Best Forex Brokers in Kenya 2024

We have ranked the best forex brokers in Kenya after comparing their regulation with CMA & other Top-tier regulations, ease of funding & withdrawals in Kenya, trading platforms supported, level of customer support & 8 other factors. See our research & metrics below.

Forex Traders in Kenya can choose from a number of Forex brokers. But it is important to consider that the broker that you are choosing is considered safe, is able to offer timely withdrawals and has low fees.

In this guide, we have listed the reputed forex brokers that accept traders based in Kenya.

List of 7 Best Forex Brokers in Kenya for 2024

- FXPesa – Overall Best Forex Broker in Kenya

- HF Markets – Best Forex Broker with no deposit & withdrawal fees

- Scope Markets – Best Forex Broker with low commission

- PepperStone – Best Forex Broker with best platforms

- Exinity – Best Forex Broker with low trading cost

- Exness – Best Forex Broker with tight spread

- AvaTrade – Best Multi Regulated Forex Broker in Kenya

Comparison of Best Forex Brokers in Kenya 2024

| Spread Betting Platform | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage (Forex) | |

|---|---|---|---|---|

| FxPesa |

1.4 pips

|

$5

|

1:400

|

Visit Broker |

| HF Markets |

1.3 pip

|

$5

|

1:400

|

Visit Broker |

| Scope Markets |

1.1 pips

|

$100

|

1:400

|

Visit Broker |

| Pepperstone |

0.69 pips

|

$0

|

1:400

|

Visit Broker |

| Exinity |

0 pips + $4 per lot

|

$20

|

1:400

|

Visit Broker |

| Exness |

1 pips

|

$20

|

1:400

|

Visit Broker |

| AvaTrade |

0.9 pips

|

$100

|

1:400

|

Visit Broker |

We judged these forex brokers using certain parameters such as; regulation with Kenya’s regulatory authority CMA, the fees charged for trading & non-trading, withdrawal methods & ease of withdrawals, and 5 more factors.

Best Forex Brokers in Kenya

Below is a list of the six best forex brokers for Kenyan traders.

#1 FXPesa – Overall Best Forex Broker in Kenya

FXPesa broker operates in Kenta as the brand name of EGM Securities limited. EGM Securities Limited is a registered company in Kenya with registration number PVT-AAAAFF7.

The parent company of FXPesa i.e EGM Securities is registered and regulated by the Capital Markets Authority of Kenya (CMA). The CMA is the government agency saddled with the responsibility of regulating the activities of Financial Service Providers in Kenya. FXPesa is part of Equiti Group which is also licensed with the Financial Conduct Authority (FCA) in the United Kingdom with registration number 528328 (Equiti Capital UK Limited). The FCA is an International Tier-1 Regulator of Financial Service Providers.

Because of its multiple regulations, FXPesa is considered a low-risk forex broker.

Trading on FXPesa can be carried out on Two account types; the Executive and Premier account. The minimum deposit on the Executive account is $5 while that of the premier account is $100.

FXPesa Premier account offers spread as low as 0 pip while the Executive account has spread beginning from 1.4pips.

For major FX pairs as a benchmark, the typical spread for EUR/USD, and GBP/USD is 1.4 pips, 2.1 pips with Premiere Account, while the max. leverage is 1:400. That of USDCHF is 0.3 pips on the Premiere account and 2.0 on the Executive accounts. USD/JPY has a spread of 0.0 pip on premiere accounts and 1.4 pips on Executive accounts. EUR/CHF has a spread of 0.7 and 2.8 pips for its premiere and executive accounts respectively.

You must note that there is an extra commission of USD 7/lot with the Executive account with this spread.

The FXPesa maximum leverage on forex pairs and precious metals is 1:400, 1:200 on most CFDs, and 1:20 for equities. This is for the Executive account & the same leverage applies to the Premiere account.

Deposits and withdrawals can be made via a variety of methods on FXPesa. FXPesa allows deposits on wire and bank transfers, debit/credit cards, E-wallets, and Mobile Payment methods. For wire and bank transfers, it takes 3 days for deposits to reflect. However, for other payment methods, it is instant.

FXPesa allows withdrawals in USD and KES with most methods apart from mobile payment methods that do not offer USD. FXPesa also does not charge any fee for wire/bank and mobile payment withdrawals. However, 1 per cent is charged for every 30 USD equivalent e-wallet

For withdrawals, it takes 3 to 5 working days for wire/bank transfer withdrawals to reflect. E-Wallets and Mobile payments withdrawals 3 hours to reflect.

