OctaFX Kenya Review 2023

OctaFX is not regulated by CMA in Kenya. Kenyan clients are registered under SVGFSA regulation. Check out our honest and comprehensive review of OctaFX before opening account.

OctaFX is an offshore regulated CFD broker that allows low-cost trading across various financial instruments. They are not regulated by CMA in Kenya.

We have thoroughly analyzed every component of OctaFX to provide a comprehensive and honest review of OctaFX. This review has been done specifically for Kenyan clients.

OctaFX Kenya Pros

- Spreads are as low as 0.6 pips without commission.

- MT5 account type does not incur any swap fee

- No non-trading charges

- Free cryptocurrency deposits and withdrawals are available

- Multiple bonus and promotional activities

- Live chat support is available 24/7

OctaFX Kenya Cons

- OctaFX is not regulated by CMA in Kenya

- Not regulated by any top-tier regulatory authority

- The number of available trading instruments is low

- KES cannot be chosen as account currency

- Local phone support is not available in Kenya

- Local bank deposits from Kenya are not accepted

Table of Content

OctaFX Kenya Summary

| Broker Name | Octa Markets Incorporated |

| Website | www.octafx.com |

| Regulation | CySEC, SVGFSA |

| Year of Establishment | 2011 |

| Minimum Deposit | $25 |

| Maximum Leverage | 1:500 |

| Trading Platforms | MT4, MT5 |

| Trading Instruments | 50+ CFDs on forex pairs, commodities, indices, shares, ETFs, cryptocurrencies |

Safety and Regulation

OctaFX Safety Pros

- OctaFX is regulated by CySEC and FSA of St Vincent and Grenadines

- OctaFX has been providing CFD trading services since 2011

OctaFX Safety Cons

- OctaFX is not regulated by any top-tier regulatory authority

- OctaFX is a market maker and can make profits on the losses of clients

- OctaFX carries high third-party risk

It is important to check the regulations and protection while trading online. The safety of your deposited funds largely depends on the regulatory compliance of the broker.

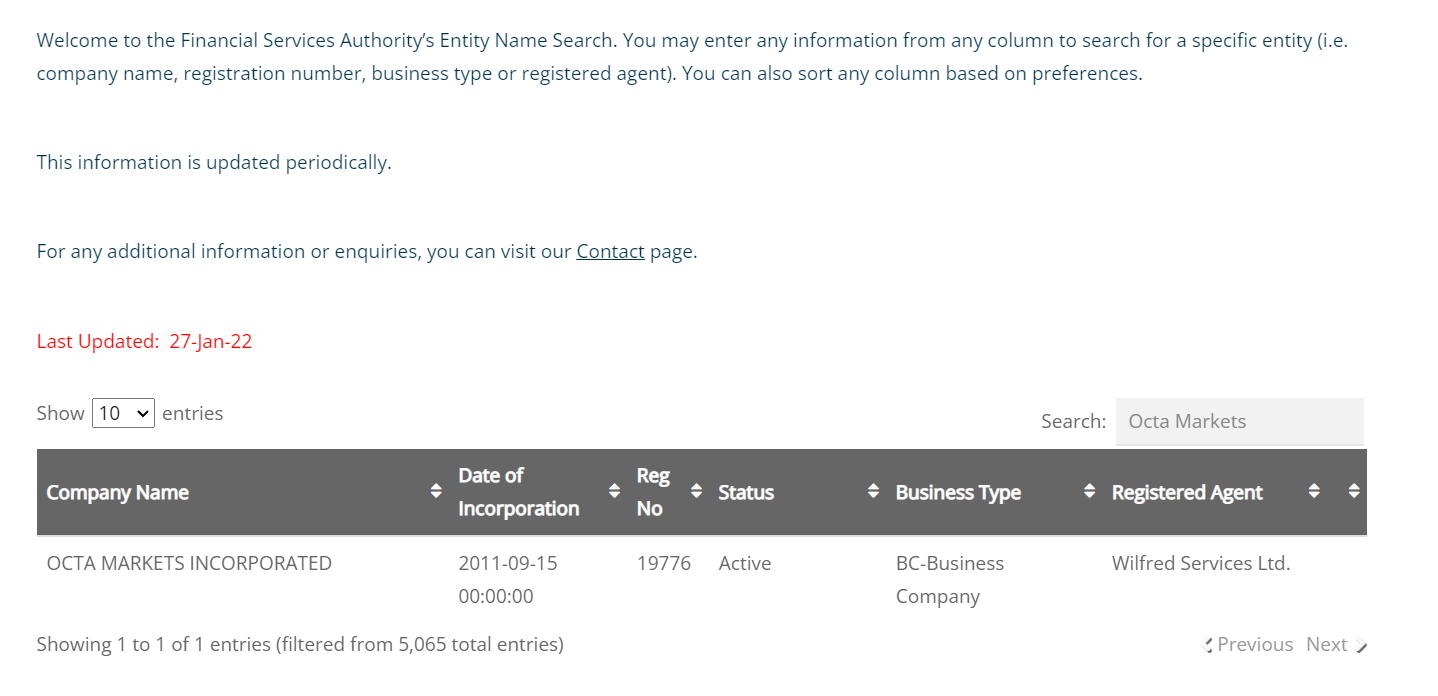

Clients residing in Kenya are regulated by the Financial Services Authority of St Vincent and Grenadines (SVGFSA). OctaFX Markets Incorporated is the legal entity under SVGFSA regulation with license number 19776. This license was acquired by OctaFX in 2011.

style=”border: 1px solid #ECECEC; padding: 10px; box-shadow: 0 0 30px rgba(0,0,0,.05);”

style=”border: 1px solid #ECECEC; padding: 10px; box-shadow: 0 0 30px rgba(0,0,0,.05);”

/>

The FSA of St. Vincent and Grenadines follows the guidelines and regimes of St Vincent and Grenadines. It is responsible for the activities of the licensed entities and their conflict of interest with the clients. FSA is responsible to the Ministry of Finance and Government of St Vincent and Grenadines.

St. Vincent and the Grenadines is an island nation. The SVGFSA has lenient regulatory compliance compared to the Financial Sector Conduct Authority of Kenya.

OctaFX can be chosen to trade CFDs in Kenya but the clients are registered under offshore regulation. The third-party risk of choosing OctaFX in Kenya is higher than all the top-tier regulated CFD brokers in Kenya.

OctaFX also holds a regulatory license from Cyprus Securities and Exchange Commission (CySEC). Octa Markets Cyprus Ltd is a regulated entity under license number 372/18. The CySEC license grants permission to operate its business in the European Union. Only clients in the European Union are registered under CySEC regulation.

