FXTM South Africa Review 2024

FXTM is an FSCA regulated CFD broker. They are ECN broker with multiple choices for account types. Read all the pros and cons of choosing FXTM in South Africa.

FXTM is an FSCA-regulated CFD broker. It is licensed to provide trading services in South Africa on various financial instruments. It is an ECN broker that offers maximum leverage of up to 1:2000 in South Africa.

There are several pros and cons of choosing FXTM in South Africa. Clients must check and compare every aspect of an online CFD broker to choose the best-suited broker for themselves.

We have honestly reviewed every component of the broker that can affect the trading experience. FXTM has an FSCA-regulated entity for clients in South Africa. In this review, we have comprehensively reviewed the South African entity of FXTM named Forextime Ltd for clients based in South Africa.

FXTM South Africa Pros

- FXTM is regulated and authorized by FSCA in South Africa

- Multiple account types available for all types of traders

- The minimum deposit is $/€/£ 10

- Local banking solutions can be used to deposit and withdraw in South Africa

FXTM South Africa Cons

- Spreads are higher than average

- Each withdrawal through local bank, credit card, and bank wire incurs a fixed commission

- cTrader trading platform not available

- Inactivity fees are charged after 6 months of inactivity

- Local phone support is not available in South Africa

- No bonus available

Table of Content

FXTM South Afrifca Summary

| Broker Name | ForexTime Ltd |

| Website | www.forextime.com |

| Regulation | FSCA, FCA, CySEC |

| Year of Establishment | 2011 |

| Minimum Deposit | $/€/£ 10 |

| Maximum Leverage | 1:2000 |

| Trading Platforms | MT4, MT5 |

| Trading Instruments | 200+ CFDs on forex pairs, commodities, indices, shares, ETFs, cryptocurrencies |

Safety and Regulation

FXTM Safety Pros

- Regulated by FSCA in the UK

- Regulated by FCA and CySEC

- FXTM is an ECN broker

FXTM Safety Cons

- FXTM is not listed on any stock exchange

Forex brokers are regulated by government financial authorities like the CFTC (U.S.), FCA (U.K.), ASIC (Australia), etc. Regulations ensure brokers follow standards for licensing, financial stability, client fund segregation, risk disclosure, and anti-money laundering. Traders should choose regulated brokers for security and transparency.

The safety of funds and data of clients depends largely on regulatory compliance under which the clients are getting registered. The regulation of a particular CFD broker can be different for clients residing in a different jurisdiction.

Following are the regulation details of FXTM for different entities.

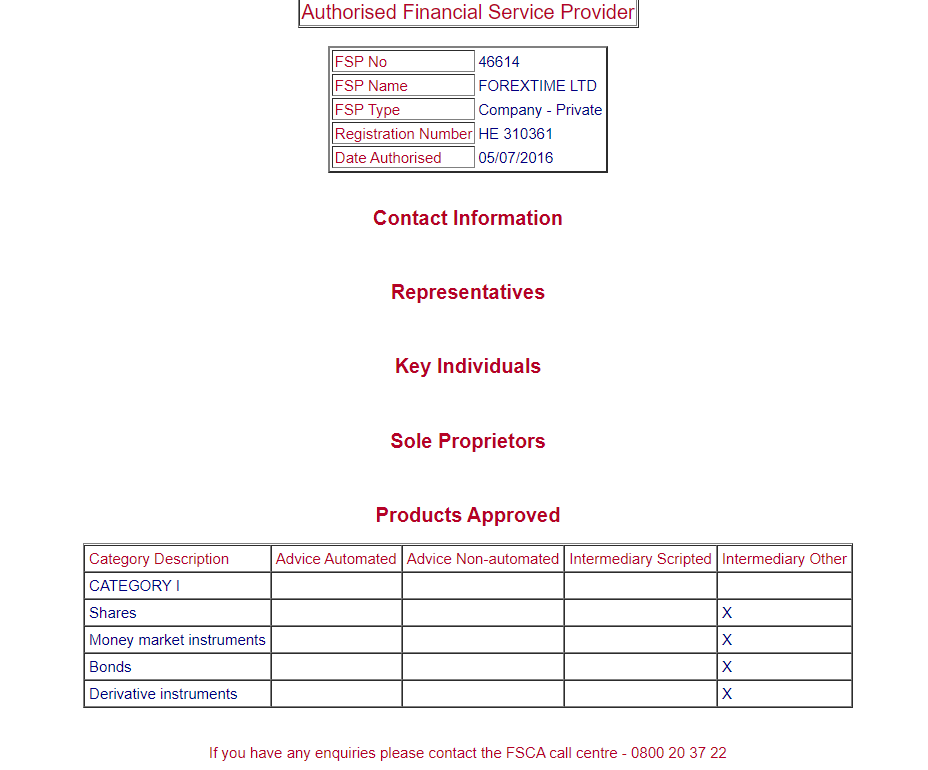

The FSCA is a top-tier regulatory authority in the jurisdiction of South Africa. FXTM is Authorised by the FSCA of South Africa under FSP number 46614. The entity name of the FSCA-regulated entity of FXTM is Forextime Ltd. The FSCA-authorized entity is also regulated by the CySEC.

Clients in South Africa are registered under FSCA regulation. This makes FXTM fairly safe for clients in South Africa.

In case of any dispute, clients are protected under the Financial Ombudsman Service of CySEC regulation. Each client is covered with insurance of up to $20,000.

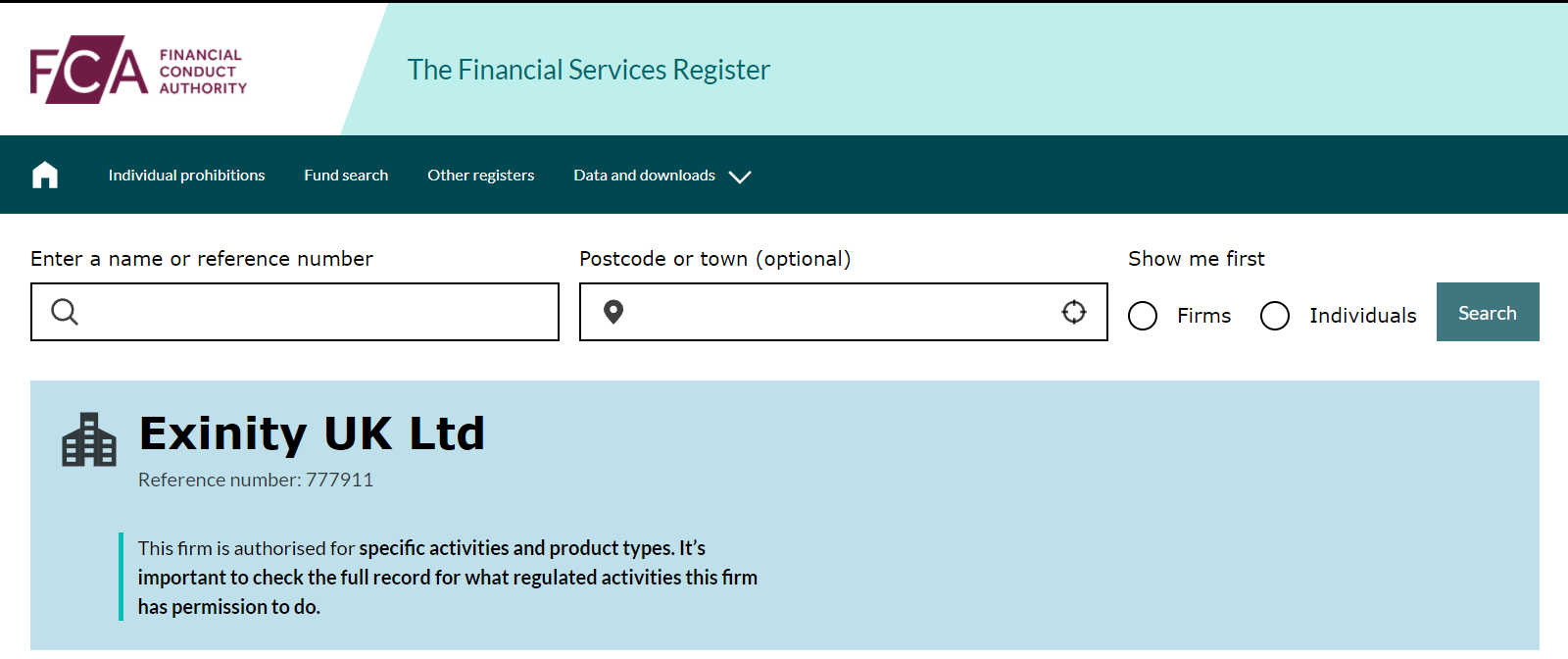

FCA is the local financial regulatory authority in the United Kingdom. FXTM is regulated as well as authorized by the Financial Conduct Authority (FCA) of the UK. Exinity UK Ltd is the FCA-regulated entity in the United Kingdom under firm reference number 777911. FXTM and ForexTime are the trading names of Exinity UK Ltd.

The compliance, protection, current status, and other details of FXTM in the UK can be checked through the official FCA website. Clients in the UK are protected under the Financial Ombudsman Service of the Financial Conduct Authority (FCA). South African clients are not registered under FCA regulations and regimes.

CySEC is not a top-tier regulatory authority but it is based in a member country of the European Economic Area (EEA). A regulatory license from CySEC authorises FSPs to operate their business in Europe.

FXTM holds the CySEC license under license number 185/12. The entity is registered as Forextime Ltd with the website www.forextime.com/eu.