#2 HF Markets – Best Forex Broker with no deposit & withdrawal fees

HF Markets is a popular broker in Africa in the Forex brokerage industry. This broker is registered as HFM Investments Ltd in Kenya and is regulated by Kenya’s Capital Markets Authority (CMA) as of 2021.

HotForex Group is also registered and regulated with the highly revered Financial Conduct Authority (FCA) in the U.K with registration number 801701, and with the FSCA in South Africa. Being a well-regulated Forex broker makes them safe for Kenyan traders.

HF Markets was previously known as HotForex. There are six different account types available for traders using HF Markets as their broker of choice.

They are; premium, zero, micro, HFCopy, PAMM, and Auto accounts. The HF Markets premium account has a minimum deposit of $100, spread beginning from 1pip and maximum leverage of 1:500. The Micro account spread begins from 1pip, with a minimum deposit of $5 and maximum leverage of 1:1000.

The zero spread account has a minimum deposit of $200, spread beginning from 0pip, and maximum leverage of 1:500. This is the same with the Auto account except for the pip. The auto account offers from 1pip. The PAMM account has a minimum deposit of $250, maximum leverage of 1:300, and spread from 1pip.

Finally, the HFCopy account has a minimum deposit of $500 for the strategy provider and $100 for followers. Maximum leverage of 1:400 and spread beginning from 1pip.

HF Markets Kenya’s account can be opened with base currencies USD, EUR & KES.

On HF Markets, deposits are made across the following options; bank/wire transfer, credit/debit cards, and E-wallet options such as Neteller, Perfect Money, Fasapay, Skrill, WebMoney, Bitpay, etc. The minimum deposit on bank/wire transfer is $50 while the maximum deposit is unlimited. For credit/debit cards, the minimum deposit is $5 while the maximum deposit is $10,000. The minimum and maximum deposits vary across the alternative payment methods.

For withdrawals, HF Markets accepts bank/wire transfers, credit/debit cards, and other alternative payment methods such as Fasapay, Neteller, Perfect Money, VLoad, etc. The minimum amount withdrawal for bank/wire transfer is $10, and credit/debit cards are $5.

The HFCopy, Micro, Premium, and Auto accounts do not carry any form of trading commission. However, the zero spread and the PAMM premium accounts do charge commissions on trades.

HF Markets offers trades on instruments such as currency pairs, CFDs on metals, energy, indices, commodities, bonds, etc. Please note that all these instruments at HF are traded as CFDs with margin trading.

The trading platforms on HF Markets are; Web, MT4, and MT5 apps across all devices and HF Markets FIX/API.

#3 Scope Markets – Best Forex Broker with low commission

Scope Market is a local forex broker headquartered in Kenya. It is regulated by the Capital Markets Authority as well as CySEC and South Africa’s FSCA.

This broker is regarded as trustworthy among Kenyan traders due to its CMA registration and its headquarters in Kenya.

Scope Markets offers two account types to traders. The Silver and Gold accounts. The silver account has a spread of 1.1pips for EUR/USD pairs while the spread for the gold account is 0.2pips for EUR/USD. There is no trading commission for the silver account but the gold account has a trading commission of $3.5 per lot per side.

The leverage on Scope Market is 1:400 and the minimum deposit is $100. Both accounts have USD as their default currency.

Trading on Scope Market is carried out on the MetaTrader 4 and MetaTrader 5 platform.

#4 PepperStone – Best Forex Broker with best platforms

PepperStone was founded in 2010. This broker is registered with Kenya’s CMA, Australia’s ASIC, and the U.K’s Financial Conduct Authority. This makes it a highly trusted broker in the brokerage industry.

PepperStone offers two account types namely the Razor and Standard accounts. For EUR/USD, the minimum spread for a razor account is 0pip while that of the standard account is 1pip. GBP/USD spread on the razor account starts from 0pip and that of the standard account is 1pip. The same pattern follows for USD/CHF, USD/JPY, and AUD/USD.

PepperStone charges a commission on razor accounts when trading forex and CFDs.

Traders can deposit to their PepperStone account via the following methods; Visa, Master Card, Bank transfers, MPesa, and PayPal. Withdrawals can also be made using the methods listed above.

Trading is carried out on PepperStone using MT4, MT5, cTrader, and Social Trading platforms.

#5 Exinity – Best Forex Broker with Low Trading Cost

Exinity is a financial service provider that offers forex brokerage services to clients in Kenya and all over the world.

Exinity is a registered company in Kenya and is regulated by the Kenyan Capital Markets Authority. It is also regulated by other international regulators such as FSC Mauritius and the UAE’s FSRA.