OctaFX was launched in 2011 and accepts clients from various countries of the world. Although, they only have CySEC and FSASVG regulatory licenses. They are not regulated by any top-tier regulatory authorities like FCA, FSCA, or ASIC.

The safety ratings of OctaFX are lower than most of the CFD brokers in Kenya which are regulated by top-tier authorities. This means that the third-party risk of choosing OctaFX is high while client protection is low.

OctaFX Fees

OctaFX Fees Pros

- The spreads at OctaFX are lower than many other brokers

- OctaFX does not incur trading commission

- No non-trading charges like inactivity, deposit, or withdrawal fees exist

OctaFX Fees Cons

- Commisison based trading account with lower spread is not available

The trading cost at OctaFX is low. We have reviewed each component of broker fees that are commonly charged by CFD brokers in Kenya. There are two account types at OctaFX but both have the same pricing structure. Following are the details of fees incurred at OctaFX.

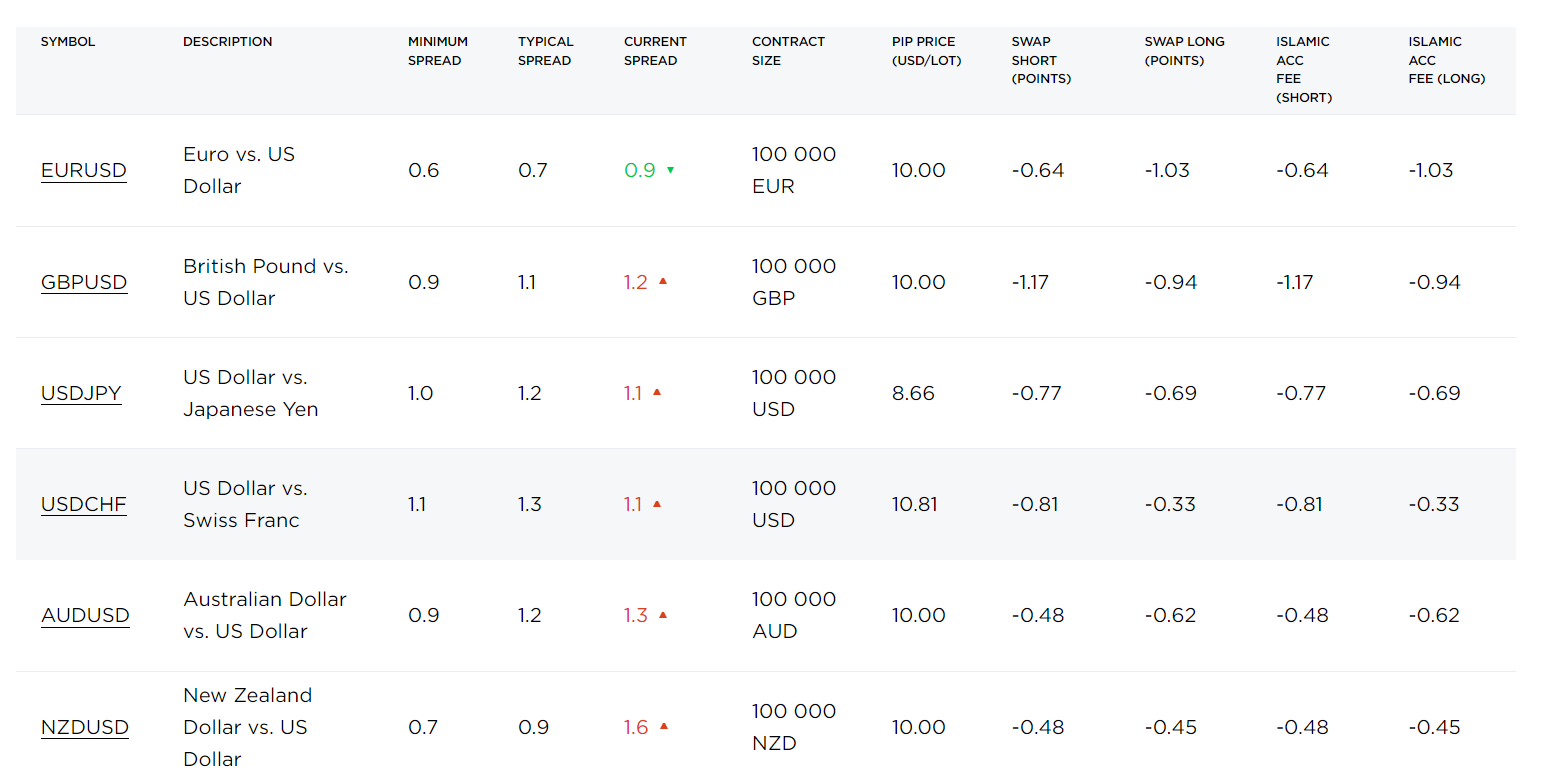

- Spread: This is the major CFD trading fee that is basically the difference between the bid and ask price of a financial instrument. The spreads at OctaFX are variable and fluctuate according to liquidity in the market.

The average spread for EUR/USD currency pair is 0.7 pips and the minimum is 0.6 pips. The table below describes the average typical spread for some of the commonly traded instruments.

Trading Instrument OctaFX MT5 OctaFX MT4 EUR/USD 0.7 0.7 GBP/USD 1.10 1.10 EUR/GBP 2.1 2.1 Gold/USD 2.0 2.0 Crude Oil 1.1 1.1 US Tech 100 Index 3.5 3.5 UK 100 1.8 N.A. - Commission: Most CFD brokers in Kenya also incur a fixed commission for each trade order. No such trading commission is incurred at OctaFX. There is no commission-based account type with fixed or zero spread.

- Swap Fees: These are also called overnight charges or rollover rates. It is the interest that is paid for every night if a position is kept open. At OctaFX in Kenya, there are no swap fees with the MT5 trading account. This can be very beneficial for those who keep their positions open for a longer period.

Clients choosing MT4 trading accounts will be charged with swap fees on every position kept open overnight. The swap fees for EUR/USD are -0.10 and -0.06 for long and short positions respectively.

Swap fee is exempted in Islamic accounts at the expense of Islamic account fee. The Islamic account fee is a commission that is fixed for the long and short positions of each instrument. Clients need to select an Islamic account while opening the account for this.

- Non-Trading Commission: Non-trading commissions are the additional charges that are incurred without executing trade orders. At OctaFX, there are no non-trading fees applicable to Kenyan clients. There are no inactivity charges, account opening fees, maintenance fees, etc. Deposit and withdrawal through all the available methods are free from the broker’s side.

