What is the Best Time to Trade Forex?

The Forex market remains open throughout the day; however, specific hours may not suit a few traders. Forex is a market for trading global currencies, and currency volatility depend on the active trading regions.

The prices of currency pairs move differently during different sessions. Therefore, day traders focus on market liquidity and volatility, whereas trend traders concentrate on entry and exit timings. The latter would prefer high-volatility markets to earn movement profits.

Grasping the timing concept can become challenging for new forex traders, and they should consider variable regional trading session timings. The best trading time would depend on the region wherein the trader is located.

Major Forex Trading Sessions

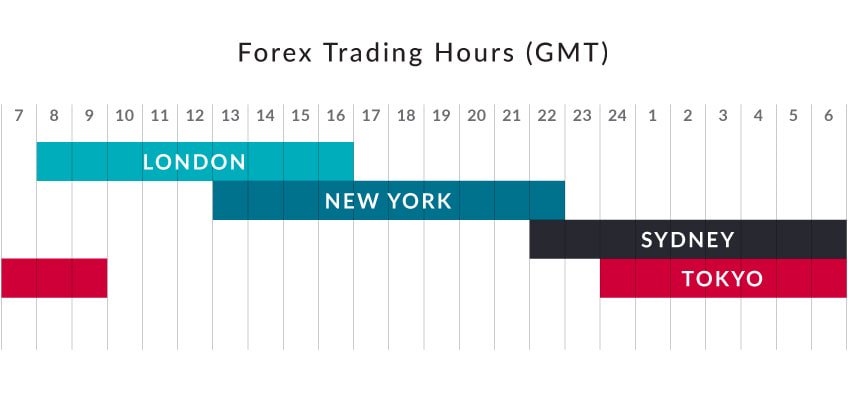

London Session: This trading session is widely acknowledged as one of the most dynamically active periods in forex trading. It experiences an overlap with the New York session for several hours, resulting in heightened market volatility. The London session typically commences around 8:00 AM GMT and concludes around 4:00 PM GMT.

New York Session: Renowned for its substantial trading volume, the New York session sees significant activity, particularly during its overlap with the London session. It initiates at approximately 1:00 PM GMT and concludes around 9:00 PM GMT.

Tokyo Session: The Tokyo session is distinctive for its comparatively lower levels of volatility when compared to the London and New York sessions. Operating from approximately 12:00 AM GMT to 9:00 AM GMT, it provides a distinct trading environment.

Sydney Session: While displaying reduced volatility, the Sydney session still presents viable trading prospects. Operating between 10:00 PM GMT and 7:00 AM GMT, it caters to traders seeking opportunities in a relatively stable market.

Asian-European Session Overlap: The convergence of the Tokyo and London sessions, transpiring between 8:00 AM and 9:00 AM GMT, often generates heightened trading activity and market participation.

European-North American Session Overlap: Widely regarded as one of the most active phases for trading, the overlap between the London and New York sessions (from approximately 12:00 PM to 4:00 PM GMT) benefits from the simultaneous involvement of two prominent financial centers.

Significant Forex Trading Sessions

Tokyo, Sydney, London, and New York are the four significant global forex market trading sessions. The beginning and end timings of these markets are based on the local time and are easy to predict through GMT.

Summer Timings

- The opening timings of Sydney, Tokyo, London, and New York trading sessions are 10 PM, 11 PM, 7 AM, and 12 PM.

- The closing timings are 7 AM, 8 AM, 4 PM, and 9 PM during summer respectively.

Winter Timings

- On the other hand, winter opening timings for Sydney, Tokyo, London, and New York sessions are 9 PM, 11 PM, 8 AM, and 1 PM.

- Closing timings are 6 AM, 8 AM, 5 PM, and 10 PM respectively.

The trading sessions of the world’s major financial hubs correspondence to the general timing zones. The trading in Asia, Europe, and America reach the highest volumes during active trading sessions in Tokyo, London, and New York. The American forex market drops significantly between 19:00 and 22:00 GMT as the American workforce returns home from work.