The spread on major currency pairs on Exinity usually begins from 0 pip. However, Exinity charges $4 per lot on FX trades.

The trading platform on exinity are MetaTrader 4 and MetaTrader 5. Instruments on offer from Exinity include forex pairs, commodities, stocks, and indices.

Exinity accepts deposits from bank transfers, debit/credit cards, and Neteller. The time for deposits is usually instant. However, withdrawals via bank transfer usually take around 3 to 5 days to complete.

#6 Exness – Best Forex Broker with tight spread

This broker has a midlevel trust among traders in Kenya. This is due to the fact it is not registered with the Kenyan Capital Markets Authority (CMA).

However, its registration with other top-tier regulators like the U.K’s Financial Conduct Authority (FCA) and CySEC provides the cover traders desperately need.

Kenyan traders with Exness are offered two account types- the standard and professional accounts. The leverage for the standard account type is 1: Unlimited.

The Exness standard account has two sub-account underneath, the Standard Cent and the Raw Spread accounts. The Professional account also has the Pro and Zero account. The spread of major FX pairs on these accounts differs.

For example, on the standard account, AUDUSD, EURUSD, USDCAD, and USDJPY has a spread of 1.5, 1, 2.2, and 1.1 respectively. The spread for the professional account on EURUSD, GBPUSD, NZDUSD, and USDCHF are 0.6, 0.7, 1.2, and 0.9 respectively.

The minimum deposit for a standard account on Exness depends on the payment methods while that of the Pro account is $200. Deposits methods on Exness Bank/Wire transfer, E-payment systems such as Sticpay, Neteller, Skrill, WebMoney, Mpesa, etc, and Debit/Credit cards. The transaction time for E-payment systems is instant while bank transfer usually takes up to 24hrs. Exness does not charge any fees or commissions on deposits.

For withdrawals, the same deposit methods are also used. Exness does not charge any fee or commission on withdrawals. Also, the transaction processing time for withdrawals through E-payment systems is usually instant.

Bank transfer withdrawals usually take between 24 to 48hrs.

Exness offers Kenyan traders the following trading platforms; MetaTrader 4 and 5 for desktop and mobile, Multiterminal, Web Terminal, and Exness Trader App.

#7 AvaTrade – Best Multi Regulated Forex Broker in Kenya

AvaTrade is not regulated by the CMA in Kenya but it holds multiple regulatory licenses from top-tier regulatory authorities

Avatrade is regulated under the FSCA of South Africa with FSP number 45984. They are also regulated by the ASIC of Australia (406684) and CySec of the European Union (347/17). This makes Avatrade less risky for Kenyan clients but it is not regulated by the CMA in Kenya.

There is no choice for account types at AvaTrade. The pricing structure and trading conditions are the same for all the clients in South Africa. The average spread for EUR/USD is 0.9 pips with no additional commission.

There is a high inactivity fee of $50 (monthly) at Avatrade if no trades are executed for more than 3 months. For inactivity of more than 12 months, the inactivity fees increase to $100 until the account balance reached 0.

AvaTrade offers multiple trading platforms for trading CFDs. It offers MT4, MT5, and a proprietary trading platform called AvaTradeGO. The social trading and copy trading features are also very convenient for suitable clients.

The minimum deposit amount is $100 or R1500 depending on the base currency of the account. Transactions can also be done through wire transfer but that may incur additional charges and the minimum deposit amount is $500.

More than 700 instruments can be traded at AvaTrade including 55 currency pairs, 25 commodities, and 20 cryptocurrencies.

The customer support service is good with the availability of local phone support and a live chat window. The support service is not available on the weekends.

Is Forex Trading Legal in Kenya?

Yes, forex trading is legal in the jurisdiction of Kenya and is regulated by the Capital Markets Authority (CMA) of Kenya. However, there are some brokers that are offering CFD trading services in Kenya and are not regulated by CMA. Traders opening their accounts with such brokers are exposed to high third-party risk.

CMA of Kenya has warned Kenyan traders multiple times against trading with brokers that are not licensed and regulated by the CMA. CMA also stated that traders opening their accounts with such brokers are at risk of losing their investment and are not protected by the law.

If you wish to trade forex and CFDs in Kenya legally, it is essential to choose a CMA-regulated broker. Currently, there are only 7 forex and CFD brokers that are regulated by the CMA of Kenya. All these brokers are non-dealing desk brokers. As per CMA regulatory compliance, 1:400 is the highest leverage that licensed brokers can offer to retail clients.

How to Open an Account with a Forex Broker in Kenya

The steps in opening a trading account with a forex broker are similar across different brokerage firms in Kenya. It involves having a functional email, phone number, and perhaps a bank account.

