Best Forex Trading Apps in South Africa

We have ranked the best forex trading apps for traders in South Africa. The Forex Trading apps in our list are based on their trust score, fees, platforms, support & other factors.

Almost every forex or CFD broker offers an app that can be used on Android or iOS devices. This has made forex trading highly convenient, but it does not mean that every forex broker is safe to trade through.

Forex brokers need to be regulated by the FSCA (Financial Sector Conduct Authority) and other top-tier regulators in order to be considered safe.

This is why we’ve brought you this list, in which we cover the safest and best forex trading apps that are available to traders operating from South Africa.

6 Best Forex Trading Apps in South Africa for Beginner Traders

- Exness – Best Forex Trading App for South Africans

- HotForex– Good Forex Trading App for Beginners

- AvaTradeGo App – Forex Trading App for Fixed Spread

- FBS – Best Regulated Forex App

- XM – MetaTrader Broker App

- FXTM Trader App – Well Regulated Trading App

Our methodology is simple but effective. We check the safety of forex brokers by confirming their regulated status and the licenses that they hold.

Further, we ensure that these brokers have local deposit and withdrawal options in ZAR so that it is convenient for South African traders. Lastly, we check their ratings and trading capabilities to ascertain whether they provide good services to their traders/users.

So, without further ado, here are the best forex trading apps for South Africans, according to our independent research.

Best Forex Trading apps in South Africa

Let’s compare the detailed review of these forex trading apps one by one for better understanding & comparison.

#1 Exness – Best Forex Trading App for South Africans

Exness is a popular forex broker that has been in operation since 2008.

Trust Score: In terms of the trust, Exness gets a score of 9 out of 10. This is because Exness is regulated by the FSCA of South Africa and holds FSP No. 51024. They are registered in South Africa under the name Vlerizo Pty Limited. Additionally, Exness (UK) Ltd is regulated by the FCA & Exness (Cy) Ltd is regulated by CySEC. Overall, Exness broker has a high trust score due to its multiple regulations.

However, the major drawback is that it is not regulated by top regulators such as the FCA of the UK or the ASIC of Australia.

Trading and Non-trading Fees: Exness offers two types of accounts- Standard and Professional. The fees charged depend on the type of account held by the trader. Under the Standard account, they charge a spread that begins from 0.3 pips. They do not charge a commission under the Standard account.

They offer three types of Professional accounts – Raw Spread, Zero, and Pro. Under the Raw Spread account, they charge a very tight spread which starts from 0 pips but they also charge a commission of up to USD 3 per trade.

As far as non-trading fees go, Exness does not charge any fees for deposits or withdrawals, however, you may be charged a payment processing fee by your payment service provider. Further, Exness does not charge any inactivity fee.

Funding Options: Exness offers ZAR as the base currency or account currency for your trading account. This means that you can deposit and withdraw funds denominated in ZAR. Exness offers a variety of methods through which you can deposit or withdraw funds including offline bank transfer, online bank transfer, Bitcoin, UPI, and Skrill.

App Features: The Exness trading app is available for both Android and iOS. Some of the key features available through the app are 24/7 customer support, free trading signals, a built-in economic calendar, single-tap orders, and quick deposits.

We found the app to be quite user-friendly. The app takes up very less storage space and is quite fast.

Trading Conditions: The minimum deposit that you need to make depends on the type of account you want to open. For example, if you want to open a Professional account, then you need to make a minimum deposit of USD 500.

Exness offers currencies, stocks, energies, and metals to trade. However, the overall range of trading instruments is smaller than that offered by comparable brokers.

Exness provides up to unlimited leverage, however, you can trade with a leverage of 1:1 as well.

Exness Pros

- Low minimum deposit (R150)

- Multiple account types available

- Exness is regulated by FSCA in South Africa

- ZAR available as base currency of the account

- No non-trading charges are incurred

Exness Cons

- High trading commission on commission-based accounts

#2 HotForex – Good Forex Trading App for Beginners

HotForex has been around since 2010 and provides STP services.

Trust Score: HotForex gets a score of 9/10 from us in terms of safety and trust. The company is regulated by the FSCA of South Africa and carries FSP No. 46632. Additionally, the broker is regulated by the FCA of the UK which is a tier-1 financial authority. The broker is also licensed to operate by the CySEC of Cyprus, the DFSA of the UAE, and the FSA of Seychelles.

Further, Hotforex also provides other security features such as negative balance protection, segregation of funds, and insurance.

