FBS South Africa Review 2024

FBS is an FSCA regulated forex and CFD broker in South Africa. They offer multiple account types with low minimum deposits and fixed as well as floating spreads. Check all the pros and cons before opening your account at FBS.

FBS is an FSCA-regulated forex and CFD broker that offers online trading services through electronic trading platforms. It is a well-regulated broker with tight spreads across various financial instruments.

FBS offers trading services in the forex market and provides access to a wide range of currency pairs, as well as CFDs on indices, commodities, stocks, and cryptocurrencies. The broker supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are popular among traders for their features and tools.

In this comprehensive review of FBS South Africa, we have separately reviewed all the aspects of the broker that can affect the traders. We have discussed all the pros and cons of choosing FBS in South Africa.

Our objective is to assist the traders in making an informed decision and know everything about the broker before opening the account. This review has been done specifically for FBS South Africa which is an FSCA-regulated forex and CFD broker in South Africa.

FBS South Africa Pros

- FBS is regulated and authorized by FSCA in South Africa

- MT4 and MT5 trading platform is available for CFD trading

- The minimum deposit is $1

- FBS is an STP broker

- No inactivity fee is charged from traders

- Multiple account types are available to suit different types of traders

FBS South Africa Cons

- Each withdrawal through debit/credit card incurs a minimum commission of $1

- The number of available instruments is less than the majority of forex brokers in South Africa

- Local phone support is not available in South Africa

Table of Content

FBS South Africa Summary

| Broker Name | TRADE STONE SA (PTY) LTD |

| Website | https://fbs.com/ |

| Regulation | ASIC, FSCA, CySEC |

| Year of Establishment | 2009 |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:500 |

| Trading Platforms | MT4, MT5 |

| Trading Instruments | 150+ CFDs on forex pairs, commodities, indices, shares, ETFs, cryptocurrencies |

FBS Safety and Regulation

FBS Safety Pros

- Regulated by FSCA in South Africa

- Regulated by ASIC and CySEC

- Clients are protected under FSCA regulation

- FBS accepts clients from more than 150 countries

FBS Safety Cons

- FBS is not listed on any stock exchange

The safety of traders and their deposited amount greatly depends on the regulatory authority that authorizes and regulates the broker in a particular jurisdiction. Following are the details of regulatory licenses held by FBS in different jurisdictions.

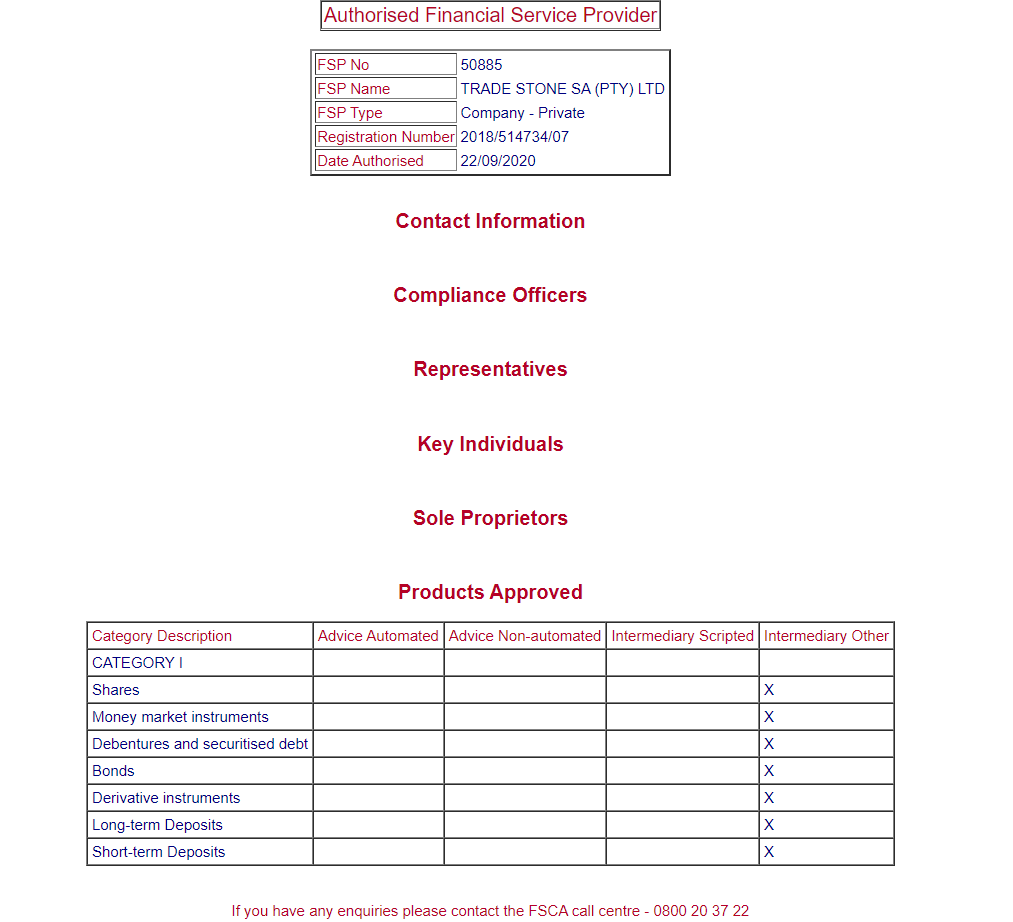

- FSCA

FBS is an authorized financial service provider in South Africa by the Financial Sector Conduct Authority (FSCA). FBS is the trading name of the legal entity Trade Stone SA (Pty) Ltd under license number 50885. FBS acquired the FSCA license on 22/09/2020.

The FSCA is also a top-tier regulatory authority in the jurisdiction of South Africa. South African clients are registered under FSCA regulation. This makes FBS safe for South African clients.

