FXTM UK Review 2024

FXTM is authorised and regulated by the FCA in UK. The fees at FXTM are higher than average. Check all the pros and cons of choosing FXTM to trade CFDs in the UK.

FXTM is an FCA-Authorised CFD broker. It is licensed to provide trading services in the UK on various financial instruments. It is an STP/ECN broker that offers maximum leverage of 1:30 in the United Kingdom.

There are several pros and cons of choosing FXTM in the UK. Clients must check and compare every aspect of an online CFD broker to choose the best-suited broker for themselves.

We have honestly reviewed every component of the broker that can affect the trading experience. FXTM has an FCA-regulated entity for clients in the United Kingdom. In this review, we have comprehensively reviewed the UK entity of FXTM registered by the name Exinity UK Ltd for clients based in the UK.

FXTM UK Pros

- FXTM is regulated and authorized by FCA in the UK

- Multiple account types available for all types of traders

- The minimum deposit is $/€/£ 10

- Local phone support available in the UK

- GBP can be chosen as the base currency of the account

- MT4 as well as MT5 trading platforms available

- FXTM is an STP/ECN forex and CFD broker

FXTM UK Cons

- Spreads are higher than average

- Each withdrawal through credit card and bank wire incurs a fixed commission

- cTrader trading platform not available

- The total number of trading instruments is low

- Inactivity fees are charged after 6 months of inactivity

Table of Content

FXTM UK Summary

| Broker Name | Exinity UK Limited |

| Website | www.forextime.com/uk |

| Regulation | FSCA, FCA, CySEC |

| Year of Establishment | 2011 |

| Minimum Deposit | $/€/£ 10 |

| Maximum Leverage | 1:30 |

| Trading Platforms | MT4, MT5 |

| Trading Instruments | 62 forex pairs and 200+ CFDs on commodities, indices, shares, ETFs, cryptocurrencies |

Safety and Regulation

FXTM Safety Pros

- Regulated by FCA in the UK

- Regulated by FSCA and CySEC

- Clients are protected by up to €85,000

- FXTM is an ECN broker

FXTM Safety Cons

- FXTM is not listed on any stock exchange

Forex brokers are regulated by government financial authorities like the CFTC (U.S.), FCA (U.K.), ASIC (Australia), etc. Regulations ensure brokers follow standards for licensing, financial stability, client fund segregation, risk disclosure, and anti-money laundering. Traders should choose regulated brokers for security and transparency.

The safety of funds and data of clients depends largely on regulatory compliance under which the clients are getting registered. The regulation of a particular CFD broker can be different for clients residing in a different jurisdiction.

Following are the regulation details of FXTM for different entities.

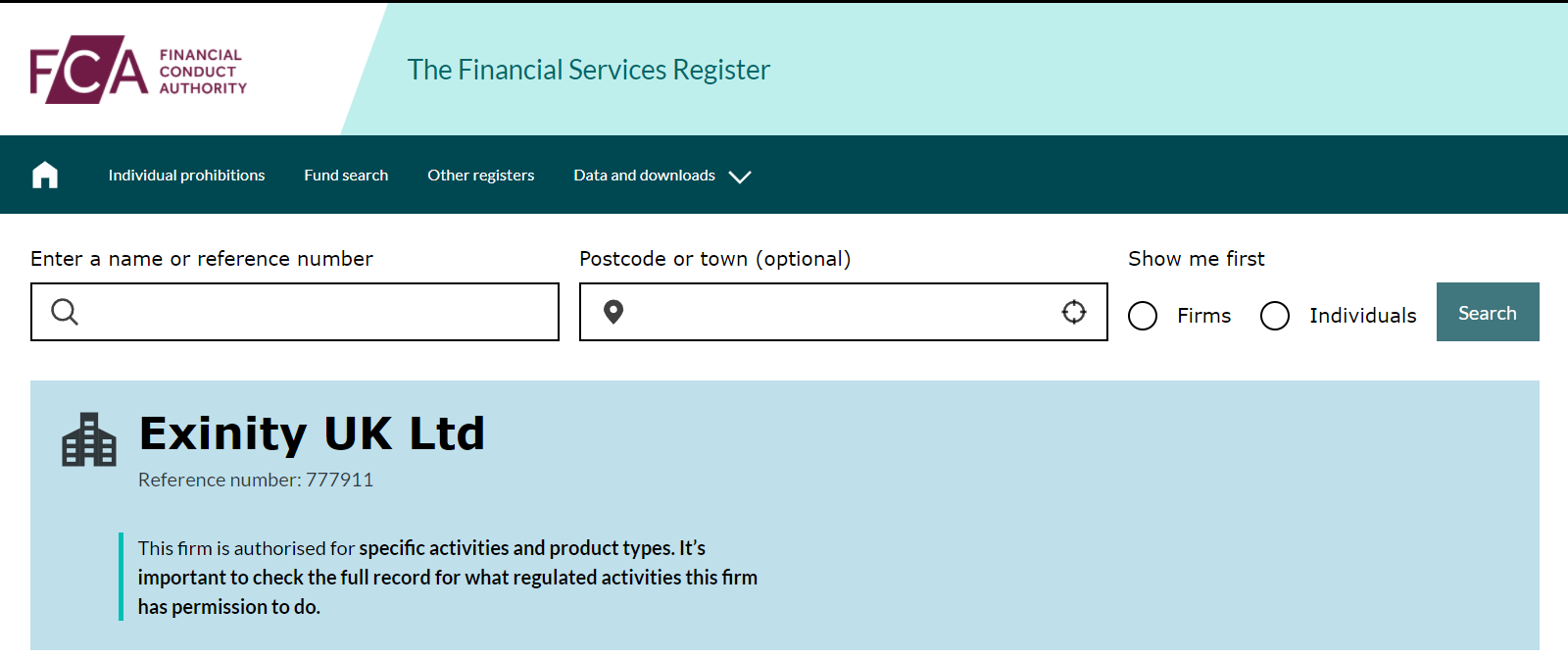

- Financial Conduct Authority (FCA)

FCA is the local financial regulatory authority in the United Kingdom. FXTM is regulated as well as authorised by the Financial Conduct Authority (FCA) of the UK. Exinity UK Ltd is the FCA-regulated entity in the United Kingdom under firm reference number 777911. FXTM and ForexTime are the trading names of Exinity UK Ltd.

The compliance, protection, current status, and other details of FXTM in the UK can be checked through the official FCA website. Clients in the UK are protected under the Financial Ombudsman Service of the Financial Conduct Authority (FCA).

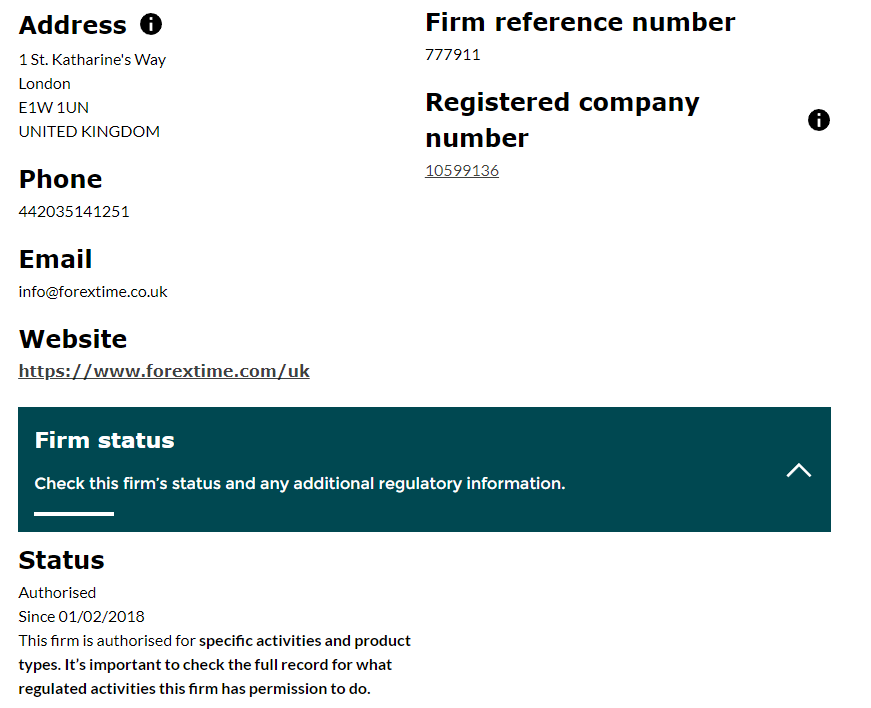

In case of any unsettled dispute between clients and the broker, clients will be covered by the Financial Services Compensation Scheme (FSCS). This compensation fund is similar to insurance for clients of Exinity UK Ltd. FSCS provides coverage of up to €85,000 per case.

Clients residing in the United Kingdom can only register under the FCA-regulated entity of FXTM. No clients from the outside UK can register under Exinity UK Ltd. The registered office of FXTM in the UK is situated at 1 St. Katharine’s Way, London, E1W 1UN, UNITED KINGDOM.