Trading and Non-Trading Fees: HotForex offers a total of seven account types, each with a different fee structure. Out of the seven account types, six do not charge any commission and only charge a spread. For example, the typical spread for trading the benchmark EURUSD currency pair is 1.2 pips.

If you trade through the Zero Spread account, you will be charged a commission of USD 7 per lot, but the spread will be very tight.

HotForex does not charge any fee for withdrawal or deposit and they do not charge an inactivity fee.

Funding Options: HotForex offers ZAR-denominated accounts for traders from South Africa. They provide a variety of ways in which you can make a deposit including local bank transfers, wire transfers, debit cards, credit cards, and payment wallets.

Depositing or withdrawing funds is quite a smooth process, and HotForex provides a timeline of how soon you can see your funds reflected in your trading account.

App Features: HotForex offers an MT4 or MT5 trading app which is both available for Android and iOS. The trading app is feature-rich since it is powered by MetaTrader which is the most popular trading platform in the world. You have the option of choosing MT4 or MT5 for your trading needs.

You can enjoy features such as 20+ technical indicators, live tick chart trading, trading history, real-time profit or loss, and so on. The trading apps are meant to be highly user-friendly and require almost no setup time.

Trading conditions: You will need to make a minimum deposit of $5 if you want to trade through HotForex. However, this amount can be more depending on the type of trading account that you choose.

HotForex offers a leverage of up to 1:1000. They offer a large number of currency pairs, metals, energy, indices, cryptocurrencies, ETFs, bonds, shares, and commodities. The overall range of trading instruments is quite high when compared to similar brokers.

HotForex Pros

- Low minimum deposit ($5)

- Multiple account types available

- HotForex is regulated by FSCA in South Africa

- ZAR available as base currency of the account

- Local phone support available in South Africa

HotForex Cons

- Spreads are higher than average

- support services not available on weekends

#3 AvaTradeGo App – Forex Trading App for Fixed Spread

AvaTrade is a market-making broker that was founded in 2006.

Trust Score: In terms of safety, Avatrade gets a score of 8/10. The broker is well-regulated and holds an FSCA license with FSP No. 45984. AvaTrade is registered in South Africa under the name Ava Capital Markets Pty Limited.

In addition, AvaTrade is also regulated by the ASIC of Australia which is a tier-1 financial regulator. Further, AvaTrade also carries licenses from Ireland, Poland, the British Virgin Islands, Japan, and the United Arab Emirates.

Avatrade also ensures trader safety through practices such as negative balance protection and segregation of funds.

Trading and Non-Trading Fees: AvaTrade is a fixed spread broker. This means that the spread charged by the broker does not depend on the timing of the trade. AvaTrade charges a spread of 0.9 pips for trading the benchmark EURUSD currency pair.

It does not charge any commission on trades. This makes it very cost-effective to trade through Avatrade. Overall, their fees are lower than other comparable brokers.

In terms of non-trading fees, AvaTrade does not charge any fees for withdrawal, deposit, or inactivity. Hence, there are no hidden fees when you trade through them.

Funding Options: Avatrade does not offer ZAR-denominated trading accounts. Hence, you will need to deposit funds denominated in USD. Avatrade offers wire transfers, bank transfers, and debit/credit card transfers, as means to make a deposit. You can also make a transfer through certain payment wallets.

Their withdrawal process is also quite transparent and they will provide a timeline within which you can expect the funds to show up in your bank account.

App Features: The AvaTradeGo app is rich in features such as market trends, social trends, technical charts, multi-lingual support, and more. The trading app is available for both Android and iOS devices. Their trading app integrates seamlessly with the rest of the features offered by AvaTrade.

Trading Conditions: The minimum deposit that must be made in order to start trading through Avatrade is $100. Even though the minimum deposit is quite high, the overall cost of trading through Avatrade is low thanks to their fixed spread and no commission policy.

Avatrade provides a large range of trading instruments such as more than 60 currency pairs, stocks, indices, cryptocurrencies, ETFs, bonds, and commodities.

AvaTrade Pros

- AvaTrade is regulated by FSCA in South Africa

- User friendly trading platform

- Local phone support available in South Africa

- Spreads at Avatrade are lower than average

- No non-trading fees exist

AvaTrade Cons

- High inactivity fees

- No choices for account types

- ZAR is not available as base currency

#4 FBS – Best Regulated Forex App

FBS was founded in 2009 and has made a name for itself in the trading space in a short time.