Meanwhile, New Zealand and Australian workers are beginning their day. The above scenario is weekdays only as the forex market remains closed during the weekends, Christmas, and New Year’s. The working hours ultimately increase the dependency on the selected trading sessions. For example, people in Asia prefer Tokyo, Singapore, or Australian sessions.

- Trading during an active session of a forex time zone is more profitable.

- Focussing on an extensive session helps to understand movements and keep a time zone-based track of the news related to them.

- Focussing on overlapping trading sessions is also profitable as the duration causes higher liquidity.

- Overlap sessions also increase regional market activity.

For example, Tokyo and London sessions overlap between 8 AM and 9 AM GST during summer. Similarly, London and New York sessions bundle together between 1 PM and 5 PM GST during the entire year. According to a source, market movement is substantially highest during the London session.

Forex traders cannot ignore the importance of active market movement. The peak timings for New York, Tokyo, and London sessions are 1 PM GST to 10 PM, 12:00 AM GST to 9:00 AM, and 8 AM to 5 PM GST. Moreover, the timings may vary based on the daylight saving timings of different countries.

Peak Forex Trading Timings

The peak forex trading timing depends on the local time zone. The best timing may vary for traders in Africa and Japan. Besides this, traders should also rely on the volatility and liquidity of the forex pair.

As mentioned earlier, the London session has the highest liquidity because many multinational banks have banks in England’s capital. Therefore, traders undergo a similar experience during the New York session. Besides this, the best timings also vary on the chosen currency and the currency pair. Therefore, traders need to find the best times based on the local working hours.

, For example, , a Nigerian forex trading website experiences the highest trading volumes in Nigeria and South Africa during the London session, corresponding to their working hours. So, African traders should trade during the same session. According to BIS, the trading volume of ZAR currency pairs is 14% in South Africa and 50% in the UK.

So, traders will experience higher volatility for EUR/ZAR and USD/ZAR currency pairs during the London session. Meanwhile, traders in Asia have diversified peak timings. Moreover, the best trading sessions for a trader in Japan, Australia, and New Zealand are when the Japanese and Australian markets are active.

On the other hand, the volatility of South East and South Asia traders for their pairs would be sufficiently lower in their time zones. As a result, they can trade in either New York or London sessions. Likewise, Japanese currency traders would find higher currency exchange volumes during the Tokyo session.

London session is the best for UK and EU traders because it offers minor volatility, especially during Frankfurt trading hours. US dollar pair volatility is highest during the New York tra/.,ding session. A key point to remember, especially for new traders, is avoiding trading during low-liquidity markets.

Why is it Not Recommended to Trade Forex in Odd Timings

Most beginners in the forex market often wonder why can’t they trade anytime they want forex market remains active 24 hours a day. The truth is you can trade on any currency pair at any time you want (on weekdays) but there will be consequences while trading at odd hours.

- When the financial markets and businesses of a country are inactive, there are lesser exchanges of currencies on a global scale.

- Hence, when a trading session is not active, the liquidity on the currency pair will be low. This will increase the spread.

- Liquidity and spread are the major reasons why it is better to trade a currency pair during a particular time.

- Under low liquidity markets, the prices of currency pairs can be highly volatile and may not move at all. Therefore, market movement comprehension would become challenging for traders.

- Under such circumstances, currency pairs’ technical analysis and fundamentals don’t work as the market moves are often random.

- Eventually making profits in such a market would be extremely difficult and trades can be a gamble.

According to a source, the New York exchange is essential for foreign investors as the USD pairs with 90% of global currencies. Therefore, the training market has a possibility of experiencing a ripple effect. Trading volume and volatility can spike due to military or political crises arising during slow-moving hours.

The source also suggests that the New York and London exchanges account for more than 50% of all forex exchanges. Moreover, the Singapore & Sydney exchanges have comparatively lower trade volumes than New York & London exchanges due to the timings. Also, the assumption is based on the fact that no significant news broke during trading hours and can account as an exception.