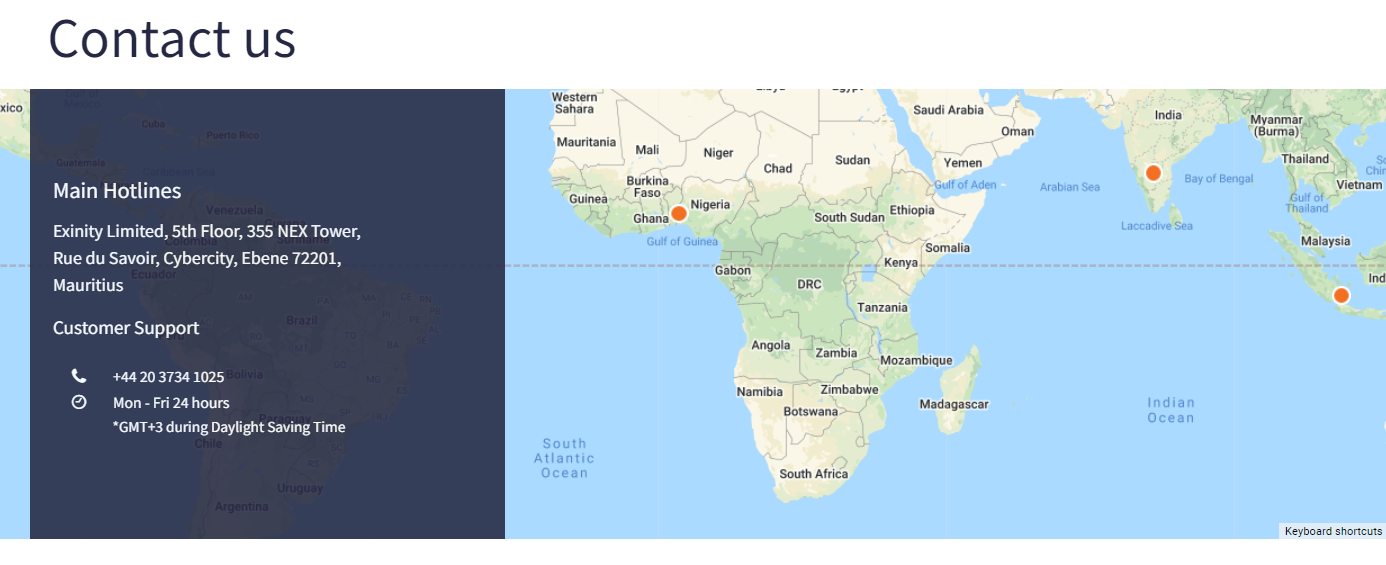

The global entity of FXTM is regulated under the Financial Services Commission of Mauritius. Exinity Limited is a regulated entity under FSC with an Investment Dealer License number C113012295.

According to our review, FXTM is a well-regulated CFD broker. The FSCA regulation makes them fairly safe for clients in South Africa. The third-party risk of choosing FXTM in South Africa is very low.

FXTM Fees

FXTM Fees Pros

- Multiple fee structure available

- Spreads are very low with Advantage Account

- No non-trading fees exist except inactivity fees

FXTM Fees Cons

- Spreads at FXTM are higher than average

- Slightly more costly than several regulated brokers

- Complex fee structure with MT4 Advantage account

The fees charged by online CFD brokers for trading and non-trading activities can have a major impact on the trading experience. For a comprehensive analysis and comparison of the fee structure at FXTM, we have separately reviewed every component of fees.

- Spread: The difference between the bid and ask price of a CFD instrument is called the spread. This is the most important component of trading fees.

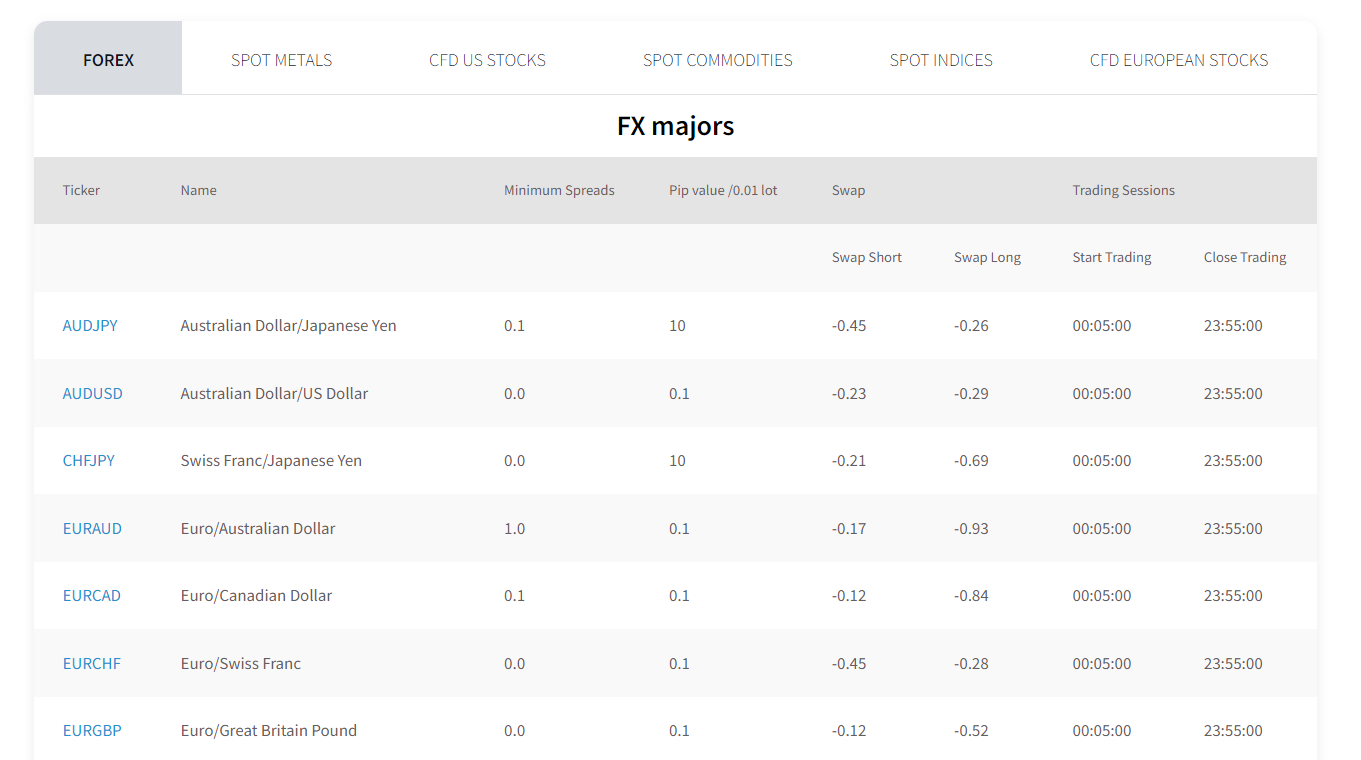

The spreads at FXTM start from 1.5 pips with the Standard Account type. The Advantage account type has lower spreads starting from 0 but a fixed commission on currency pairs and metals.The average spread for EUR/USD is 1.9 pips with the Standard and Micro account types. The Advantage Plus account incurs an average spread of 2.1 pips for EUR/USD. Spreads are negligible on currency pairs with the Advantage Account.

The following table compares the spreads incurred with different account types at FXTM.

Trading Instrument Standard Account Advantage Account Advantage Plus Account EUR/USD 1.9 0 2.1 GBP/USD 2 0.2 2.5 EUR/GBP 2.4 0.6 2.7 Gold/USD 45 9 36 Crude Oil 9 6 12 US Tech 100 Index 40 8 36 UK 100 50 14 45 - Trading Commission: FXTM offers commission-based trading on CFD instruments with spreads as low as 0 pips. The trading commission is only incurred with the Advantage account at FXTM.

The trading commission for the MT5 Advantage account is fixed at $4 for a round trade of a standard lot.