Trust Score: FBS is a well-regulated broker that holds FSP No. 50885 from the FSCA of South Africa. The company is also regulated by the CySEC of Cyprus and the IFSC of Belize. The company is registered in Belize for international traders (including traders from South Africa). An FBS group company called Intelligent Financial Markets is also regulated by the ASIC of Australia.

Further, FBS also follows safety practices such as negative balance protection.

Hence, we accord it a trust score of 8/10.

Trading and Non-Trading Fees: FBS offers traders the option to choose between variable spread, tight spread, and zero spread.

The typical spread for trading the benchmark EURUSD currency pair is 1.1 pips through their Standard account (with no commission).

The broker charges a commission of $6 per trade when trading through its ECN account. If trading through its Zero Spread account, the commission charged is $20 per trade per lot.

However, FBS does charge a deposit and withdrawal fee from its traders. The fee depends upon the mode of payment chosen by the trader.

FBS does not charge any inactivity fees.

Funding Options: FBS does not offer ZAR-denominated accounts for traders based in South Africa. The funding options available to traders is also quite limited. You can only make a deposit through your debit card or credit card in USD or EUR. Other options include payment wallets like Neteller, Skrill, or local exchanges.

In terms of funding options for South African residents, FBS falls short of other international brokers.

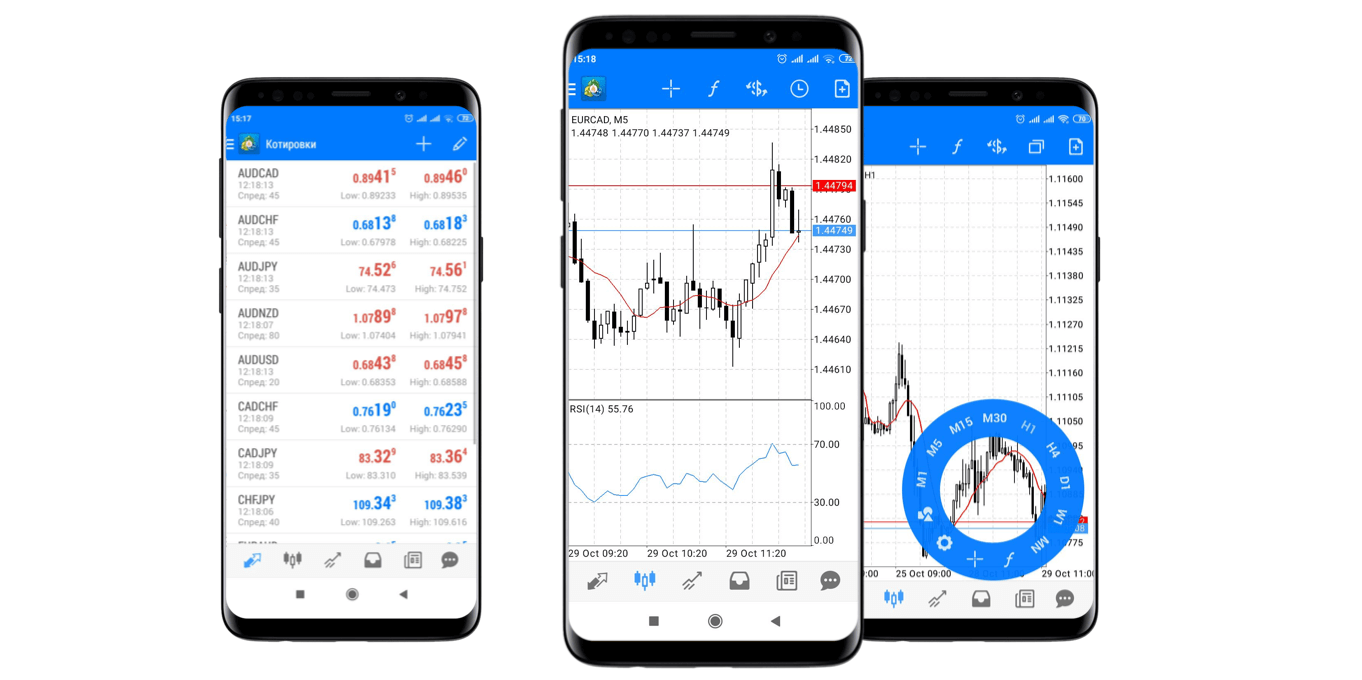

App Features: FBS offers a smart trading app for users of both Android and iOS. They have a proprietary trading app that provides features such as 24/7 customer support, multilingual customer support, a demo account, and more.

The trading app is quite limited in terms of technical indicators and charts, however, it is an easy-to-use app that works for new traders.

