability.

#1 Pepperstone – Best MT4 Broker with Multiple Platforms

Pepperstone is among the best forex and CFD brokers in the UK as they allow trading through 3 major trading platforms namely MT4, MT5, and cTrader with 2 different pricing structures.

Pepperstone Limited is FCA-regulated and authorized forex and CFD broker based in London. They hold the FCA license under license number 684312. Pepperstone is also regulated in Germany, Cyprus, Australia, the United Arab Emirates, the Bahamas, and Kenya. It can be considered safe for trading in the UK.

Pepperstone has two different account types with different fee patterns. The Standard account incurs spreads and swaps with spreads starting from 0.6 pips. The Razor account involves a trading commission of GBP 4.5 per round trade of standard lot apart from the low spreads.

The average spread for the EUR/USD currency pair at Pepperstone is 0.09 pips with the Razor account and 0.69 pips with the Standard account type.

More than 700 financial instruments can be traded at Pepperstone with the MT4 trading platform including 62 currency pairs.

Pepperstone allows trading through MT4, MT5, as well as cTrader platform. The availability of 3 major trading platforms with GBP as the base currency and different fee structures allows traders to customize their trading accounts.

Pepperstone Pros

- Pepperstone is STP/ECN Regulated by FCA in the UK

- Low spread on Standard account

- Commission based account available

- Wide range of trading instruments

- Good customer support

- GBP available as base currency

Pepperstone Cons

- Support services not available on weekends

- The commission is high on Razor account

#2 CMC Markets – Best MT4 Broker in UK with Highest Instrument Availability

CMC Markets is an FCA regulated forex and CFD broker that allows trading through MT4 and the NextGen trading platform for all types of devices.

CMC Markets has been in the spread betting business since 1989 and has two separate entities regulated by the FCA of the UK. CMC Markets UK PLC holds license number 173730 while CMC Spreadbet LLC holds license number 170627.

CMC Markets is also regulated by several other regulatory authorities in the jurisdiction of Germany, Canada, Australia, New Zealand, Singapore, and the United Arab Emirates.

They offer a single account type for types of traders in which the trading fee is comprised of spreads and swaps. No trading commission is charged for any instrument apart from stock CFDs.

MT4 is the most preferred trading platform at CMC Markets but they also support a modern-looking platform with a user-friendly interface called NextGen Platform.

CMC Markets allows trading on more than 12000 financial instruments including 300+ forex pairs. The number of available forex pairs on MT4 with CMC Markets is the highest in the UK.

CMC Markets Pros

- CMC Markets is FCA-regulated and trustworthy

- Good customer support available at all times during weekdays

- Decent fees with no commission apart from stock CFDs

- Decent range of trading instruments

CMC Markets Cons

- You cannot change the leverage of your trades

- Lack of good educational materials for new traders

#3 City Index – Best Low Cost MT4 Broker in UK

City Index is FCA-regulated forex and CFD broker that allows trading at low cost on the various financial instrument on the MT4 trading platform.

City Index is the trading name of the legal entity StoneX Financial Limited regulated by the FCA under license number 446717. StoneX Group is US based financial services provider and is also listed on the NASDAQ with the ticker symbol SNEX.

City Index has been operating since 1983 and is licensed by FCA since 2006. They are also regulated by ASIC of Australia, MAS of Singapore, and CFTC, NFA in the USA.

Spreads and swaps are the only components of trading fees at City Index in the UK. Trading commissions are only incurred on stock CFDs. The spreads start from 0.5 pips and the average spread on EUR/USD is 0.6 pips. This is lower than many other FCA-regulated brokers in the UK.

MT4 is the only available trading platform at City Index. The account can be opened with GBP as the base currency. More than 4700 financial instruments can be traded at City Index including 84 currency pairs.

City Index Pros

- No commission to trade forex instruments

- Highly regulated and has a strong reputation with a long history

- No hidden fees such as deposit or withdrawal fees

City Index Cons

- Customer support only available through live chat

- Low leverage offered through Trader and Premium Trader accounts

#4 FXTM – Best STP/ECN Broker with MT4 Trading Platform

FXTM is an FCA-regulated forex and CFD broker that allows trading through MT4 and MT5 platforms with multiple pricing structure.

FXTM is the trading name of the legal entity Exinity UK Ltd which is regulated by the FCA of the UK under license number 777911. They are also regulated by the FSCA of South Africa and CySEC of the European Union. Hence can be considered safe to trade in the UK.