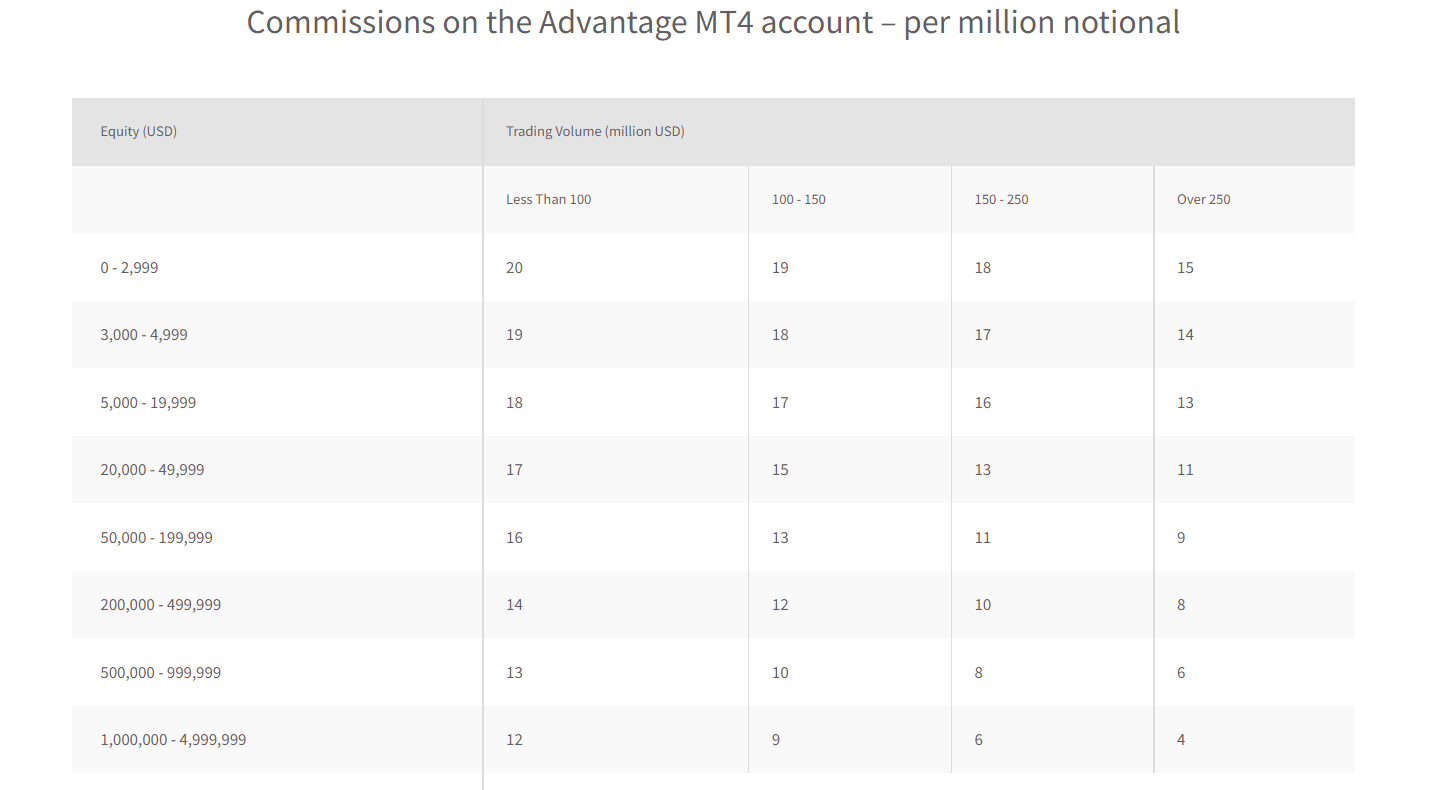

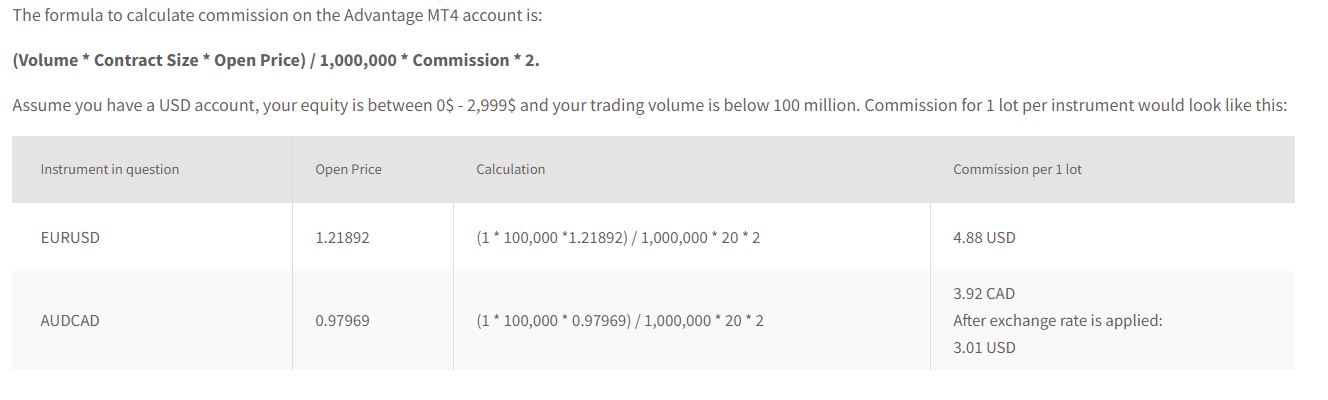

The trading commission at FXTM with the MT4 Advantage account is variable and depends on the volume traded. It is calculated with a predefined formula.

(Volume * Contract Size * Open Price) / 1,000,000 * Commission * 2For a round-turn trade of 1 standard lot of EUR/USD, the commission is $4.88. Although it depends on the prevailing rates and equity in the account.

- Swap Fee: When a leveraged position is kept open for more than a day, an interest needs to be paid to the leverage provider. This interest is called a swap fee or overnight charges or rollover rates.

For keeping a position open for EUR/USD (standard lot) overnight, clients will be charged -0.63 pips and -0.08 pips respectively for long and short positions.Clients who trade for more than a day must check the swap fees before trading. A swap fee is not applicable if a position is opened and closed on the same day.

- Non-Trading Commission: There are a few other components of the fee that can be incurred without executing trade orders.

At FXTM in South Africa, deposits are free for all the available methods but a fixed commission is charged on withdrawals through some of the methods. The withdrawal fees are different for each method and have been reviewed separately under the deposits and withdrawal section.

FXTM also charges inactivity fees if no trading activities occur consecutively for 6 months. After 6 months of inactivity, 5 EUR/ USD/ GBP (depending on the account currency) will be deducted every month until the account balance reaches 0.

Apart from these, there is no other non-trading fee at FXTM in South Africa.

The spread at FXTM is slightly higher with the commission-free account type. The following table compares the average spread on major currency pairs with different regulated brokers in South Africa. It must be noted that the spreads mentioned in the table are with the commission-free account types and spread-only fee structure.

| Trading Instrument | FXTM | eToro | CMC Markets | Pepperstone |

|---|---|---|---|---|

| EUR/USD | 1.9 | 1.1 | 0.70 | 0.77 |

| GBP/USD | 2 | 2.3 | 0.9 | 1.19 |

| EUR/GBP | 2.4 | 2.8 | 1.10 | 1.40 |

| USD/JPY | 2.2 | 1.2 | 0.7 | 0.86 |

| USD/CAD | 2.5 | 1.7 | 1.3 | 1.07 |

Overall, the spreads are higher at FXTM when compared with the majority of CFD brokers in South Africa. The spreads can be slightly lower at times with the Advantage Plus account but it is still wider than many peers.

The commission is variable and depends on the trade size or the account equity. Compared to commission-based accounts of other regulated CFD brokers, commissions are average at FXTM.

The swap rates and non-trading charges are higher than average. Many regulated brokers in South Africa do not charge inactivity fees or withdrawal commissions.

FXTM Account Types

Different account types are ideal for different types of traders. We have separately reviewed features and differences between all the account types at FXTM in South Africa. If you cannot decide which account type is best for you, this section can assist in choosing.