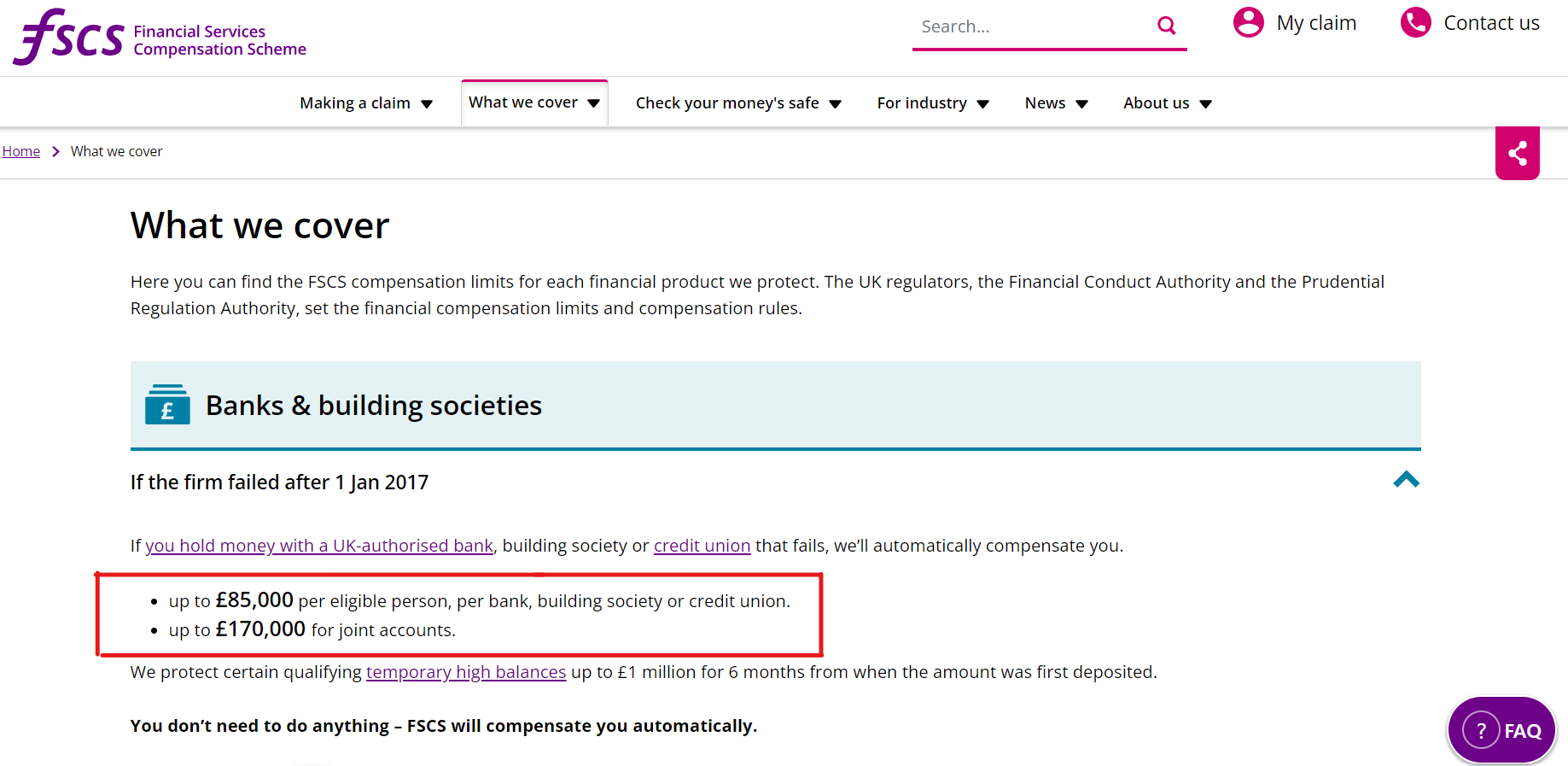

- Financial Sector Conduct Authority (FSCA)

The FSCA is another top-tier regulatory authority in the jurisdiction of South Africa. FXTM is regulated by the FSCA of South Africa under FSP number 46614. The name of the FSCA-regulated entity of FXTM is Forextime Ltd.

Clients in the UK are not registered under FSCA but it increases the trust factor and safety ratings of FXTM. - Cyprus Securities and Exchange Commission (CySEC)

CySEC is not a top-tier regulatory authority but it is based in a member country of the European Economic Area (EEA). A regulatory license from CySEC authorises FSPs to operate their business in Europe.

FXTM holds the CySEC license under license number 185/12. The entity is registered as Forextime Ltd with the website www.forextime.com/eu. - Financial Services Commission (FSC) of Mauritius

The global entity of FXTM is regulated under the Financial Services Commission of Mauritius. Exinity Limited is a regulated entity under FSC with an Investment Dealer License number C113012295.

FXTM was launched in 2011 and acquired the FCA license in 2018. They offer CFD trading services in the UK according to the regulatory regimes of FCA. They are an ECN broker which means they do not take part in clients’ trade orders.

According to our review, FXTM is a well-regulated CFD broker. The FCA regulation makes them fairly safe for clients in the UK. The third-party risk of choosing FXTM in the UK is very low.

FXTM Fees

FXTM Fees Pros

- Multiple fee structure available

- Spreads are very low with Advantage Account

- No non-trading fees exist except inactivity fees

FXTM Fees Cons

- Spreads at FXTM are higher than average

- Slightly more costly than several FCA-regulated brokers

- Complex fee structure with MT4 Advantage account

The fees charged by online CFD brokers for trading and non-trading activities can have a major impact on the trading experience. For a comprehensive analysis and comparison of the fee structure at FXTM, we have separately reviewed every component of fees.

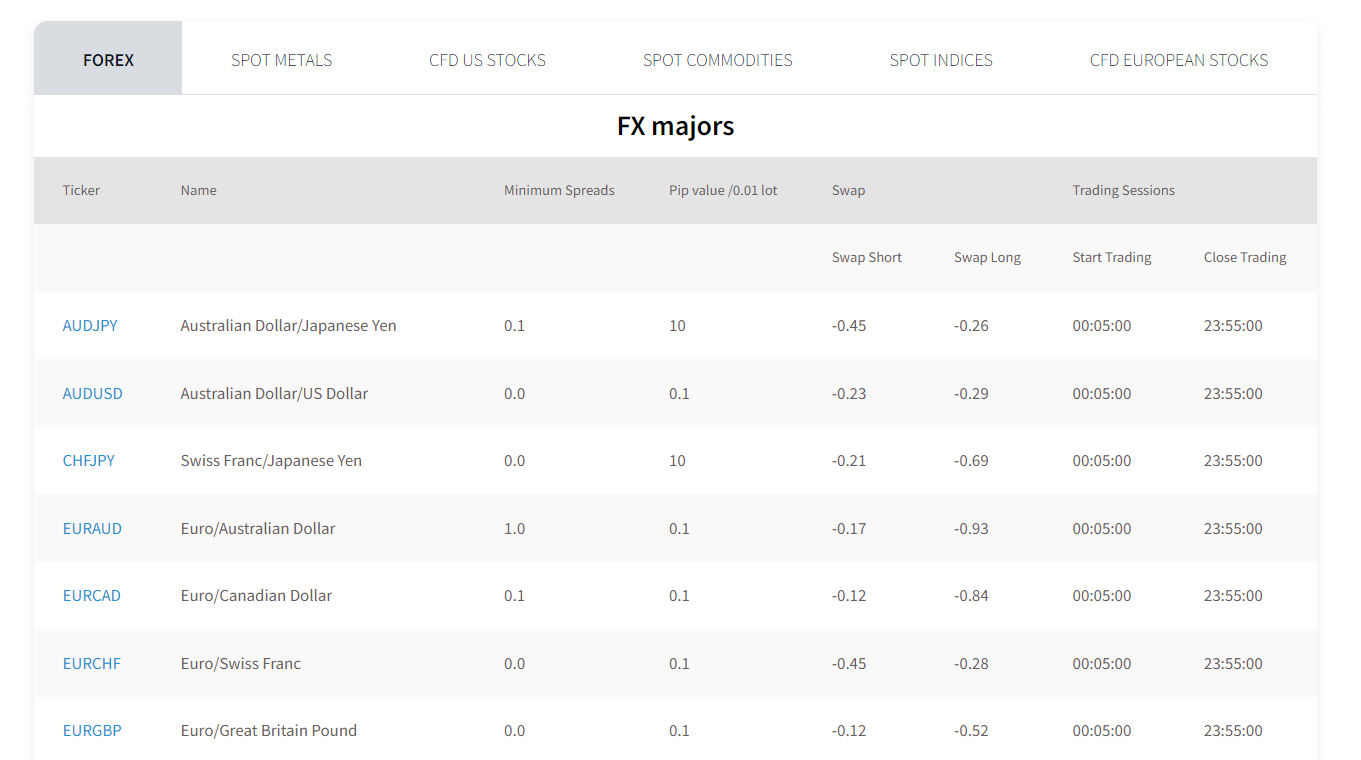

- Spread: The difference between the bid and ask price of a CFD instrument is called the spread. This is the most important component of trading fees.

The spreads at FXTM start from 1.5 pips with the Standard Account type. The Advantage account type has lower spreads starting from 0 but a fixed commission on currency pairs and metals.

The average spread for EUR/USD is 1.9 pips with the Micro account type. The Advantage Plus account incurs an average spread of 2.1 pips for EUR/USD. Spreads are negligible on currency pairs with the Advantage Account.

The following table compares the spreads incurred with different account types at FXTM.

