Best FCA regulated Forex Brokers UK 2024

FCA is the financial regulatory authority in the UK that overlooks the financial services providers in the UK. Not all but many forex brokers in the UK are regulated by the FCA. Find out the best suited broker for yourself.

The Financial Conduct Authority (FCA) is the financial regulator in the jurisdiction of the United Kingdom. Their objective is to regulate the conduct of financial services providers in the UK and promote the financial markets in a fair and competitive manner.

FCA ensures that the regulated broker or financial service provider is safe for retailers, corporates, and the economy. They regulate more than 50,000 firms in the financial sector and have specific regulatory guidelines for more than 18,000 firms.

A forex broker accepting retail clients from the UK may or may not have an FCA license. However, FCA-regulated forex brokers have low third-party risk and the registered clients are protected by up to GBP 85,000 per client.

List of Best FCA Regulated Forex Brokers in the UK

- Pepperstone – Best FCA Regulated Broker with Multiple Platforms

- eToro – Best FCA Regulated Broker for Copy Trading

- City Index – FCA Regulated Broker with Distinct Features

- CMC Markets – Best Low Spread FCA Regulated Broker in the UK

- FXTM – Best FCA Regulated STP/ECN Forex Broker in the UK

FCA regulates more than 50,000 firms that offer financial services in the UK. We have compared more than 40 most chosen forex brokers on the basis of 12 different factors to list the 5 best FCA Regulated Forex brokers in the UK.

We have also described each broker with a short description to help the traders choose a suitable one.