Compared to the majority of the CFD brokers in Kenya, the spreads at OctaFX are lower. We have compared the average typical spread incurred by various forex and CFD brokers in Kenya. It must be noted that these spreads are with the Standard account with no commission.

| Trading Instrument | OctaFX | FXTM | eToro | CMC Markets | Pepperstone |

|---|---|---|---|---|---|

| EUR/USD | 0.9 | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 1 | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 1.5 | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 1.8 | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 2.1 | 2.5 | 1.7 | 1.3 | 1.07 |

Overall, OctaFX is among the most cost-effective broker to trade CFDs in Kenya. The spreads are low with no added commission. No swaps fees are applicable on the MT5 account and MT4 swaps are lower than many CFD brokers in Kenya.

OctaFX Account Types

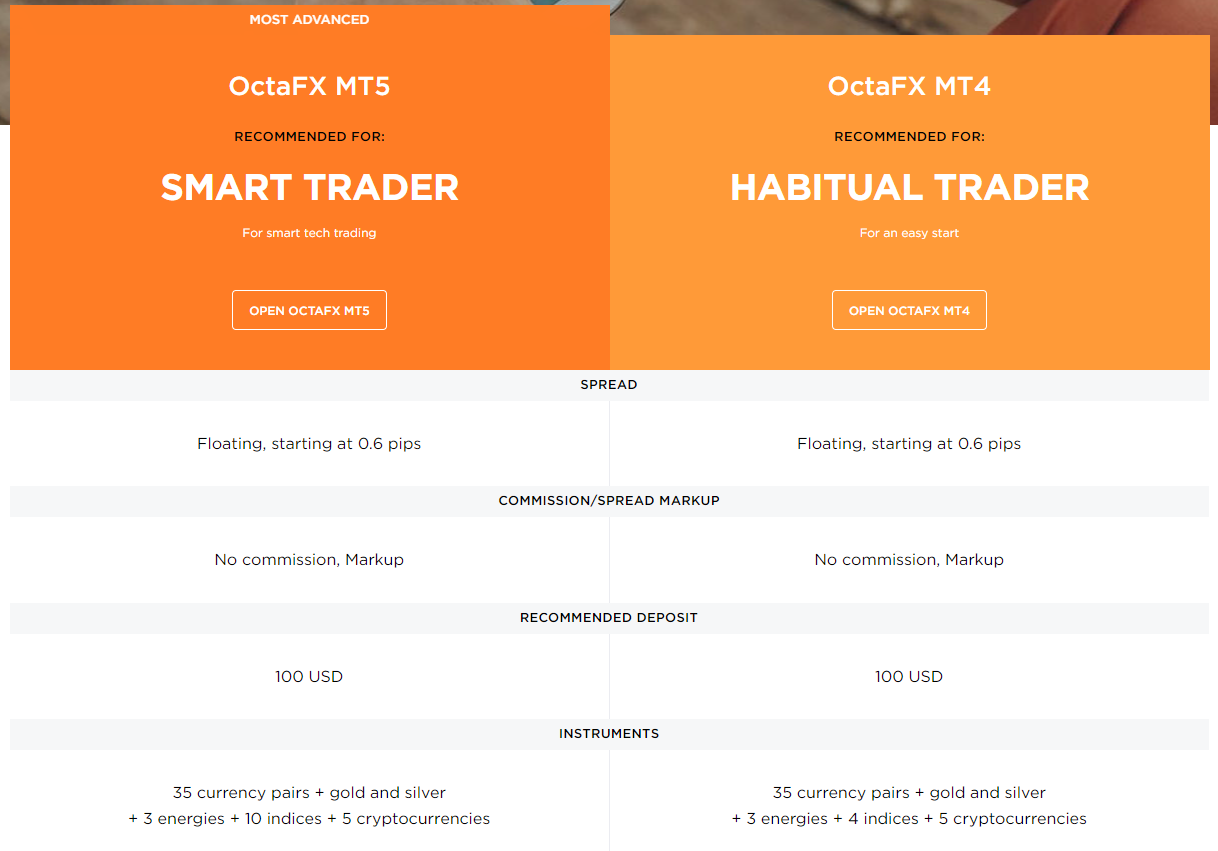

There are two account types at OctaFX. The features, services, and trading conditions are nearly similar for both account types. Both account types can be chosen either with USD or EUR as the base currency. KES is not available as the base currency of the accounts.

The pricing structure of both the account types is the same as the trading fee is built into spreads. No commission is incurred on any of the instruments. The two account types are mainly separated on the basis of supported trading platforms.

- OctaFX MT5: As the name suggests, this account type grants access to MetaTrader 5 trading platform. The major advantage of choosing this account type is there is no swap fee applicable while the spreads are the same as the MT4 account type.

Additionally, the MT5 account type allows trading on 10 indices CFD while only 4 indices are available to trade with the MT4 account.

- OctaFX MT4: This account type allows trading on the most widely used MT4 trading platform. In Kenya, choosing this account type will incur swap fees for keeping the position open overnight.

According to our review, the MT5 trading account is a better choice for those who use advanced trading strategies. This is also ideal for those who wish to keep their positions open for more than a day. The MT4 account type is more ideal for habitual traders who prefer to trade with MetaTrader 4 trading platform.

OctaFX does not offer zero spread and commission-based trading accounts. Scalpers and high-volume traders who seek to trade CFDs with little or no spread won’t find OctaFX useful.

How to Open an Account at OctaFX?

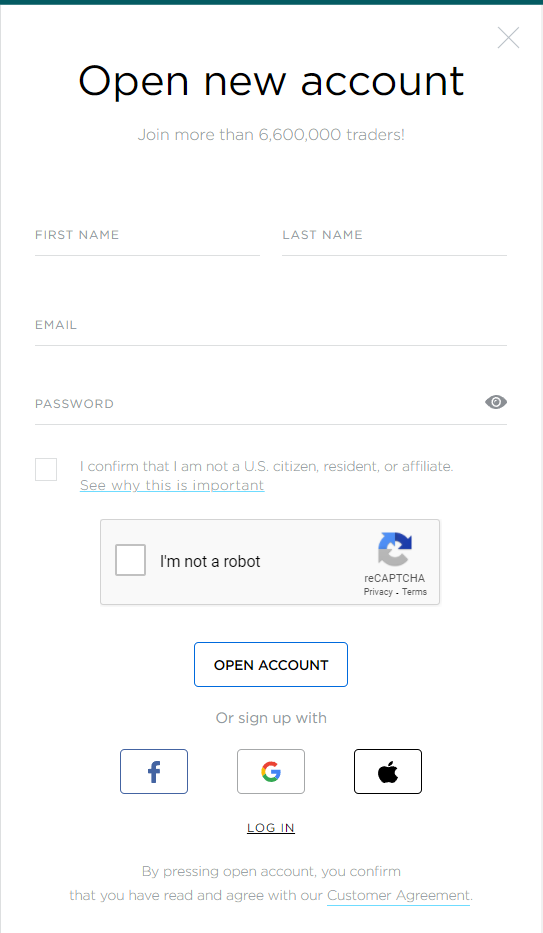

The account opening process at OctaFX is quite simple. The account can be opened with any device and the process is completed within 24 hours in general. Following are the steps included in the opening live trading account at OctaFX.