Trading Instrument Micro Account Advantage Account Advantage Plus Account EUR/USD 1.9 0 2.1 GBP/USD 2 0.2 2.5 EUR/GBP 2.4 0.6 2.7 Gold/USD 45 9 36 Crude Oil 9 6 12 US Tech 100 Index 40 8 36 UK 100 50 14 45 - Trading Commission: FXTM offers commission-based trading on CFD instruments with spreads as low as 0 pips. The trading commission is only incurred with the Advantage account at FXTM.

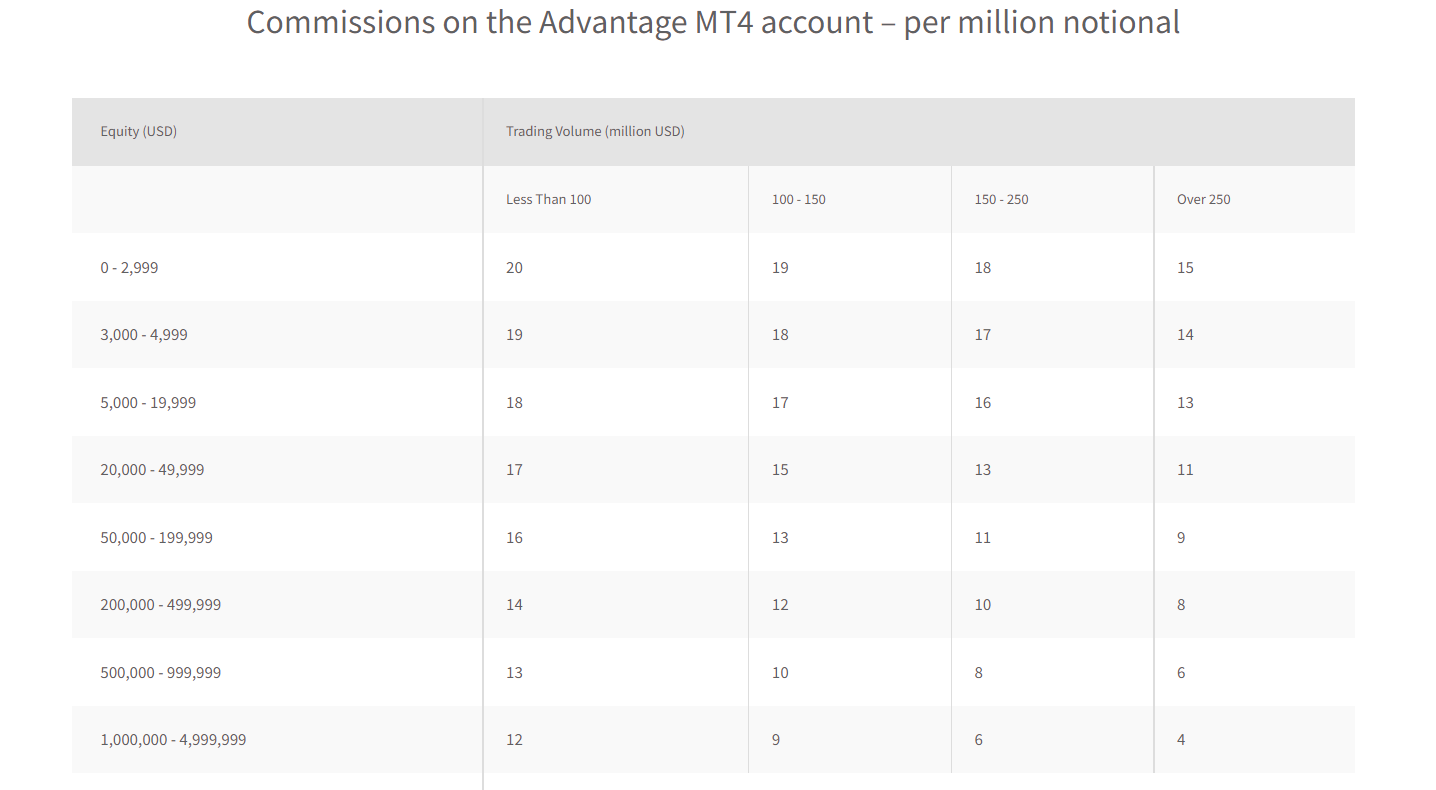

The trading commission for the MT5 Advantage account is fixed at $4 for a round trade of a standard lot.

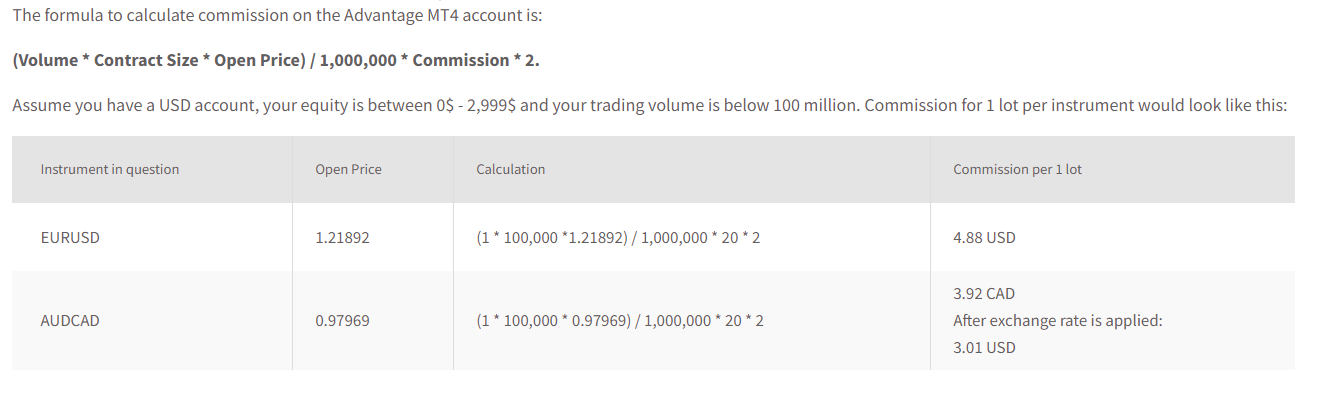

The trading commission at FXTM with the MT4 Advantage account is variable and depends on the volume traded. It is calculated with a predefined formula.

(Volume * Contract Size * Open Price) / 1,000,000 * Commission * 2For a round-turn trade of 1 standard lot of EUR/USD, the commission is $4.88. Although it depends on the prevailing rates and equity in the account.

- Swap Fee: When a leveraged position is kept open for more than a day, an interest needs to be paid to the leverage provider. This interest is called a swap fee or overnight charges or rollover rates.

For keeping a position open for EUR/USD (standard lot) overnight, clients will be charged -0.63 pips and -0.08 pips respectively for long and short positions.Clients who trade for more than a day must check the swap fees before trading. A swap fee is not applicable if a position is opened and closed on the same day.

- Non-Trading Commission: There are a few other components of the fee that can be incurred without executing trade orders.

At FXTM in the UK, deposits are free for all the available methods but a fixed commission is charged on withdrawals. The withdrawal fees are different for each method and have been reviewed separately under the deposits and withdrawal section.

FXTM also charges inactivity fees if no trading activities occur consecutively for 6 months. After 6 months of inactivity, 5 EUR/ USD/ GBP (depending on the account currency) will be deducted every month until the account balance reaches 0.

Apart from these, there is no other non-trading fee at FXTM in the UK.

The spread at FXTM is slightly higher with the commission-free account type. The following table compares the average spread on major currency pairs with different FCA-regulated brokers in the UK. It must be noted that the spreads mentioned in the table are with the commission-free account types and spread-only fee structure.

| Trading Instrument | FXTM | eToro | CMC Markets | Pepperstone |

|---|---|---|---|---|

| EUR/USD | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 2.5 | 1.7 | 1.3 | 1.07 |

Overall, the spreads are higher at FXTM when compared with the majority of CFD brokers in the UK. The spreads can be slightly lower at times with the Advantage Plus account but it is still wider than many peers.

The commission is variable and below if the trade size or the account equity is high. Compared to commission-based accounts of other regulated CFD brokers, commissions are average at FXTM.

The swap rates and non-trading charges are higher than average. Many regulated brokers in the UK do not charge inactivity fees or withdrawal commissions.

