Tickmill Malaysia Review 2024

Tickmill is a top-tier regulated CFD broker in Malaysia. Malaysian clients are registered in FSA Seychelles regulations. Check everything you need to know about Tickmill in Malaysia.

Tickmill is a well-regulated forex and CFD broker with no dealing desk. They offer multiple account types with different fee patterns to suit different types of traders.

Tickmill allows trading through multiple trading platforms including the most widely used MT4 and MT5 trading platforms.

We have reviewed every aspect of Tickmill comprehensively specifically for the clients residing in Malaysia. In this review, we have covered all the pros and cons of choosing Tickmill for the legal entity Tickmill LTD.

Tickmill Malaysia Pros

- Tickmill is regulated and authorized by FSCA and FCA

- No non-trading charges exist

- Free deposits and withdrawals through multiple methods

- Low trading commission

- Multiple account types available

Tickmill Malaysia Cons

- MYR is not available as the base currency of the account

- Malaysian clients are registered under offshore regulation of FSA Seychelles

- The number of available instrument is low

- The spreads with the Classic account is high

Table of Content

Tickmill Malaysia Summary

| Broker Name | Tickmill Ltd |

| Website | www.tickmill.com |

| Regulation | FCA, FSCA, CySEC |

| Year of Establishment | 2015 |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Trading Platforms | MT4, MT5 |

| Trading Instruments | 200+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

Tickmill Safety and Regulation

The financial regulatory authority that provides licenses to the brokers ensures the safety of the traders. Tickmill is regulated by the following regulatory authorities.

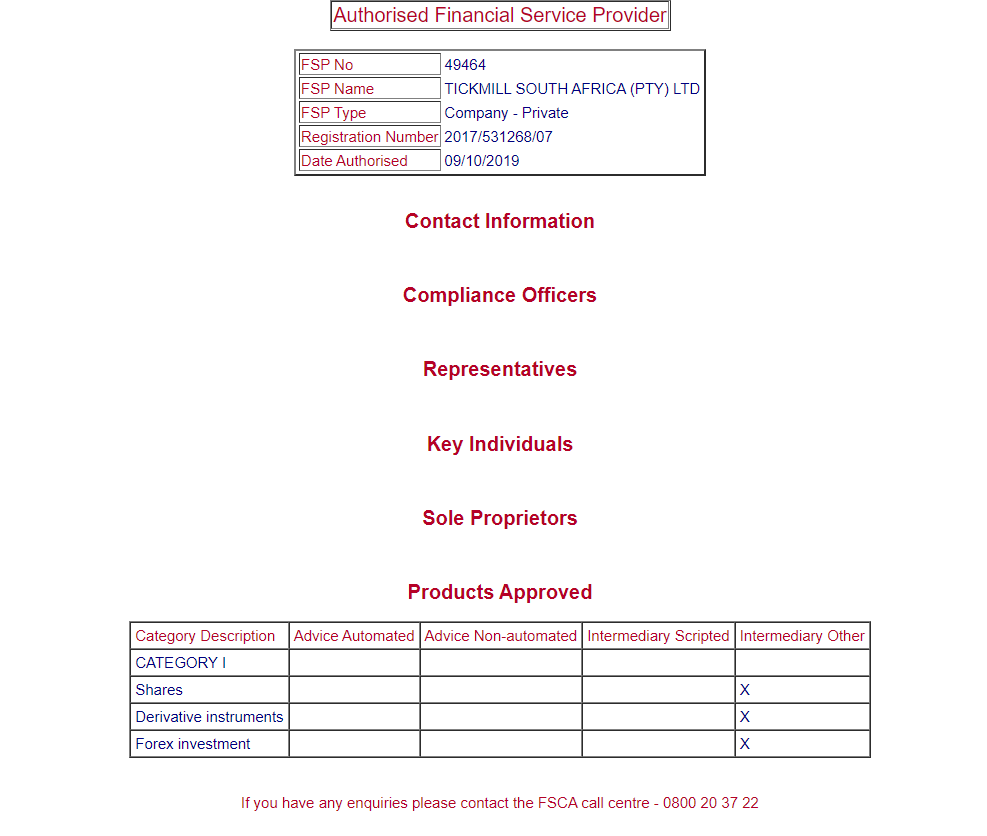

- Financial Sector Conduct Authority (FSCA)

FSCA is a top-tier regulatory authority based in the jurisdiction of South Africa. Tickmill is regulated by FSCA of South Africa under license number 49464 with the legal entity TICKMILL SOUTH AFRICA (PTY) LTD.

The FSCA license was acquired by Tickmill in 2019. Only South African clients are registered under FSCA regulation.