Step 1: Basic Details

Clients can start the account opening process by clicking on ‘Open Account’ through the OctaFX official website and app.

The first step is to enter your name, email address, and choose a password. Clients can also choose to log in with Facebook, Google, or Apple Accounts. The registered or entered email address will be used to register the account at OctaFX.

Step 2: Address and DOB

After completing the first step, a mail will be sent to your registered email address. This mail will have the link to advance in the account opening process.

The link will redirect you to the account form where you will need to enter country, city, address, and date of birth. Clients must note that all the details in the account opening form should match with the details on their documents.

Step 3: Account configuration

In the next step, clients will need to configure their accounts by making choices. Clients can choose between MT4 and MT5 account types, USD or EUR as the base currency, Islamic or not, demo or real.

The maximum leverage of the account also needs to be selected in this step by the clients. The maximum leverage can be chosen from 1:1 to 1:500. Any prevailing bonus offers will also appear on this page.

Step 4: Document Verification

After configuring the account, OctaFX will generate login credentials for the chosen trading platforms. The account needs to be verified by the executives at OctaFX.

In the personal area, there is an option to ‘get verified’. This will require clients to upload a scanned copy of their name and address proofs. The executives at OctaFX will verify the details and will send a confirmation email. The confirmation is generally done within 1-3 hours but can also take up to 24 hours.

Step 5: Deposit

Once the account is verified, clients need to make a deposit. The recommended deposit amount at OctaFX is $100 but clients can deposit as low as $25 to start trading. Multiple methods are accepted for deposits and withdrawals at OctaFX.

OctaFX Demo Account Review

To open a demo account at OctaFX, clients need to enter basic details on the registration window and login into the personal area. After logging in, clients will have the option to open a real and demo account.

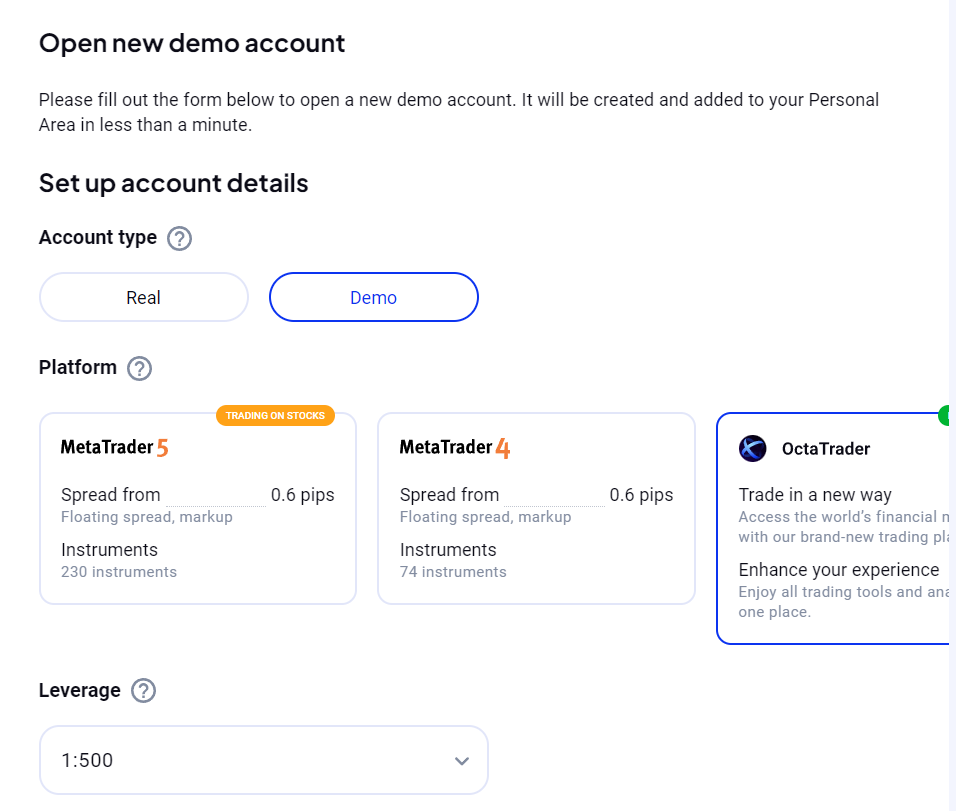

OctaFX offers 3 options for trading platforms in the demo account. The MT5 account allows virtual trading on 230 instruments while the MT4 trading platform allows trading on 74 instruments. The OctaTrader is a proprietary trading platform of OctaFX exclusively available for demo accounts. It is an ideal platform for beginners with a simple interface and easily available trading tools. However, the OctaTrader is not available for real accounts and will not provide the experience of the MT4 or MT5 live trading platform.

The maximum leverage can be chosen from 1:1 to 1:500 for the demo account with any of the trading platforms. There are no options to choose the pricing structure or base account currency. The opening account balance for the demo account can be entered while creating the account. The balance can also be added later on after opening the demo account.

The OctaFX demo trading account is useful for beginners to gain experience of trading forex and CFDs. Beginners in forex trading must use the demo account for a few weeks to learn the terminologies and strategies of trading.