In this guide, we will use FXPesa to describe the steps in opening an account with a forex broker in Kenya.

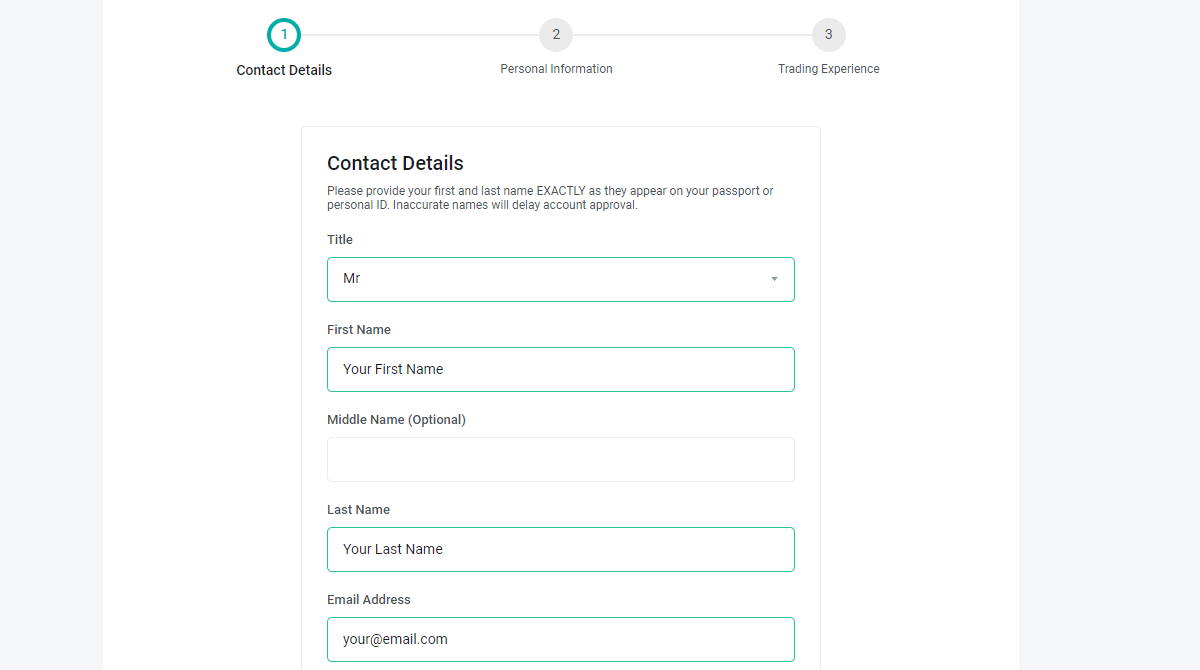

There are three steps to opening an account on FXPesa.

- Registration: This consists of three sections; Provision of personal details, contact details and trading experience/employment status. This process is instant and moves from one to another. You’re expected to input the correct details as they’ll be verified. You’ll be requested to put your phone number and a PIN will be sent to you to complete that stage.