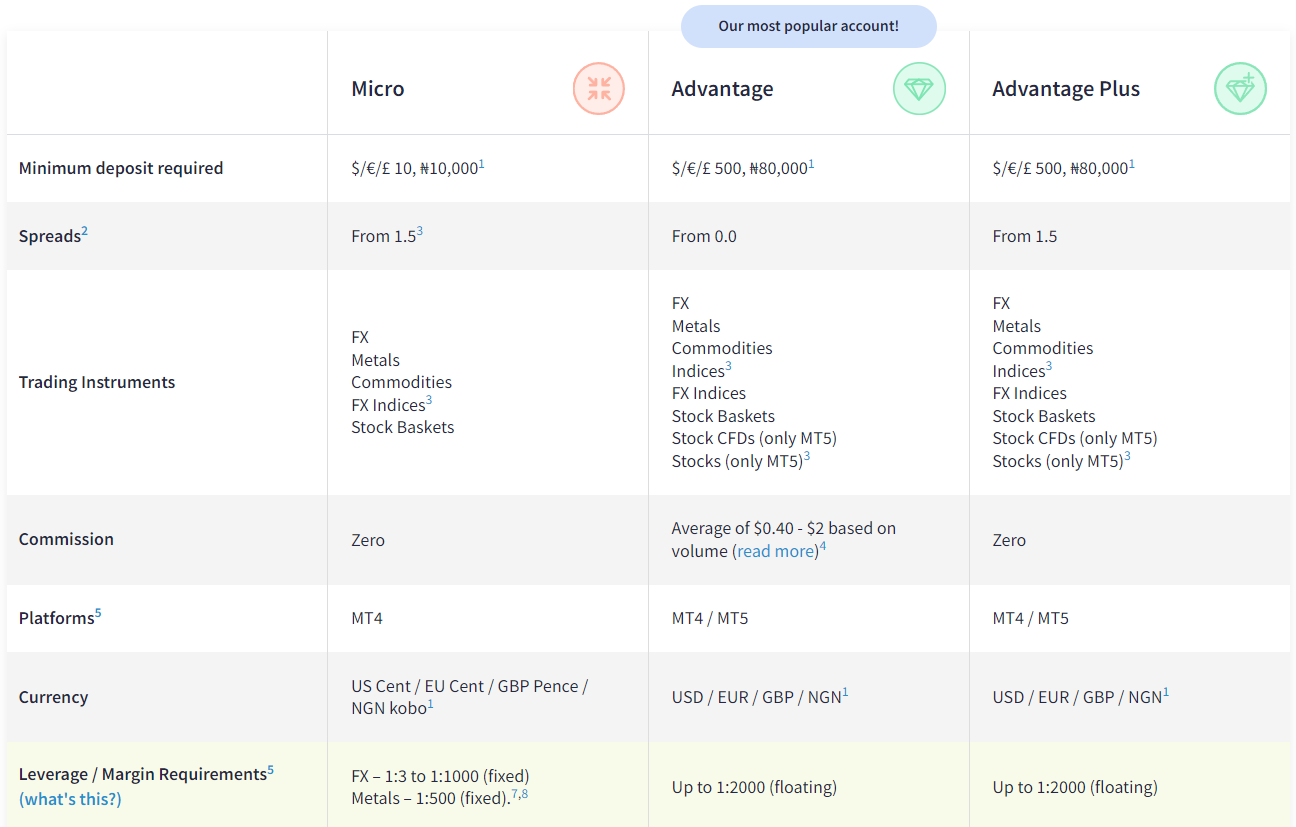

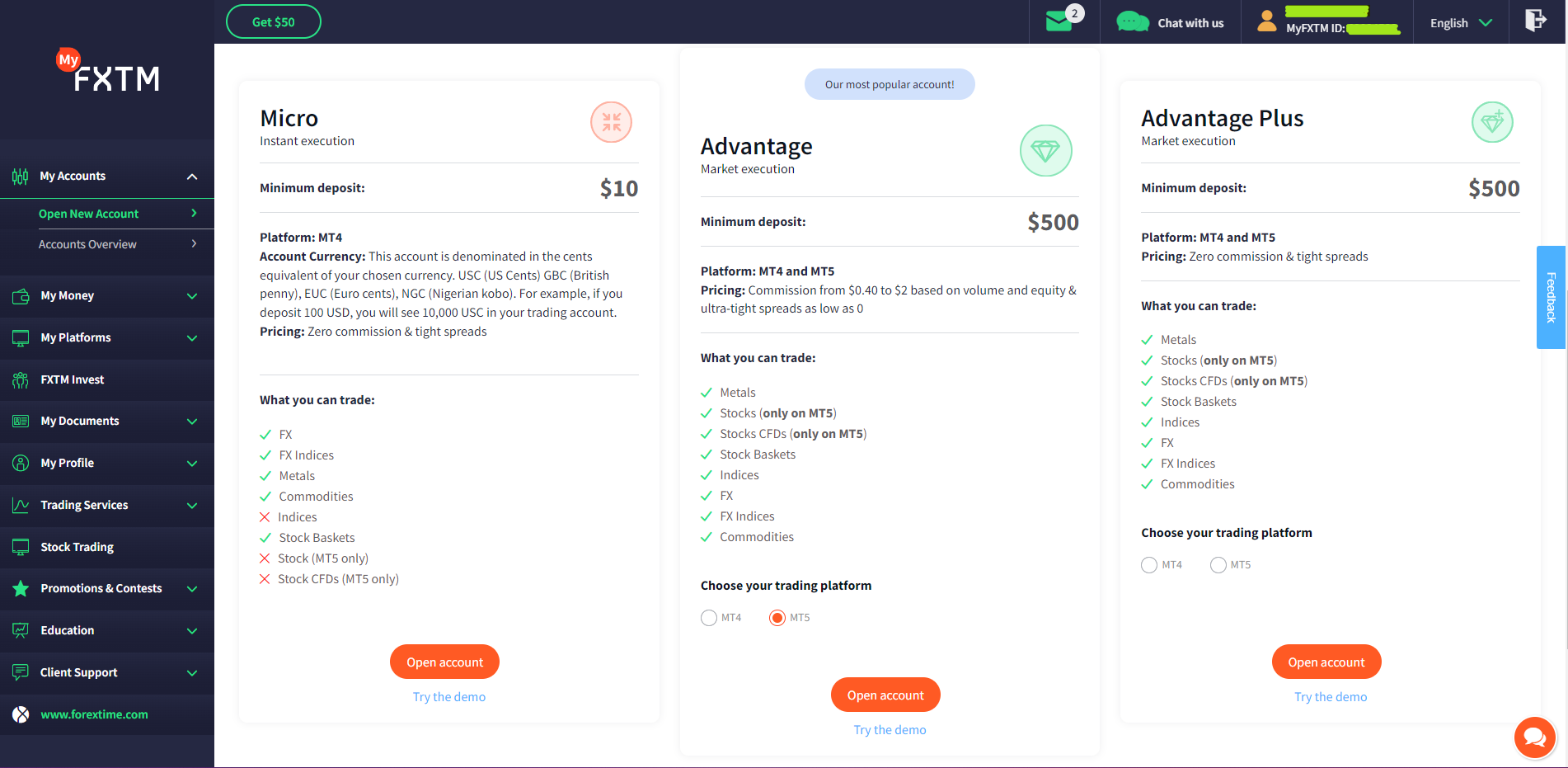

There are 4 types of accounts at FXTM with a difference in fee structure, execution method, and a few other methods. Clients can open a demo account with trading conditions of all the account types.

Each account type can be chosen with GBP/USD/EUR as the base currency. The account equity will be held in this currency regardless of the deposit currency. ZAR deposits will be automatically converted to base account currency according to prevailing conversion rates.

Following are the available account types at FXTM in South Africa.

- Standard: This is the basic account type at FXTM that can be opened with a minimum deposit of $/€/£ 10. The trading fees with this account are built only into spreads.

It uses an instant execution technique in which trades are executed at the quoted price only. A maximum of 10 lots can be traded in a single order with a margin call of 60%.

The disadvantage of choosing this account is that it does not allow trading on all the available instruments. It can only be chosen with MT4 trading platform.

This account is ideal for all types of traders seeking spread-based CFD trading on forex, gold, and silver.

- Micro: This is the Micro version of the Standard account type. The only difference is that the lot size is micro (1000) instead of standard (100,000). All other features and trading conditions with this account are the same as the Standard Account. The account equity is kept as US Cent / EU Cent / GBP Pence.

This account type is ideal for beginners and small volume traders.

- Advantage Account: This is a commission-based account with very low spreads. The trading commission with this account is calculated according to a formula (discussed under the fees section).

The Advantage account follows the market execution technique where orders are executed without requotes.

The minimum deposit for this account is $/€/£ 500. All the available instruments at FXTM can be traded with the Advantage account. This account can be chosen with MT4 and MT5 trading platforms. The commission with the MT5 platform is fixed while with MT4 is variable.

The Advantage account at FXTM is ideal for scalpers and large-volume traders who wish to trade with very low spreads at the expense of trading commission.

- Advantage Plus: This account type offers market execution without trading commission. The spreads are slightly lower than the Standard account type but the minimum deposit amount is $/€/£ 500. This account type can be used either with MT4 or MT5 trading platforms.

All the available CFD instruments at FXTM can be traded with this account type. This account is ideal for all types of traders who wish to trade with market execution without commission at a slightly lower spread.

Apart from pricing patterns and order execution techniques, there are no major differences in the account types. Although, different account types can suffice the needs and suit the trading styles for different types of traders in South Africa.

How to Open an Account at FXTM

Before opening the account, clients must check and compare all the components of the broker. Once you are certain of the choice of account type, a trading account can be opened through the website and app of FXTM.

Clients residing in South Africa must register only with the FSCA and CySEC regulated entity Forextime Ltd from the website www.forextime.com/eu. Follow these steps to open an account at FXTM.

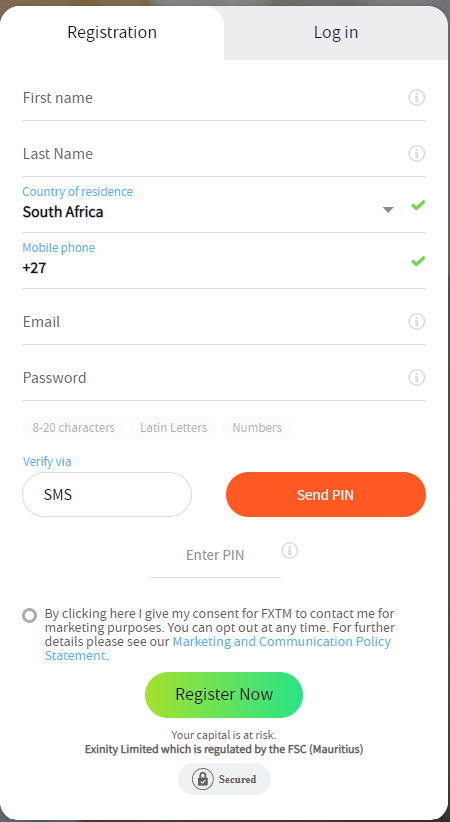

Step 1: Basic Details

Clients need to visit the account opening page at FXTM and enter their basic details. This includes first name, last name, county of residence, mobile number, email, and password. The phone number needs to be verified through OTP via SMS.

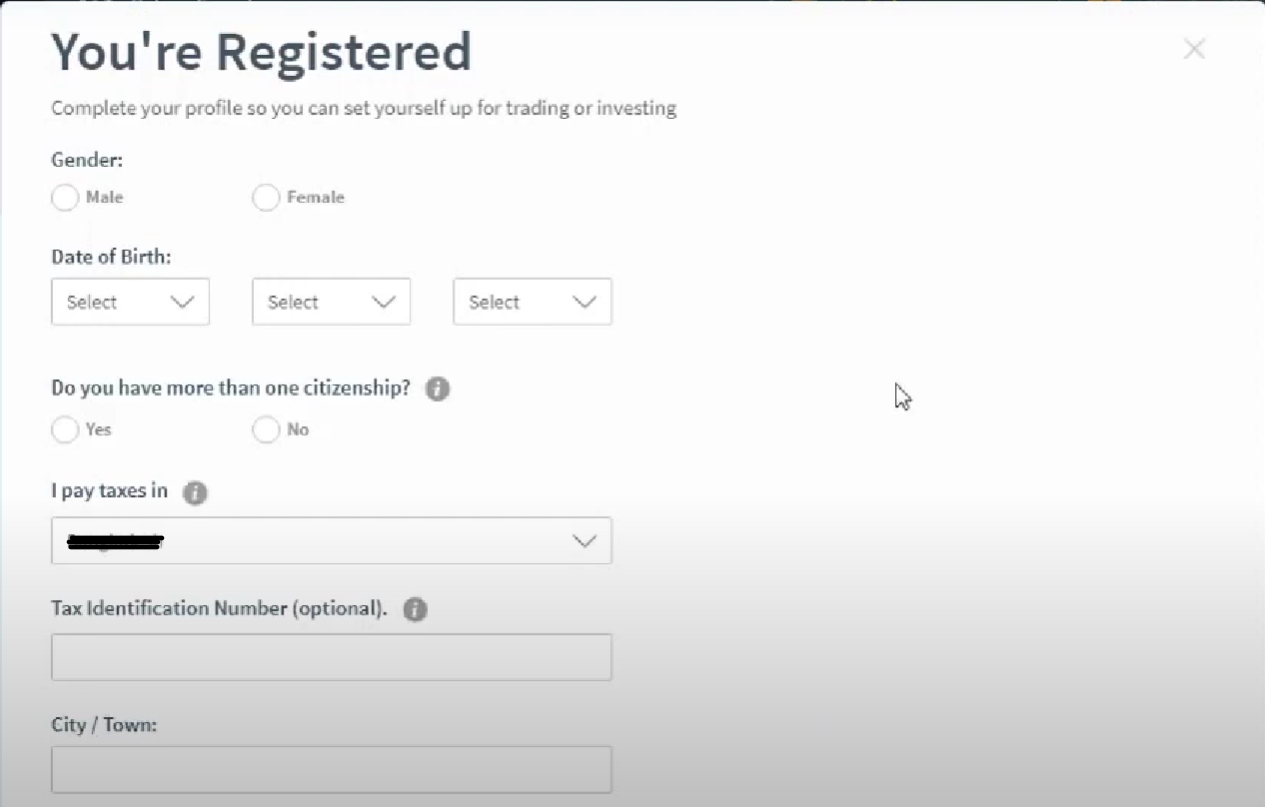

Step 2: Address and DOB

After verification of the phone number, you will be redirected to your personal area but you will need to fill up the address form before using it. Gender, date of birth, address, and Tax Identification Number (TIN) need to be filled in.