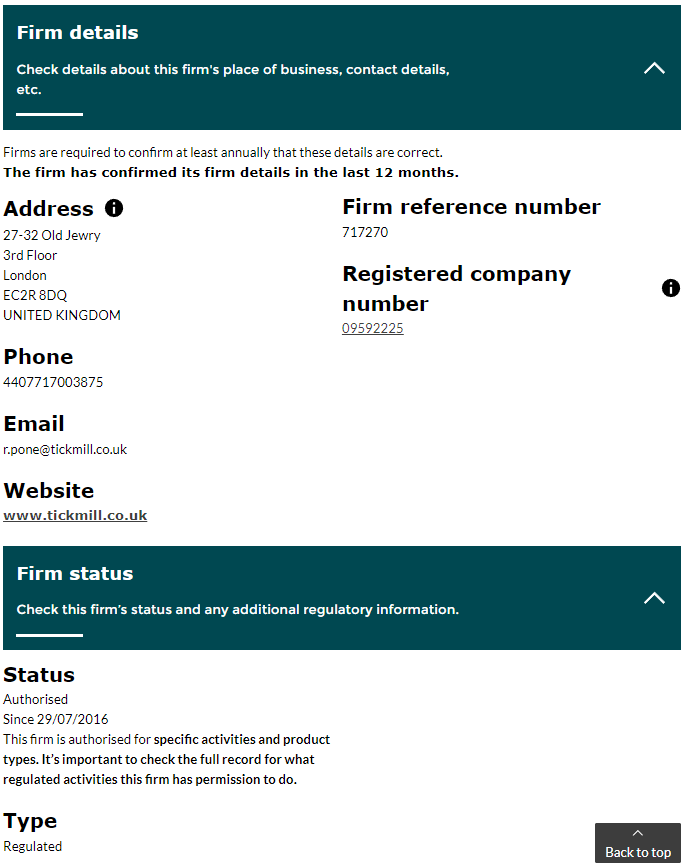

- Financial Conduct Authority (FCA)

FCA is the top-tier financial regulatory authority in the UK. Tickmill is regulated by FCA since 2016. Tickmill UK Ltd is the legal entity of Tickmill regulated by the FCA of the UK under license number 717270.

Traders residing in the UK are registered in FCA regulations. This makes Tickmill safe for UK clients as they are protected by up to GBP 85,000 in case of an unsettled dispute between broker and client.

Apart from these two top-tier regulatory authorities, Tickmill is also regulated by CySEC of the European Union (278/15) and the FSA of Seychelles (SD008). Malaysian clients are registered under FSA regulations.

Tickmill is a privately held firm launched in 2015. It is not listed on any stock exchange. Compared to most of the regulated brokers in Malaysia, Tickmill is new.

Tickmill does not have a dealing desk and uses STP/ECN method for trade execution. This means that they cannot take part in the trading positions opened by the clients.

The top-tier FSCA and FCA regulation makes Tickmill a safe choice for clients residing in Malaysia. However, Malaysian clients are registered under FSA regulation.

Tickmill Fees

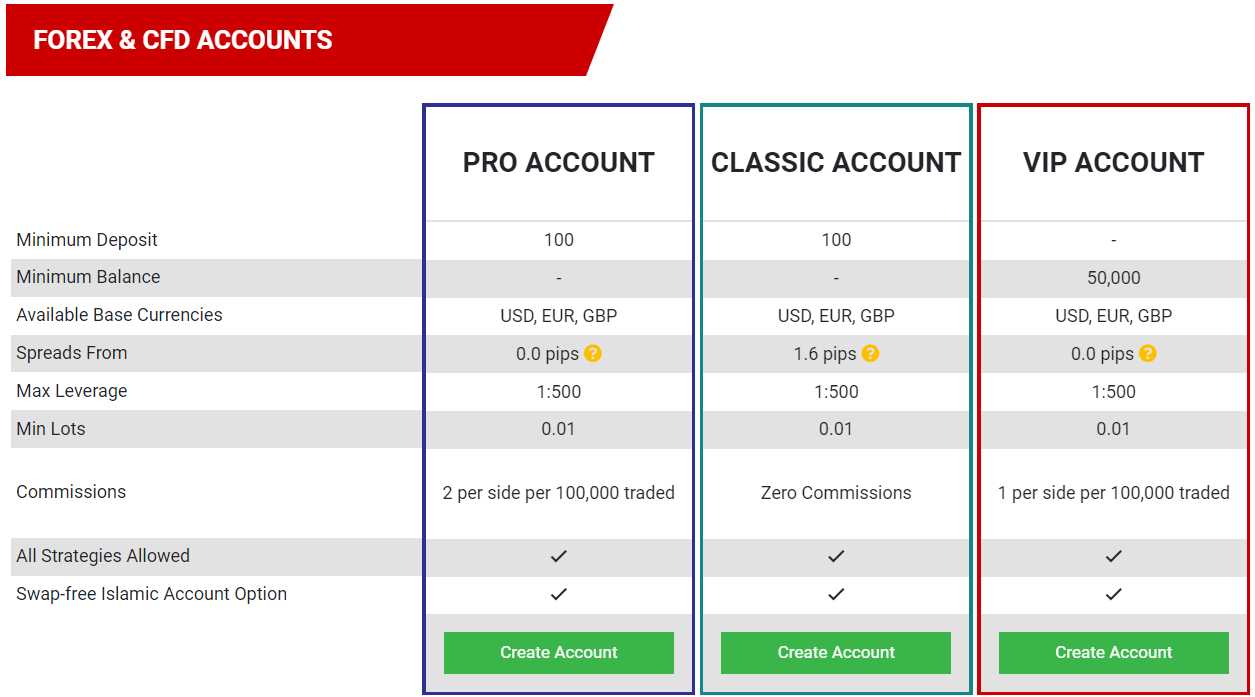

The fee structure for trading CFDs at Tickmill depends on the account type chosen by the trader. For traders residing in Malaysia, Tickmill offers 3 account types namely Pro, Classic, and VIP. The Pro and VIP account are commission-based accounts while the Classic account is a spread-only account.