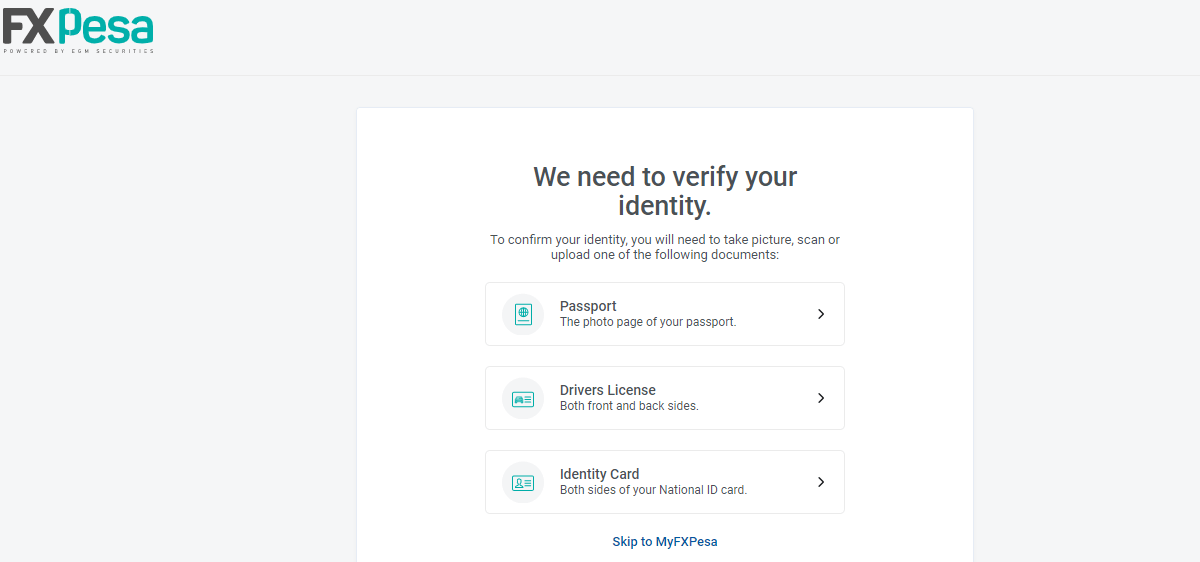

- Verification of accounts: Here you’ll have to upload a passport and valid means of identification, most likely a government identity card. In this stage, a text message will be sent to you with a link to start the verification/activation of the account. On clicking the link, you’ll be asked to provide your password and start the verification process.

- Confirmation of documents submitted by you: This process is not instant as the rest are. On confirmation of the documents submitted, you’ll be able to make deposits and start trading.

Normally the KYC at forex brokers can take up to 48 business hours max. But most brokers will verify much earlier within this time frame.

How To Choose the Best Forex Brokers in Kenya

To choose the best forex broker in Kenya, certain factors must be considered. These factors include; the regulation of the broker, fees on trading, and ease of deposits and withdrawals. We will look into these factors and their importance in determining which broker ha best for Kenyan traders.

1) Regulation: In order to guarantee the safety of traders’ funds, governments all over the world do establish regulatory institutions. In Kenya, the Financial Markets Regulatory Institution that regulates Online Forex Trading is the Capital Markets Authority (CMA). The CMA has the responsibility of registering and regulating the conduct and activities of forex brokers in Kenya.

As a forex trader in Kenya, it is important your choice broker is registered with the CMA to protect the investment. To check if a broker is regulated by the Kenyan CMA, can either be found on the broker’s website or on the official website of the CMA.

Aside from that, we also have other regulatory agencies such as South Africa’s FSCA, U.K’s FCA, CySEC, Australia’s ASIC, etc. These are potent international financial regulatory institutions that should regulate the activities of your broker of choice.