- ASIC

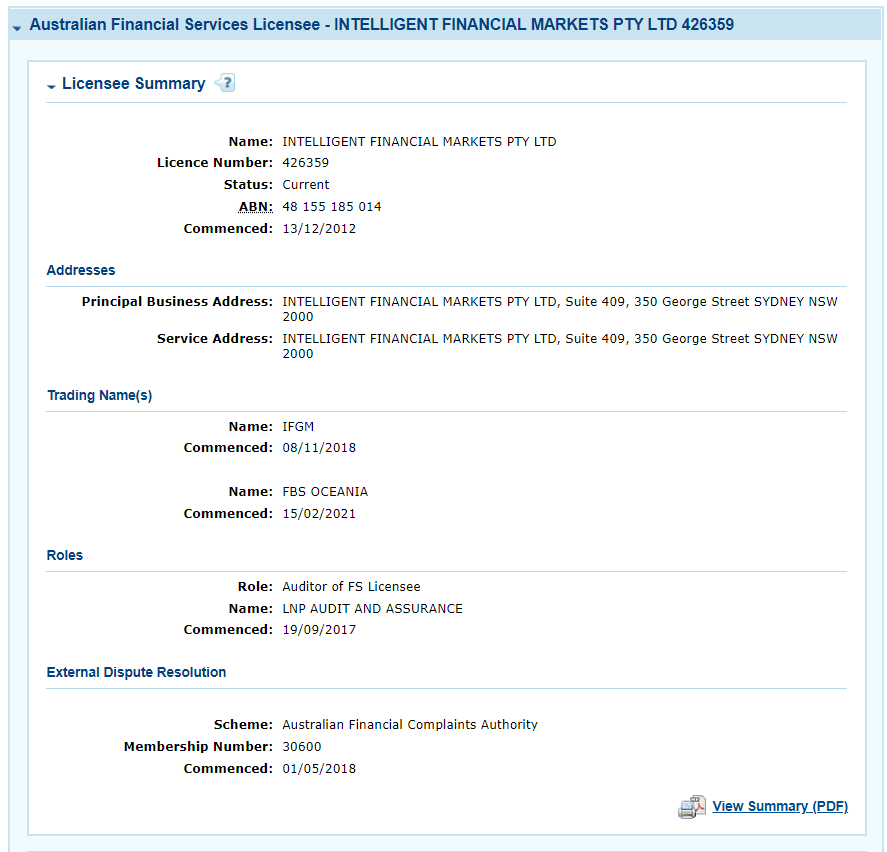

FBS is authorized and regulated by the Australian Securities and Exchange Commission (ASIC). FBS in Australia is registered under ASIC with the legal entity Intelligent Financial Markets Pty Ltd and AFS license number 426359 and ABN number 48 155 185 014.

The trading name of FBS in Australia is FBS Oceania. FBS acquired an ASIC license in 2012. Australian clients at FBS are registered under ASIC regulation and are protected by ASIC regulatory compliance.

- CySEC

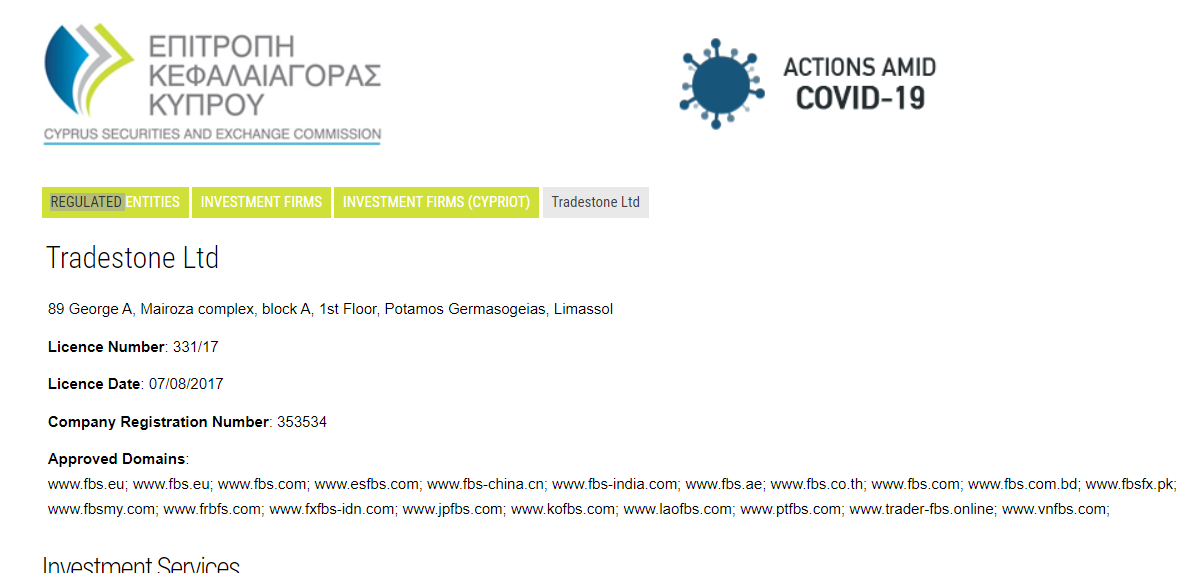

The Cyprus Securities and Exchange Commission is a tier 2 financial regulatory authority based in the island nation of Cyprus. The CySEC regulatory license grants financial services providers the to operate their business in the European Union.

FBS acquired the CySEC license in 2017 with the legal entity Tradestone Ltd and license number 331/17. South African clients are not registered under CySEC regulation.

- IFSC

The International Financial Services Commission (IFSC) is a financial regulatory authority in Belize. The IFSC license allows regulated firms to operate globally. IFSC has lenient regulatory compliance compared to ASIC, FCA, and FSCA.FBS is a registered financial services provider in Belize with the legal entity FBS Markets Inc under registration number 119717. Most global clients at FBS are registered under IFSC regulation but South African clients are not registered under IFSC regulation.

FBS was incorporated in 2009 and is headquartered in Australia at Suite 409, 350 George Street Sydney NSW 2000.

FBS can be considered safe for trading forex and CFDs in South Africa due to FSCA regulation. The broker operates in more than 150 countries and claims to have served more than 23 million traders worldwide.

FBS Fees

FBS Fees Pros

- Multiple account types with different pricing structures available

- Spreads as low as 0.7 pips

- Trading commission is low on commission-based account

- FBS does not incur inactivity fees

FBS Fees Cons

- Each withdrawal will incur AUD 5 or 5% of the withdrawal amount, whichever is higher

- deposits through e-wallets will incur 5% commission

The fees at FBS are lower than average among other FSCA-regulated brokers in South Africa. For a thorough review of the fees, we have separately described the trading and non-trading fees at FBS.

Trading Fees

The fees incurred while trading on forex and CFDs are considered trading fees. FBS offers 3 account types with different fee structures. The trading fee at FBS is different for each account type chosen by the client.