We have separately reviewed every component of the fees charged at Tickmill in Malaysia.

Trading Fees

This includes the fees that are charged while executing trade orders.

- Spread: The spreads at Tickmill with the Pro and VIP account are very low starting from 0 pip as these are the commission-based accounts. The Classic account incurs a spread-only pricing structure with spreads starting from 1.6 pips.

The average typical spread for EUR/USD as a benchmark is 1.8 pips with the Classic account. For Pro and VIP account types, the same is 0 pip. The spreads at Tickmill with the Classic account are higher than many other regulated brokers in Malaysia.

The following table compares the average typical spread for commonly traded currency pairs with the Standard account of other brokers in Malaysia. It must be noted that these spreads are with the spread-only account types where no trading commission is involved.

Trading Instrument Tickmill FXTM eToro CMC Markets Pepperstone EUR/USD 1.8 1.9 1.1 0.70 0.77 GBP/USD 1.9 2 2.3 0.9 1.19 EUR/GBP 2.1 2.4 2.8 1.10 1.40 USD/JPY 1.9 2.2 1.2 0.7 0.86 USD/CAD 1.8 2.5 1.7 1.3 1.07 - Commission: The trading commission is incurred on each trade with the Pro and VIP accounts. The trading commission with the Pro account is $4 or £4 per round-turn trade of a standard lot. The same with the VIP account is $2 or £2 for a round trade of a standard lot.

The trading commission at Tickmill is lower than many peers in Malaysia. The commission could differ from the base account currency chosen. The commission with the VIP account type is very attractive but this account requires a minimum deposit of $50,000.

Non Trading Fees

Most forex brokers do charge fees without any trading positions opened. However, no non-trading fees are incurred at Tickmill in Malaysia. There is no account opening charge, inactivity fees, deposit or withdrawal fee, etc.

Overall, Tickmill is a very cost-effective broker if you wish to trade with a commission-based structure of Pro account type. With the Classic account type, you might find yourself paying higher than many other regulated brokers in Malaysia. The advantage of the Classic account is that there is no commission which may be suitable for new traders or low-volume traders who may prefer to a wider spread rather than a fixed commission. The VIP account offers the best pricing but it requires a minimum deposit of $50,000 which is not feasible for all retail traders.

Tickcmill Account Types

Tickmill offers 3 account types called as Classic, Pro, and VIP. The major difference between these accounts is based on the fee structure.

- Classic Account: This is the basic account type at Tickmill where the spread is the only trading fee. The classic account can be opened with a minimum deposit of $100 or £100.

- Pro Account: The pro account also requires a minimum deposit of $100 or £100 but in this account, the commission is incurred on each opened trading position. The spreads are negligible with this account.

- VIP Account: The VIP account at Tickmill offers the best pricing for CFD trading in Malaysia. However, most retail traders cannot avail themselves of the benefits of low commission as the minimum deposit requirement is $50,000 or £50,000.

All three CFD trading account types can be opened with USD, EUR, and GBP in Malaysia. The maximum leverage for the retail clients is 1:500 on all three account types.

Tickmill also offers a separate futures account which can only be used to trade futures derivative contracts. The minimum deposit amount for this account is $1000.

The availability of multiple account types makes Tickmill suitable for different types of traders. Small volume traders will find the classic account ideal for them while the high volume traders and scalpers will prefer the Pro account.