Trading Conditions: To trade through FBS, you will need to make a minimum deposit of $1 which is very attractive. Further, FBS also offers a deposit bonus to incentivize making a higher deposit.

The company offers a small range of trading instruments such as 28 or more currency pairs, indices, metals, commodities, and stocks. They do not offer any cryptocurrencies.

FBS Pros

- FBS is regulated by FSCA in South Africa

- Multiple trading accounts available

- Local phone support available in South Africa

- Low minimum deposit requirement

- No non-trading fees exist

FBS Cons

- High trading commission

- ZAR is not available as base currency

#5 XM – MetaTrader Broker App

XM was founded in 2009 and is a market-maker

Trust Score: XM has been accorded a low trust score of 5/10 because it is not regulated by the FSCA. It holds licenses from the IFSC for international traders (including those from South Africa) and the CySEC of Cyprus. It is also not regulated by any top-tier financial regulators such as the FCA or the ASIC.

However, XM does follow safety practices such as negative balance protection and segregation of funds.

Trading and Non-Trading Fees: XM charges a variable spread from its traders that depends upon the instrument being traded, the timing of the trade, and the type of account held by the trader.

Through their Standard account, the typical spread for trading the benchmark EURUSD currency pair is 1.7 pips. As can be seen, their charges are on the higher side when compared to other comparable brokers.

There is no commission if you’re trading through the Ultra Low, Micro, or Standard accounts.

However, they charge a commission of USD 0.04 per share if you’re trading through their Shares account. The commission varies depending on the type of instrument being traded. They also charge a minimum commission per trade through the Shares account.

Funding Options: XM offers a variety of ways in which you can make a deposit or withdrawal. Once you’ve signed up, you’ll have the option of choosing between local bank transfers, wire transfers, credit cards, debit cards, or certain payment wallets.

You can deposit money in any currency and it will automatically be converted into the base currency of your account.

Depositing money is convenient and hassle-free, and they provide a timeline of when you can expect the money to reflect in your account.

App Features: XM offers the MetaTrader 4 or MetaTrader 5 apps for traders who want to trade through their smartphones. Both platforms are available for Android and iOS. XM does not offer any proprietary trading platform, however, the MT4 and MT5 apps are more than enough.

The trading app is one of the most popular in the trading space. They offer a variety of advanced features such as technical indicators and tools, intuitive and informative charts, fast execution speeds, customer support, and more.

Trading Conditions: XM requires a minimum deposit of $5. They offer a wide variety of instruments including more than 50 currency pairs, more than 1000 stock CFDs, commodities, metals, indices, and energy. They also provide helpful customer support in case of any issues.

XM Pros

- The spreads at XM are very low

- User friendly trading platform

- Local phone support available in South Africa

- Low minimum deposit (R70)

- Low non-trading fees

XM Cons

- The parent company of XM is well regulated by XM is not regulated by FSCA

#6 FXTM Trader App – Well-Regulated Trading App

FXTM is a market-making broker that was started in 2011.

Trust Score: FXTM has a high trust score of 8/10. It is regulated by the FSCA and carries FSP No. 46614. The broker is also regulated by the FCA of the UK which is a tier-1 financial regulator, hence, it increases the credibility of the broker. FXTM is also regulated by the CySEC of Cyprus which is another reputable financial regulator.

FXTM also implements safety practices such as the segregation of funds and negative balance protection.

Hence, FXTM is considered to be a safe broker for South African traders.

Trading and Non-Trading Fees: FXTM charges a typical spread of 1.9 pips for trading the benchmark EURUSD currency pair through its Standard account. This is quite high when compared to other similar brokers.

FXTM only charges a commission from traders using its ECN account. They charge a commission of USD 2 per lot per side.

Even though FXTM does not charge a deposit fee, they do charge a withdrawal fee depending on the payment method being used.

Further, FXTM charges an inactivity fee if your account has been dormant for more than 6 months.

Funding Options: FXTM allows for the local bank transfers in ZAR for South African residents. They also have a variety of other deposit methods such as debit cards, credit cards, and payment wallets.

App Features: FXTM has a proprietary mobile trading app called FXTM Trader. This app is available for both Android and iOS users. The app provides functions such as live rates, tracking features, demo accounts, and more. You can also deposit and withdraw funds directly through the app.

The app does not have advanced features like sophisticated technical indicators or charts. However, it is intuitive and the user experience is smooth.