- Spread

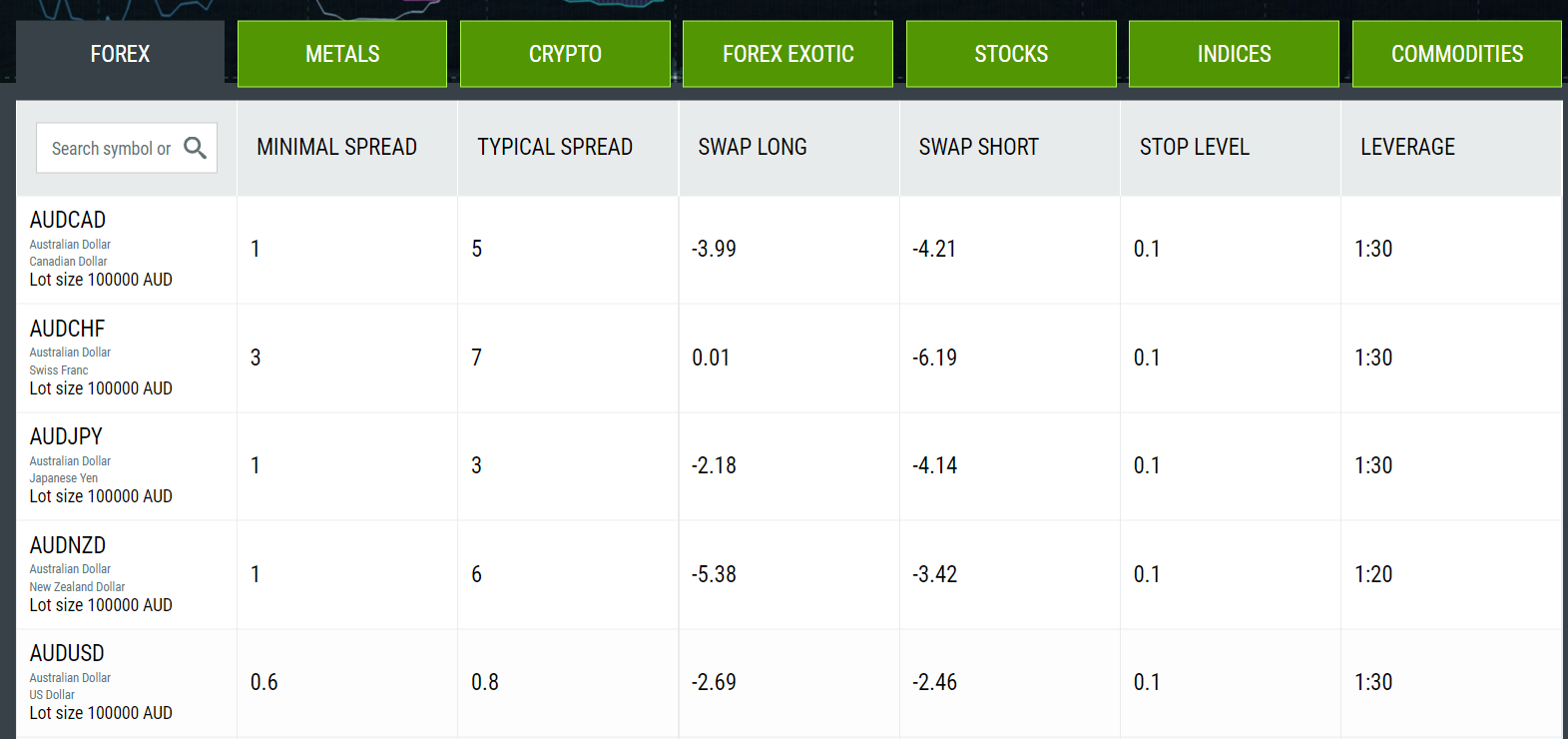

The spreads with the Standard account type are floating and start with 0.7 pips. There is no major difference between Standard and Cent account types in terms of trading fees. The ECN account is a commission-based account where the spreads start from 0 pips. The zero spread account has a fixed spread at 0 and does not fluctuate.The average typical spread for EUR/USD currency pair is 1.1 pips with the Standard account and 0.1 pips with the Ultra account type.

For a better understanding of the spreads incurred at FBS, we have compared the average typical spread charged by some of the most chosen brokers in South Africa. The following table compares the spread charged by the brokers with their commission-free accounts.

Trading Instrument IC Markets FXTM eToro FBS Pepperstone EUR/USD 0.62 1.9 1.1 0.8 0.77 GBP/USD 0.83 2 2.3 0.9 1.19 EUR/GBP 1.27 2.4 2.8 2.6 1.40 USD/JPY 0.74 2.2 1.2 1.2 0.86 USD/CAD 0.85 2.5 1.7 1.4 1.07 - Commission

The trading commission at FBS is only incurred with the Ultra account type. For a round trade of a standard lot, the trading commission with the Ultra account type is AUD 8.12 or USD 6 or EUR 5 depending on the base currency of the account.No trading commission is incurred with the Standard account type at FBS. The Zero spread account is also a commission-based account where no spreads are involved. The spreads with the Zero Spread account are fixed at 0 and do not change. The trading commission is $20 for a round trade of a standard lot.

- Swap Fee

A swap or overnight charge is the fee that is incurred if a leveraged position is kept open overnight. Swap fees are different for each instrument and also differ for long and short positions. The swap fee for EUR/USD at FBS with either of the account types is 6.37 and 0.69 for long and short positions respectively.

Overall, the trading fees at FBS are decent as the spreads are average while the swap fee is slightly higher compared to other FSCA-regulated brokers in South Africa.

Non-Trading Fees

These are the charges that are incurred from traders without executing any trade orders. Following are the components of non-trading fees at FBS in South Africa.

- Deposit/Withdrawal charges

FBS does not charge a deposit fee if the deposits are made through credit and debit cards. For deposits made through Skrill, Sticpay, and Neteller, clients will be charged up to 5% of the deposit amount as a transaction fee.