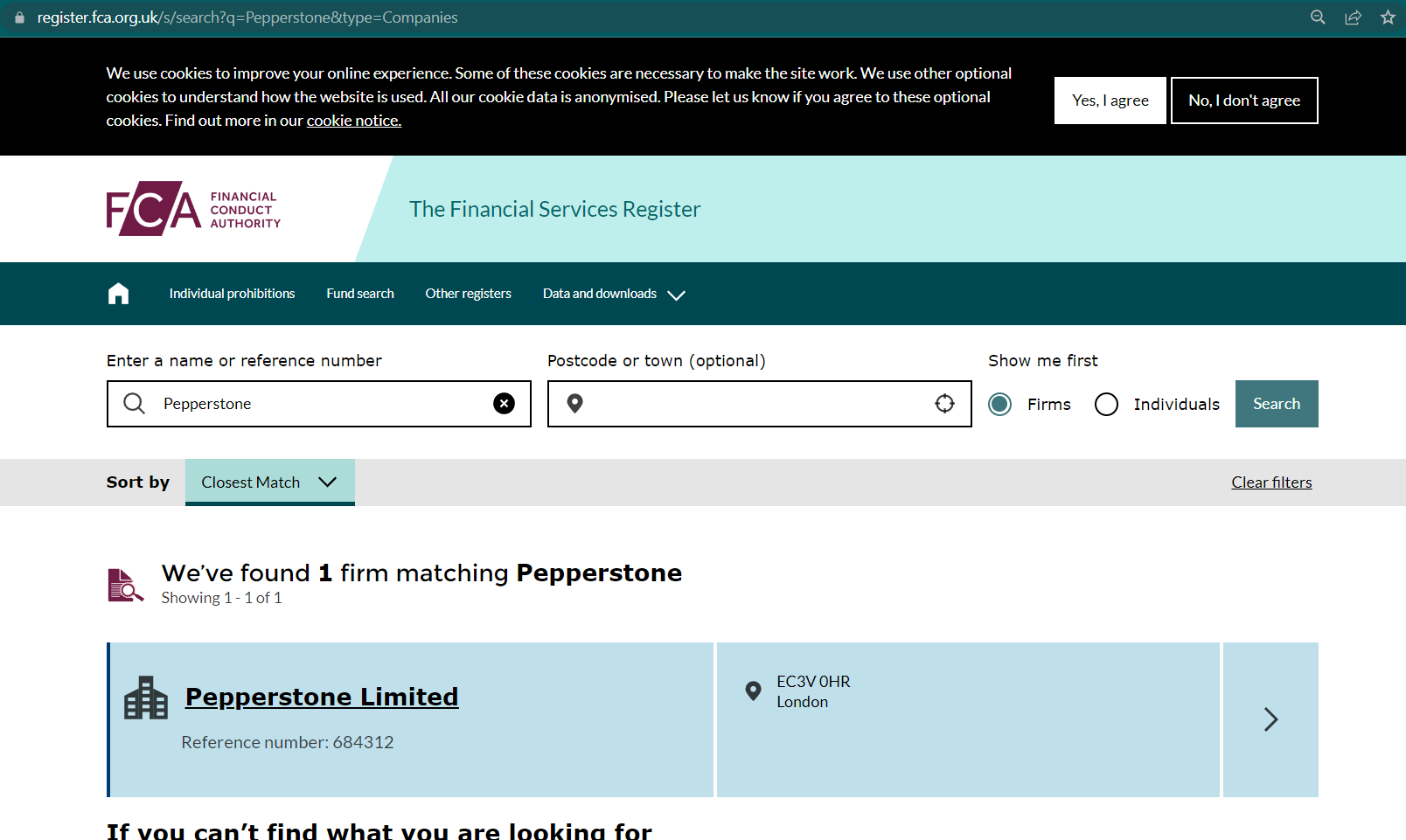

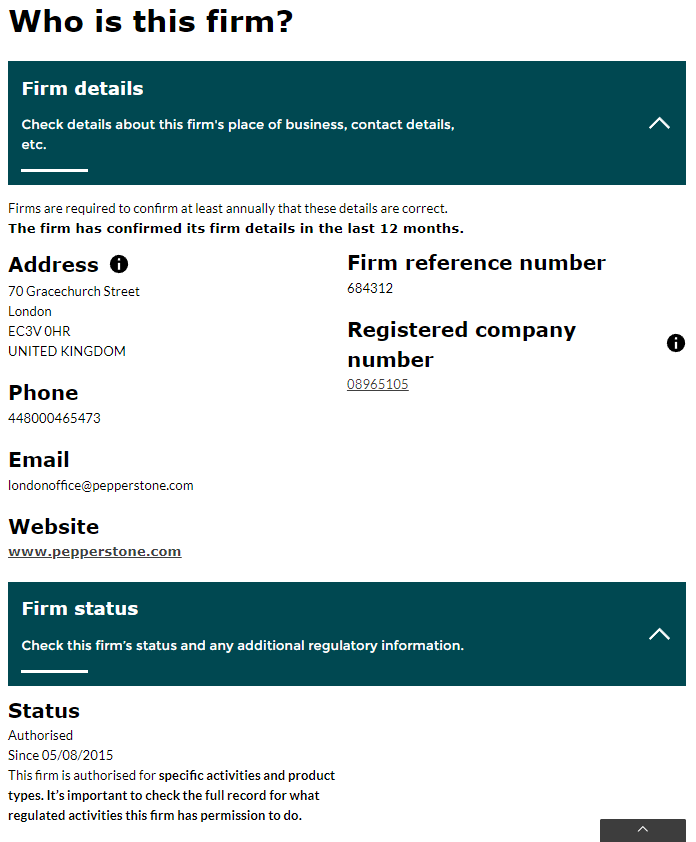

#1 Pepperstone – Best FCA Regulated Broker with Multiple Platforms

Pepperstone is among the best FCA regulated brokers in the UK as it offers multiple account types supported by multiple trading platforms.

Pepperstone is an FCA-regulated forex and CFD broker that holds the FCA license number 684312. It is also regulated by ASIC in Australia, CySEC in the European Union, BaFIN of Germany, and many other regulatory authorities.

Pepperstone offers two account types namely Standard and Razor. The standard account involves spread only with spreads as low as 0.69 pips per lot.