FXTM has 3 different account types to offer for UK clients namely Micro, Advantage, and Advantage Plus account type. MT4 can be chosen as a trading platform with all three account types while MT5 can only be chosen with the Advantage and Advantage Plus account types.

The Micro account can be opened with a minimum deposit of GBP 10 but it only allows trading on limited instruments. The Advantage and Advantage Plus accounts give access to all the instruments but have a minimum deposit requirement of GBP 500.

MT4 and MT5 are the options for trading platforms. Traders can either trade with a spread-only pricing structure or commission with the low spreads pricing structure. The average spreads for EUR/USD currency pair at FXTM is 1.8 pips that are higher than the average among FCA-regulated forex and CFD brokers.

FXTM Pros

- Multiple top-tier regulatory license including FCA

- FXTM uses 100% STP method for trade execution

- Low minimum deposit of GBP 10

- GBP available as base currency of the account

- Multiple account types available for all types of traders

FXTM Cons

- Higher trading fees and spread

#5 IG Markets – Oldest FCA Regulated MT4 Broker in the UK

IG Markets is an FCA-regulated forex and CFD broker that has been offering trading services since 1974. It is the oldest MT4 broker regulated by FCA in the UK.

IG Markets is regulated by the FCA of the UK, ASIC of Australia, FSCA of South Africa, and NFA, CFTC in the US. They are regulated by all the top-tier regulatory authorities with the strictest regulation in leveraged CFD trading. The FCA license is held by the name IG Markets Limited under license number 195355.

There are no choices of account types at IG Markets and the average spread for the EUR/USD currency pair is 1 pip. GBP can be chosen as the base currency of the account but the minimum deposit amount is slightly high GBP 300.

Apart from MT4, IG Markets also allows trading through ProRealTime and L2 Dealer trading platforms. However, MT4 is the most chosen trading platform at IG Markets.

They allow trading on more than 12000 financial instruments including 90 currency pairs.

IG Markets Pros

- Multiple top-tier regulatory license including FCA

- Wide range of trading instruments (more than 12,000)

- Multiple trading platforms available apart from MT4

- GBP available as base currency of the account

- Among the oldest brokers that support MT4

IG Markets Cons

- Higher trading fees

- Decent customer support services

What is MT4 Trading Platform?

MetaTrader 4 (MT4) is a popular electronic trading platform used extensively for trading Forex, contracts for differences (CFDs), and futures markets. It was developed by MetaQuotes Software and officially released on July 1, 2005. MT4 is favored for its user-friendly interface, advanced charting capabilities, comprehensive technical analysis tools, and the ability to support automated trading through expert advisors (EAs).

Key features of MT4 include:

- Real-time Market Access: Traders are provided with live quotes, charts, and news.

- Analytical Tools: The platform offers a range of technical indicators and graphical objects for market analysis.

- Automated Trading: MT4 supports the development, testing, and application of EAs and algorithmic trading strategies.

- Customization: Users can tailor the interface and trading experience to suit their preferences.

Despite the introduction of its successor, MetaTrader 5 (MT5), MT4 continues to be highly preferred within the Forex trading community due to its simplicity, extensive broker adoption, and strong online community support.

Pros and Cons of Trading on MT4 Trading Platform

There are several pros and cons of choosing the MT4 trading platform over other platforms.

Pros of Trading with MT4

- MT4 has a simple interface

- A variety of useful patterns, indicators, and trading tools are available

- Technical errors, slippage, order failure are very rare in MT4

- Free demo accounts are available at MT4

- It is compatible with any type of electronic device as the hardware requirement is low

- MT4 is ideal for beginners as well as experienced traders

- Uses MQL4 trading language for automated trading

- MT4 is among the most chosen forex and CFD trading platform in the world

Cons of Trading with MT4

- There are limited trading tools at MT4 compared to MT5 and cTrader

- The number of patterns, indicators, and time frames, are lower

- The look and feel of MT4 are old like Windows 98

- MT4 was launched in 2005 and is relatively old. More advanced trading platforms with better features have been launched after MT4.

How to Choose MT4 Brokers in the UK?

If you have made up your mind to trade with the MT4 trading platform, you will need to open an account with a broker that supports the MT4 trading platform. There are more than 100 brokers that allow trading on the MT4 trading platform. Traders need to look out for the following major aspects before opening their account with any MT4 brokers in the UK.

Regulation

The safety of your funds is the top priority while trading online through any platform. Financial Conduct Authority (FCA) is the financial regulatory authority in the UK that overlooks the activities of regulated entities and safeguards the interest of traders and investors.