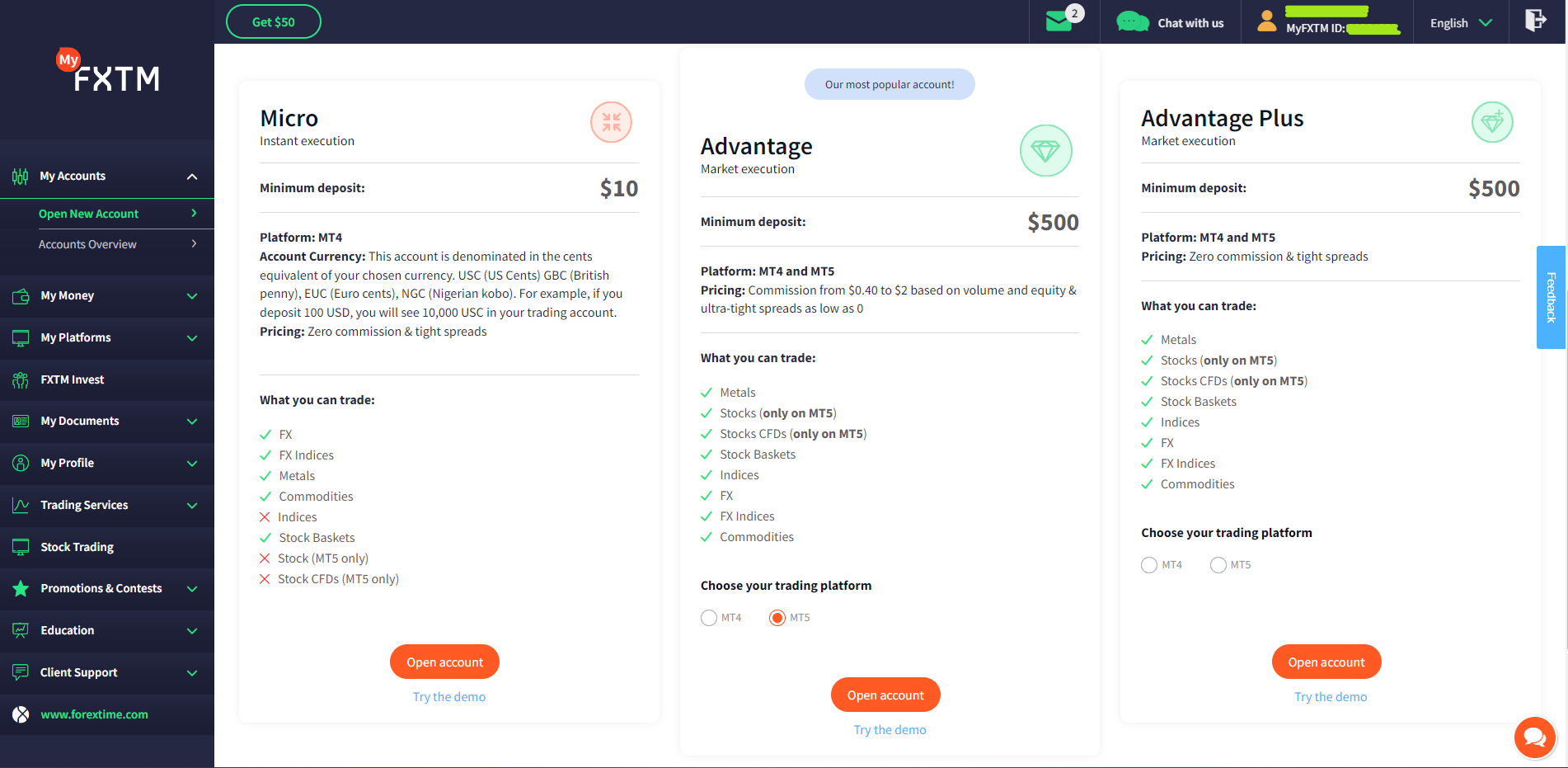

FXTM Account Types

Different account types are ideal for different types of traders. We have separately reviewed features and differences between all the account types at FXTM in the UK. If you cannot decide which account type is best for you, this section can assist in choosing.

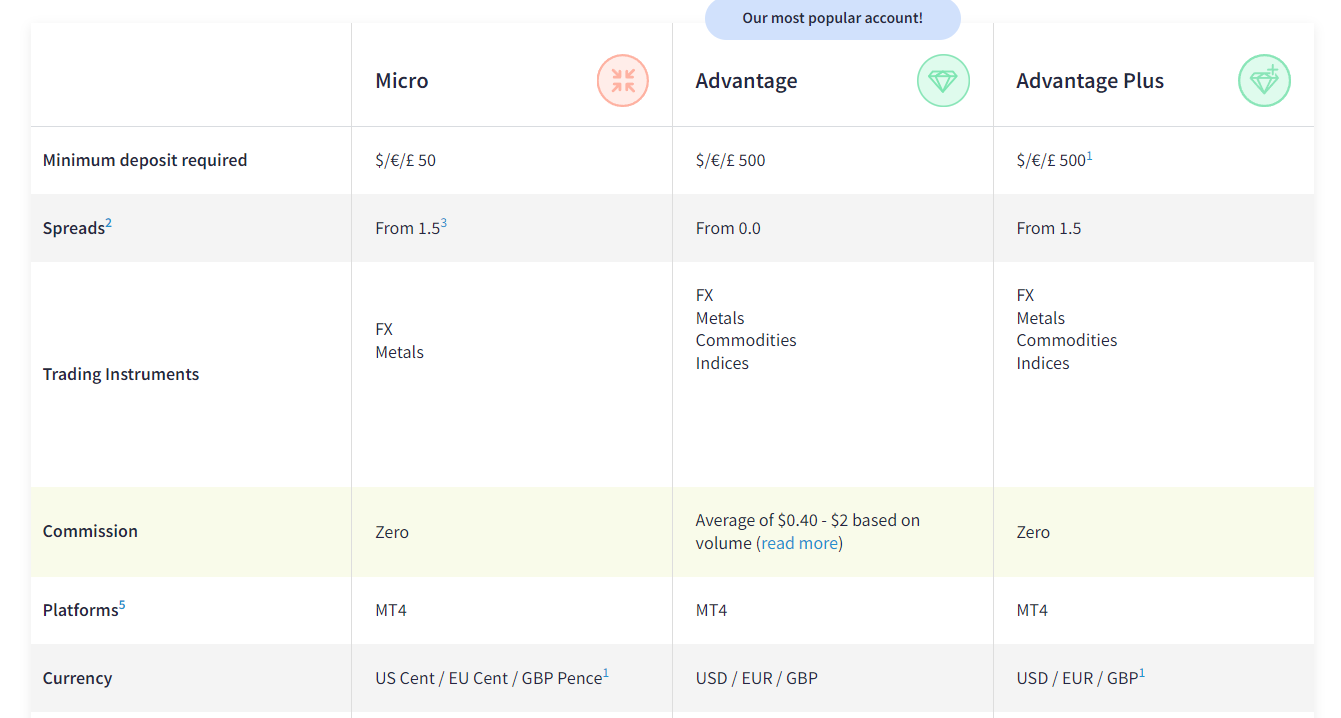

There are 4 types of accounts at FXTM with a difference in fee structure, execution method, and a few other methods. Clients can open a demo account with trading conditions of all the account types.

Each account type can be chosen with GBP/USD/EUR as the base currency. The account equity will be held in this currency regardless of the deposit currency.

Following are the available account types at FXTM in the UK.

- Micro: This is the basic account type at FXTM that can be opened with a minimum deposit of $/€/£ 10. The trading fees with this account are built only into spreads.

It uses an instant execution technique in which trades are executed at the quoted price only. A maximum of 10 lots can be traded in a single order with a margin call of 60%.

The disadvantage of choosing the Micro account is that it only allows trading on available forex pairs and metal crosses. Commodities and Indices cannot be traded with the Standard account.

This account is ideal for all types of traders seeking spread-based CFD trading on forex, gold, and silver.

- Advantage Account: This is a commission-based account with very low spreads. The trading commission with this account is calculated according to a formula (discussed under the fees section).

The Advantage account follows the market execution technique where orders are executed without requotes.

The minimum deposit for this account is $/€/£ 500. All the available instruments at FXTM can be traded with the Advantage account. This account can be chosen with MT4 and MT5 trading platforms. The commission with the MT5 platform is fixed while with MT4 is variable.

The Advantage account at FXTM is ideal for scalpers and large-volume traders who wish to trade with very low spreads at the expense of trading commission.

- Advantage Plus: This account type offers market execution without trading commission. The spreads are slightly lower than the Standard account type but the minimum deposit amount is $/€/£ 500.

All the available CFD instruments at FXTM can be traded with this account type. This account is ideal for all types of traders who wish to trade with market execution without commission at a slightly lower spread.

Retail trading accounts can be converted to professional accounts if certain criteria are met by the client. The size of the portfolio (all assets) should be more than 500,000 EUR, the client must have work experience of more than 1 year in the financial sector, and must have traded at least 10 standard lots in the last 4 quarters. The maximum leverage is increased up to 1:300 with the professional account.

Apart from pricing patterns and order execution techniques, there are no major differences in the account types. Although, different account types can suffice the needs and suit the trading styles of different types of traders in the UK.

How to Open an Account at FXTM

Before opening the account, clients must check and compare all the components of the broker. Once you are certain about the choice of account type, a trading account can be opened through the website and app of FXTM.

Clients residing in the UK must register only with the FCA-regulated entity Exinity UK Ltd from the website www.forextime.com/uk. Follow these steps to open an account at FXTM.

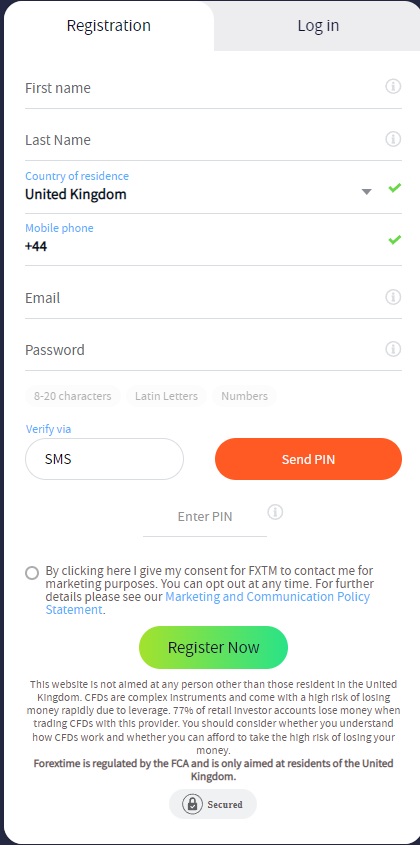

Step 1: Basic Details

Clients need to visit the account opening page at FXTM and enter their basic details. This includes first name, last name, county of residence, mobile number, email, and password. The phone number needs to be verified through OTP via SMS.