Moreover, Consumer Price Index (CPI), consumer confidence, trade deficits, and consumer consumption are a few factors that have steady, scheduled releases and move the market. Traders can benefit by keeping track of news related to these forms of economic data. London session is the most suited for traders, and the latter should even consider London and New York sessions overlap.

Also, the worst timing for trading is between the beginning of the Sydney session and the end of the New York session. According to a Citibank study, 30% of traders in the retail business break even better, and 84% believe in making money in the forex market. Moreover, currency trades consist of 1000 to 1 and other high average rates.

Also, the ratio might seem like a profit opportunity and even offers investors the risk of losing financial security on a single trade. So, new forex investors should open demo platform accounts with mock trades, profits, and losses. Traders can become seasons should start with a real account.

Overlap in Forex Trading Hours and The Role of Spread

The forex spread is the difference between the buy and sell price and is calculated based on the pip value. For example, if the buy and sell prices of EUR/USD are 1.4398 and 1.4404, the difference is 0.0006, and the spread is calculated up to the fourth decimal, so it is 0.6 pips. But, the value for Japanese Yen currency exchanges bears up to the second decimal.

Overlap sessions are the best for forex traders, especially in open markets. Such sessions offer more enormous opportunities due to higher price ranges. The three significant overlaps include happening globally during weekdays are as follows:

US and London

According to a source, 70% of market trades happen during the US and London session overlaps because it involves two significant currencies: USD and EUR. The timing (8 AM to noon EST) is optimal for trading due to high volatility/price activity.

Sydney and Tokyo

Traders may not expect as high trading as US and London exchanges because the Sydney and Tokyo overlap (2 AM to 4 AM EST) does not have the same volatility; however, they can expect high pip fluctuation. Also, EUR and JPY are two significant currencies influenced during this tenure.

London and Tokyo

The London and Tokyo overlap (3 AM to 4 AM EST) is the least significant because most US traders remain asleep, and one hour is insufficient for making significant pip changes. Therefore, traders should expect minimal action during this session.

However, trades can significantly alter with big news or scheduled announcements. Therefore, anyone interested in making a profit should follow global news that might directly impact different sessions, especially the overlaps, and calculate pips accordingly.

What is the Best Time to Trade Forex in the UK?

The best time to trade forex pair depends on the currency pair you are dealing with. The aim should be to trade forex when the markets are most active as it lowers the spread.

- Most forex trading activity begins at 8 AM (UK Time) as the London session begins and the liquidity as well as volatility increases in the forex market.

- The forex trading activities slow down after 10 AM and increase again after 12 AM (British Winter Time) when the New York session starts.

- Forex markets remain most active from 12 AM to 3 PM or 13:00 to 16:00 GMT as the London session overlaps with the New York Session during this time.

- As there are two time zones in the UK i.e. British Winter Time and British Summer Time, there will be a difference of 1 hour between both seasons.

- The best time to trade EUR/USD is not the best time to trade AUD/JPY as the involved currencies are associated with different regions separated by time zones.

- The best time to trade any forex pair is when the regions where the currencies belong are active and more liquid.

How Does Economic News Releases Impact Forex Market

The liquidity on forex pairs may increase or decrease at a particular time but each currency pair can be traded at any time of the day. The spread of the currency pairs can widen or narrow due to a decrease and increase in liquidity respectively. However, the spreads can also be affected by the News Releases concerning the economy and capital markets.

Some News Releases have a major impact on the forex market. Such data release causes sudden widening of the spreads and trading at such times won’t be feasible even during the peak trading hours on active sessions. Experienced traders take advantage of news releases to predict the price movement in currency pairs. Following are the major events that a forex trader should look out for and comprehend their effect on the prices of currency pairs.

Interest Rates

The interbank interest rate or repo rate is controlled by the central bank or monetary authority of a country. The changes are made in the interest rates on regular basis for contractionary and expansionary monetary policies. This is done to control inflation and liquidity in the market. Higher interest rates will attract foreign investments and will have a major impact on the prices of currency pairs.