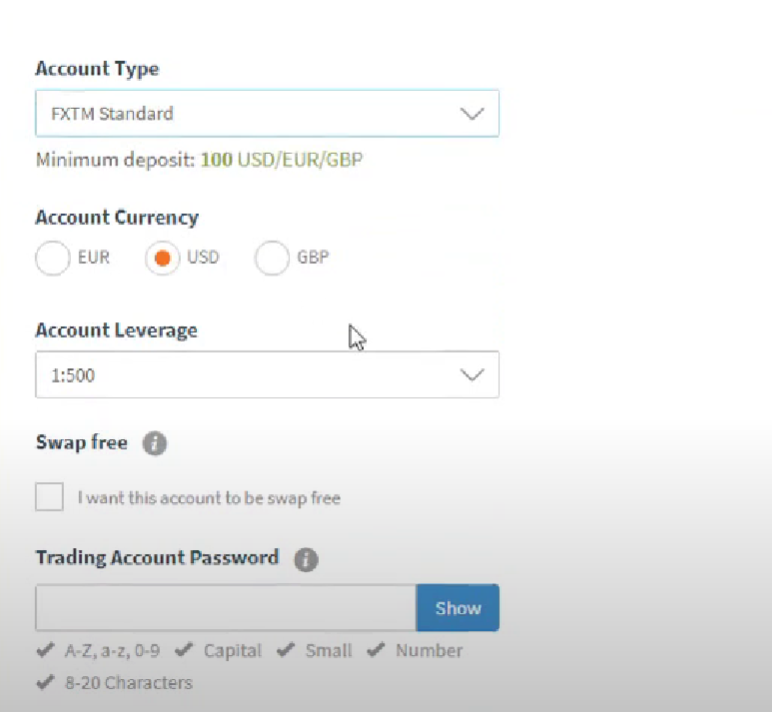

Step 3: Account Configuration

After submitting the address form, the account needs to be configured according to personal preferences. In this step, the account type has to be chosen. Clients also need to select the base account currency between USD, EUR, and GBP and maximum leverage. Once done a password needs to be chosen by the client for the trading account.

Step 4: Verification

To access all the features in the personal area, clients are required to verify their accounts by uploading documents supporting proof of address and identity. A passport or any national ID can be used for this. A scanned copy can be uploaded under profile verification. The verification can take up to 24 hours.

Step 5: Deposit & Trade

Once the account is verified, a confirmation mail is sent to the registered email. Now clients only need to make a deposit to start trading. Several methods can be used to deposit at FXTM in South Africa. Once the deposits are reflected in the bank account, the trading platform can be downloaded or a web trader platform can be used to execute trade orders.

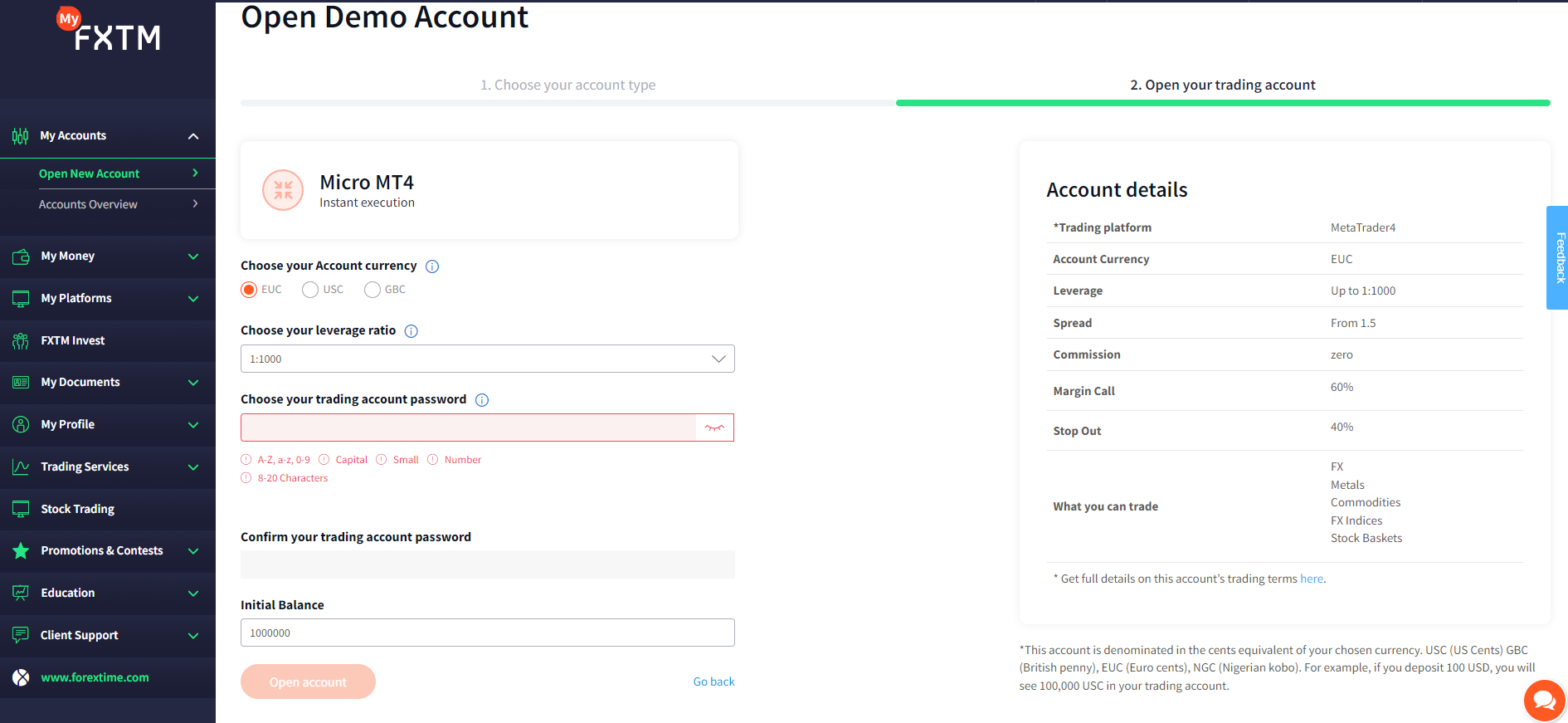

FXTM Demo Account Review

The demo account at FXTM can be opened directly without verification of the documents. Traders only need to enter their basic details to open a demo account. The demo account at FXTM can be customised according to the preferences of traders which is highly advantageous for beginners as well as experienced traders.

To open a demo account at FXTM in South Africa, traders need to enter their basic details like name, email, and phone, on the ‘open account’ screen. Once entered, either of phone number or email needs to be verified through an OTP. Upon completion, traders will be redirected to the personal area at FXTM.

There are 3 options for the demo account type at FXTM namely Micro, Advantage, and Advantage Plus. The pricing structure for each account type is different, hence the traders can choose the best-suited fee structure to practice their trades at the FXTM demo account.

Each demo account type can further be configured with the account currency choices between USD, EUR, and GBP. AUD cannot be chosen as the base currency for the demo account. The maximum leverage can be chosen from 1:25 to 1:1000 for major pairs. Traders can have any amount of their preference as the initial deposit amount on the demo account.

The amount of virtual currency to be added to the demo account balance can be entered while opening the demo account. Traders can also top-up their demo account any time after opening the account.

The demo account at FXTM can be used on the MT4 trading platform with all three account types. The Advantage and Advantage Plus account types can be used with the MT5 trading platform as well.

According to our analysis and comparison, FXTM offers a very useful demo account for traders. The customization of the demo account according to the preferences of the trader is a major advantage for all types of traders.