The Razor account at Pepperstone offers spreads as low as 0.1 pips with an additional commission of $4 per single side trade of a standard lot.

Pepperstone allows trading on MT4, MT5, and cTrader trading platforms. Traders can choose the best-suited trading platform with account configuration of preference. Each account type can be configured with GBP as the base currency.

Pepperstone Pros

- Wide range of trading instruments

- Multiple account types and trading platforms available

- GBP available as base currency of account

- Highly regulated and trustworthy

Pepperstone Cons

- The commission is slightly high on Razor Account

#2 eToro – Best FCA Regulated Broker for Copy Trading

eToro is an FCA regulated broker that only allows trading on its own trading platform. The interface is simple and the copy trading feature is easily accessible.

eToro (UK) Ltd is the legal entity of eToro that is regulated by the FCA in the UK under license number 583263. It is also regulated by ASIC in Australia and CySEC in the European Union.

The spreads at eToro start from 1 pip and are 1.1 pips on average for EUR/USD. They do not provide any other account type with commission or a different pricing structure. The commission is only incurred on trading shares CFD.

eToro will incur a withdrawal fee of $5 for each withdrawal regardless of the amount. Inactivity fees is $10 per month after 12 months of inactivity on the trading account.

GBP cannot be chosen as the base currency of the account as USD is the only available currency. More than 2500 instruments can be traded including 49 currency pairs.

eToro Pros

- Good trading platform for social trading

- Wide range of cryptocurrencies

eToro Cons

- Customer support is not good

- Each withdrawal incurs a commission

#3 City Index – FCA Regulated Broker with Distinct Features

City Index is an FCA-regulated forex and CFD broker that offers low spread trading on the MT4 trading platform.

City Index holds the FCA license as the legal entity StoneX Financial Limited under license number 446717. The FCA license was acquired by City Index in 2006. They are also regulated by the ASIC of Australia and MAS of Singapore.

City Index is a market maker and can take part in the trading positions opened by the clients. The spreads at City Index start from 0.5 pips and the average spread for EUR/USD at City Index is 0.8 pips.

No other account types are available with the different pricing structures. City Index supports the MT4 trading platform for all devices and offers 4000+ trading instruments including 84 currency pairs.

GBP can be chosen as the base currency of the account. The customer support service is only available through the live chat window.

City Index Pros

- No commission to trade forex instruments

- Highly regulated and has a strong reputation with a long history

- No hidden fees such as deposit or withdrawal fees

City Index Cons

- Customer support only available through live chat

- Low leverage offered through Trader and Premium Trader accounts

#4 CMC Markets – Best Low Spread FCA Regulated Broker in the UK

CMC Markets is among the oldest forex and CFD brokers in the UK that is regulated by FCA. It offers a good spread compared to other FCA-regulated brokers.

CMC Markets UK PLC is the legal entity regulated by the FCA in the UK under license number 173730. City Index also has spread betting authorization from the FCA with legal entity CMC Spreadbet LLC under license number 170627.

CMC Markets is regulated by several other regulatory authorities globally and is also a listed company on the London Stock Exchange. It can be considered very safe for traders in the UK.

The spreads at CMC Markets start from 0.6 pips and the average typical spread for EUR/USD is 0.7 pips. No trading commission is charged on trading forex and other CFDs apart from stocks.

They do not have a minimum deposit amount and GBP can be chosen as the base currency of the account. MT4 is the only option for trading platforms as no other platforms are supported.