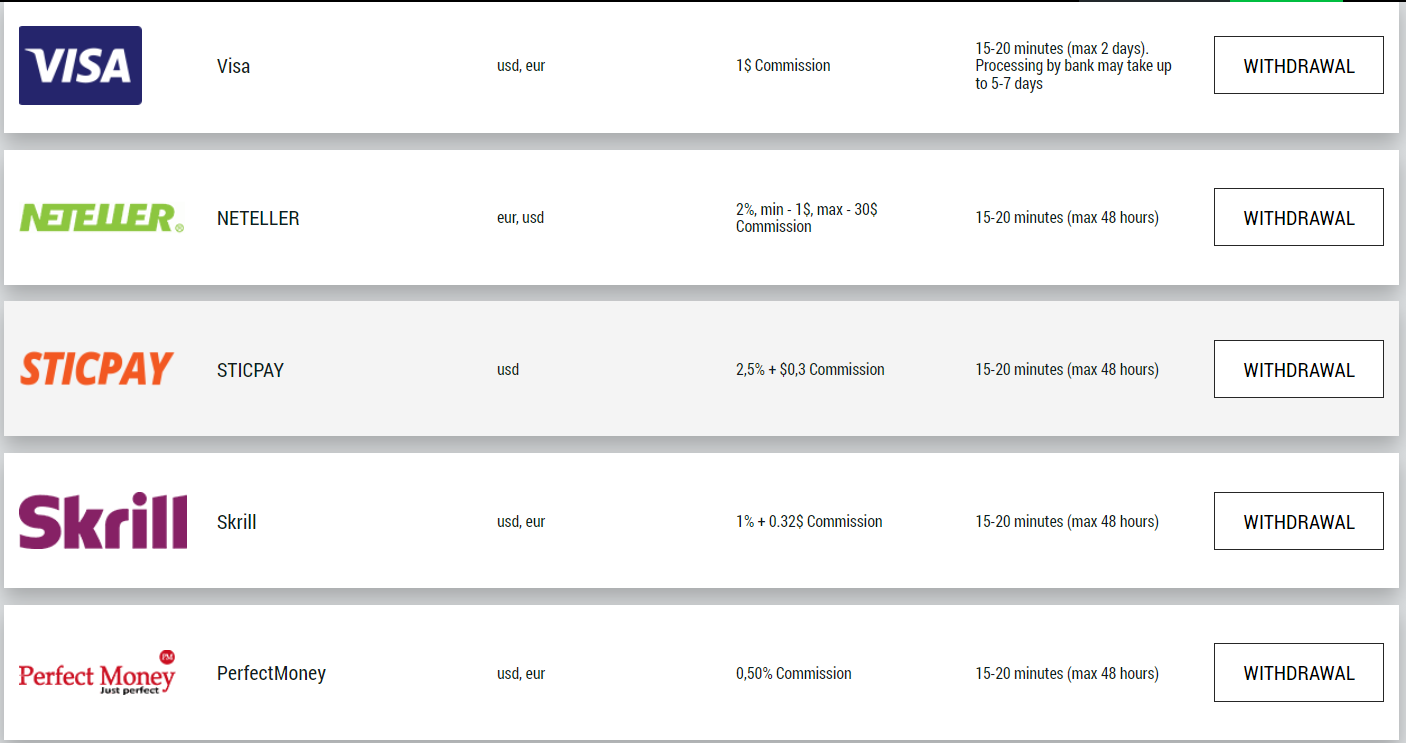

The withdrawals through any of the methods used will incur a minimum commission of $1 or 5% of the withdrawal amount. Free withdrawals cannot be made through any method at FBS.

- Inactivity Fees

The inactivity fee is a monthly fee that is only incurred if no trading activity is witnessed for a prolonged period. Most forex and CFD brokers do charge this fee after a predefined period of inactivity.

Majority of FSCA-regulated brokers do charge inactivity fees but no such charges are incurred at FBS in South Africa.

Apart from this, we couldn’t find any other non-trading charges at FBS. They do not charge any account opening fee. A currency conversion fee may be incurred if the deposit currency differs from the base account currency. This can be an issue for the traders making a deposit in ZAR currency.

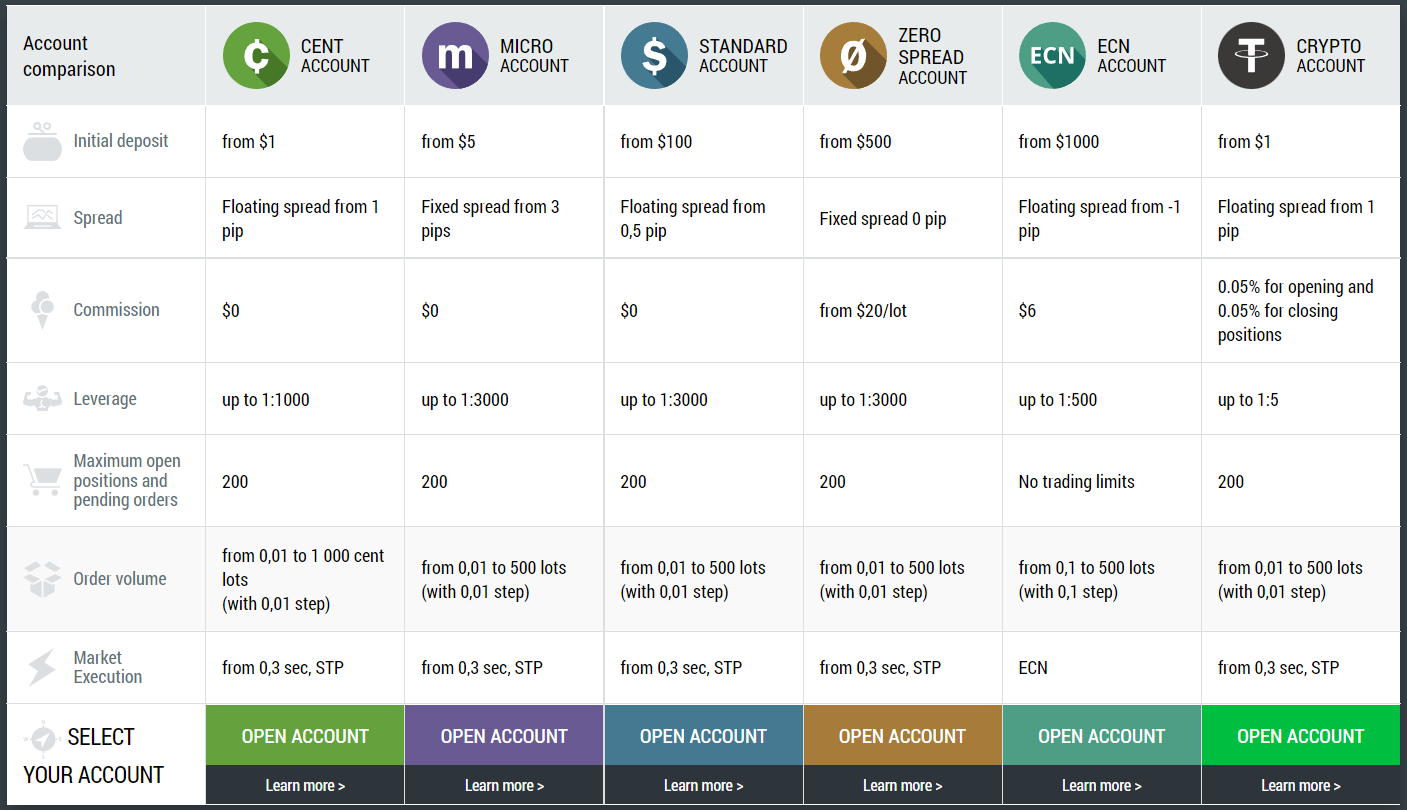

FBS Account Types

FBS offers 6 types of live accounts namely Standard, Cent, Micro, Zero Spread, ECN, and crypto. Following is the description of each account type at FBS.

- Standard Account: The Standard account type at FBS is the basic account type that has the spread-only pricing structure. It allows trading with a maximum leverage of 1:3000 and can be opened with a minimum deposit of $100. This account type offers the best spreads without commission.

- Cent Account: The cent account at FBS can be opened with a minimum deposit of $1. The trading fee is built into spreads starting from 1 pip. This account allows traders to trade with cents as the base currency. It is ideal for beginners who wish to gain experience with a small deposit amount and trading volume.

- Micro Account: The Micro account type at FBS can be opened with a minimum deposit of $5. the spreads start from 3 pips and the maximum leverage is as high as 1:3000.