Traders must ensure that the forex and CFD broker that they are choosing in the UK is regulated by the FCA. The FCA regulation makes brokers safe for traders in the UK and greatly reduces third-party risk.

Traders can search for the FCA regulation details on the website of the brokers and can also enquire about the same through customer support services. The regulation details can also be cross-checked through the official website of FCA.

Fees

Each forex and CFD broker that allows trading through MetaTrader 4 trading platform incurs different trading and non-trading fees. Traders must check and compare every component of the fee before they open their accounts.

The commonly incurred trading fees on forex and CFDs include spreads, trading commissions on each trade, and overnight charges. The non-trading charges include an inactivity fee, account opening fee, maintenance fee, deposit/withdrawal fee, currency conversion fee, etc.

Deposit and Withdrawal

Each broker that supports the MT4 trading platform, accepts transactions through different methods. It is important to ensure that the chosen broker accepts deposits and withdrawals through the method preferred by the trader.

Traders must also check the associated fees for deposits and withdrawals, minimum and maximum limits, and the time taken for each method to process the deposits and withdrawals. This can be compared with other brokers that support the MT4 platform to choose the best MT4 broker in the UK.

How to Open Trading Position on MT4 Trading Platform?

After opening an account and making a deposit into your trading account, you can open trading positions on the MT4 trading platform through the website, mobile, and desktop applications.

Step 1: Login into Your Account

Step 2: Select the Instrument you wish to trade

Step 3: Place new Order

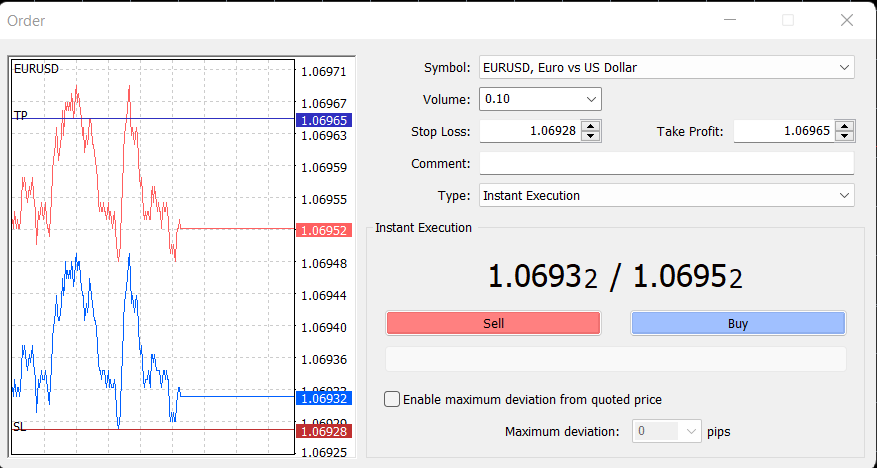

The new order can be placed directly by entering the lot size in the tab at the top left corner of the graph. However, it is always advisable to open a trading position with stop loss and take profit limits. To do this, press the new order tab or simply press the f9 key if using the desktop version of MT4.

Step 4: Configure the Order

It is essential to select the lot size of the trading position and select the stop loss and take the profit limit. These are the extreme limit at which the position will get closed if triggered. Once configured, the long and short positions can be opened by buy and sell tabs respectively.

Step 5: Monitor, Modify, or Close the order

Once a trading position is opened, its details can be viewed from the trade book at the bottom of the trading platform window. Any order can be closed or the limits can be modified at any moment whenever required.

Comparison Between MT4 and MT5 Trading Platform

1. Purpose and Asset Classes:

MT4: Primarily designed for forex trading, granting access to different currency pairs.

MT5: Expands its scope beyond forex to encompass trading in stocks, commodities, indices, cryptocurrencies, and more.

2. Timeframes and Charts:

MT4: Offers 9 timeframes for charts.

MT5: Elevates timeframes to 21, affording more precise analysis options.

3. Technical Indicators:

MT4: Equips traders with 30 built-in technical indicators.

MT5: Elevates the count to 38 built-in indicators along with a broader set of analytical tools.

4. Depth of Market:

MT4: Lacks a native Depth of Market feature.

MT5: Incorporates a Depth of Market tool, providing insights into bid and ask prices at varying levels.

5. Number of Pending Orders:

MT4: Supports 4 types of pending orders.

MT5: Expands the options to 6 types of pending orders, introducing Buy Stop Limit and Sell Stop Limit.