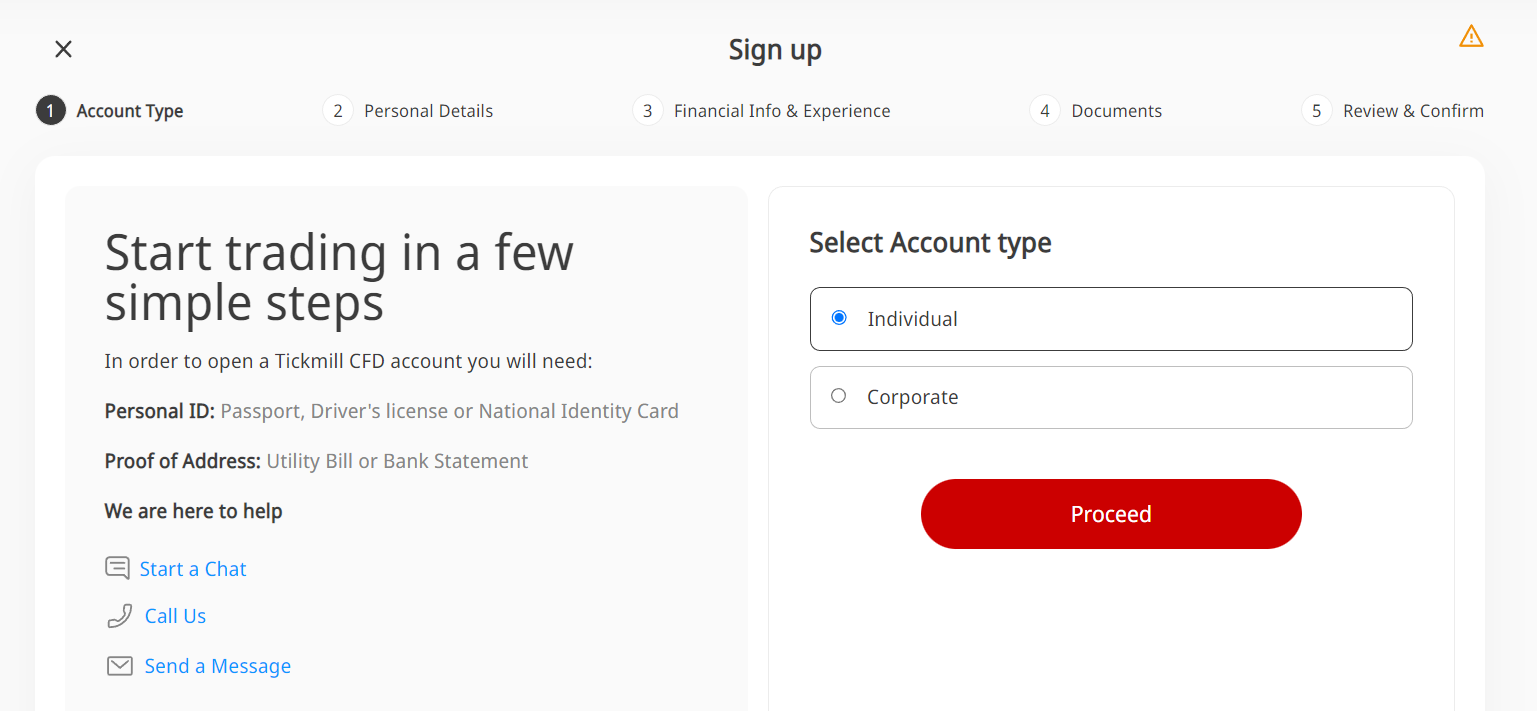

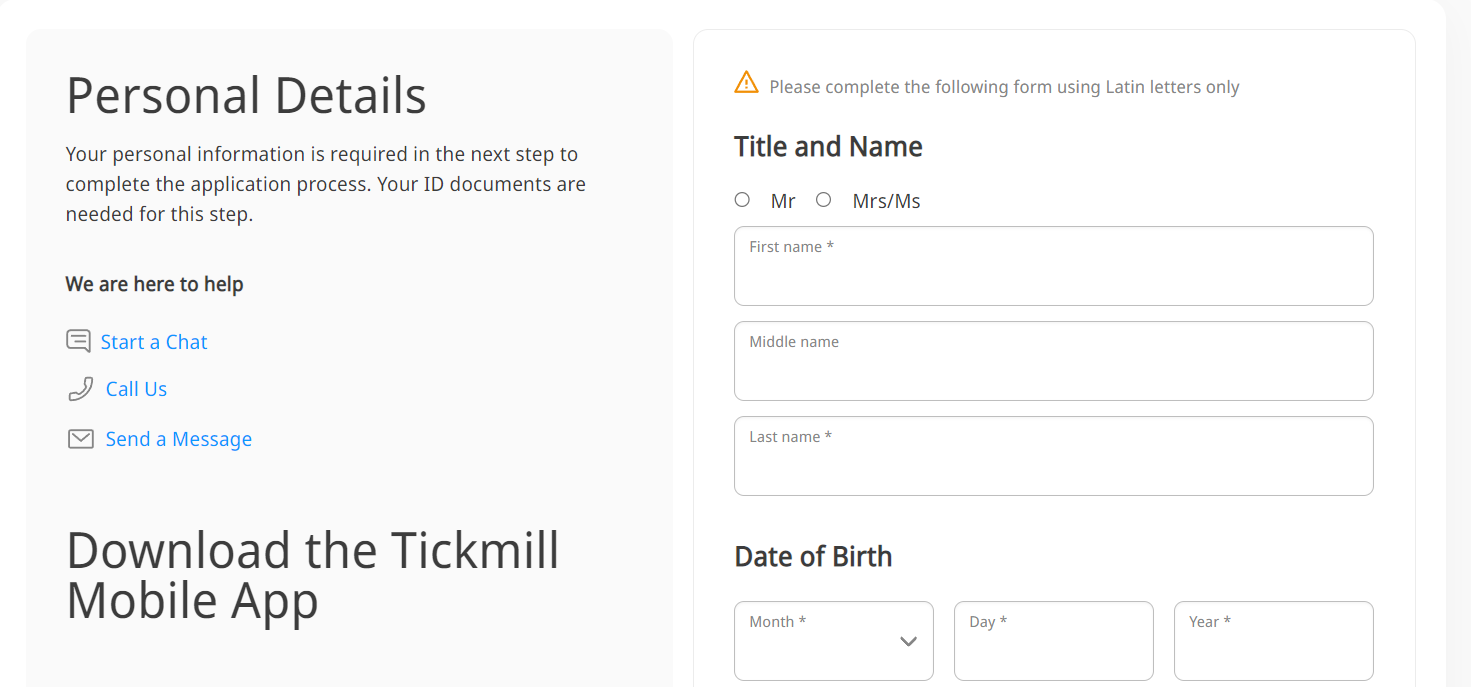

How to Open Account at Tickmill?

The account opening process at Tickmill can be completed online through a web browser and Tickmill mobile application. Following are the steps to open a live trading account at Tickmill in Malaysia.