CMC Markets Pros

- Good customer support available at all times during weekdays

- Decent fees with no commission apart from stock CFDs

- Decent range of trading instruments

CMC Markets Cons

- No choices of account types

- Lack of good educational materials for new traders

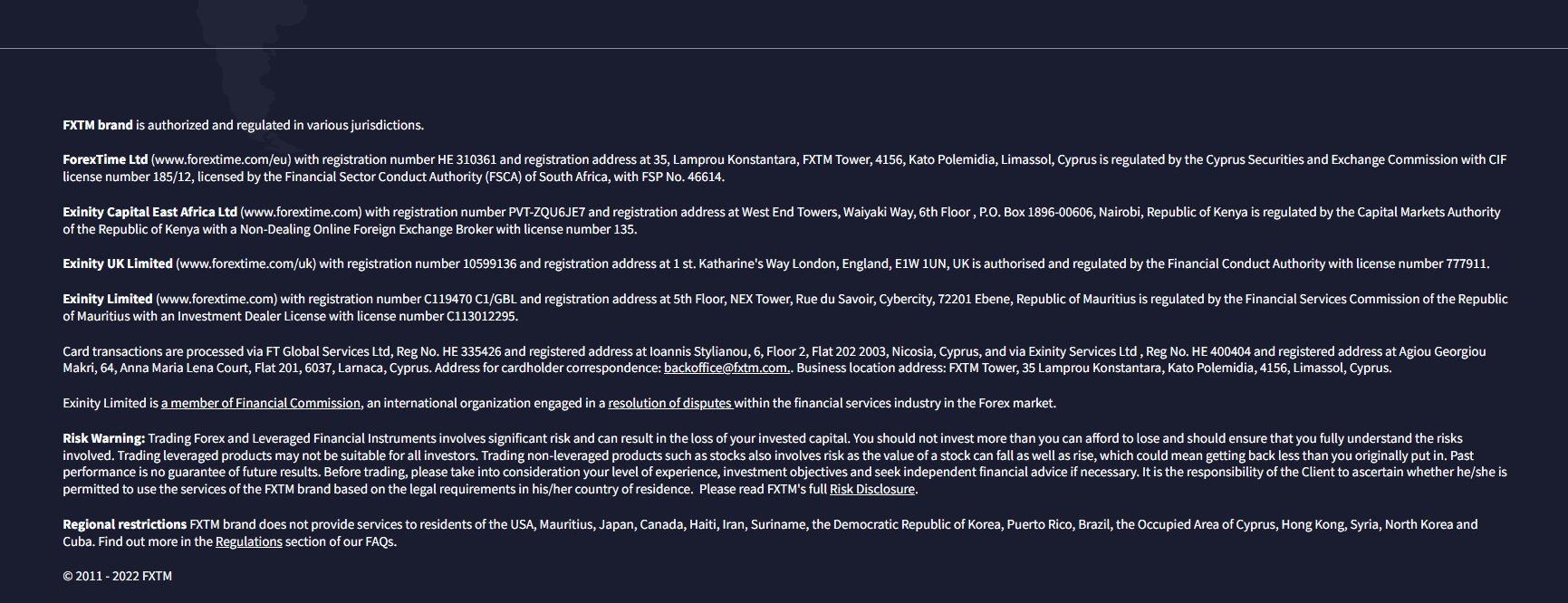

#5 FXTM – Best FCA Regulated STP/ECN Forex Broker in the UK

FXTM is an FCA-regulated STP and ECN broker allows trading through multiple pricing structures differed by account types.

FXTM is the trading name of the legal entity Exinity UK Limited which is authorized and regulated by the FCA under license number 777911. FXTM is also regulated by the FSCA of South Africa and CySEC of the EU.

Their spreads are slightly higher on the Standard account but multiple pricing structures can be chosen by the trader. The average spread for EUR/USD with the Standard account is 1.8 pips.

The standard account can be opened with a minimum deposit of GBP 5 while the Advantage and Advantage Plus accounts require a minimum deposit of GBP 500. Only the Advantage account is a commission-based account where the spreads are as low as 0.1 pips.

The trading commission with the Advantage account depends on the trading volume. It ranges from $0.4 to $2 for a single side trade. The advantage Plus account offers the best pricing with low spreads and no commission.

MT4 and MT5 trading platforms are available to choose however, the Micro or standard account type can only be chosen with the MT4 trading platform. More than 2000 trading instruments are available including 60 currency pairs at FXTM.