- Zero Spread Account: The Zero spread account at FBS allows traders to enjoy trading without spreads. The spreads with this account are fixed at 0. The minimum deposit amount is $500 and the commission is $20 per lot for a round trade.

- ECN Account: The ECN account at FBS can be opened with a minimum deposit of $10000 with spreads as low as 0 pip. The trading commission with the ECN account is much lesser than the Zero Spread account i.e. $6 for a round trade of a standard lot.

- Crypto account: The crypto account is ideal for specifically trading the cryptocurrencies in South Africa. The spreads start with 1 pip while there is also a commission of 0.05% of the trading volume. This account can be opened with a minimum deposit of $1.

Apart from pricing structure, there are no major differences between the account types at FBS in South Africa. All the account types require a minimum deposit of 50 units of the base account currency.

AUD, USD, and EUR can be selected as the base currency of the account while opening the account and cannot be changed later on. ZAR is not available as base currency of the account at FBS.

How to Open an Account at FBS?

The account opening process at FBS is simple and can be done through the FBS website from any device. Following are the steps to open an account at FBS in South Africa.

- Step 1: Open Account

The first step is to visit the official website of FBS and click on open account at the top right corner of the window. - Step 2: Email and Name

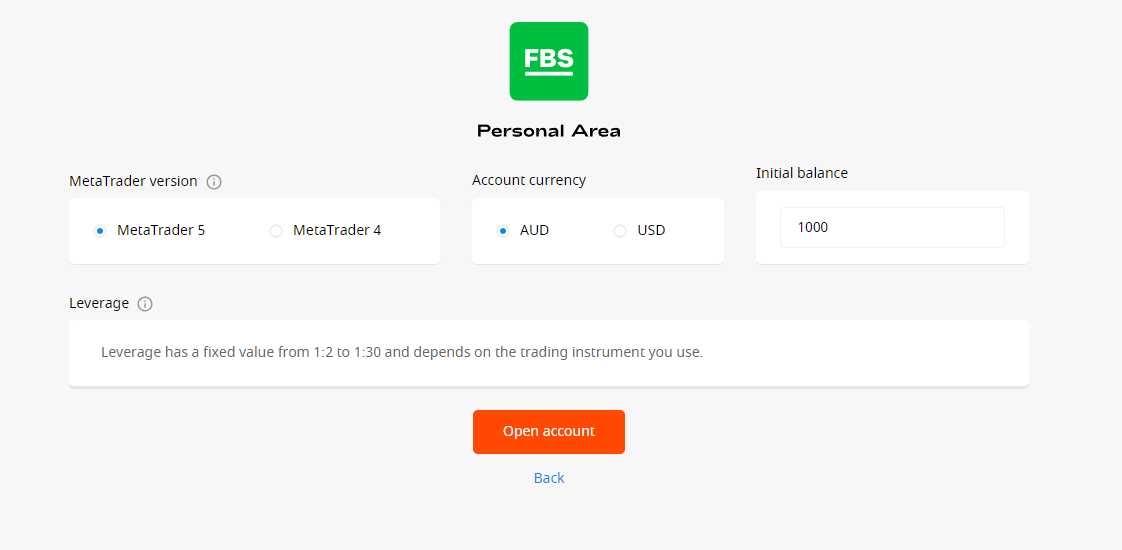

Once you click on open account, you will be redirected to a separate window where the location can be changed. Here clients need to enter the email address and full name of the trader as on the documents. - Step 3: Configure the Account

The next step is to choose the account type and base account currency. Traders can choose between 3 live accounts namely Standard, Cent, and Ultra according to their preference. The base currency can also be chosen between AUD, USD, and EUR. Trading platforms can be chosen between MT4 and MT5. - Step 4: Verify Email and Phone Number

The next step is to verify the email and phone number that you have entered. A mail will be sent to your email address with the link to verify the email. After that, clients can choose the password for their account to login in the future. - Step 5: Document Verification

After email and phone verification, clients can log in to their personal area and submit the documents to complete the KYC process. The executives at FBS will approve the documents within a few hours on a business day. - Step 6: Deposit and Trade

The last step is to make a deposit through any of the available methods. 4 methods to deposit are available in South Africa. The chosen trading platform can be downloaded on your device for instant login. After making a deposit, trade orders can be placed through the chosen trading platform.

FBS Demo Account Review

Demo accounts are used to learn about the forex market, gain experience in the market, and test trading strategies. FBS offers a useful demo account for traders with virtual currencies. This account can be configured in multiple ways to suit the traders.

To open a demo account at FBS in South Africa, traders need to visit the official website on the web or download the FBS application on mobile. After clicking on ‘open demo account’, clients will be redirected to a page similar to a real account opening page. However, clients only need to provide their email to open a demo account. No other details are to be provided for a demo account.

After email confirmation, traders can configure the demo account by choosing the trading platform between MT4 and MT5. AUD and USD are the two options for the account currency of the demo account. Clients can enter any amount, to begin with, the demo account.

The demo account at FBS can only be opened with the pricing structure of the Standard account. There is no option to choose the commission-based ‘Ultra’ account type.

Overall, the demo account is useful for beginners as well as experienced traders at FBS. Those who prefer to trade with commission-based pricing with a low spread won’t find the demo account at FBS much useful. The choice of account type could have made it more useful for all types of traders.