h2 id=”funds” class=”heading_2 mt-md-5 mt-4″>OctaFX Deposits and Withdrawals

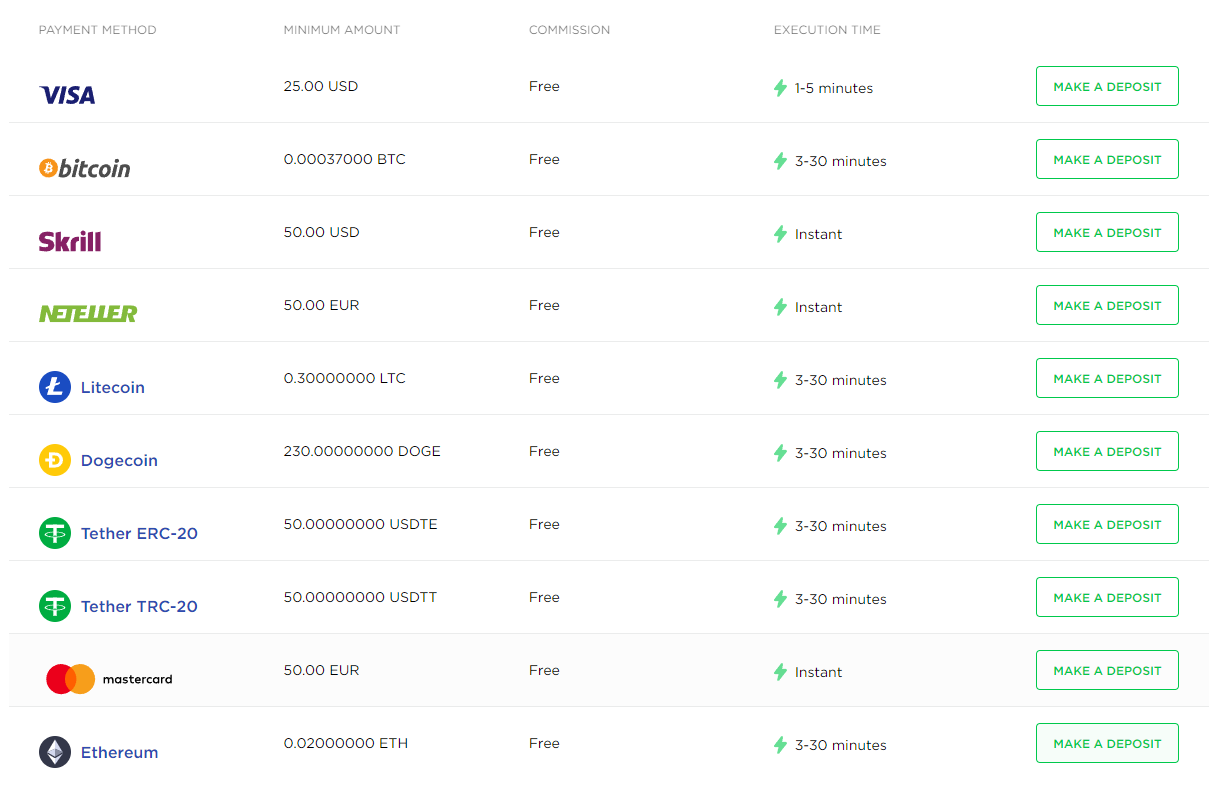

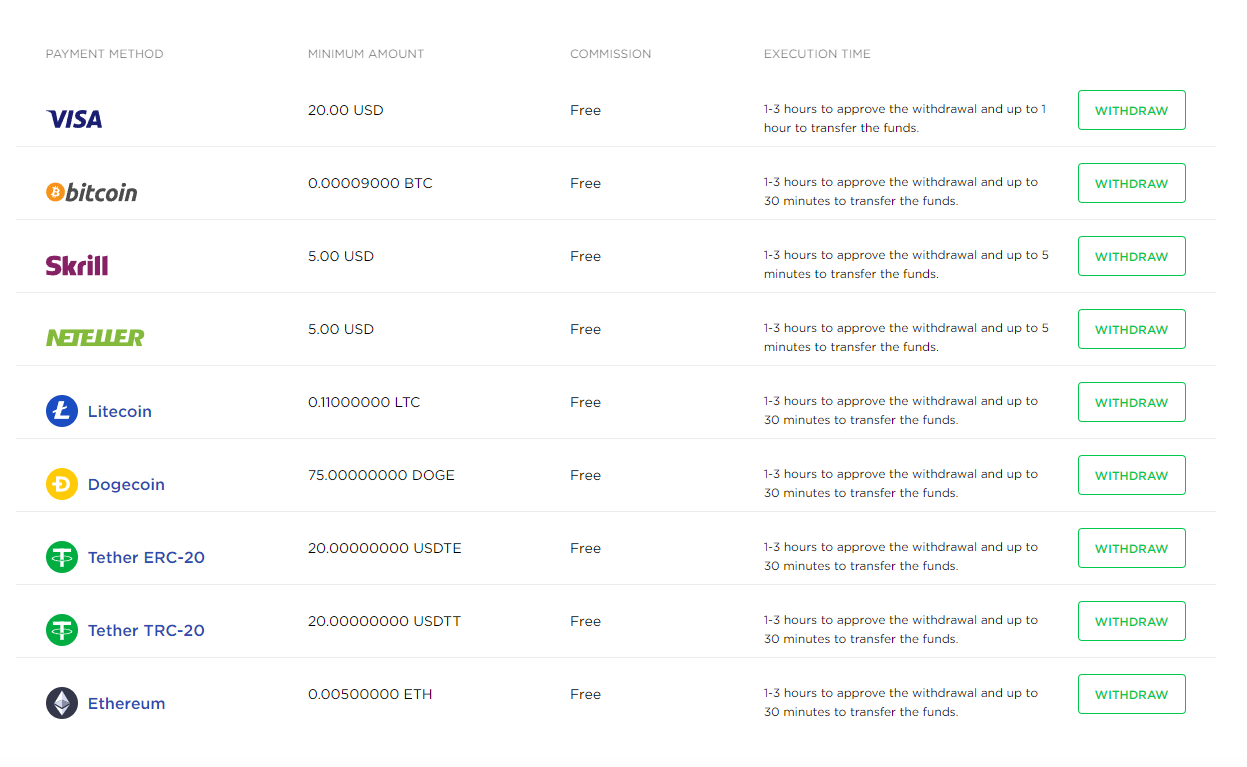

Before opening an account with a CFD broker, clients must know about the accepted methods for deposits and withdrawals. Kenyan clients at OctaFX can deposit and withdraw through the following methods.

- Credit/Debit cards: Credit and debit cards of VISA and MasterCard can be used to deposit and withdraw at OctaFX. The name on the card must match the name used to register and verify the trading account.

The minimum deposit amount is $25 for Visa cards and €50 for Mastercard. The minimum withdrawal amount is $20 with this method. Deposits are reflected in the trading account within 5 minutes while the withdrawal can take up to 4 hours to reflect in the bank account.

- E-Wallet: Skrill and Neteller can be used to deposit and withdraw at OctaFX in Kenya. The minimum deposit amount is $50 and €50 while the minimum withdrawal amount is $5 and €5 respectively with Skrill and Neteller. E-wallet deposits are processed instantly while the withdrawals can take up to 3 hours.

- Cryptocurrency: Bitcoin, Litecoin, Dogecoin, Tether, and Ethereum can be used to deposit and withdraw funds at OctaFX in Kenya. Each cryptocurrency has a different minimum deposit amount while all the deposits are processed within 30 minutes through this method.