FXTM Pros

- FXTM is 100% STP/ECN broker regulated by FCA

- Multiple account types for different types of traders

- Low minimum deposit

FXTM Cons

- Trading fee is higher than average

Benefits of Trading with an FCA Regulated Forex Broker

- Trading with an FCA-regulated broker in the UK is always safer than trading with a non-FCA-regulated broker.

- The third-party risk is much lower with the FCA-regulated broker.

- Brokers that are not regulated by FCA can be fake or scammers.

- Clients registered under FCA regulation are protected by up to GBP 85,000 per client in case of an unsettled dispute between broker and client.

- Traders registered under FCA regulation will be protected by the safety regulatory compliance that will be followed by the FCA-regulated brokers.

- The maximum leverage at FCA-regulated forex brokers is capped at 1:30 for major pairs to keep the traders safe from the risk of high leverage.

- FCA-regulated brokers are required to keep their funds segregated from the funds of the traders which cannot be used in any case by the broker.

What is FCA?

The abbreviation FCA stands for the Financial Conduct Authority. This is a regulatory organization located in the United Kingdom that is responsible for supervising and regulating financial markets and firms. Its main objectives include ensuring the fairness and transparency of the financial system, safeguarding consumers, and promoting healthy competition within the financial industry. The FCA plays a crucial role in maintaining the public’s trust in financial markets by overseeing various sectors such as banking, insurance, investments, and more.

How to Check the Authenticity of FCA Regulation?

Checking the availability and authenticity of the FCA license is important as some brokers also display fake license details in order to gain the trust of traders. Anyone can check the regulatory license details and cross-check it by following these steps:

Step 1) Search for an FCA license on the broker’s official website

FCA-regulated forex and CFD brokers generally mention the details of FCA regulation at the footnote of their official website. They may also have a separate page containing regulation details. Clients need to find the name of the regulated legal entity and their license number.

If you cannot find the details of FCA regulation anywhere, you can also ask for the same through customer support services. This way you can also check the quality of their support services.

Step 2) Search for the broker at the FCA Official website

The financial services register at the official website of FCA (www.fca.org.uk) contains the regulation details of all the regulated brokers and financial services providers.

The name or the firm reference number also known as the license number can be entered in the search bar of the financial services register to cross-check the authenticity of the FCA license. If the details of the broker are not available on the FCA website, the broker is very likely to be fake.

Step 3) Cross-check the FCA license details at the FCA website with the one provided by the broker

Traders must look out for spelling mistakes, license numbers, and other red flags. The details should match with no errors.

The financial services register can also provide other details like cloned firms, license date, registered case of dispute, and other details that might not be provided by the broker itself.

Each FCA-regulated broker in the UK offers different trading conditions with different fee structures. Before opening their account traders must check the fees, available instruments, trading platforms, customer support and contract specifications. For beginners, it is always advisable to learn terminologies and gain experience in trading through demo accounts before opening live accounts.

What Else to Consider?

FCA regulation does not ensure a certain quality of service or the fees charged. Each FCA-regulated broker is allowed to charge any fees for different types of services. The following are the factors that traders need to consider before opening their accounts.

Fees

The fees can be different for each broker in the UK. Traders must check and compare every component of the fees incurred by the traders before opening their accounts. Most forex and CFD brokers charge spread as the only trading fee. However, they can also charge a fixed or variable commission on each lot traded. Apart from this, brokers can incur non-trading charges like deposit/withdrawal fees, inactivity fees, account opening/maintenance fees, currency conversion fees, etc.

Trading Platform

All the trade orders in forex and CFD trading will be executed through a trading platform. MT4 and MT5 are the most preferred trading platforms but each broker can offer different platforms. It is important to check whether the available trading platform at the broker is ideal for the trader or not. Traders must be able to access all features and should be familiar with the tabs and interface of the chosen trading platforms.