FXTM Deposits and Withdrawals

FXTM Deposit/Withdrawal Pros

- Deposits can be made through credit cards, bankwire, and e-wallets

- Deposits are processed within 2 hours

FXTM Deposit/Withdrawal Cons

- Low number of deposit/withdrawal methods available

- Each withdrawal incurs a commission

- Cryptocurrency deposit not available

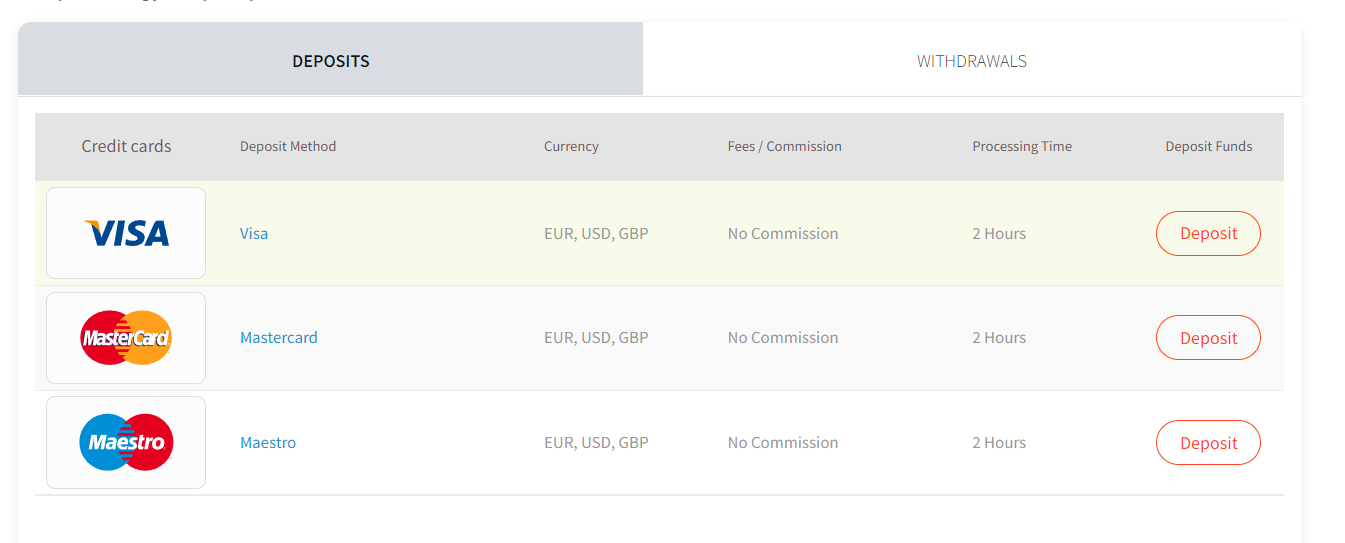

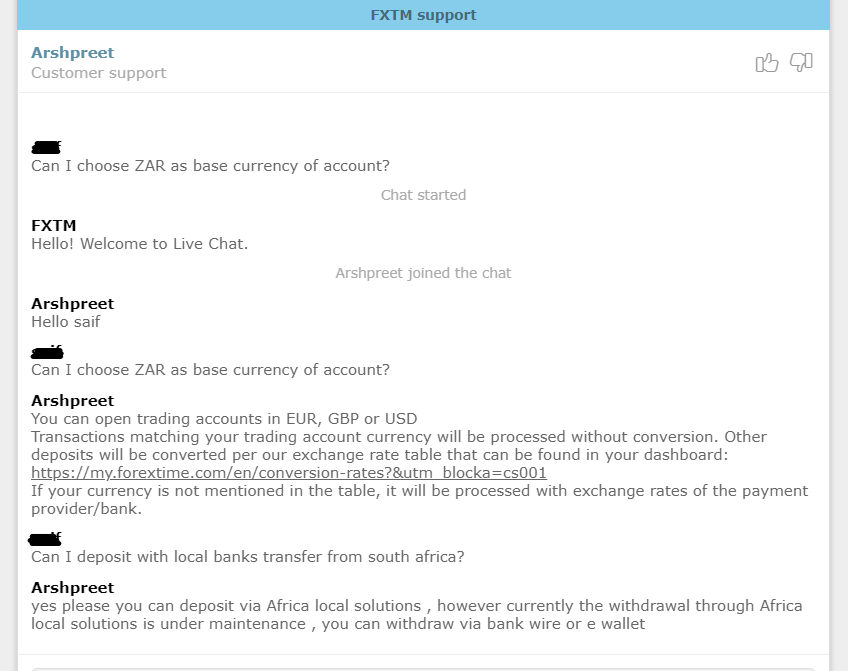

Clients residing in South Africa can deposit and withdraw at FXTM through local bank transfers, Credit cards, E-wallets, and Bankwire transfers. The processing time and the withdrawal commission are different for each available method.

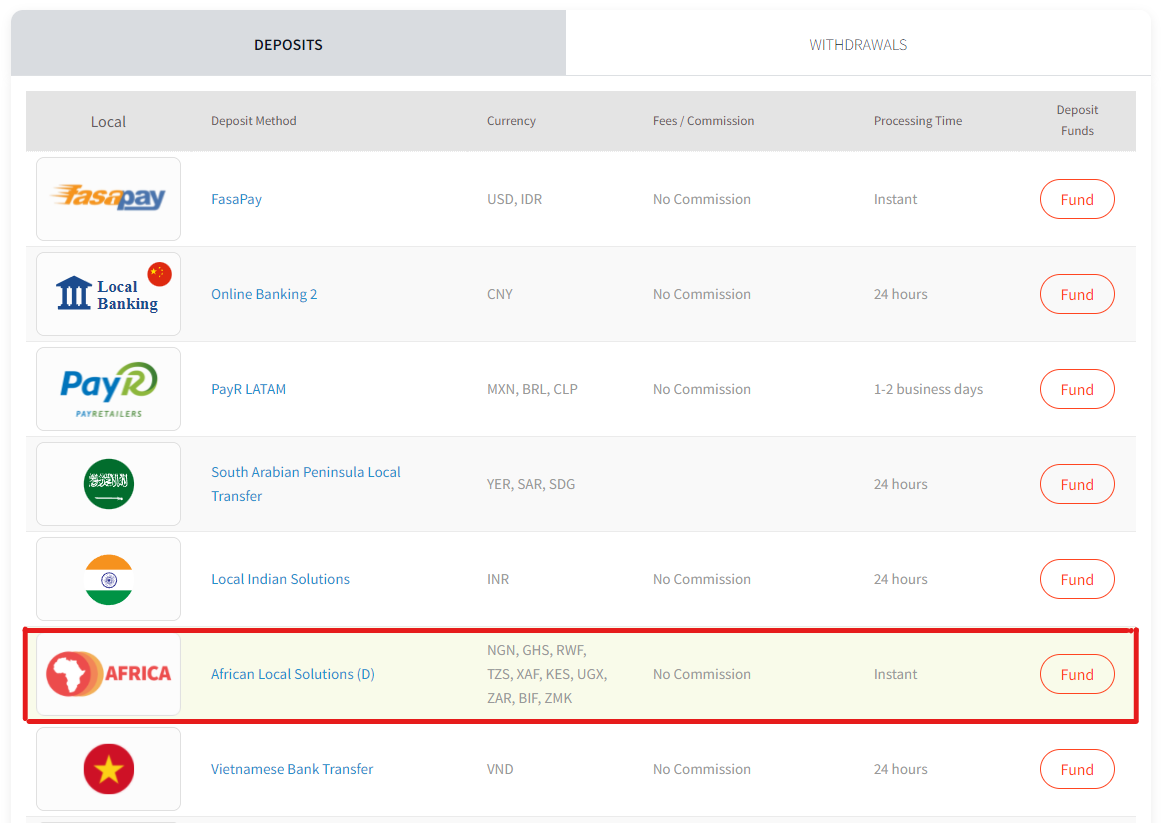

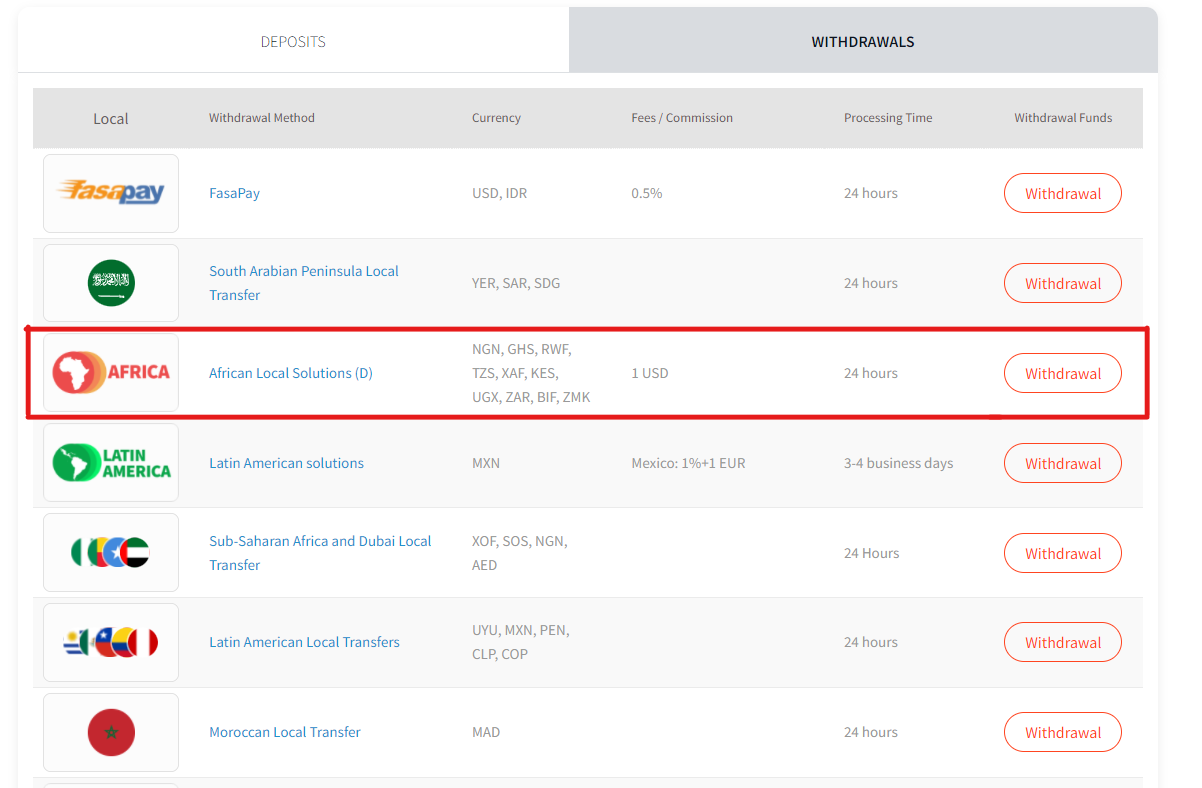

- Local African Solution: FXTM accepts deposits and withdrawals from local bank transfers in South Africa. ZAR deposits can be made through this method without any additional commission for deposit and conversion. Deposits are processed instantly while withdrawals can take up to 24 hours to process. Deposits are free but each withdrawal through this method will incur a fixed commission of $1 or equivalent.

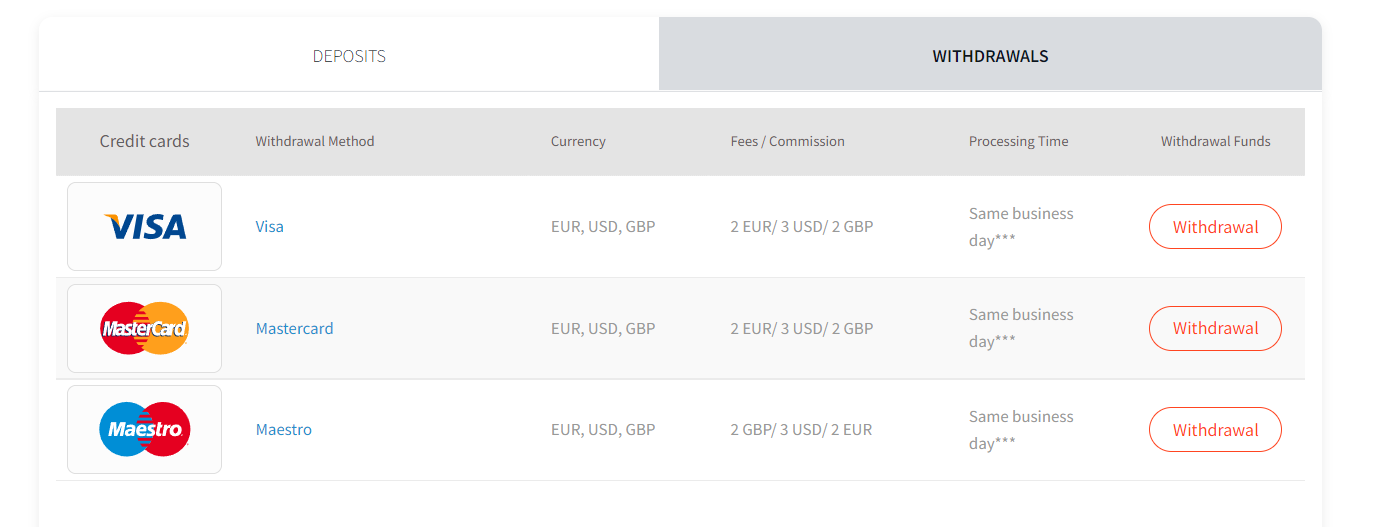

- Credit Cards: Clients in South Africa can deposit and withdraw through the credit cards of VISA, Mastercard, and Maestro. Deposits can be done in GBP, USD, and EUR. The Processing time for deposits is 2 hours and withdrawals can take up to 24 hours to reflect in the bank account.