Step 1: Basic Details

Clients who wish to open an account at Tickmill can do so through the official website and mobile application of Tickmill. Firstly they need to choose the individual account and enter basic details like name, email address, and phone number.

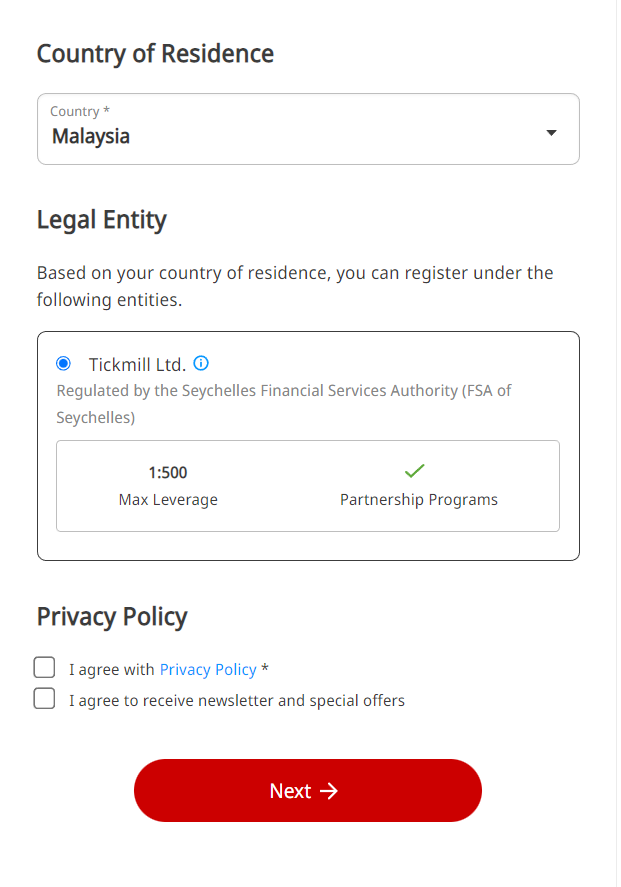

Step 2: Country of Residence

Traders need to select their country of residence. Depending on the country, Tickmill will show the available legal entities under which an account can be opened in the country of residence.

Step 3: Financial Details and Trading Experience

In the next step, traders need to provide their financial details and trading experience. Clients need to enter their annual income and answer a few other questions regarding their experience of trading financial instruments.

Step 4: Document Verification

This could be the most time-consuming step as traders need to submit a valid document which will act as proof of name and address. The soft copy of the documents will be uploaded by clients. The executives at Tickmill will verify the account with documents and will send a confirmation mail upon successful completion.

Step 5: Deposit

Once the account is verified, traders need to make a deposit through any of the available methods to start trading with Tickmill.

Tickmill Demo Account Review

A demo account, provided by Tickmill, serves as a virtual trading platform that allows traders to practice and gain familiarity with the company’s trading features and strategies without the risk of using real money. These demo accounts simulate real market conditions and provide users with virtual funds to execute trades.

The advantages of utilizing a Tickmill demo account include:

Risk-Free Practice: Demo accounts enable traders to practice their strategies and become comfortable with the trading platform, all without risking actual funds. This is particularly valuable for novice traders who are still learning the ins and outs of trading. Practicing is not just for new traders. Experienced traders can also benefit from using a demo account since they test their methods and technical analysis frameworks.

Platform Familiarization: By utilizing a demo account, traders can become well-acquainted with the trading platform’s tools, features, and order execution methods. This familiarity can significantly enhance their efficiency when they eventually transition to a live trading account.

Strategy Testing: Demo accounts offer an opportunity to test and refine trading strategies within a simulated environment. Traders can assess the effectiveness of different approaches, indicators, and risk management techniques without incurring any financial losses.

Evaluation of Broker’s Services: Utilizing a demo account allows traders to evaluate Tickmill’s trading conditions, including spreads, execution speed, and customer support, before committing real funds to a live trading account.

While demo trading provides a valuable learning experience, it’s important to recognize that it may differ from live trading in terms of factors such as liquidity, slippage, and psychological aspects. Traders should exercise caution when transitioning to live trading and implement appropriate risk management strategies.