Local bank transfers and wire transfers are not available at OctaFX in Kenya. No commission is charged for any of the methods chosen for deposits and withdrawals.

Deposits made in KES, cryptocurrency, or any other currency will be automatically converted to the base account currency (USD or EUR) according to prevailing conversion rates.

OctaFX Trading Platforms

The trading platform is where traders will spend most of their time trading forex and CFDs online. It is important to comprehend the available features and terminologies available at a trading platform to make better trading decisions. Trading platforms for desktop, mobile and web traders are available at XM.

Web Trading Platform

Traders at XM can choose between MT4 and MT5 web traders for trading through any browser. The MT4 web trader is not supported by mobile devices. For desktop devices, traders can trade on MT4 and MT5 web traders through their regular web browsers. Web traders are available in more than 20 languages and are highly customisable.

The web trading platform at OctaFX can be accessed through the official OctaFX website. It has a one-step login and can be linked with online tools and plugins.

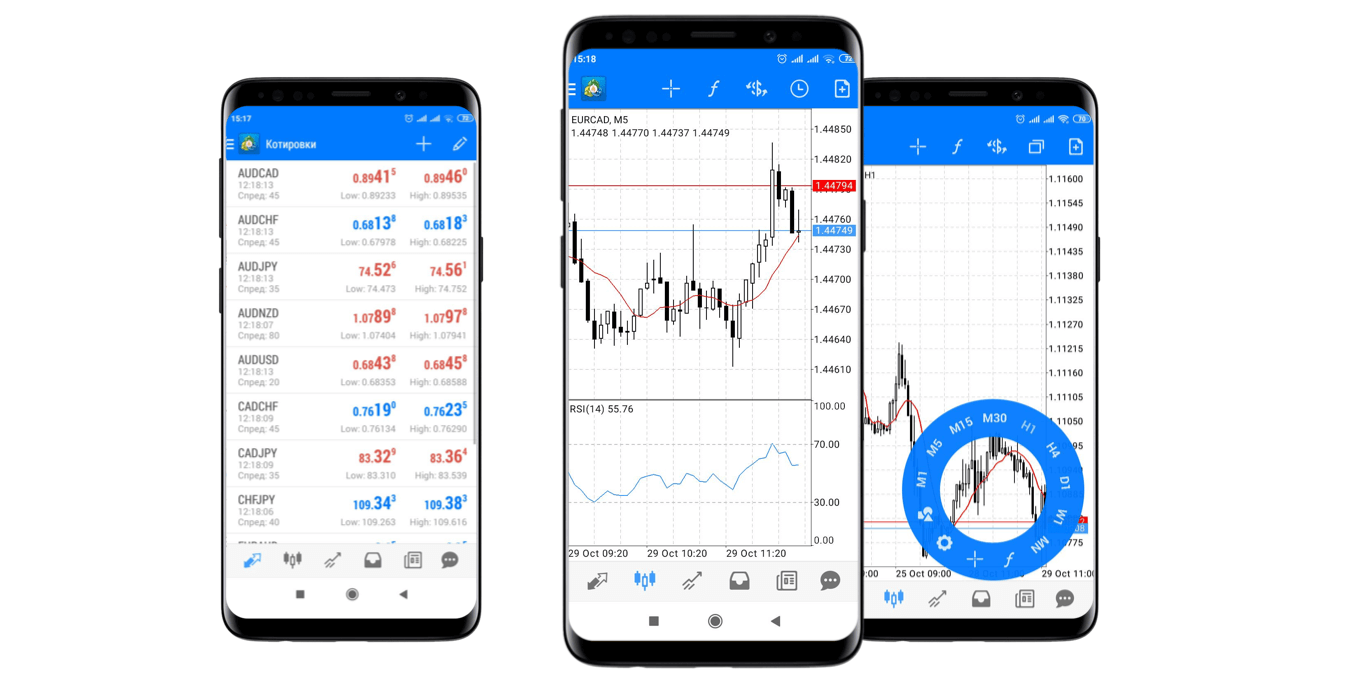

Mobile Trading Platforms

MT4 and MT5 mobile trading platforms can be downloaded on mobile and tablets of Android and iOS operating systems. Apart from MT4 and MT5, no other trading application is supported at OctaFX. Traders need to separately download the MT4 or MT5 trading application from the play store or app store and link it with the live trading account at OctaFX.

Desktop Trading Platform

The desktop trading platforms offer the best trading experience with the best customisation and fastest execution. MT4 and MT5 are the two desktop trading platforms at OctaFX. Both these platforms are developed by MetaQuotes Software for online trading.

MT4 is the most widely used desktop trading platform with a very basic interface that looks similar to Windows 98. MT4 was launched in 2005 and is still used by a lot of traders globally. MT5 is an upgraded version of MT4 with more advanced features, indicators, and patterns. MT5 is preferred by algorithmic traders and experienced traders.

Available Instruments

A decent number of financial instruments are available to trade at OctaFX in Kenya. Clients must note that all the available financial instruments at OctaFX are traded in the form of Contract for Deposit (CFD).

CFDs are derivative instruments in which the price difference is speculated. There is no physical settlement of the underlying asset. These are traded in lot size. Each asset class can have different sizes of a standard lot. For currency pairs, one standard lot has 100,000 units of the base currency.

Following are the financial instruments that can be traded as CFDs in Kenya at OctaFX.

- 35 Currency Pairs: Major, minor, and exotic currency pairs can be traded as CFD at OctaFX. The maximum leverage for currency pairs is 1:500.

- Gold and Silver: CFDs of Gold and Silver are available to trade at OctaFX with a maximum leverage of 1:200. The standard lot size of gold and silver is 100 Troy Ounce 5000 Troy Ounce respectively.

- 3 Energies: Three CFDs on energies include US Natural Gas, WTI Crude Oil, and Brent Crude Oil. The standard lot size at OctaFX is 1000 barrels for crude and 10,000 barrels for natural gas. The maximum leverage for CFDs on energies is 1:100.

- 10 Indices: CFDs on major stock indices can be traded at OctaFX. The MT4 trading account allows trading on 4 indices while 10 indices can be traded with the MT5 account type. The maximum leverage is 1:50 on indices CFD.

- 30 Cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple, and many other cryptocurrencies can be traded as CFD at OctaFX. The maximum leverage on crypto trading at OctaFX is 1:25.

- 150 Stocks: OctaFX allows trading on stocks of various stock exchanges of U.S., U.K., Europe, Japan, Singapore, and Australia. These stocks can only be traded as CFDs with a maximum leverage of 1:20.

| Trading Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Forex | 35 | 1:500 |

| Precious Metals CFDs | 2 | 1:200 |

| Energy CFDs | 3 | 1:100 |

| Indices CFD | 10 | 1:50 |

| Cryptocurrencies CFD | 30 | 1:25 |

| Stocks CFD | 150 | 1:20 |

Overall, the total number of available trading instruments at OctaFX is lower than most of the CFD brokers in Kenya. The leverage on cryptocurrency CFD is high.