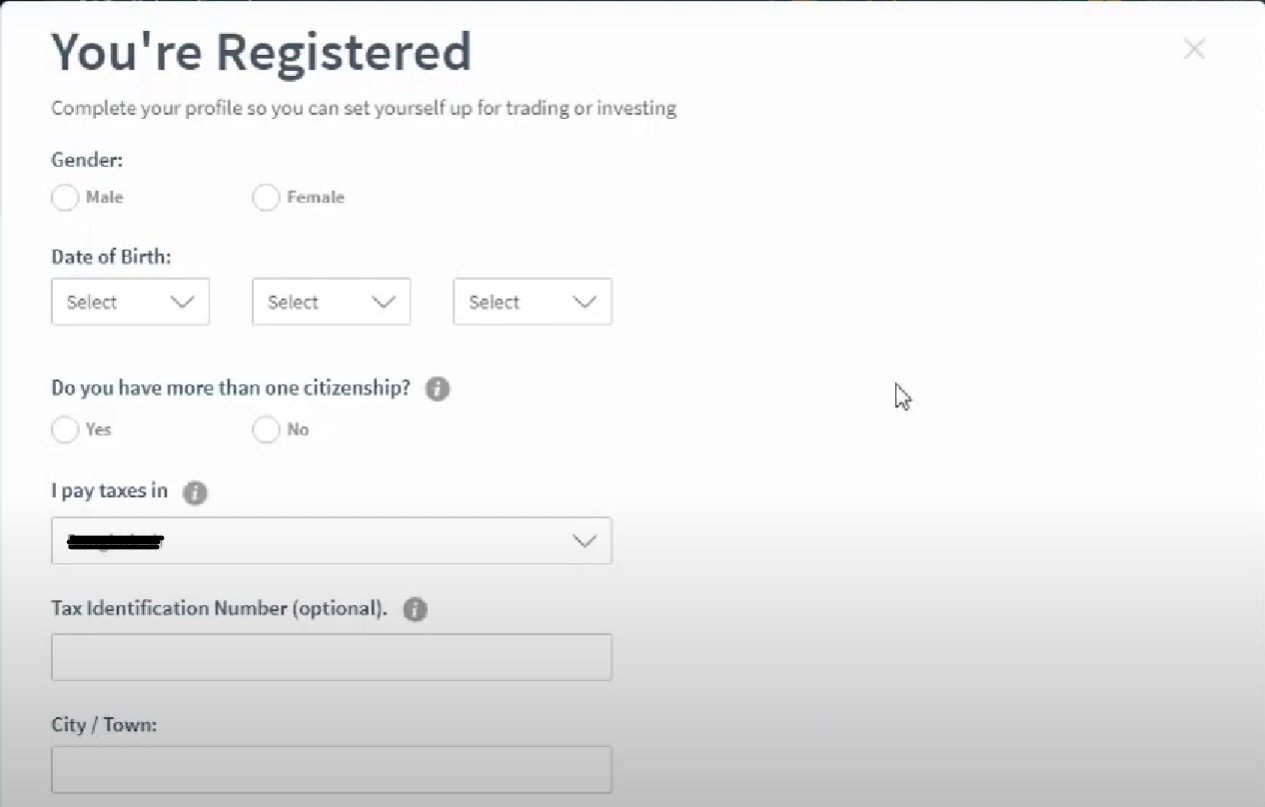

Step 2: Address and DOB

After verification of the phone number, you will be redirected to your personal area but you will need to fill up the address form before using it. Gender, date of birth, address, and Tax Identification Number (TIN) need to be filled in.

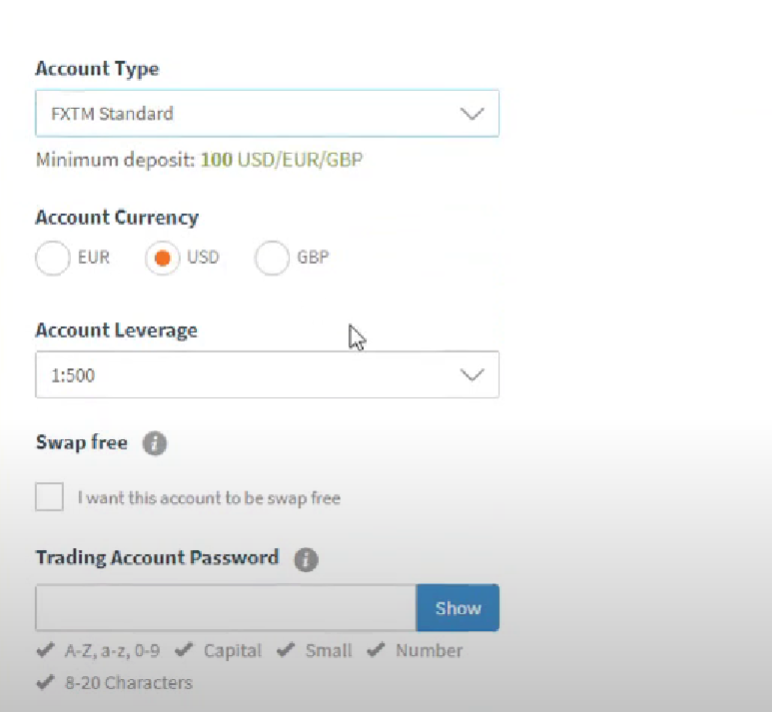

Step 3: Account Configuration

After submitting the address form, the account needs to be configured according to personal preferences. In this step, the account type has to be chosen. Clients also need to select the base account currency between USD, EUR, and GBP and maximum leverage. Once done a password needs to be chosen by the client for the trading account.

Step 4: Verification

To access all the features in the personal area, clients are required to verify their accounts by uploading documents supporting proof of address and identity. A passport or any national ID can be used for this. A scanned copy can be uploaded under profile verification. The verification can take up to 24 hours.

Step 5: Deposit & Trade

Once the account is verified, a confirmation mail is sent to the registered email. Now clients only need to make a deposit to start trading. Several methods can be used to deposit at FXTM in the UK. Once the deposits are reflected in the bank account, the trading platform can be downloaded or a web trader platform can be used to execute trade orders.

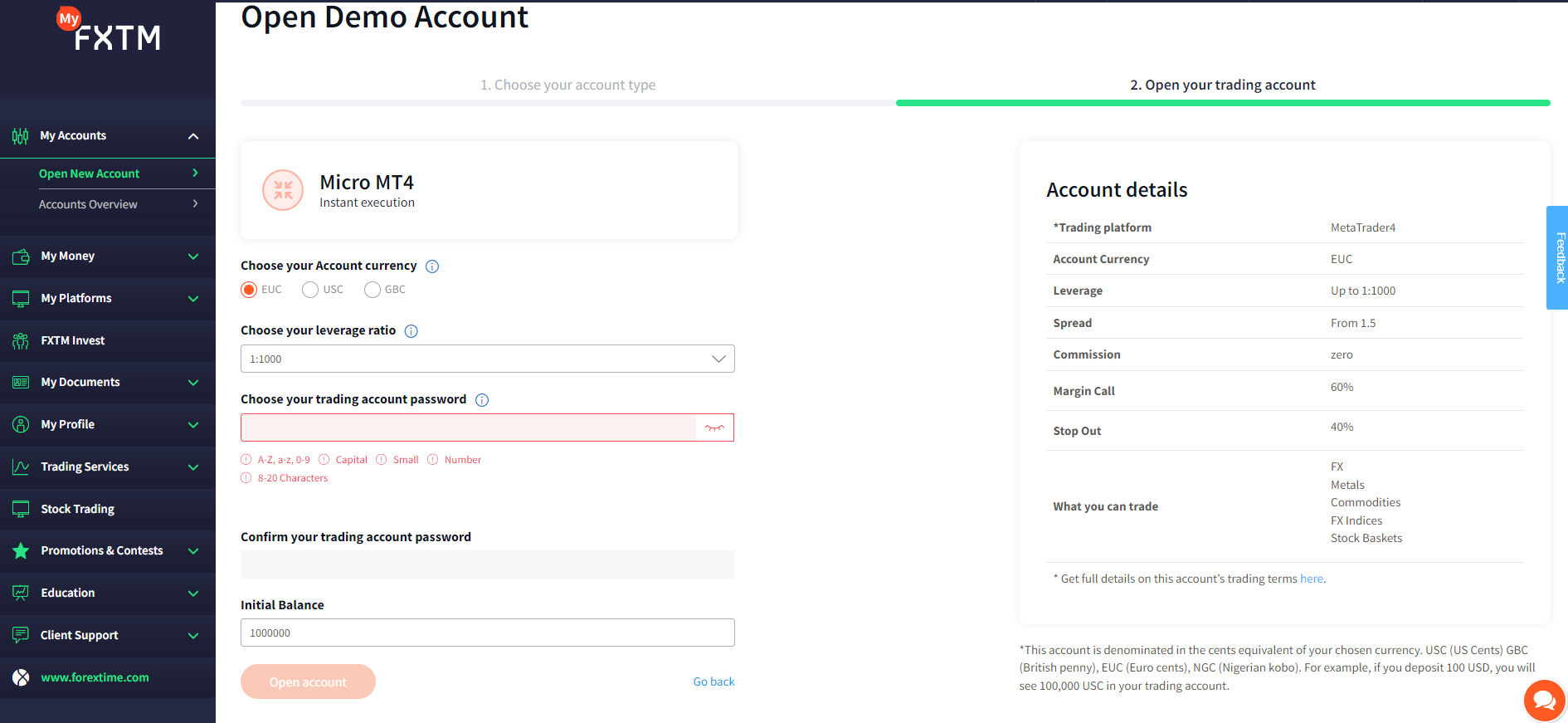

FXTM Demo Account Review

The demo account at FXTM can be opened directly without verification of the documents. Traders only need to enter their basic details to open a demo account. The demo account at FXTM can be customised according to the preferences of traders which is highly advantageous for beginners as well as experienced traders.