6. Economic Calendar:

MT4: Requires third-party plugins to access economic news and events.

MT5: Seamlessly integrates an economic calendar into the platform, supplying vital market information.

7. Hedging:

MT4: Embraces hedging, enabling traders to hold multiple positions, both long and short, on the same instrument.

MT5: Offers support for both hedging and netting modes. Netting mode restricts traders to a single position per instrument.

8. Expert Advisors (EAs) and Algorithmic Trading:

MT4: Gains fame for robust EA and algorithmic trading support, appealing to automated traders.

MT5: Enhances the MQL5 programming language, providing superior support for intricate trading strategies and higher timeframes.

Tips for Trading with MT4 Trading Platform

- Learn the basics of the platform and chart analysis.

- Customize your workspace for efficiency.

- Enable one-click trading for quick orders.

- Set price alerts for important levels.

- Practice on a demo account first.

- Implement risk management with stop-loss and take-profit orders.

- Stay informed with economic calendars and news feeds.

- Use trailing stops to protect profits.

- Keep a trading journal for self-assessment.

- Backtest strategies using historical data.

- Stay disciplined and avoid emotional trading.

- Ensure the security of your trading account.

- Keep your platform and indicators up to date.

- Engage with trading communities for insights.

- Be patient and selective in your trading decisions.

Comparison of Best MT4 Forex Brokers UK

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| CMC Markets |

0.7 pips

|

£100

|

1:30

|

Visit Broker |

| Pepperstone |

0.09 pips

|

£0

|

1:30

|

Visit Broker |

| City Index |

0.5 pips

|

£100

|

1:30

|

Visit Broker |

| IG Markets |

1 pip

|

$300

|

1:30

|

Visit Broker |

| FXTM |

1.8 pips

|

$10

|

1:30

|

Visit Broker |

FAQs on Best MT4 Brokers UK

Which MT4 broker is the best?

Each broker offers different services and incurs a different fee for the same. Hence, the suitability of an MT4 broker in the UK depends on traders. According to our analysis and comparison, Pepperston, CMC Markets, and City Index are the best MT4 forex brokers in the UK.

Do I need a broker for MetaTrader 4?

Yes, MetaTrader 4 or MT4 is an electronic trading platform that redirects the orders placed by online traders to the broker. You need to open an account with a broker that supports the MT4 trading platform to trade through MT4.

Which broker is good for beginners in MT4?

Pepperstone, IG Markets, FXTM, etc can be considered good for the beginners with MT4 trading platform. Beginners should look for brokers that have low minimum deposit requirements, friendly support services, and low spreads with no additional commission.

Which forex broker is best in UK?

Pepperstone, CMC Markets, City Index, etc can be considered best for trading forex and CFDs in the UK. Each broker is ideal for different types of traders. It is important to check and compare every pros and cons of a broker before opening an account and making a deposit.

Can MT4 make money?

No, MT4 is not a money-making software. MT4 is a trading platform that can be used to trade on forex pairs and CFDs after opening an account with a broker. Traders can make money or lose money by trading on MT4 depending on their skills.

What is better than MT4?

MT5 and cTrader can be considered better than MT4 for some traders. However, MT4 is the most chosen trading platform. MT5 has better features and more tools to work with good automation features. cTrader has a better-looking interface. Each trading platform has its own pros and cons and a particular trading platform can be considered best for all types of traders.

Is MetaTrader 4 real or fake?

MT4 or MetaTrader 4 is an authentic forex and CFD trading platform that was developed by MetaQuotes Software Ltd in 2005. It is the most widely used forex and CFD trading platform globally. The broker that offers trading on MT4 platform can be real or fake.

What broker to use for MetaTrader 4 UK?

Traders must choose an FCA-regulated broker with the MT4 trading platform. Apart from FCA regulation, traders must also check and compare the fees, available instruments, customer support, deposits and withdrawal methods. Pepperstone, CMC Markets, FXTM, City Index, etc are among the best brokers to use with MT4 platform.

Is MetaTrader 4 legal in UK?

Yes, MT4 is legal in the UK for trading forex and CFD instruments. Several brokers in the UK support MT4 as the trading platform. However, traders must only choose a broker that is regulated by the FCA of the UK.

How much is the minimum deposit in MetaTrader 4?

The minimum deposit amount depends on the broker you have opened your account with. Each broker that supports the MT4 trading platform can have a different minimum deposit requirement. Pepperstone has no lower limit on minimum deposits and offers an MT4 trading platform.