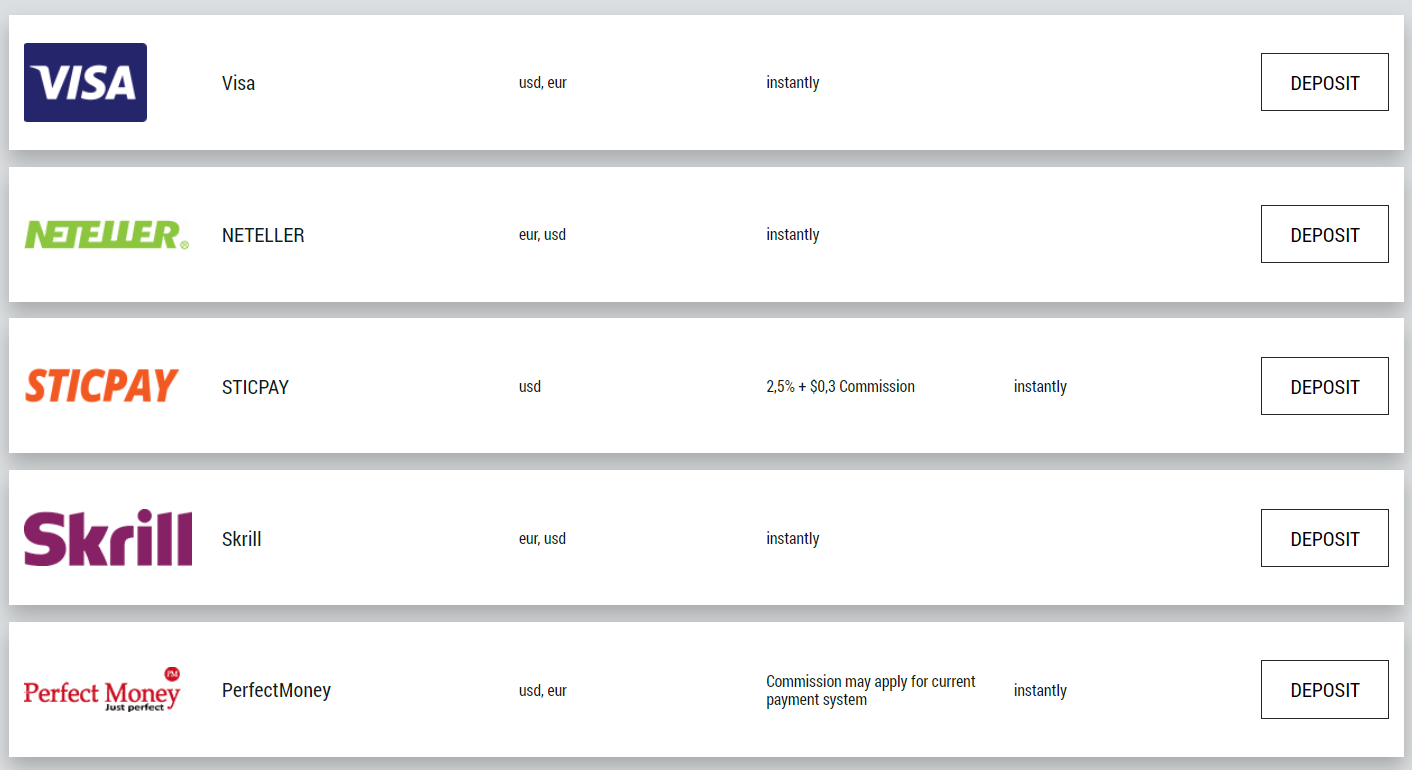

FBS Deposits and Withdrawals

FBS Deposit/Withdrwal Pros

- Multiple Deposit and Withdrawal Options: FBS offers various methods for depositing and withdrawing funds, including bank transfers, credit/debit cards, and e-wallets like Neteller, PerfectMoney, Skrill, and Sticpay.

- Low Minimum Deposit: FBS allows traders to start with a very low minimum deposit, making it accessible for beginners or those with limited capital.

- Cryptocurrency Transactions: FBS supports depositing with various cryptocurrencies, providing more flexibility for traders interested in using digital currencies.

FBS Deposit/Withdrawal Cons

- Withdrawal Fees: While depositing is generally free, there may be withdrawal fees depending on the method chosen, so it’s essential to check the specific charges for your preferred withdrawal method.

- Withdrawal Limitations for Credit/Debit Cards: Although you can deposit using credit/debit cards, there might be limitations or specific conditions for withdrawals back to cards, which could require using alternative withdrawal methods like bank transfers.

- Account Verification Required: Before making withdrawals, FBS requires account verification, which is a standard procedure but might be seen as an inconvenience by some users.

- Delay in Deposit Processing: On some occasions, deposits may show up with a delay in the account, which can be a drawback for traders who need immediate funding.

FBS supports convenient deposits and withdrawals in AUD, USD, and EUR currencies. However, withdrawals will incur commission. Following are the methods that can be used for deposits and withdrawals at FBS in South Africa.

- Credit/Debit Cards: FBS accepts free deposits through VISA and Mastercard debit and credit cards. The deposits are processed instantly while the withdrawals may take 2 days. The processing of withdrawals by the bank may take 5-7 working days. The withdrawals through this method will incur a fixed commission of $5 per transaction.

- E-wallets: Skrill and Neteller are the two e-wallets that can be used to deposit and withdraw at FBS in South Africa. The deposits, as well as withdrawals, are processed instantly through both the payment gateways. Deposits are free but the withdrawals will incur a commission of 4.99% through both e-wallets.

According to our analysis and comparison with other brokers, the withdrawal fees at FBS are higher for all methods.

FBS Trading Platforms

FBS offers multiple trading platforms for different devices. We have separately reviewed the available trading platforms at FBS for different devices. For Desktop and web trading platforms, MT4 and MT5 are available at FBS. For mobile devices, FBS also offers their proprietary trading application called FBS Trader apart from MT4 and MT5.

Web Trading Platform

MetaTrader 4 and MetaTrader 5 are the available web trading platforms at FBS with all the available account types. Both these web trading platforms are third-party platforms. These are available in multiple languages and can be customised according to the client’s needs.

The web trading platform offers limited features compared to desktop platforms. Online external trading tools and plugins can be paired with these platforms. It has a one-step login and can be accessed through any web browser on desktop devices.