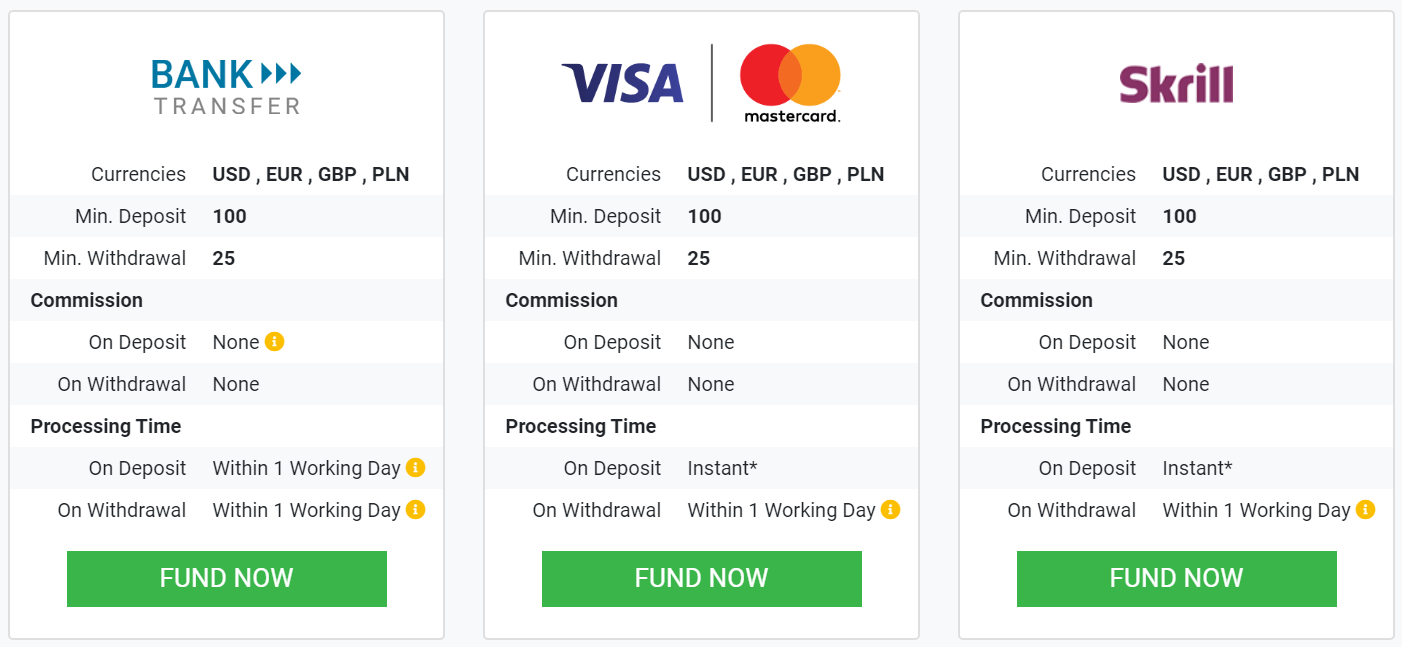

Tickmill Deposits and Withdrawals

Tickmill supports multiple methods for deposit and withdrawal. Following are the details of each accepted transaction method at Tickmill in Malaysia.

- Bank Transfer: The local bank transfer can be used to deposit and withdraw at Tickmill in USD, EUR, and, GBP. The minimum deposit amount is 100 while the minimum withdrawal amount is 25 units of the base currency. There are no commissions and the transactions are processed within 24 hours.

- Debit/Credit Card: The debit cards and credit cards of VISA and MasterCard can be used to free deposit instantly and withdraw within 24 hours at Tickmill. The minimum deposit and withdrawal amount are 100 and 25 units of the base currency respectively.

- E-Wallets: Skrill, Neteller, Stic Pay, FASAPay, Union Pay, and Web Money are the available deposit and withdrawal methods. The deposits through all the accepted e-wallets are processed instantly into trading accounts. Withdrawals can take up to 24 hours to reflect in the account. The minimum and maximum amounts are 100 and 25 units of the base currency for all the e-wallets.

Tickmill accepts deposits and withdrawals through multiple methods. The major advantage is none of the accepted methods will incur an added commission for deposit or withdrawal.