Customer Support

Traders must be able to connect with the customer support staff with ease to resolve any query faced while trading online. Most brokers offer live chat support, email support, and local phone support for customer support services. Traders can raise a random query through the available methods to check the support services of the broker.

Available Instruments

Each broker allows trading on different instruments. Traders must check whether their preferred trading instrument is available for trading with the chosen forex broker or not. The availability of multiple instruments provides more trading opportunities to the trader. However, traders must always trade on the instruments that are familiar. Trading on unknown instruments is risky.

Deposits and Withdrawals

The chosen broker must support the deposit and withdrawal method that is preferred by the trader. Traders must also check and compare the processing time and the fees associated with the preferred method for deposit and withdrawal.

Roles of FCA of the UK

Regulation of Financial Firms

The FCA sets standards for how financial services firms should operate and can take action against firms that fail to meet these standards. This includes banks, insurance companies, investment firms, and other financial services providers.

Consumer Protection

Protecting consumers is at the heart of the FCA’s mission. The FCA works to ensure that consumers get a fair deal by setting and enforcing rules that financial services firms must follow, including the provision of clear and honest information to consumers.

Market Integrity

The FCA aims to ensure that financial markets operate effectively, transparently, and honestly, thereby promoting healthy competition and confidence in the UK financial system.

Promotion of Competition

The FCA has a mandate to promote competition in the interest of consumers. This involves removing barriers to entry and non-discriminatory practices that might limit consumer choice or innovation.

Prudential Regulation

For some firms, such as insurance companies and larger investment firms, the FCA is responsible for prudential regulation, ensuring that these firms have enough financial resources to remain solvent and meet their obligations.

Authorization and Licensing

The FCA is responsible for authorizing and licensing financial services firms and individuals who wish to undertake regulated activities within the UK.

Supervision

The FCA supervises the conduct of over 59,000 financial services firms and markets in the UK, ensuring that they comply with laws and regulations.

Enforcement

The FCA has the power to investigate firms and individuals and, if necessary, take enforcement action such as imposing fines, banning financial products, and bringing criminal prosecutions against those who breach regulations or commit financial crimes like insider trading or market manipulation.

Policy and Rule-Making

The FCA creates and updates rules and policies that govern the UK financial services industry, reflecting changes in markets, products, and consumer behavior.

Financial Crime Prevention

The FCA plays a crucial role in the prevention of financial crimes, including money laundering, fraud, and unauthorized financial activities. It sets standards for firms’ controls and monitors their compliance to protect the financial system.

Consumer Education and Awareness

The FCA also works to educate and inform consumers about financial products and risks, helping them to make more informed decisions through initiatives like the Money and Pensions Service.

International Cooperation

The FCA collaborates with international regulatory bodies to ensure that global financial markets are safe, stable, and transparent.

Risk of Trading Forex in the UK

Trading forex in the UK comes with inherent risks that traders should be aware of:

Market Volatility: Forex markets are highly volatile, driven by economic indicators, geopolitical events, and market sentiment. Prices can fluctuate rapidly, leading to potential gains or losses.

Currency Exchange Rate Risk: Fluctuations in exchange rates can impact the value of forex trades. Changes in currency pairs’ exchange rates can affect profitability, especially for cross-border transactions.

Leverage and Margin Risk: Forex trading often involves leverage, amplifying both potential profits and losses. Traders must manage leverage and margin requirements carefully to avoid excessive risk.

Counterparty Risk: Trading involves counterparties such as brokers or financial institutions. There’s a risk of default or insolvency, which can affect accessing funds or closing positions. Choosing reputable and regulated brokers mitigates this risk.

Regulatory and Legal Risks: Forex trading in the UK is subject to regulation by the FCA and other authorities. Changes in regulations or legal requirements can impact trading conditions, margin limits, and investor protection.

Economic and Political Factors: Economic indicators, government policies, and political events influence currency values. Staying informed about these factors helps traders anticipate market movements and adjust their positions accordingly.