CPI Data

The consumer Price Index or CPI is a measure of the average change in the prices paid by consumers in an economy. The news release with CPI data can have a major impact on the prices of currency pairs.

Meetings Concerning Monetary Policy

Traders should keep an eye on the timings of meetings that can affect the monetary policies of a country. Spreads of concerned pairs are generally higher around the meetings which can possibly affect the economic activities of the country.

GDP Data

Gross domestic product is a measure of all goods and services produced in a country in a given time period. The GDP data is released on a regular basis and the growth in the GDP can be compared between two nations to predict the price movement of a currency pair.

Other News

Many other news releases like unemployment data, trade deficit or surplus, major foreign investment, etc can also create significant volatility in the market leading to a widening of spreads in currency pairs. However, the widening of spread due to news events is of a short period compared to inactive trading sessions. Short-term volatility due to news releases can be used to the advantage of traders.

Bottom Line

Traders can make more informed decisions by understanding the spread and currency pair movements during trading sessions. The first impression might seem complex; however, in due time, understanding would become more accessible. Moreover, a high volatility session may not often prove profitable for traders.

As mentioned earlier, high volatility comes with higher risk and low margins. Therefore, demo account trading is much more helpful in obtaining self-confidence and understanding trading structures.

The best trading time in the UK is between 13:00 GMT to 16:00 GMT as London and New York sessions overlap during this period. More than 90% of forex trades involve USD and nearly 43% of the global trades involve GBP according to the BIS report. Hence, 13:00 GMT to 16:00 GMT can be considered the best time to trade forex globally.

Also, 23:00 to 7:00 GMT is the worst time to trade forex pairs involving either USD or GBP as both markets are inactive. Trading pairs with AUD and JPY would be a good idea during this time.

FAQs on Best Time to Trade Forex

When should I take profit in forex?

Forex traders should always open any trading position with targets of take profit and stop loss limits. If the prices hit take profit limits the position is automatically closed. Entering the trade without a predefined target of profit is risky. Traders can use trailing stop-loss orders if they believe the price is expected to move further in profit.

What are the 4 trading sessions?

New York, London, Tokyo, and Sydney are the 4 major trading sessions in forex. Each session is active at different times corresponding to narrowing and widening of spreads for different currencies at different times.

Is it good to trade at night?

No, It is not recommended to trade forex at night because most capital markets and business activities remain inactive during the night. This leads to less exchange of currencies and causes liquidity issues for forex traders. The spreads on forex pairs will be very high during the night and traders are more likely to face losses.

What is the best time to trade USD to GBP?

13:00 GMT to 16:00 GMT is the best time to trade USD/GBP currency pair. This is because during this time New York as well as London session are active. Hence, the spread on USD/GBP currency pair will be lowest during this time.

What is the best time to trade forex in UK?

The best time to trade forex pair depends on the currency pair that you prefer to trade. 13:00 GMT to 16:00 GMT is the best time to trade forex pairs involving USD, EUR, and GBP.

Which month is not good for forex trading?

The volatility or stability in the forex market cannot be predicted on the basis of months. However, many traders do not prefer summer for trading as the market generally gets stable and there is less volatility. The months of June, July, and August may not be ideal for trading forex but some traders prefer to trade in stable markets.

What time of day is best to trade FX?

The best time to trade forex depends on the currency that you are trading. The London session is active from 9 AM to 6 PM (local time), hence this can be a good time to trade currency pairs involving GBP. The spread on currency pairs involving GBP is lowest during this time.

What time does forex market close UK time?

The forex market remains active throughout the day from monday to friday. However during inactive hours the liquidity is low and the spreads are increased. Hence it is better to trade forex when the markets involving the concerned currency pair are active.

What are the worst days to trade forex?

Forex market remains inactive during the weekend and opens on Monday. In the early hours of Monday, there can be increased volatility in the market as many pending forex transactions occur. Due to this many traders prefer to trade between Tuesday to Friday as markets can be unpredictable on Monday.