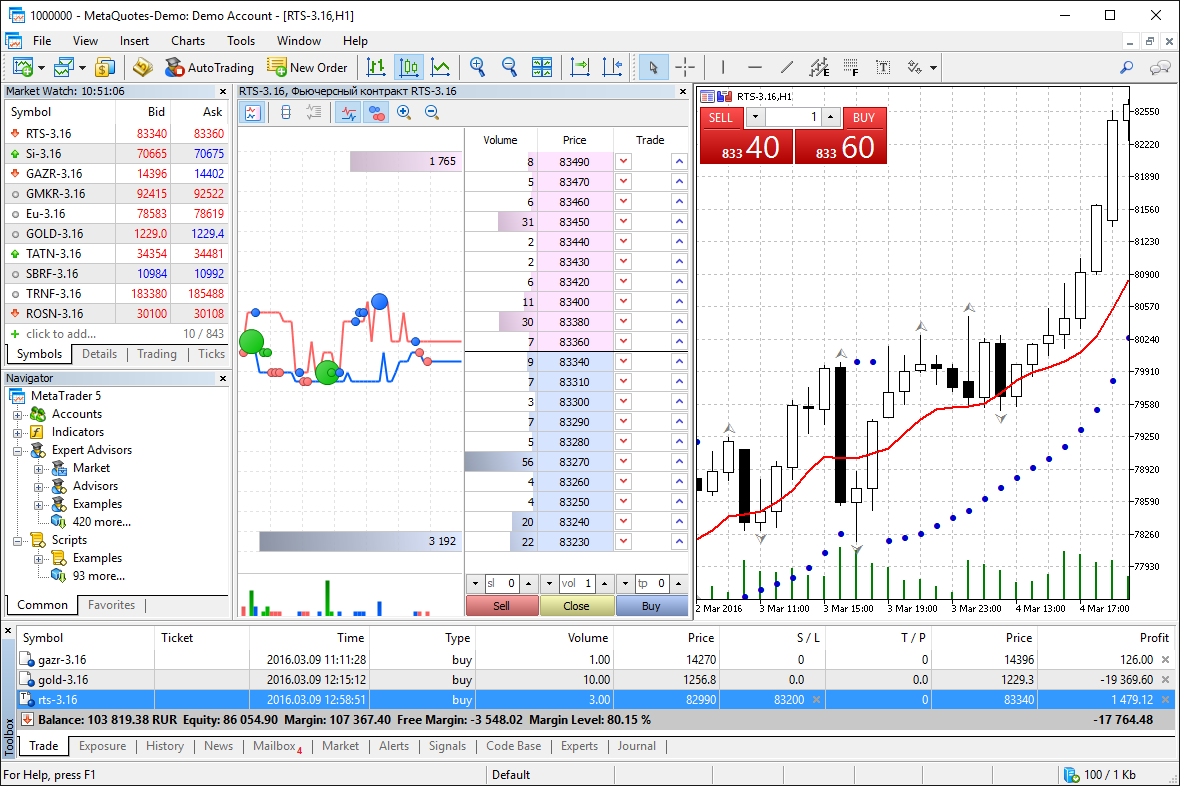

Tickmill Trading Platforms

Tickmill offers the most widely used trading platforms namely MT4 and MT5 for trading all the available instruments. Additionally, they also support trading through modern platforms like CGQ, Trading View, and Agena Trader for futures and options trading.

MT4 is among the oldest CFD trading platforms that are still preferred by a large number of traders worldwide. This is because of its fast processing, simple design, and easy compatibility with all types of devices. MT4 was launched in 2005 by MetaQuotes Software.

MT5 is an upgraded version of MT4 with more trading tools, indicators, time frames, and patterns. The MT5 looks modern and offers a convenient environment for basic as well as advanced traders. MT5 was launched in 2011 by MetaQuotes Software.

Both the CFD trading platforms MT4 and MT5 can be chosen with any of the account types with USD, EUR, and, GBP as the base currency of the account. MYR is not available as the base currency of the account.

Tickmill Research and Education

Tickmill offers a wide range of tools that can assist traders in researching and gaining knowledge regarding trading and capital markets. These tools can enhance the trading experience and assist traders in making better trading decisions. The following are the available tools at Tickmill:

- Webinars and Seminars: Tickmill regularly organises seminars and webinars to educate and update the traders regarding news events and topics that can help them, traders. On average, there will be 3-4 webinars in a day and 2-3 seminars per month at different locations in the world. The details of upcoming webinars and seminars are available on their official website and application.

- Tutorials: To educate beginners in forex and CFD trading, Tickmill offers a variety of educational materials. This includes eBooks, video tutorials, infographics, forex glossary, etc. These tools are highly useful for newcomers or those who have no history of trading in forex or CFDs.

- Analysis Reports: The fundamental and technical analysis reports are separately published on the Tickmill website on a regular basis. These analysis reports are notified to the traders regularly. These reports can greatly assist traders in their research.

- Market Insights: The latest activities in the global forex and CFD market and their effect on the concerned instruments are available through news articles and reports under market insights. These insights can keep traders updated with the latest trends and price movements.

- Autochartist: The auto chartist is a very useful research tool for technical analysis. This tool identifies the trends and patterns and can predict future price swings at a given time. The auto chartist tool can be added as a plugin with the MT4 and MT5 trading platforms to get the signals of price trends.

- Economic Calendar: A calendar that contains the important dates and times when an economic event will take place is called an economic calendar. This calendar contains details of important economic events like GDP data releases, federal meetings, etc. Such events can have a major impact on the forex and CFD market.

Apart from the above-mentioned research and education tools, there are several more available on the official Tickmill website and application. According to our analysis and comparison, Tickmill offers sufficient and useful tools for clients. The number of available tools is more than many other regulated brokers.

Tickmill Trade Execution Method

Tickmill is an STP/ECN broker. Following are the details of trade execution method at Tickmill:

- ECN/STP Model: Tickmill typically employs an Electronic Communication Network (ECN) or Straight Through Processing (STP) model. This aims to grant traders direct access to liquidity providers and interbank markets.

- No Dealing Desk (NDD): Tickmill emphasizes its no dealing desk approach, suggesting automated electronic trade processing without manual interference.

- Variable Spreads: Depending on market conditions and account type, Tickmill provides variable spreads. Spreads might narrow during high liquidity and widen when markets are volatile.

- Market Depth: Through ECN/STP, traders may access market depth info, revealing multiple bid and ask price levels.

- Price Aggregation: Tickmill likely consolidates prices from diverse liquidity sources, proposing competitive bid and ask prices.

- Commission Structure: The Pro account often includes a commission per traded lot, while the Classic account features wider spreads without an extra commission.

- Swift Execution: Tickmill’s ECN/STP approach aims for rapid, direct execution to minimize delays.

- No Requotes: Typically, Tickmill seeks to execute orders without requotes, responding to available market prices.

- Scalping and Expert Advisors: Tickmill typically accommodates scalping and usage of Expert Advisors (EAs), catering to algorithmic trading.

Tickmill Customer Support

The customer support services at Tickmill are excellent. We tried to connect with the support staff through different methods to test their services. Following are the methods through which clients can connect with the support staff at Tickmill.