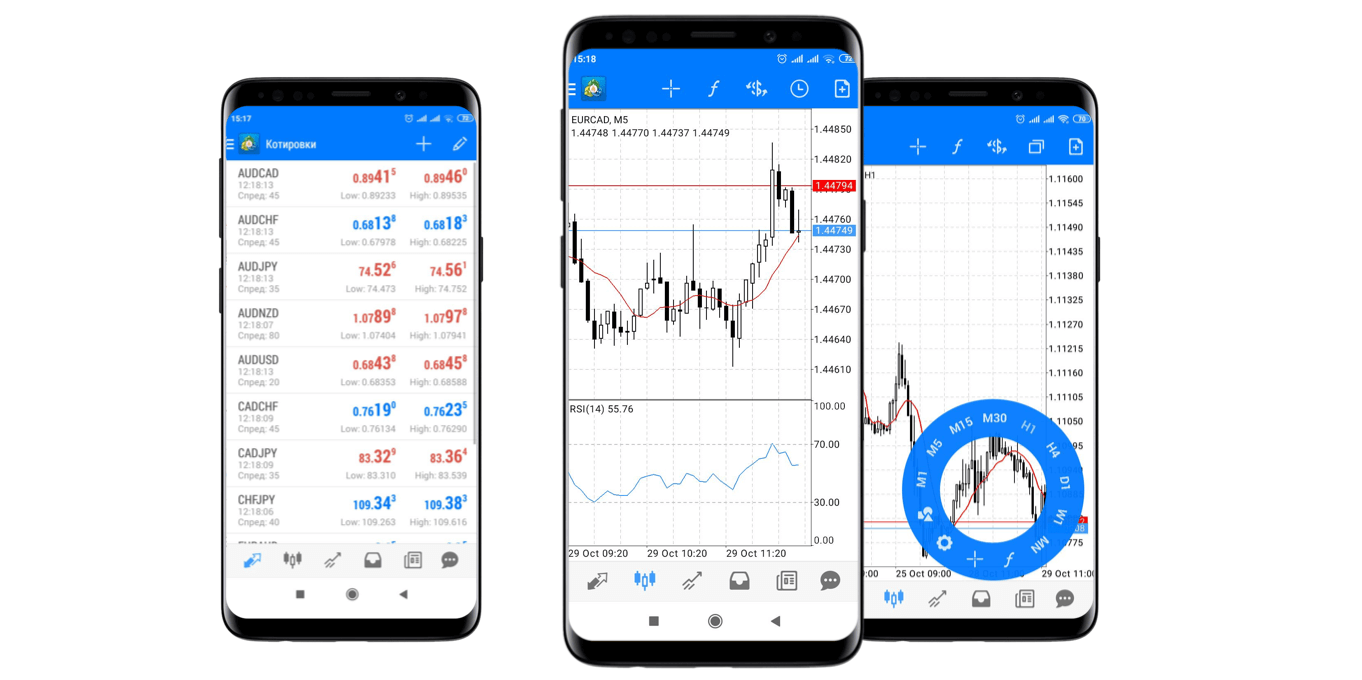

Mobile Trading Platform

For Android and iOS devices, FBS offers three trading platforms including their proprietary trading app. FBS Trader is an innovative trading platform for mobile devices with a simple interface and fast execution. The FBS Trader app is ideal for beginners but advanced traders might not find useful tools in the FBS Trader app.

Apart from FBS Trader App, MT4 and MT5 trading applications can also be downloaded on Android and iOS devices. MT4 and MT5 mobile apps can be linked with the FBS trading account to trade from mobile. These two apps are developed by MetaQuotes software but the accounts are managed by FBS.

The interface of MT4 and MT5 trading applications looks older and more complex compared to the FBS Trader app. Although the processing speed is the same with more trader tools and features.

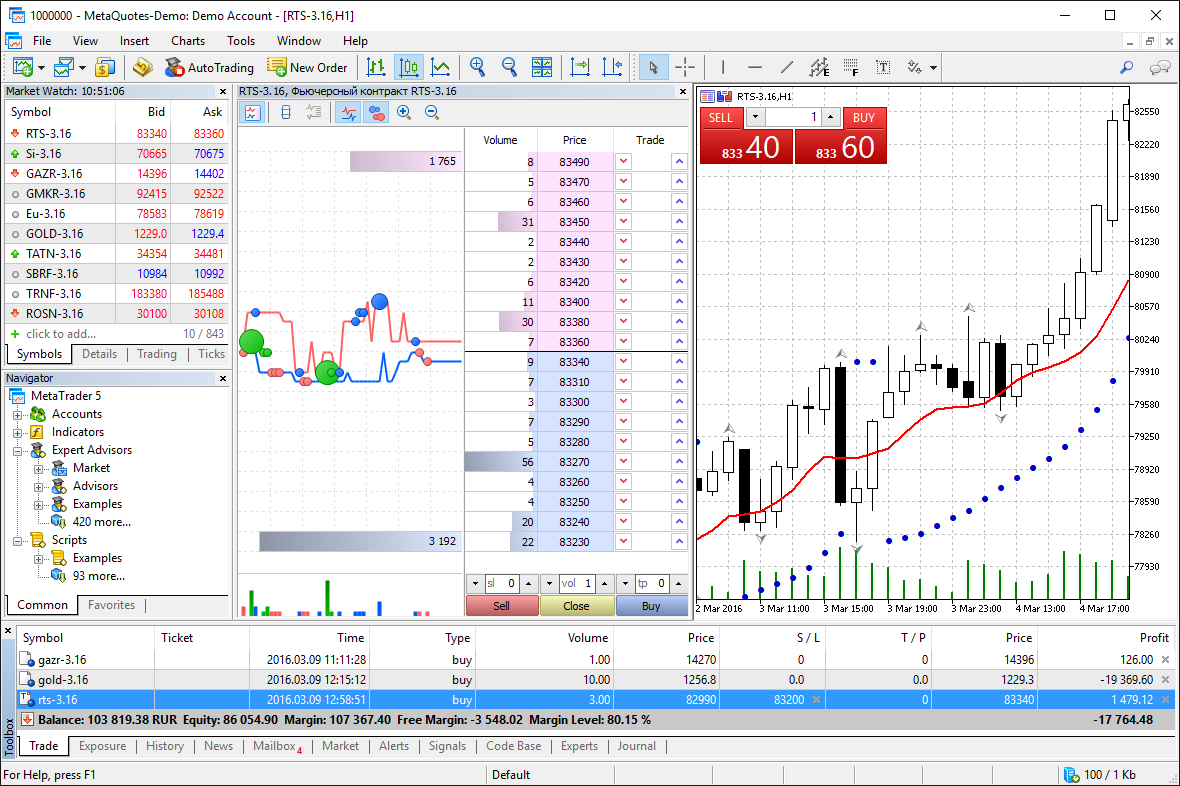

Desktop Trading Platform

MetaTrader 4 and MetaTrader 5 are the two options for desktop trading platforms at FBS.

MT4 has a simple interface that looks similar to Windows 98. MT4 has fewer timeframes, indicators, and features compared to MT5 but is the most chosen forex and CFD trading platform globally. It was introduced by MetaQuotes Software in 2005 and is still used by a large number of traders.

MetaTrader 5 or MT5 is an upgraded version of MT4 that offers more advanced tools. MT5 is preferred mostly by experienced and professional traders. This platform allows easier access to algorithmic trading through the MQL5 language. The look and feel of MT5 are also better than MT4 with better visuals and features.

MetaTrader 4 and MetaTrader 5 are available at FBS for web, mobile, and desktop. The FBS Trader App is only available for mobile devices and is a much more convenient platform for beginners. No other trading platforms are available at FBS.