To open a demo account at FXTM in the UK, traders need to enter their basic details like name, email, and phone, on the ‘open account’ screen. Once entered, either of phone number or email needs to be verified through an OTP. Upon completion, traders will be redirected to the personal area at FXTM.

There are 3 options for the demo account type at FXTM namely Micro, Advantage, and Advantage Plus. The pricing structure for each account type is different, hence the traders can choose the best-suited fee structure to practice their trades at the FXTM demo account.

Each demo account type can further be configured with the account currency choices between USD, EUR, and GBP. AUD cannot be chosen as the base currency for the demo account. The maximum leverage can be chosen from 1:25 to 1:1000 for major pairs. Traders can have any amount of their preference as the initial deposit amount on the demo account.

The amount of virtual currency to be added to the demo account balance can be entered while opening the demo account. Traders can also top-up their demo account any time after opening the account.

The demo account at FXTM can be used on the MT4 trading platform with all three account types. The Advantage and Advantage Plus account types can be used with the MT5 trading platform as well.

According to our analysis and comparison, FXTM offers a very useful demo account for traders. The customization of the demo account according to the preferences of the trader is a major advantage for all types of traders.

FXTM Deposits and Withdrawals

FXTM Deposit/Withdrawal Pros

- Deposits can be made through credit cards, bankwire, and e-wallets

- Deposits are processed within 2 hours

FXTM Deposit/Withdrawal Cons

- Low number of deposit/withdrawal methods available

- Each withdrawal incurs a commission

- Cryptocurrency deposit not available

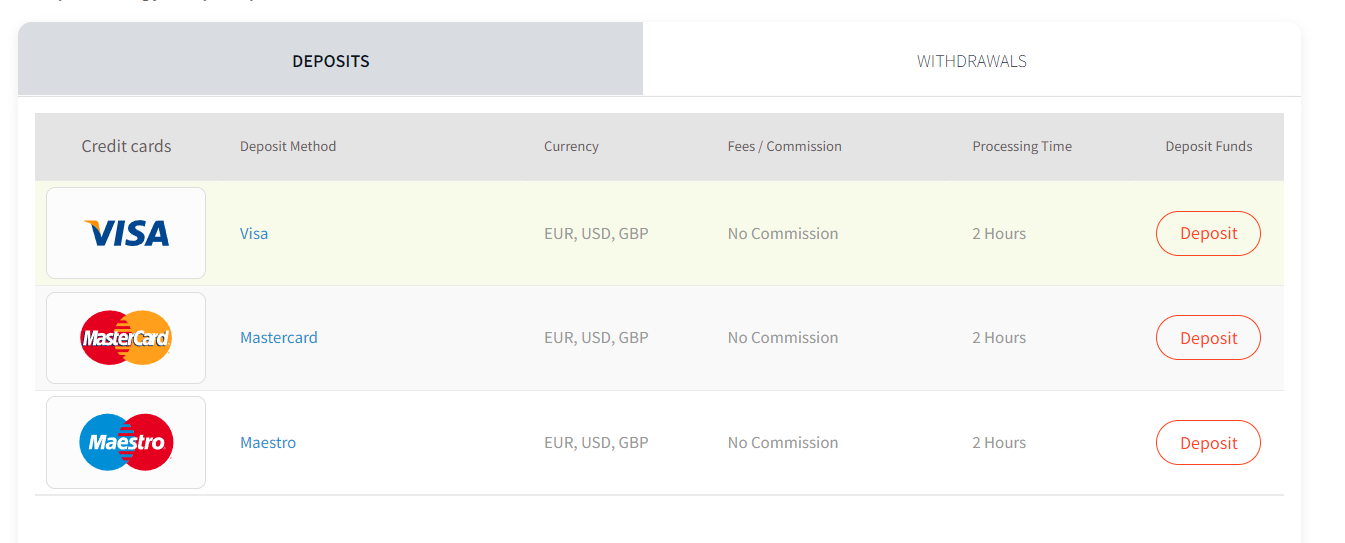

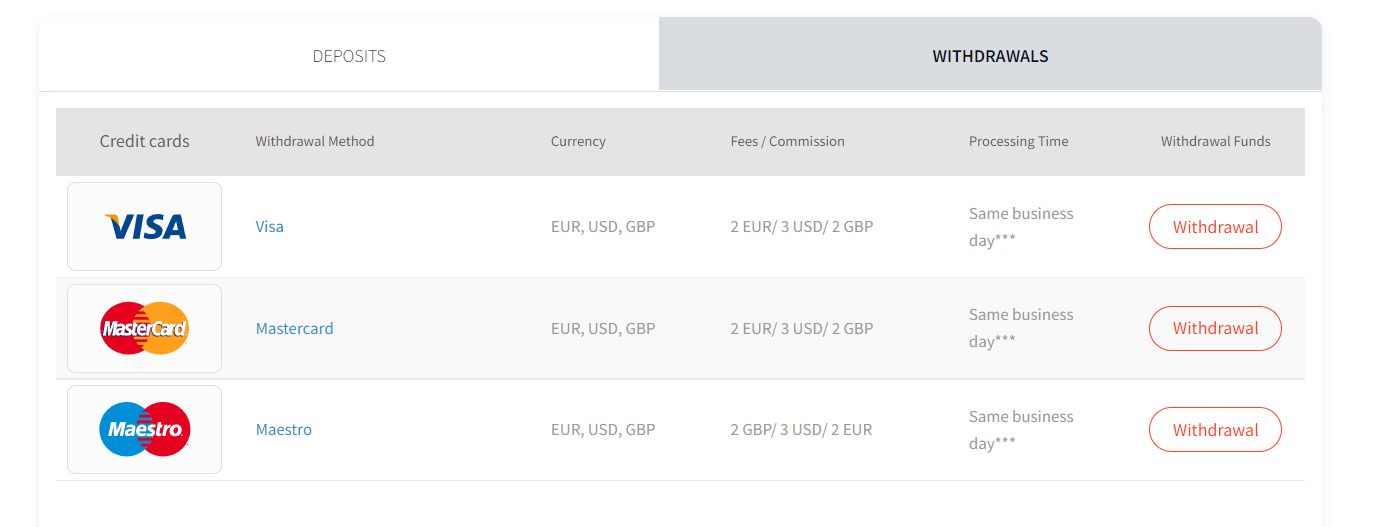

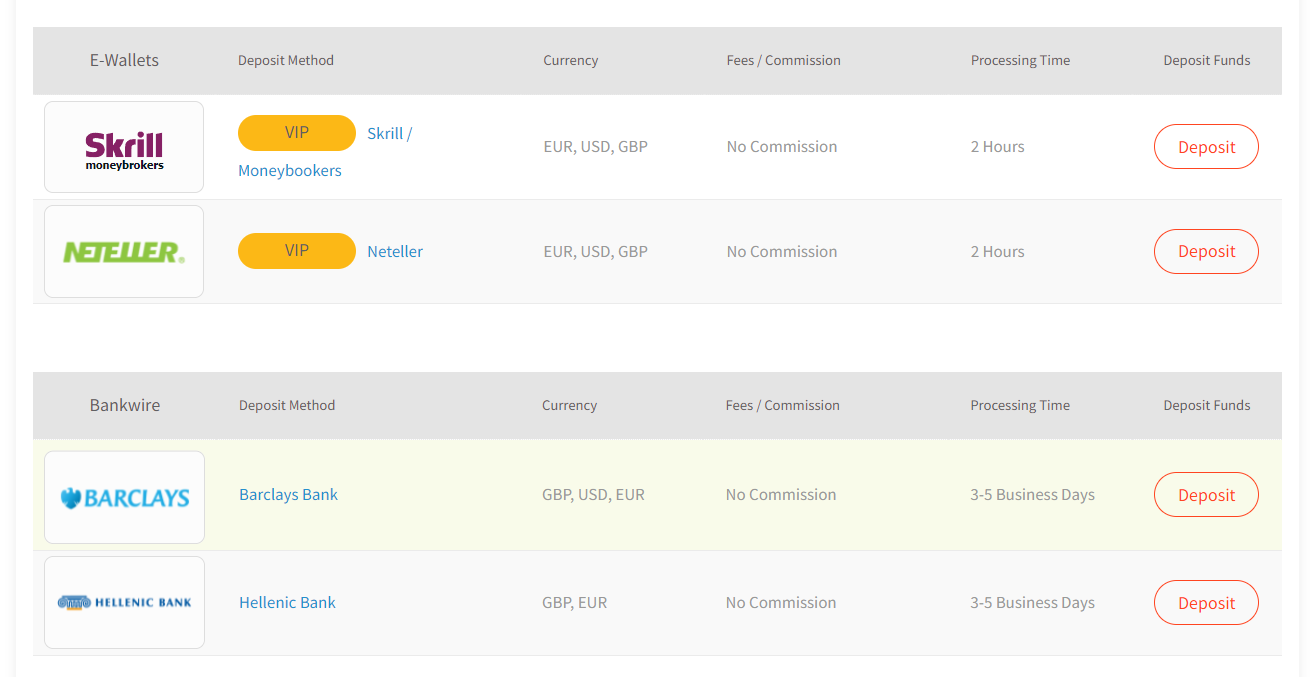

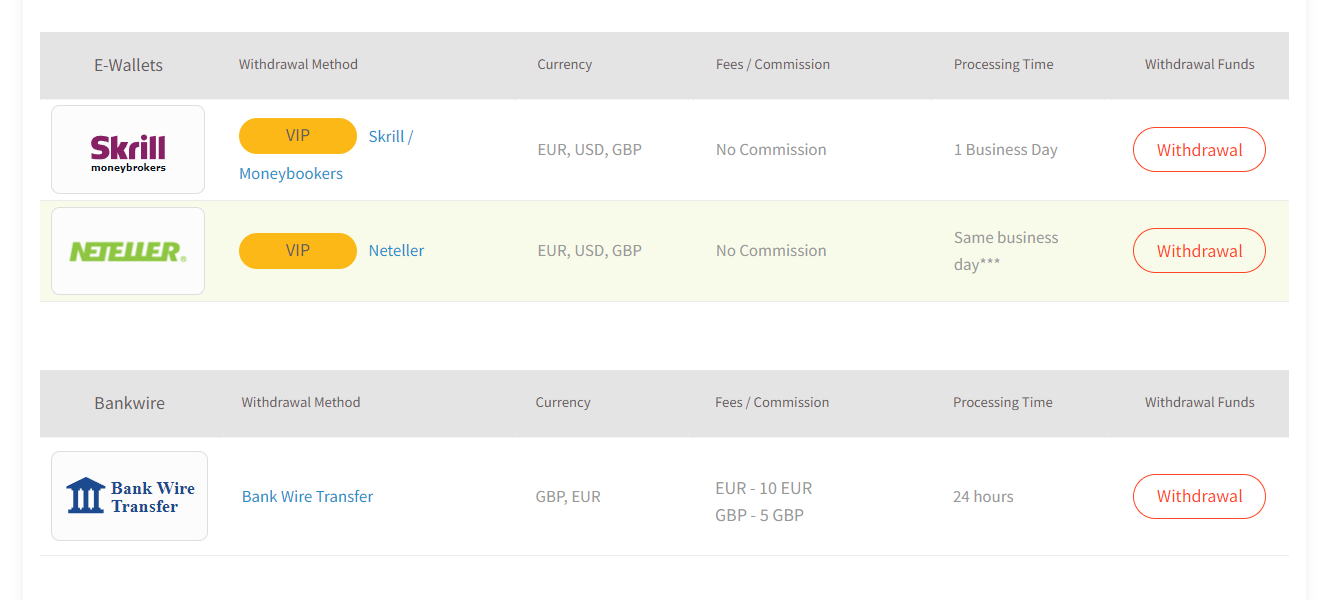

Clients residing in the UK can deposit and withdraw at FXTM through Credit cards, E-wallets, and Bankwire transfers. The processing time and the withdrawal commission are different for each available method.

- Credit Cards: Clients in the UK can deposit and withdraw through the credit cards of VISA, Mastercard, and Maestro. Deposits can be done in GBP, USD, and EUR. The Processing time for deposits is 2 hours and withdrawals can take up to 24 hours to reflect in the bank account.