OctaFX Research and Education Tools

Following are the research and education tools offered by OctaFX:

Market Analysis: OctaFX may offer daily, weekly, or monthly market analysis reports. These reports could include fundamental analysis of major economic events, technical analysis of currency pairs, and insights into market trends.

Economic Calendar: An economic calendar is a tool that displays upcoming economic events, such as central bank announcements, economic indicators, and other events that could impact the forex market. This tool helps traders stay informed about potential market-moving events.

Technical Analysis Tools: Forex brokers often provide technical analysis tools, including charting platforms with indicators, drawing tools, and other features that help traders analyze price charts and patterns.

Educational Resources: OctaFX might offer educational resources such as articles, videos, webinars, and courses to help traders learn about forex trading concepts, strategies, risk management, and other relevant topics.

Demo Accounts: Demo accounts allow traders to practice trading in a simulated environment using virtual funds. This is a valuable tool for beginners to gain experience without risking real money.

Trading Calculators: Trading calculators can assist traders in performing various calculations, such as position sizing, pip value, risk management, and potential profit/loss scenarios.

Copy Trading: Some brokers offer copy trading platforms that allow traders to replicate the trades of experienced and successful traders. This can be a learning tool as well as a way to potentially generate profits.

Mobile Apps: Many brokers, including OctaFX, offer mobile trading apps that provide access to trading tools, analysis, and execution on the go.

OctaFX Customer Support

The customer support service plays an important role whenever clients face queries while trading. The quality and diligence of support services must be checked before opening the account.

We have reviewed the available methods to connect with the customer support staff at OctaFX.

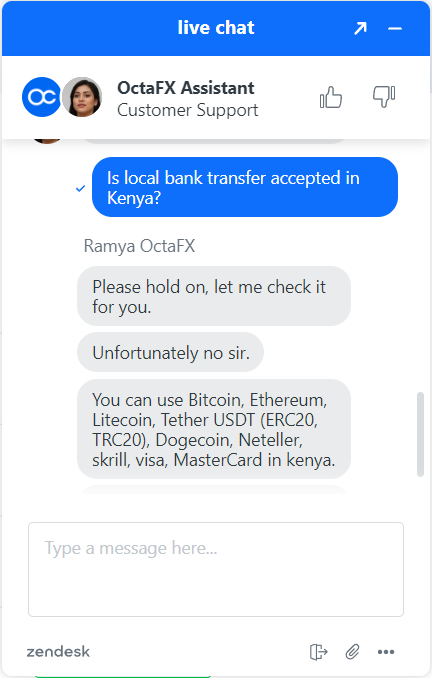

- Live Chat: The live chat support service is excellent at OctaFX for Kenyan clients. The live chat window on the website and application is active 24/7. The live chat is directly connected to a customer support executive without a chatbot.

Kenyan clients can clear their queries at any time. We raised multiple queries at different times of the day. We were connected to the agent within 2 minutes (on average) and received relevant replies to our queries. - Email: Clients can also raise queries through email at [email protected]. Those who do not have an account can raise queries directly through email addresses. Those who have an account at OctaFX can also mail them via their personal area.

The email support service can take 3 hours on average to clear a query. It can be useful when clients require a soft copy of any document.

- No Local Phone Support: There is no local phone support available for Kenyan clients at OctaFX. The broker does not provide an international or any phone number for customer support.

Live chat support is a resourceful method to connect with executives and resolve queries. The 24/7 availability of a live chat window is a major advantage but the absence of local phone support is a limitation of choosing OctaFX in Kenya.

OctaFX Bonus

OctaFX offers a variety of bonus offerings for Kenyan clients. They constantly roll out contests and giveaways on regular basis to reward the clients.

- Contests: OctaFX regularly organizes contests for demo as well as real accounts. They reward the winners with attractive prize money, car, gadgets, etc. The contests are for a limited period and keep changing every month.

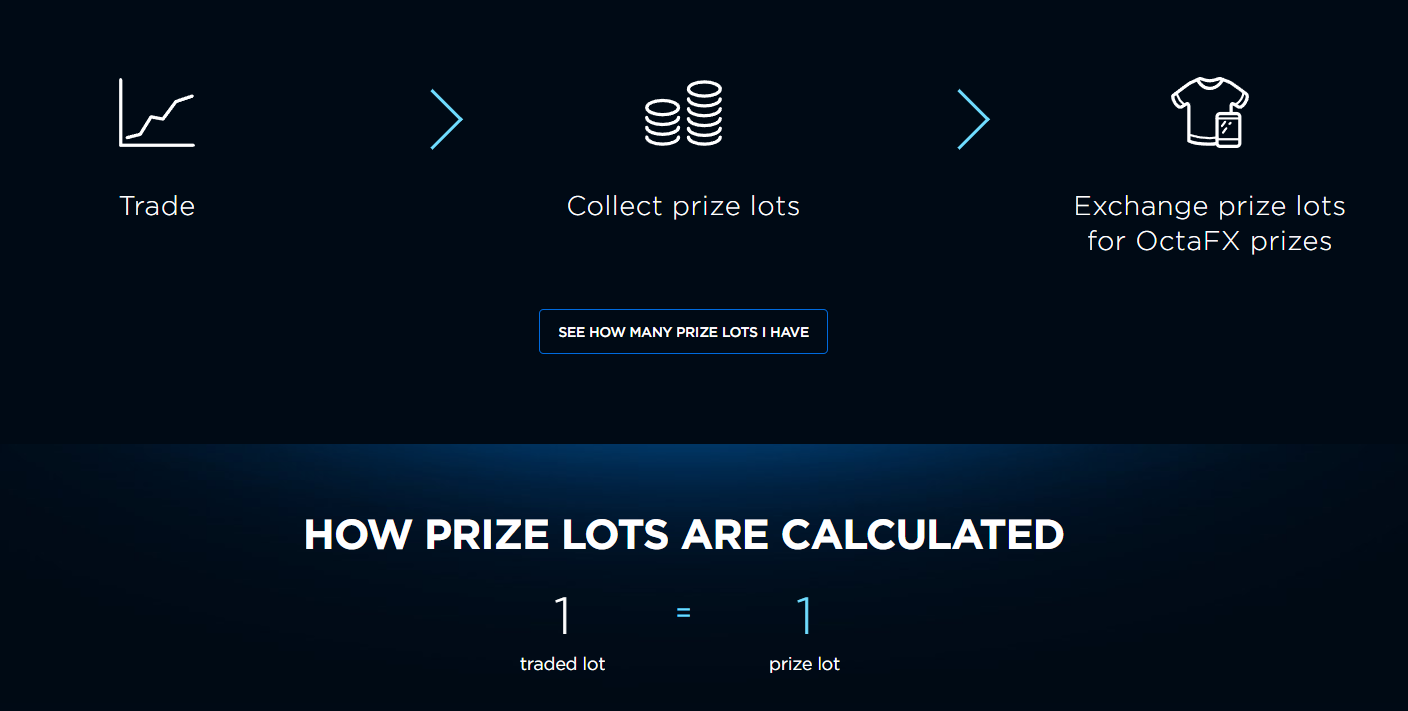

- Giveaway: Clients at OctaFX are rewarded with a prize lot for every lot they trade. These lots can be exchanged in return for prizes like laptops, smartphones, etc.