Deposits through credit cards are free while each withdrawal will incur a fixed commission of 2 EUR/ 3 USD/ 2 GBP. - E-Wallets: Skrill, Neteller, several other e-wallets can be used to deposit and withdraw without any commission. The deposits are processed in 2 hours while withdrawals can take up to 24 hours.

- Bankwire: The bank wire transfer through Barclays Bank and Hellenic Bank are accepted. This may not be the ideal option to deposit as the minimum deposit amount is 500 units of the base currency. The deposits take 3 to 5 business days to process. Each withdrawal will incur a fixed commission of 10 EUR or 5 GBP depending on account currency.

Compared to other CFD brokers in South Africa, the number of available transaction methods is high. Local African Solution is the best method to transact at FXTM in South Africa. A commission on withdrawal is a disadvantage at FXTM.

FXTM Research and Education

FXTM Research and Education Pros

- Diverse Educational Resources: Offers a broad array of educational materials including free e-books, videos, articles, tutorials, and a detailed glossary of terms, catering to traders at different levels of expertise.

- Regular Educational Events: Hosts regular webinars and seminars globally, providing opportunities for in-depth learning and skill enhancement.

- Comprehensive Market Analysis: Provides twice-daily trading signals, economic calendars, video updates, and quarterly market forecast reports to aid in informed decision-making.

- Innovative Learning Tools: Features unique tools like the FXTM Periodic Table for learning forex terminology in a visual format, enhancing the learning experience.

- Accessible Learning Platforms: Educational and research materials are available on a wide range of platforms, making them accessible to a broad audience.

FXTM Research and Education Cons

- Lack of Fundamental Data Tools: Does not offer fundamental data tools, which are important for forex forecasting and analysis that factors in political, social, and economic trends.

- Limited Differentiation in Trading Platforms: While FXTM offers popular MT4 and MT5 platforms, the absence of unique or proprietary trading platforms may be seen as a downside for traders looking for a differentiated trading experience.

- Research Tools Could Be Enhanced: Although FXTM provides a decent number of research tools, compared to some competitors, the research offerings might be viewed as average in terms of depth and breadth.

The research and education tools at FXTM can assist traders to stay connected with the events and activities that can influence forex and CFD markets. However, one may not find the available research and analysis tools at FXTM adequate.

Market Analysis: FXTM usually offers daily market analysis, including technical and fundamental analysis, market news, and insights from their team of analysts. This analysis can help traders stay informed about current market trends and potential trading opportunities.

Economic Calendar: An economic calendar is a crucial tool for traders as it shows scheduled economic events and data releases that can influence the financial markets. FXTM’s economic calendar typically displays key economic indicators and their expected impact on various instruments.

Forex News: FXTM may provide real-time forex news updates, keeping traders informed about the latest developments in the currency markets.

Trading Signals: FXTM might offer trading signals based on technical analysis, providing traders with potential entry and exit points for different instruments.

Education Tools

Educational Articles and Webinars: FXTM usually offers a library of educational articles and webinars covering various trading topics, strategies, technical analysis, risk management, and more. These resources are designed to help traders improve their knowledge and skills.

Video Tutorials: FXTM might provide video tutorials that offer step-by-step guidance on using their trading platforms, understanding trading concepts, and navigating the forex markets.

Demo Accounts: Demo accounts are valuable tools that allow traders to practice trading with virtual funds, helping them become familiar with FXTM’s trading platforms and test their strategies without risking real money.

Forex Seminars and Events: FXTM may organize seminars, workshops, and events in different locations to provide in-person education and networking opportunities for traders.

E-Books and Guides: FXTM might offer downloadable e-books and trading guides on various topics, providing traders with comprehensive educational resources.

FXTM Trading Platforms

FXTM supports the complete suite of MetaTrader 4 trading platform for all account types. The MT4 trading platform is the most widely used CFD trading platform globally. While the MT5 trading platform is an upgraded version of the MT4 mostly preferred by professional and experienced traders. Currently MT5 trading platform is not supported by FXTM in South Africa.

Forex and CFD traders can trade at FXTM through web trading platforms, mobile trading platforms, and desktop trading platforms. Each trader prefers to trade through different mediums. We have separately reviewed each trading platform at FXTM.

Web Trading Platform

The web trading platform at FXTM in South Africa is built on MetaTrader 4 and MetaTrader 5 trading platform. Web platforms has a one-step login and can be customized according to the client. The web trading platform has the market, limit, and stop order. Trailing stop loss order is not available on the FXTM web trading platform. FXTM MT4 and MT5 web trading platform is available in 47 languages.

Overall, the web trading platform is convenient to use through any web browser without downloading any software. However, the web trading platform offers limited features. The accessibility to the charts is also limited.

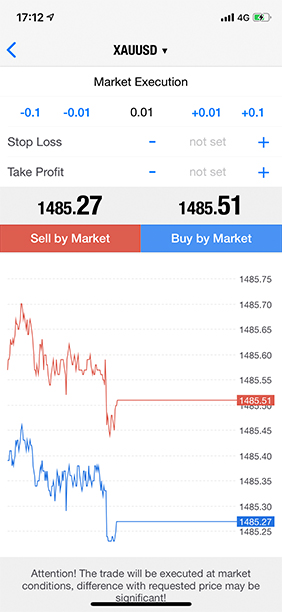

Mobile Trading Platform

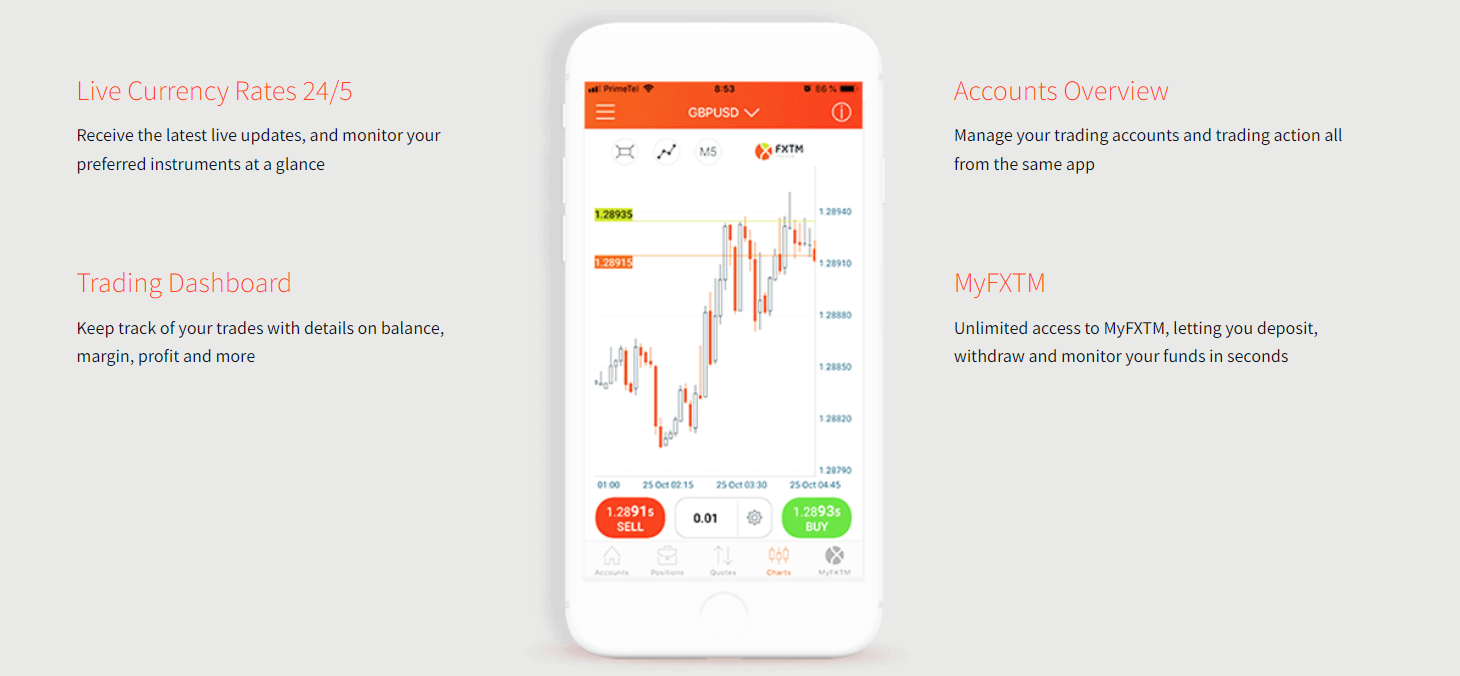

For mobile trading at FXTM in South Africa, two platforms are available. Traders can trade through FXTM trader app and FXTM MetaTrader 4 and MetaTrader 5 application.

The FXTM trader app is a proprietary trading application for mobile and tablet devices. It can be used to open, close, or modify trade orders. It has a user-friendly dashboard where accounts can be managed and monitored on the go.

FXTM MetaTrader 4 app is available on Android and iOS devices. It has a much simpler and older-looking interface compared to the FXTM Trader app. It has a one-step login with no fingerprint or faces ID authentication. The FXTM mobile trading platform has limited features, time frames, patterns, etc.

The MetaTrader 5 mobile trading platform has a better interface and looks modern. It has slightly more features compared to the MT4 platform.