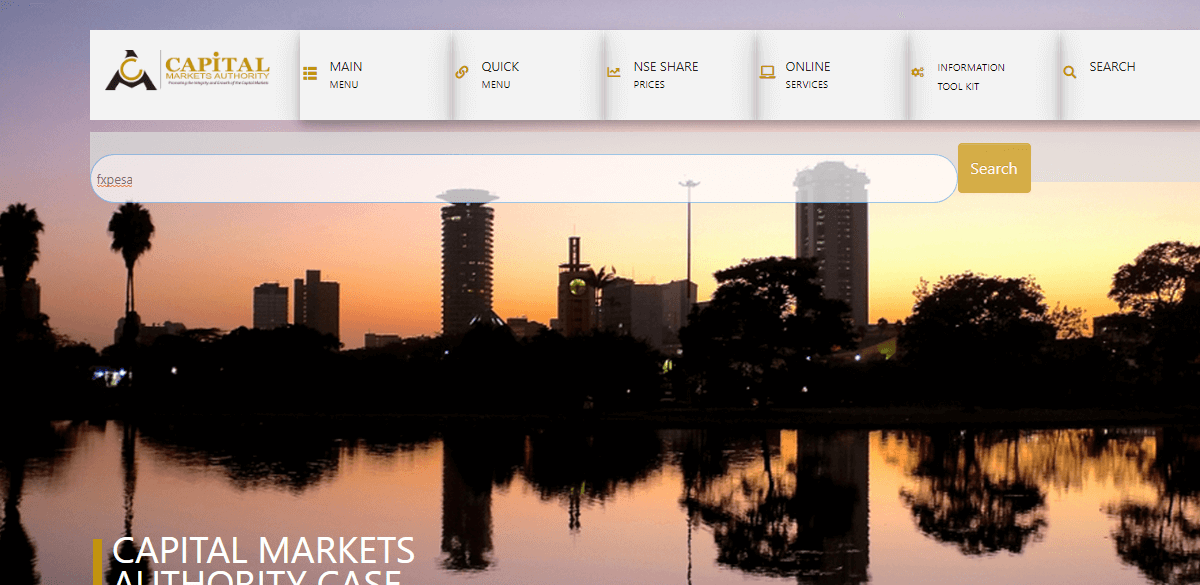

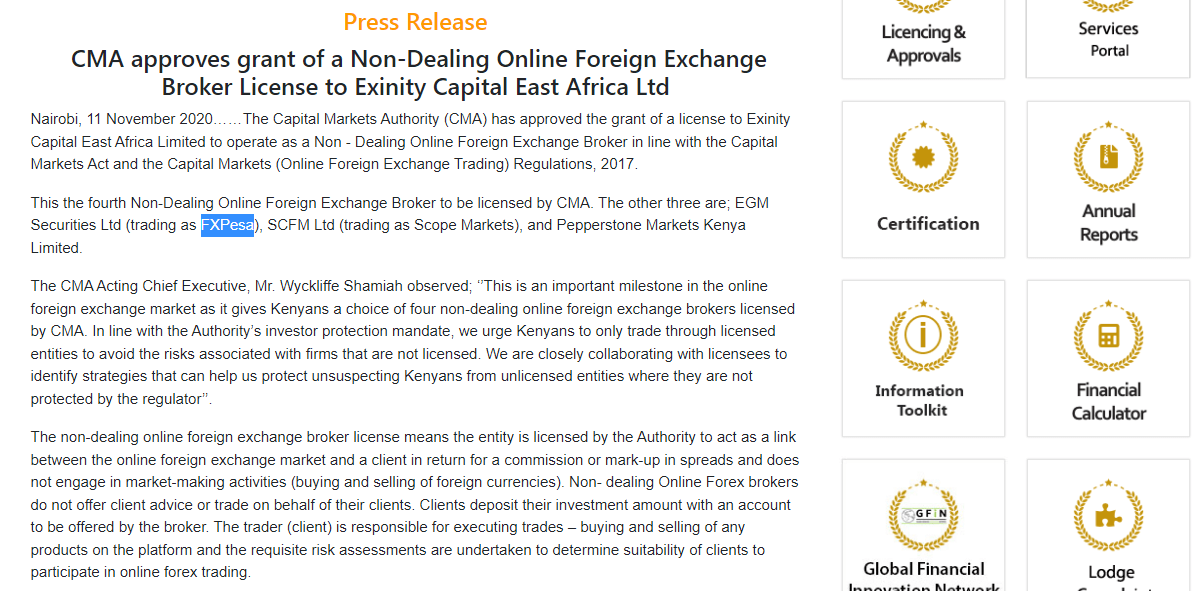

In this piece, we’ll demonstrate how to verify the registration status of a broker with the CMA.

- Visit the official website of the CMA at www.cma.or.ke

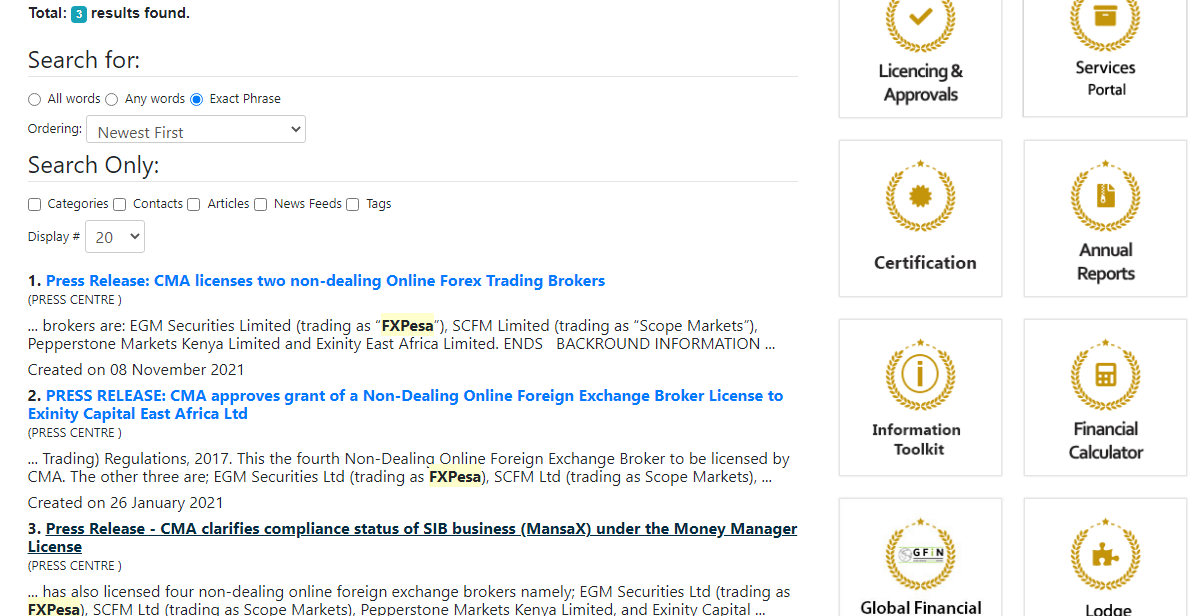

- Search the name of the broker you wish to verify on the search icon of the website. In this guide, we’ll use FXPesa.