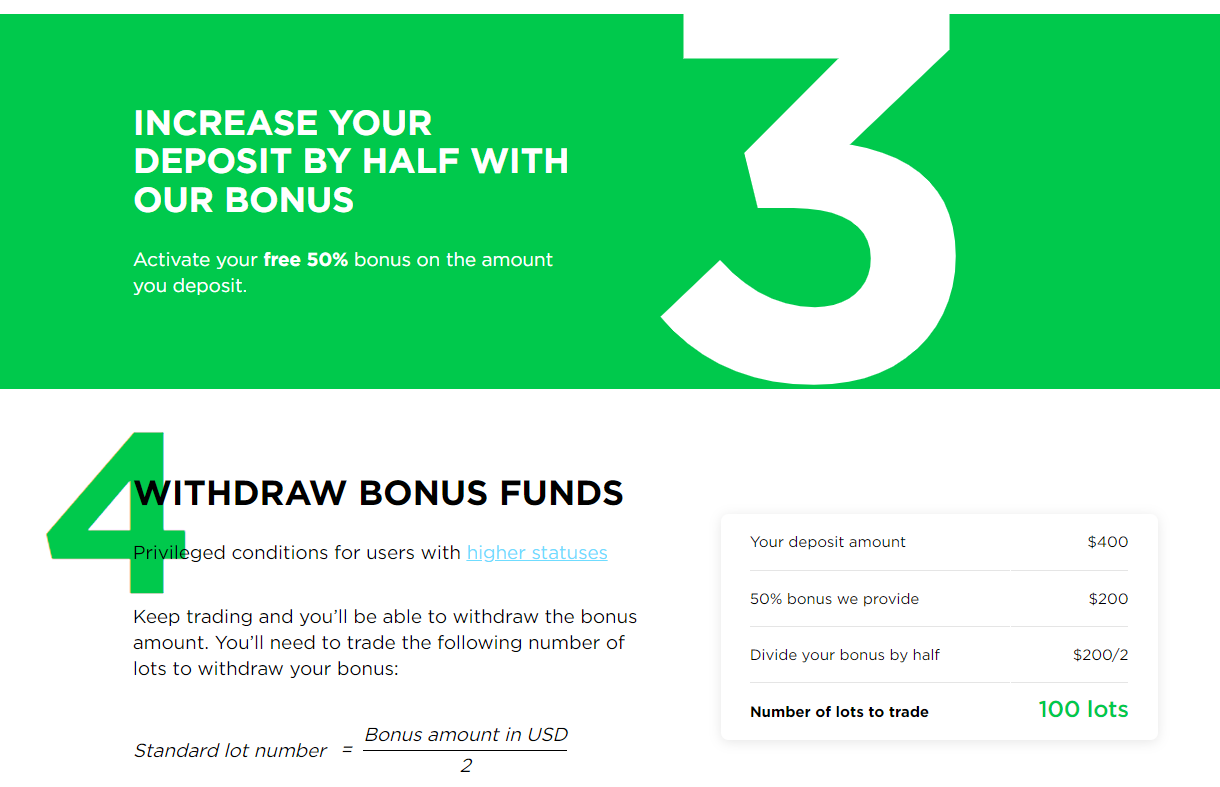

- Offers: OctaFX rewards the clients with a deposit bonus offering of 50% in Kenya. This bonus is available on all account types and each deposit. The minimum deposit amount to avail of this bonus is $50 equivalent. The bonus amount becomes available for withdrawal if the bonus amount/2 number of lots are traded by the client.

There are multiple bonus offerings for Kenyan clients at OctaFX. The bonus is attractive and among the best in Kenya.

Do We Recommend OctaFX

Yes, OctaFX can be chosen to trade CFDs in Kenya as the spreads are low and no swaps are applicable on the MT5 account type. The support services are good through live chat but local phone support is not available in Kenya.

Clients who wish to deposit and withdraw through cryptocurrency will also find OctaFX very useful. The bonus offerings are also very attractive. Although this comes at the expense of higher third-party risk. OctaFX is safe to trade due to FSASVG regulation but it is riskier than CMA-regulated CFD brokers in Kenya.

OctaFX FAQs

Is OctaFX regulated in Kenya?

No, OctaFX is not regulated by the Capital Markets Authority CMA in Kenya. The clients in Kenya are registered under offshore regulation of FSA in St Vincent and the Grenadines.

What is the minimum deposit at OctaFX?

$25. The minimum deposit at OctaFX is $25 with credit/debit VISA cards. The minimum deposit amount is different for each accepted method at OctaFX.

Is OctaFX real?

Yes, OctaFX is an offshore regulated forex and CFD broker in Kenya. It offers leveraged CFD trading services in various countries across the globe. OctaFX is not regulated by CMA in Kenya but accepts clients residing in Kenya.

Can I withdraw money from OctaFX?

Yes, OctaFX allows withdrawal of funds through multiple methods. Clients residing in Kenya can deposit and withdraw through credit/debit cards, e-wallets, and cryptocurrency wallets. OctaFX does not charge any fee for deposits or withdrawals in Kenya.

Which country owns OctaFX?

OctaFX is a privately owned financial services provider based in the Island nation of St Vincent and Grenadines. OctaFX offers CFD trading services in various countries of the world.

Does OctaFX work in Kenya?

Yes, OctaFX accepts clients residing in Kenya for retail CFD trading. OctaFX is not regulated by Capital Markets Authority in Kenya but traders can trade with OctaFX in Kenya.

Is OctaFX safe?

Yes, OctaFX is not regulated by CMA in Kenya so the third-party risk in choosing OctaFX is high. Although, Kenyan clients are registered under SVGFSA regulation which makes it safe for Kenyan clients.