Technical Issues and System Disruptions: Trading platforms may experience technical glitches or failures, causing delays or rejections. Traders should be prepared for such issues and have contingency plans in place.

Traders in the UK must effectively manage these risks. Implementing risk management strategies, staying informed about market developments, and conducting thorough analysis can enhance trading performance.

Comparison Table of Best FCA Regulated Forex Brokers in the UK

| Broker Name | Highlights | Trading Fees (Benchmark EUR/USD Standard Accounts) | Account Minimum | Max. Leverage | Learn More |

|---|---|---|---|---|---|

|

Pepperstone UK Ltd is authorized by FCA under FRN (Reference No.) 684312. |

Commissions

Minimum spread of 0.7 pips

with Standard Account |

Account Minimum

0

|

Max. Leverage

1:30 for forex

|

Open Account

on Pepperstone |

|

|

Exinity UK Ltd is authorized by FCA under FRN (Reference No.) 777911. |

Commissions

Minimum spread of 1.5 pips

with Standard Account |

Account Minimum

$5

|

Max. Leverage

1:30 for forex

|

Open Account

on FXTM |

|

|

eToro is authorized by FCA under FRN (Reference No.) 583263. |

Commissions

Minimum spread of 1.1 pips

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:30 for forex

|

Open Account

on eToro |

|

|

StoneX Financial is authorized by FCA under FRN (Reference No.) 446717. |

Commissions

Minimum spread of 0.8 pip

with Standard Account |

Account Minimum

$100

|

Max. Leverage

1:30 for forex

|

Open Account

on City Index |

|

|

CMC Markets is authorized by FCA under FRN (Reference No.) 173730. |

Commissions

Minimum spread of 0.6 pips

with Standard Account |

Account Minimum

$0

|

Max. Leverage

1:30 for forex

|

Open Account

on CMC Markets |

FAQs on Best FCA Regulated Forex Brokers UK

What forex brokers are regulated in the UK?

There are more than 12 forex brokers regulated by the Financial Conduct Authority (FCA) in the UK including Pepperstone, eToro, City Index, CMC Markets, FXTM.

Who is the Most Trusted forex broker?

Any broker that is regulated by the Financial Conduct Authority (FCA) of the UK has low third-party risk and can be trusted to trade forex and CFDs in the UK. Traders registered under FCA regulation are protected by up to GBP 85,000 in case of an unsettled dispute between broker and client.

Is Metatrader 4 FCA regulated?

MetaTrader 4 is an electronic trading platform that is used for trading online through electronic devices. To trade on MetaTrader 4, traders need to open an account with an FCA-regulated broker. The brokers offering MT4 trading platform may or may not be regulated by the FCA.

How do I find a FCA forex broker?

Each FCA-regulated broker is registered with all the details at the official website of the Financial Conduct Authority. Traders can access the financial services register to check the authenticity of FCA license.

Do traders need to be FCA regulated?

Traders residing in the UK that open their trading account with an FCA-regulated broker are registered under FCA regulation. Such traders will be protected by regulatory compliance of FCA and GBP 85,000 in case of an unsettled dispute between broker and clients.

Are unregulated brokers safe?

No, Trading with brokers that are not regulated by FCA is unsafe for traders residing in the UK. Such traders are registered under offshore entities. In case of a dispute while trading with non-FCA regulated broker in the UK, no entity or authority in the UK can be held responsible.

Is eToro FCA regulated?

Yes eToro is regulated by FCA of the UK with legal entity eToro (UK) Ltd. The broker holds license since 2013 with license number 583263. eToro can be considered safe for traders residing in the UK.

How do you check if broker is regulated by FCA?

FCA regulated brokers generally mention their regulatory details on their website. It may be available at the footnote of their webpage or description. The license number or the name can be used to cross check the details from the register of regulated entities at FCA’s official website.

Which broker is the best UK?

Each forex broker is suitable for different types of traders. According to our analysis and comparison, Pepperstone and eToro are the best brokers in the UK for trading forex and CFDs.