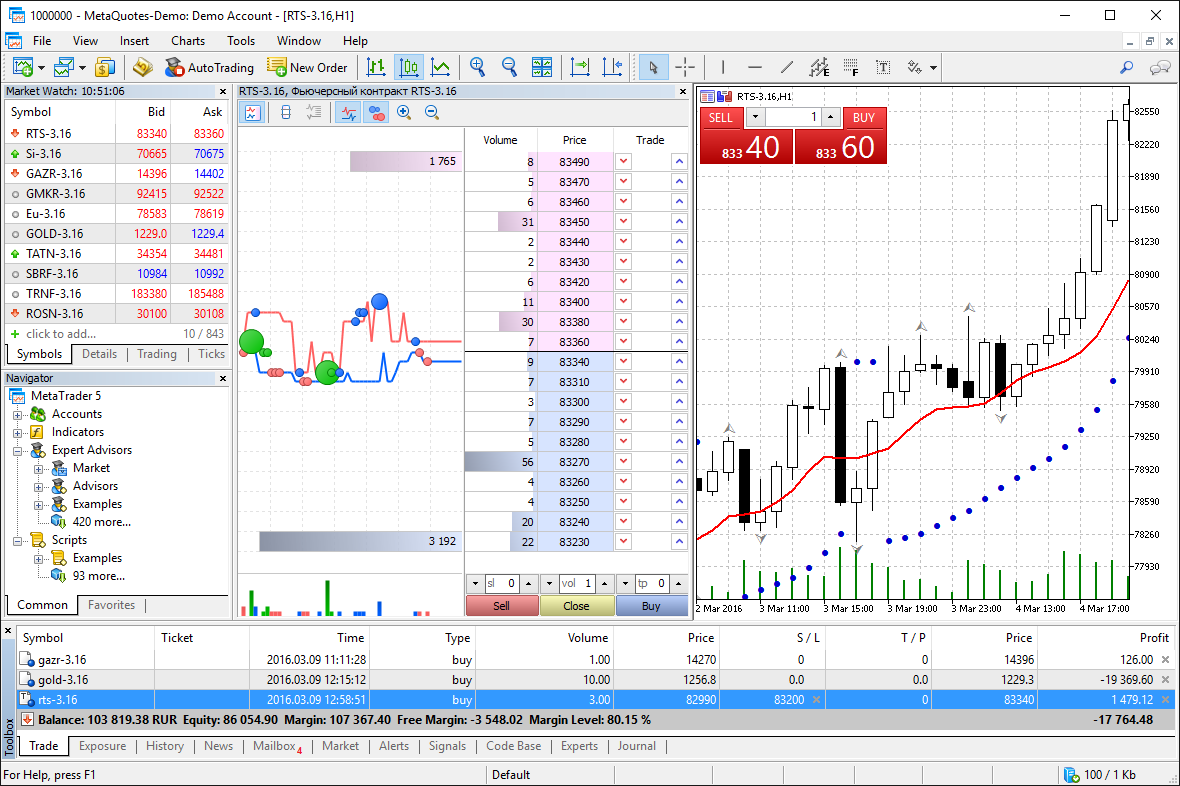

Desktop Trading Platform

FXTM offers MetaTrader 4 and MetaTrader 5 trading platforms that can be downloaded on Windows and macOS desktop devices. The desktop trading platform is similar to the web trading platform but has more features. It can be customized and does not require a login every time.

The MT4 and MT5 desktop trading platform also supports trailing stop loss apart from market, limit, and stop loss orders. FXTM additionally offers regular market updates and volatility alerts through the mailbox on the MT4 trading platform.

At the time of this review, there are no other trading platforms supported with any of the account types.

FXTM Customer Support

Whenever clients face queries, the customer support service can be reached out to resolve them. A user-friendly and easily accessible customer support service can enhance the trading experience. Chat, email, and phone are the three methods available to connect with the support staff at FXTM.

- Live Chat: We tried connecting with the support staff at multiple timings. The support service through the live chat window at the website and app is good. It is available 24/5. FXTM also offers support services through Telegram and Facebook Messenger. They generally reply within 2-5 minutes on a business day.

- E-mail: Queries can also be resolved through email support. They take 3-12 hours for a reply through e-mail. This can be useful when a soft copy of a document is needed from the support staff.

- No Local Phone Support: Clients can connect with the support staff at FXTM directly through international phone number +44 20 3514 1251. The local phone support is not available in South Africa.

- 60 Currency Pairs: Forex trading is done in currency pairs. A total of 62 currency pairs including 19 major pairs can be traded at FXTM. The maximum leverage on Major Forex pairs is up to 1:2000. For the minor and exotic currency pairs the maximum leverage is 1:500 and 1:200 respectively.

- 5 Metals: A total of 5 crosses of gold and silver can be traded as CFD at FXTM. The maximum leverage for XAUEUR, XAUGBP, and XAUUSD (gold crosses) is 1:20 and for XAGEUR, XAGUSD (silver crosses) is 1:500.

- 3 Commodities: UK Brent, US Crude, and US Natural Gas can be traded as CFD on spot prices. The maximum leverage in South Africa for the three energy CFD is 1:500.

- 11 Indices: Major stock indices from the largest stock exchanges of the world can be traded in a spot via CFDs. This includes UK 100, US Tech 100, Germany 30, Europe 50, etc. The Max leverage on CFD of Hong Kong 50 and Spain 35 is 1:10. For all the other CFDs on indices, the maximum leverage is 1:500.

- 1000+ Stock CFDs: Major stocks from American, European, and Asian stock markets can be traded as CFD without commission. 50 stocks are from Europe and 120 from the USA. The maximum leverage for CFD on shares is 1:20.

Overall, we liked the customer support service as the executives are very helpful and diligent. There is no issue in connectivity through all the available methods. The availability of support services through Telegram and Facebook Messenger is an additional advantage.

FXTM Trade Execution Method

FXTM supports STP method for trade execution and claims to be 100% STP broker with no dealing desk.

No Dealing Desk (NDD) Model: FXTM’s STP execution operates on a no dealing desk model, aiming to eliminate potential conflicts of interest and provide more transparent order processing.

Order Routing: When you place a trade, FXTM’s systems automatically route your order to liquidity providers, which can include banks, financial institutions, and other market participants.

Competitive Spreads: STP execution often allows traders to access competitive bid and ask prices from various liquidity providers. This can result in relatively tight spreads, especially during times of high liquidity.

Market Prices: With STP execution, you’re likely to receive execution at the best available market prices. This means that your trades are matched with the prices provided by liquidity providers in the broader market.

Available Instruments

Several financial instruments can be traded as Contract for Deposit (CFD) at FXTM in South Africa. A total of 4 asset classes namely forex, commodities, indices and stocks can be traded as CFD at FXTM.

Clients must note that CFDs are derivative instruments in which there is no physical settlement of the underlying asset. There is no exchange of the asset that is getting traded as CFD. Only the price difference between opening and closing positions is speculated to book profits or losses.

Following are the instruments that can be traded as CFD at FXTM.

Following is a table that compares the available instruments for all asset classes at FXTM in South Africa.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 60 | 1:2000 |

| Indices | 11 | 1:500 |

| Commodities | 8 | 1:500 |

| Shares | 120 | 1:20 |

| Cryptocurrencies | N.A. | N.A. |

Compared to other regulated CFD brokers in South Africa, the number of available forex pairs is impressive. The number of commodities and indices is comparatively lower than most of the peers. Cryptocurrency CFDs and soft commodities CFDs are not available to trade at FXTM.

FXTM Bonus

FXTM has offered several bonus and rewards to new and existing clients in the past. However, we could not find any promotional bonus at FXTM at the time of this review.

There is a referral program that can reward you with $50 every time a referred client opens an account and makes a deposit. Up to $10,000 can be earned with the referral program at FXTM. The new clients referred by the existing client also get a reward of 50$.

Many regulated CFD brokers in South Africa offer attractive bonuses for new as well as existing clients.

Do We Recommend FXTM?

Yes, FXTM is an FSCA-regulated CFD broker and can be considered safe for clients in South Africa. There are multiple account types with a different fee structure to suit the trading styles of different types of traders.

It offers excellent customer support service but the trading and non-trading fees are slightly higher than peers. Clients who wish to trade with an ECN broker that is well-regulated under FSCA can choose to trade with FXTM in South Africa.

FXTM FAQs

Is FXTM regulated in South Africa?

yes, FXTM is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under licence number 46614 and entity name Forextime Ltd.

Is FXTM good for beginners?

Yes, FXTM offers a Micro account for beginners where micro lots can be traded. The account currency is kept in cents and pence instead of dollar and pound. It also offers demo accounts. Several educational content is available on the website that can be used to learn forex and CFD trading.

How much does FXTM charge for withdrawal?

For local African Payment solution or local bank transfer, FXTM incurs a withdrawal commission of $1 or equivalent in the base account currency. Withdrawals through credit/debit cards will include a commission of $3 for each withdrawal. For bankwire transfer, the withdrawal commission is $10. Withdrawals are free at FXTM through e-wallets.

How long is FXTM withdrawal?

The processing time of withdrawal depends on the method chosen by the trader. Withdrawals through local African banks take up to 24 hours to reflect in the account. Withdrawals through credit/debit card takes less than 2 hours while bank wire transfer can take up to 5 working days to reflect in the account.

How do you make money on FXTM?

FXTM is a forex and CFD broker that allows trading with leverage. It is very risky as more than 70% traders face losses at FXTM. Traders can make money at FXTM by placing trade orders and forex pairs and CFDs of financial instruments through the trading platform.

What are the disadvantages of FXTM?

The spreads at FXTM are slightly higher than many regulated brokers while each withdrawal through credit card and bank wire transfer involves a fixed commission. The number of trading instruments is low.

How long does it take to withdraw money from FXTM?

Withdrawals through credit/debit cards are processed and reflected in the bank account within 24 hours on a business day. Withdrawals through e-wallets take less than 2 hours while bank wire transfers can take up to 5 business days to process.

Does FXTM minimum deposit?

$/€/£ 10 is the minimum deposit with the standard account type at FXTM. The minimum deposit for the Advantage and Advantage Plus account types is $/€/£ 500.