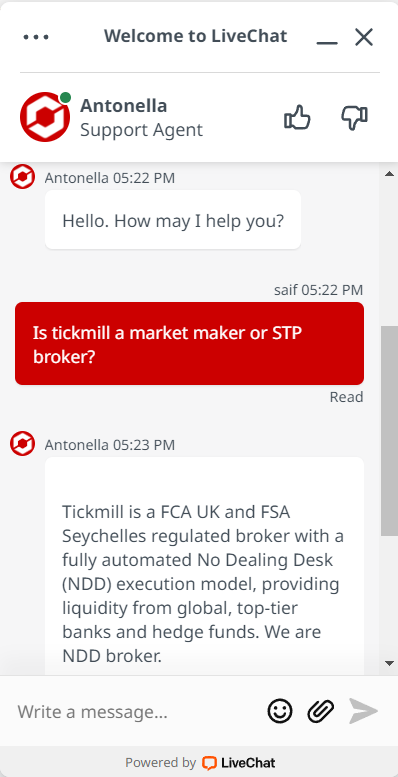

- Live Chat: The live chat window is available on the official website of Tickmill at the bottom right corner. Traders can raise their queries to the support staff in different languages. The online and offline status of different teams globally can be checked before connecting.

We raised multiple queries through live chat and found the answers relevant to our queries. The response time was less than a minute most of the time. The Malay language can also be selected in the live chat window to chat in Malay.

- Email: Queries can also be raised through email at [email protected]. Clients can also attach pictures with queries. The response time through email is 1-3 hours on business days. Email support is helpful when traders require written proof of the response provided by the support executives.

- No Local Phone Support: Tickmill does not offer local phone support for clients in Malaysia.

- 62 Currency Pairs: A total of 62 currency pairs can be traded at Tickmill including major, minor, and exotic pairs. The maximum available leverage for the major pairs is 1:500 and for minor pairs is 1:20.

- 27 Indices CFD: Stock indices from top exchanges of the world can be traded as CFD at Tickmill. The max leverage is 1:200 for retail clients.

- 5 Metals CFD: Only 5 CFDs on metals can be traded at Tickmill including Gold, Silver, copper, etc. The max leverage on Gold CFD is 1:100. For all other metals, the max leverage is 1:10.

- 4 Bonds CFD: 4 types of bonds from Europe can be traded at Tickmill with a maximum leverage of 1:10.

- 8 Cryptocurrencies CFD: Cryptocurrencies can be traded as CFD at Tickmill with a maximum leverage of 1:5.

- 98 Stock CFD: Stocks from American and European markets can be traded as CFD. Traders can also go short on all the available stocks with a maximum leverage of 1:5.

Overall, the support services are excellent at Tickmill. There are multiple means of connecting and the response time is also good. The support service is not available on the weekends and holidays.

Available Instruments

Tickmill offers CFDs on various financial instruments. Traders must note that Contract for Deposits (CFDs) are derivative instruments in which there is no physical buying and selling of underlying assets. Only the price difference between opening and closing of positions are cash settled.

Following are the instruments available for trading at Tickmill in Malaysia:

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 62 | 1:500 |

| Indices | 27 | 1:200 |

| Commodities | 5 | 1:100 |

| Shares | 98 | 1:10 |

| Cryptocurrencies | 8 | 1:5 |

Overall, the number of available instruments at Tickmill is lesser than many other regulated CFD brokers in Malaysia. Approximately 200 financial instruments are available to trade at Tickmill in Malaysia.

Do We Recommend Tickmill?

Yes, Tickmill is a regulated forex and CFD broker in Malaysia and can be considered safe. However, there is a third party risk of choosing Tickmill in Malaysia as the clients are registered under FSA regulation of Seychelles. They have a No Dealing Desk (NDD) execution policy and cannot take part in clients’ trading positions.

The number of the available instrument is low and the spreads with the Classic account is high. Commission-based traders will find Tickmill much more cost-effective than other CFD brokers in Malaysia. The support services are excellent and multiple methods can be used to deposit and withdraw.

Tickmill Malaysia FAQs

Is Tickmill legal in Malaysia?

Yes, Tickmill is an FSCA and FCA regulated forex and CFD broker. They accept Malaysian clients that are registered under FSA regulations. Any retail trader in Malaysia can open an account at Tickmill to trade online.

What is the minimum deposit for Tickmill?

$100 is the minimum deposit amount at Tickmill in Malaysia through all the accepted transaction methods.

What type of broker is Tickmill?

Tickmill market themselves as NDD and ECN broker for the Pro account. However, The standard account at Tickmill is based on market maker execution method.

Is Tickmill good for beginners?

Yes, Tickmill has low trading costs and good support services. The spreads are slightly high on the classic account type but it can be a good choice for beginners. Newbies must use a demo account before opening a live account.

Does Tickmill charge commission?

There is no commission involved with the standard account at Tickmill as the trading fee is built into spreads. Traders who wish to trade with lower spreads can choose the Pro and VIP account at the expense of a fixed commission per lot.

Is Tickmill good for scalping?

Yes, scalping is convenient on trading accounts that offer little or negligible spread on trading instruments. The Pro and VIP account at Tickmill are ideal for scalping. The classic account is not suitable for scalping due to wide spreads.

Does Tickmill have Nasdaq?

Yes, Tickmill allows trading on 3 Indices of NASDAQ through CFDs. The CFDs on US30, US500, and US Tech 100 or NASDAQ 100 can be traded at Tickmill with a maximum leverage of 1:10.