- The search result will determine the registration status of the broker. In this case, it showed information about FxPesa.

- To confirm the registration status of the broker, click on any press release carrying the name of the broker.

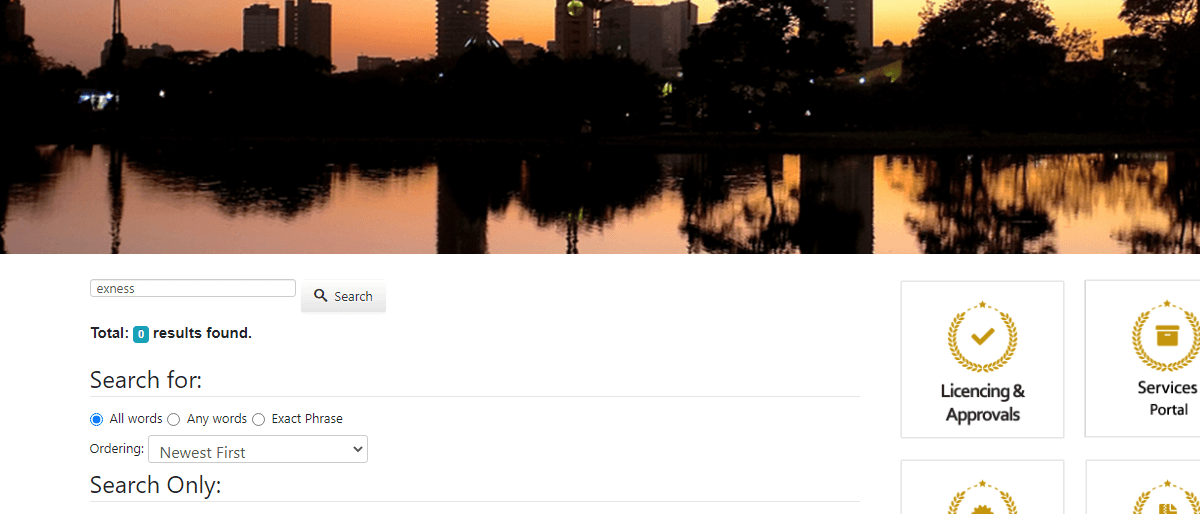

- If the broker is not registered with the CMA, the result of the search will be zero results. Exness was used to demonstrate this here.

2) Fees and Commission: A forex trader should be well informed about the trading fees and commissions being charged by a broker before trading with them. This is important since some brokers are in the habit of charging exorbitant trading fees and commissions. These charges can also come in the form of spreads and leverages. A high spread gives can eat into one’s capital or profit. Brokers who charge a high spread do so in disguise of zero fees or charges.

3) Easy Deposits and Withdrawal Methods: In choosing a broker in Kenya, a trader should look for brokers that accept deposits and withdrawals in local Kenyan banks and payment methods like MPesa.

A trader should also consider a broker that accepts deposits and withdrawals in local Kenyan currency. This will prevent the conversion of funds into trading currency and back and forth. It will also prevent conversion charges as this is a practice among some brokers.

4) Customer Support: Clients can face any random issues or have queries while trading online while trading forex. Customer support services can help resolve the clients’ queries and good quality service can greatly affect the trading experience.

Brokers may offer support services through live chat, email, social media, and phone. A broker that does not allow clients to reach out to them through any method is highly suspicious of being fake. It is always good to check the quality of support services by raising some random queries through available methods before opening the account.

5) Trading Platform and Trading Conditions: The trading platform is where the clients will spend most of their time trading forex and CFD. It is important to get comfortable with the features and terminologies of the trading platform.

MT4, MT5, and cTrader are the most chosen trading platform but a broker may also offer their own proprietary trading platform. Clients must also check and compare the details of all the trading conditions associated with their account and trading platform.

6) Available Instruments: Each broker allows trading on different instruments. Clients must check the available instruments and must only choose a broker that allows trading on their preferred instrument.

How to Open Live Forex Trading Account in Kenya

After checking and comparing each CMA-regulated broker in Kenya, clients can open their accounts online through their official websites. The account opening process is simple and can be completed within 24 hours but depends on the broker.