Deposits through credit cards are free while each withdrawal will incur a fixed commission of 2 EUR/ 3 USD/ 2 GBP. - E-Wallets: Skrill and Neteller can be used to deposit and withdraw without any commission. The deposits are processed in 2 hours while withdrawals can take up to 24 hours.

- Bankwire: The bank wire transfer through Barclays Bank and Hellenic Bank are accepted. This may not be the ideal option to deposit as the minimum deposit amount is 500 units of the base currency. The deposits take 3 to 5 business days to process. Each withdrawal will incur a fixed commission of 10 EUR or 5 GBP depending on the account currency.

Apart from this, no other methods are available to deposit or withdraw at FXTM in the UK. Compared to other CFD brokers in the UK, the number of available transaction methods is low. A commission on withdrawal is also a disadvantage of FXTM.

FXTM Trading Platforms

FXTM supports the complete suite of MetaTrader 4 trading platforms for all account types. The MT4 trading platform is the most widely used CFD trading platform globally. While the MT5 trading platform is an upgraded version of the MT4 mostly preferred by professional and experienced traders. Currently, the MT5 trading platform is not supported by FXTM in the UK.

Forex and CFD traders can trade at FXTM through web trading platforms, mobile trading platforms, and desktop trading platforms. Each trader prefers to trade through different mediums. We have separately reviewed each trading platform at FXTM.

Web Trading Platform

The web trading platform at FXTM in the UK is built on MetaTrader 4 trading platform. This platform has a one-step login and can be customized according to the client. The web trading platform has a market, limit, and stop order. Trailing stop loss order is not available on the FXTM web trading platform. FXTM MT4 web trading platform is available in 47 languages.

Overall, the web trading platform is convenient to use through any web browser without downloading any software. However, the web trading platform offers limited features. The accessibility to the charts is also limited.

Mobile Trading Platform

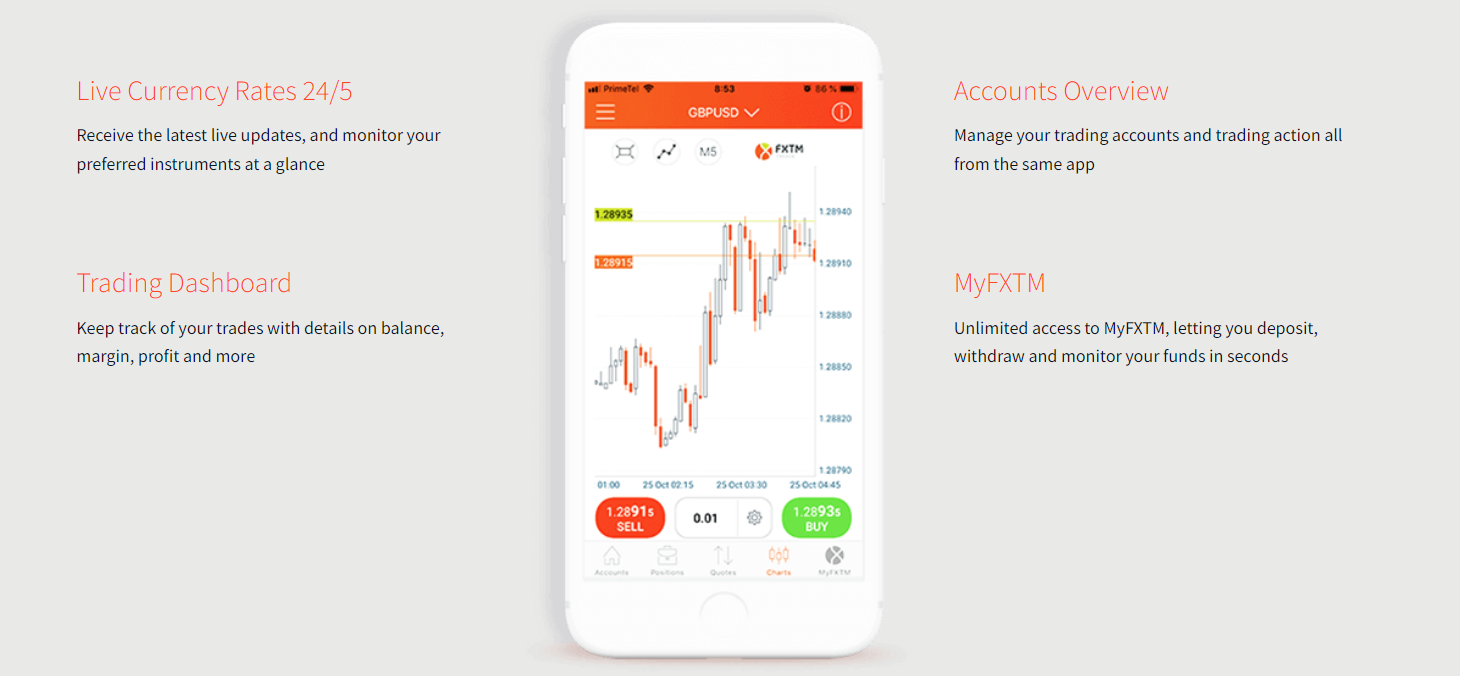

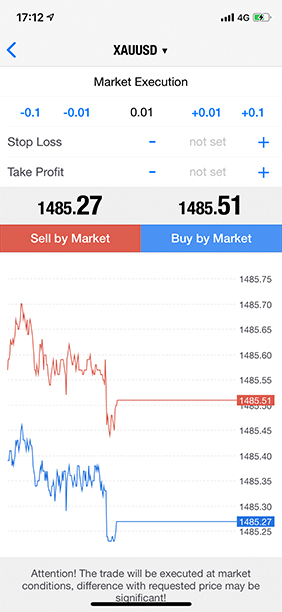

For mobile trading at FXTM in the UK, two platforms are available. Traders can trade through the FXTM trader app and FXTM MetaTrader 4 application.