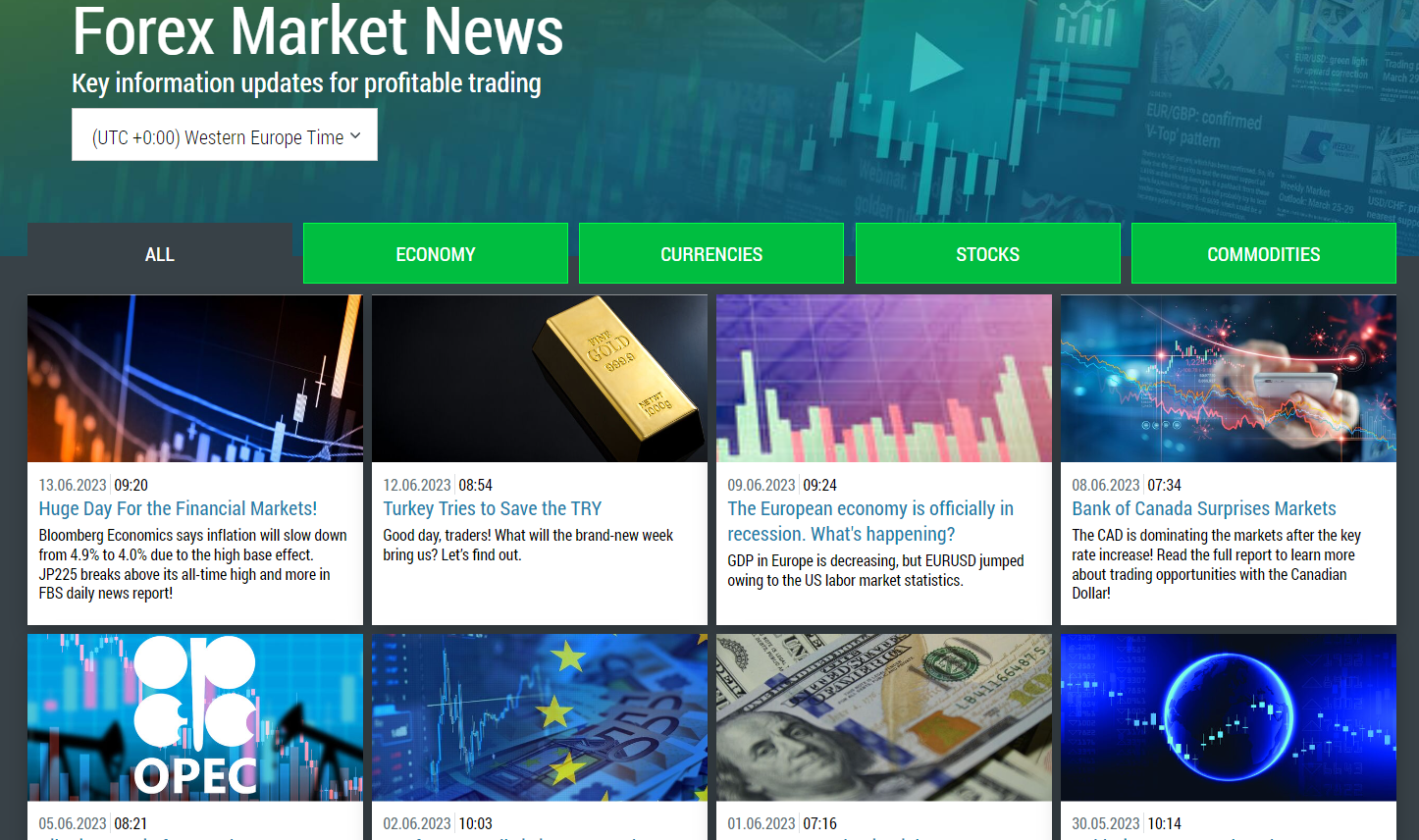

FBS Australia Research and Education

FBS offers a variety of research and analysis tools to assist the traders. Clients can access all the available tools at FBS through the official website and application under ‘Analytics and Education’ section.

The latest trends in the global capital markets and the events that can affect the prices of capital markets are published on a regular basis under the Forex News and Daily Market Analysis sections. Clients can stay updated with the latest trends and get assistance with their fundamental analysis of the capital markets.

The VIP analytics is an exclusive research report on various capital markets that is offered only to the clients who have deposited a total of $500 or more on FBS. The VIP analytics report is sent daily to the eligible traders.

Apart from this, FBS also offers trader tools like economic calendar, forex calculator, and currency converter. They also support a variety of education tools like forex guidebook, tips for traders, webinars, video lessons, seminars, and glossary.

FBS South Africa Customer Support

The customer support service at FBS is excellent for South African clients. There are multiple methods to reach out to the support executives at FBS.

- Live Chat: The live chat window is available on the official FBS website and is available on 5 business days. We raised multiple queries at different times to review their support service.

They generally take less than 2 minutes to revert on queries raised through live chat. The replies were helpful and relevant to the queries.

- Email support: Queries can also be raised through email [email protected] and the support executives will revert back within 3 hours through email. It is a helpful method to connect with FBS but it takes longer than live chat so it might not be that helpful to resolve a query.

- No Phone Support: FBS does not offers local phone support for South African clients.

.

Overall, the customer support services at FBS are good for South African clients. The support staff is diligent and friendly. They will assist you at every step with or without opening the account at FBS. Traders can also raise random queries before opening the account to check the support services.

Available Instruments

The number of available trading instruments at FBS is comparatively lower than many other FSCA-regulated brokers. However, all the major pairs that are mostly traded worldwide are available at FBS. Following are the details of available instruments at FBS in South Africa.

- 37 Currency Pairs: A total of 28 forex pairs can be traded at FBS with the Standard account type. The maximum leverage for retail traders is 1:30 for most of the pairs. A few minor and exotic pairs have a maximum leverage of 1:20. The number of available pairs with the Ultra account is 25 as exotic pairs cannot be traded with the Ultra account type.

- 5 Commodities CFD: A total of 5 commodities are available to trade at FBS namely UK Brent, US Crude, US Natural Gas, Gold, and Silver. The maximum leverage on gold CFD is 1:20 while all other commodities have max leverage of 1:10.

- 32 Cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple are available to trade with USD crosses. The maximum leverage of cryptocurrency CFD is 1:5.

- 11 Index CFD: A total of 11 indices can be traded with a maximum leverage of 1:20.

- 100+ Shares CFD: More than 100 majorly traded shares from the US, UK, and Australia can be traded as CFD with a maximum leverage of 1:5.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 37 | 1:30 for majors, 1:20 for Minors, Exotics |

| Indices | 11 | 1:20 |

| Commodities | 5 | 1:20 for Gold, 1:10 for others |

| Shares | 82 | 1:5 |

| Cryptocurrencies | 5 | 1:2 |

The number of available instruments is lower than most FSCA-regulated forex and CFD brokers. It must be noted that all the available financial instruments at FBS can only be traded as Contract for Deposit (CFD). This means that there is no actual buying or selling of the underlying assets. Only the difference between the opening and closing of the position is settled with cash.

FBS Trade Execution Method

FBS is a forex and CFD broker that typically operates using two trade execution methods for its clients, which are as follows:

Instant Execution: FBS offers instant execution for certain types of accounts. With this method, when a trader places an order, the trade is executed at the current available market price without any delays. The trade is either accepted or rejected instantly, depending on the prevailing market conditions.

Market Execution: FBS also provides market execution for some of its account types. With market execution, the trader’s order is executed at the best available market price once the order is submitted. This execution method is particularly common in ECN (Electronic Communication Network) account types, where orders are directly routed to liquidity providers for execution.

Do We Recommend FBS?

Yes. FBS is an FSCA-regulated forex and CFD broker that uses the STP method for order execution. It is also regulated by ASIC and CySEC. They offer low-cost trading with multiple pricing structures to suit different types of traders.

The number of instruments is lower than the majority of FSCA-regulated brokers but MT4, as well as MT5 trading platforms, are supported. They do not offer ZAR-based trading accounts with no local bank deposits and withdrawals and no local phone number for customer support in South Africa.