Step 1: Choose the Broker

The broker must be chosen after extensive analysis and comparison. A CMA license is a must to trade safely in Kenya.

Step 2: Provide Basic Details

Visit the official website of the chosen broker and enter basic details like name and email to begin the account opening process. If the broker offers multiple account types and trading platforms, clients will also need to configure their accounts.

Step 3: Choose Password

Choose a unique password that will be used in the future to access the trading account.

Step 4: Document Verification

Traders need to submit a soft copy of their documents that will be cross-checked by the authorities at the broker. This is the most time-consuming step. Some brokers complete this process within 2 hours while some may also take up to 24 hours to verify documents.

Step 5: Make a Deposit

Once the account is verified, clients can make a deposit through any of the accepted methods and start trading through the trading platforms.

Before starting forex trading in Kenya, it is important to understand the working of the forex market and the terminologies used while trading online. Traders must acknowledge each component of the risk involved in the forex market. It is always advisable to start with a demo account to learn the basics of trading and gain experience. More than 70% of forex traders lose money.

Risk Involved in Forex Trading

Forex is a high-risk capital market. There are multiple risk elements that a forex trader must comprehend before trading forex pairs.

Market Risk: The market risk is extremely high in forex as the market remains active throughout the day in every corner of the world. Any national or international event at any time of the day can impact the prices of currency pairs against the anticipation.

The sudden fluctuations in prices are hard to predict in the forex market. The forex market is one of the most highly liquid markets in the world which makes it less costly to trade currency pairs. However, currency pairs can fluctuate based on a variety of events which are completely unpredictable. That’s why it’s essential to always trade using appropriate risk management techniques such as stop loss.

Leverage Risk: The leverage allows traders to book higher profit with a low initial deposit but it also increases the loss traders can face. Leveraged trading is legal in South Africa but there is no defined limit on the maximum leverage that can be offered to retail traders. Hence, taking very high leverage in forex trading may wipe out the whole account equity. Traders must use safe leverage of less than 1:30 and put a stop loss on leveraged positions.

Third-Party Risk: The risk of choosing a fake broker or scammer for trading forex is called counterparty risk or third-party risk. Some fake brokers might also use fake FSCA licenses to lure retail clients. Such fake brokers will put restrictions on withdrawals and may also close your account permanently once the deposits are made. Traders must always choose an authentic FSCA-regulated broker to mitigate the counterparty risk.

Position Close Out: If a large volume trading position is opened with the little amount left in the account equity, your position might close out even when you don’t want it to. This is because a leveraged position will only accept losses equal to account equity. Once the losses are equal to the account balance the position will automatically close and the account equity will be reduced with heavy losses.

FAQs on Best Forex Brokers in Kenya

Which is the best forex broker in Kenya?

The best forex broker in Kenya is the one that is regulated by the Kenyan Capital Markets Authority, has very low fees and provides easy deposit and withdrawal methods. As per our research, there are a few good Forex brokers; which are FXPesa, HF Markets, and Scope Markets.

Which Forex brokers are regulated by the CMA in Kenya?

There are six forex brokers licensed by the CMA. They are; FXPesa, HF Markets Kenya, Scope Markets Kenya, PepperStone, Exinity Group & Windsor Markets (Kenya) Limited.

Is Forex Trading Good for Beginners?

No, Forex trading involves high risk. Those who are new to trading must spend time and effort to learn the basics and understand price movement in the forex market before starting. Forex trading can be good for those who are familiar with short-term trading in other markets.

Demo trading accounts can be very useful for beginners. Beginners in forex trading can gain experience, learn terminologies, understand volatility, check suitability, and test their strategies using demo accounts.

Which forex broker is best for beginners?

FxPesa, HF Markets, and Pepperstone can be considered best for beginners in Kenya. Accounts with lower fees, free deposit/withdrawal, good support services, and CMA regulation are ideal for beginners in the forex market.

Which broker is best for MT4?

FxPesa, HF Markets, Pepperstone, Scope Markets, and Exinity are the best choices in Kenya for MT4 trading platform. Most forex and CFD brokers across the globe support MT4 trading platform but traders residing in Kenya must only trade with the ones that are regulated by the CMA in Kenya.

Which Forex broker has the lowest fees?

FXPesa with their Premiere has one of the lowest fees among forex brokers in Kenya. Other brokers like Scope Markets & HF Markets also have similar fees with their commission-based accounts.

How do I Start Trading Forex?

To start trading forex pairs, you need to:

1. Learn about forex market and trading platforms

2. Choose a well-regulated broker & open an account

3. Deposit Funds

4. Place a trade order through the online trading platform