The FXTM trader app is a proprietary trading application for mobile and tablet devices. It can be used to open, close, or modify trade orders. It has a user-friendly dashboard where accounts can be managed and monitored on the go.

FXTM MetaTrader 4 app is available on Android and iOS devices. It has a much simpler and older-looking interface compared to the FXTM Trader app. It has a one-step login with no fingerprint or face ID authentication. The FXTM mobile trading platform has limited features, time frames, patterns, etc.

Desktop Trading Platform

FXTM offers MetaTrader 4 trading platform that can be downloaded on Windows and macOS desktop devices. The desktop trading platform is similar to the web trading platform but has more features. It can be customized and does not require login every time.

The MT4 desktop trading platform also supports trailing stop loss apart from market, limit, and stop loss orders. FXTM additionally offers regular market updates and volatility alerts through the mailbox on the MT4 trading platform.

At the time of this review, there are no other trading platforms supported with any of the account types. FXTM does not offer MT5 trading platform at the time of this review.

FXTM Trade Execution Method

FXTM supports STP method for trade execution and claims to be 100% STP broker with no dealing desk.

No Dealing Desk (NDD) Model: FXTM’s STP execution operates on a no dealing desk model, aiming to eliminate potential conflicts of interest and provide more transparent order processing.

Order Routing: When you place a trade, FXTM’s systems automatically route your order to liquidity providers, which can include banks, financial institutions, and other market participants.

Competitive Spreads: STP execution often allows traders to access competitive bid and ask prices from various liquidity providers. This can result in relatively tight spreads, especially during times of high liquidity.

Market Prices: With STP execution, you’re likely to receive execution at the best available market prices. This means that your trades are matched with the prices provided by liquidity providers in the broader market.

FXTM Customer Support

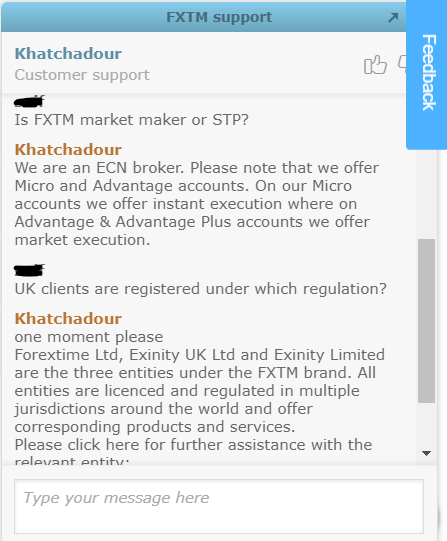

Whenever clients face queries, the customer support service can be reached out to resolve them. A user-friendly and easily accessible customer support service can enhance the trading experience. Chat, email, and phone are the three methods available to connect with the support staff at FXTM.

- Live Chat: We tried connecting with the support staff multiple times. The support service through the live chat window on the website and app is good. It is available 24/5. FXTM also offers support services through Telegram and Facebook Messenger. They generally reply within 2-5 minutes on a business day.

- E-mail: Queries can also be resolved through email support. They take 3-12 hours for a reply through e-mail. This can be useful when a soft copy of a document is needed from the support staff.

- Phone Support: Clients can connect with the support staff at FXTM directly through a local phone number +44 20 3514 1251. The local phone support is available from Monday to Friday from 06:00 – 16:00.

Overall, we liked the customer support service as the executives are very helpful and diligent. There is no issue in connectivity through all the available methods. The availability of support services through Telegram and Facebook Messenger is an additional advantage.

FXTM Research and Education Tools

FXTM Research and Education Pros

- Diverse Educational Resources: Offers a broad array of educational materials including free e-books, videos, articles, tutorials, and a detailed glossary of terms, catering to traders at different levels of expertise.

- Regular Educational Events: Hosts regular webinars and seminars globally, providing opportunities for in-depth learning and skill enhancement.

- Comprehensive Market Analysis: Provides twice-daily trading signals, economic calendars, video updates, and quarterly market forecast reports to aid in informed decision-making.

- Innovative Learning Tools: Features unique tools like the FXTM Periodic Table for learning forex terminology in a visual format, enhancing the learning experience.

- Accessible Learning Platforms: Educational and research materials are available on a wide range of platforms, making them accessible to a broad audience.

FXTM Research and Education Cons

- Lack of Fundamental Data Tools: Does not offer fundamental data tools, which are important for forex forecasting and analysis that factors in political, social, and economic trends.

- Limited Differentiation in Trading Platforms: While FXTM offers popular MT4 and MT5 platforms, the absence of unique or proprietary trading platforms may be seen as a downside for traders looking for a differentiated trading experience.

- Research Tools Could Be Enhanced: Although FXTM provides a decent number of research tools, compared to some competitors, the research offerings might be viewed as average in terms of depth and breadth.

FXTM offers various tools that can enhance the trading experience of the traders and help them make better trading decisions. FXTM offers research and education tools on the MT4/MT5 trading platform, website, and FXTM Traders app.

The tools that can help in the research are daily market analysis and an economic calendar. The daily market analysis is an analysis report published by the team of experts at FXTM. The daily reports include the overall summary of the market with predictions of trends.

The analysis report does not involve any instrument in particular but global capital markets as a whole. If you seek research reports for any particular instrument, you might need to look up to third parties. Fundamental analysis reports are also not available at FXTM.

The education tools have a rich variety and can help beginners to acknowledge the basics of forex and CFD trading. The trading guides for forex and CFD trading cover everything that a beginner must know to start trading.

However, the education tools at FXTM are limited and can only help beginners who know nothing about forex and CFD trading. There are no tools that can enhance the knowledge and trading strategies of retail traders who are already trading for a while.

In terms of research and education tools, FXTM is a decent broker with just enough learning and research tools to help beginners. Experienced traders might have to look out for third parties for research and education.

Available Instruments

Several financial instruments can be traded as Contract for Deposit (CFD) at FXTM in the UK. A total of 4 asset classes namely forex, commodities, indices and stocks can be traded as CFD at FXTM.

Clients must note that CFDs are derivative instruments in which there is no physical settlement of the underlying asset. There is no exchange of the asset that is getting traded as CFD. Only the price difference between opening and closing positions is speculated to book profits or losses.

The following are the instruments that can be traded as CFDs at FXTM.

- 62 Currency Pairs: Forex trading is done in currency pairs. A total of 62 currency pairs including 19 major pairs can be traded at FXTM. The maximum leverage for selected currency pairs namely CADCHF, CADJPY, CHFJPY, EURCAD, EURCHF, EURGBP, EURJPY, EURUSD, GBPCAD, GBPCHF, GBPJPY, GBPUSD, USDCAD, USDCHF, USDJPY is 1:30. For all the other forex pairs, the maximum leverage is 1:20 in the UK.

- 5 Metals: A total of 5 crosses of gold and silver can be traded as CFD at FXTM. The maximum leverage for XAUEUR, XAUGBP, and XAUUSD (gold crosses) is 1:20 and for XAGEUR, XAGUSD (silver crosses) is 1:10.

- 3 Commodities: UK Brent, US Crude, and US Natural Gas can be traded as CFD on spot prices. The maximum leverage in the UK for the three energy CFD is 1:10.

- 11 Indices: Major stock indices from the largest stock exchanges in the world can be traded in a spot via CFDs. This includes UK 100, US Tech 100, Germany 30, Europe 50, etc. The Max leverage on the CFD of Hong Kong 50 and Spain 35 is 1:10. For all the other CFDs on indices, the maximum leverage is 1:5.

- 170 Stock CFDs: Major stocks from American and European stock markets can be traded as CFDs without commission. 50 stocks are from Europe and 120 from the USA. The maximum leverage for CFD on shares is 1:5.

Following is a table that compares the available instruments for all asset classes at FXTM in the UK. It must be noted that the maximum leverage mentioned is for retail clients. This leverage can be increased up to 1:300 if you become a professional client upon meeting certain criteria.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 62 | 1:30 |

| Indices | 11 | 1:20 |

| Commodities | 8 | 1:20 for Gold, 1:10 for others |

| Shares | 120 | 1:5 |

| Cryptocurrencies | N.A. | N.A. |

Compared to other regulated CFD brokers in the UK, the number of available forex pairs is impressive. The number of commodities and indices is comparatively lower than most of the peers. Cryptocurrency CFDs and soft commodities CFDs are not available to trade at FXTM.

Do We Recommend FXTM?

Yes, FXTM is an FCA-regulated CFD broker and can be considered safe for clients in the UK. There are multiple account types with different fee structures to suit the trading styles of different types of traders.

It offers excellent customer support service but the trading and non-trading fees are slightly higher than peers. Clients who wish to trade with an ECN broker that is well-regulated under FCA can choose to trade with FXTM in the UK.

FXTM UK FAQs

How Legit is FXTM?

How old is FXTM?

What is the Minimum Deposit at FXTM for UK traders?

Which FXTM account is best?

Can you Make Money on FXTM?

How much does FXTM charge for withdrawal?

How long does it take to withdraw money from FXTM?

What are the disadvantages of FXTM?

How do I withdraw from FXTM?

How long does it take to withdraw money from FXTM?