Trading Conditions: FXTM requires a minimum deposit of $10 to open an account. They provide a wide range of trading instruments such as more than 60 currency pairs, and CFDs for stocks, metals, indices, commodities, and cryptocurrencies.

FXTM Pros

- FXTM is regulated by FSCA of South Africa

- Multiple trading platforms available

- Local phone support available in South Africa

- Low minimum deposit (R70)

- ZAR can be chosen as base currency of the account

FXTM Cons

- The spreads at FXTM are higher than average

How Did We Select the Best Forex Trading Apps?

Use our methodology to pick the best forex trading app that suits your needs. Every forex broker is different and their services can differ greatly. Hence, it is important to do proper research before choosing a broker.

1) Is The Broker Regulated by the FSCA: Being regulated by the South African financial regulator means that the broker is held accountable in your country. Hence, you can raise issues or initiate disputes through local courts in case there are any problems. This also means that the broker is following South African laws when they offer their services to you.

It is important to crosscheck the license number of the broker available on their website with the corresponding number on the FSCA website. This allows you to ensure that the broker is genuine and is really licensed by the FSCA.

For example, Exness on its website states that they are regulated by the FSCA and hold the FSP No. 51024. You can enter this number on the FSCA website and confirm that the license number belongs to Exness.

2) How Much Does it Cost: If the overall fees charged by a broker are too high, then you should avoid registering with them. There are several low-cost brokers available that provide great services.

, For example, , if you’re considering trading through a broker like Exness, you should go on their website and check the fees that they charge. You should check the typical spread, commissions, overnight fees, deposit and withdrawal fees, and inactivity fees.

If you do not find any information on their website, then feel free to contact customer support and ask your questions.

3) How Good is the Trading App: A feature-less app can be a detriment to your trading success. You need an app that offers advanced features like charting and technical indicators. The app should also be easy to use.

You should download the trading app on your smartphone and try it out before signing up with the broker. If the broker requires registration, then open a demo account and try it.

4) Is It Easy to Deposit and Withdraw Funds?: It should be easy to deposit and withdraw funds from your account. They should have local banking methods to make it a smooth process. South Africa has exchange control laws that make it difficult to deposit foreign funds through debit or credit cards. Hence, you should ensure that the broker takes local bank transfers.

5) Available Instruments: You should ensure that the instruments that you want to trade are offered by the broker. There is no point in signing up with a broker that does not offer the instruments that you want to trade. The available instruments can be checked on the broker’s website.

6) Customer Support Services: Traders must check the quality of customer support services before choosing a forex trading application. The support services should be accessible in a trading app at any instance. clients can raise random queries to check the support services.

7) Availability of Demo accounts: Demo accounts are highly beneficial for beginners to learn and gain experience regarding forex and CFD trading. Demo accounts are also useful for experienced traders who wish to test their strategies by practising and improvising.

Comparison of Best Forex Trading Apps in South Africa

| Forex Trading App | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| Exness |

0.3 pips in Standard Account

|

$10

|

1:2000

|

Visit Broker |

| HotForex |

1.3

|

$5

|

1:1000

|

Visit Broker |

| AvaTradeGo App |

0.9

|

$100

|

1:400

|

Visit Broker |

| FBS |

0.1

|

$1

|

1:3000

|

Visit Broker |

| XM |

1.9

|

$5

|

1:888

|

Visit Broker |

| FXTM |

1.9

|

$10

|

1:1000

|

Visit Broker |

Difference Between Trading Application, Trading Platform and Broker

Before starting to trade with any of the best forex trading apps in South Africa, it is important to understand the difference between a forex trading application, trading platform, and broker.

A trading platform is where all the trade orders are processed and executed. However, clients are required to open an account with a regulated broker before they can trade through any of the platforms.

Trading applications are mobile trading apps that may allow trading as well as account management. MT4 and MT5 are the most chosen forex trading applications globally. Traders cannot trade on MT4, MT5, and cTrader trading applications without opening an account with a broker that supports the chosen platform.

Some brokers only support their proprietary trading platforms which are developed themselves. Such brokers do not support third-party trading applications.

Trading applications may or may not allow trading. If you are trading with MT4, MT5, or the cTrader platforms you will need to download the trading platform separately. The applications of brokers that use their party trading platforms do not allow trading on their applications. These apps can be used to track the account, deposit/withdraw, research, education, and other purposes.

The brokers that have proprietary trading platforms allow trading as well as other features on the same app. Plus500 offers a proprietary trading app while HotForex, FXTM, XM, etc, use third-party trading platforms to execute trade orders.

Risk of Trading Forex Through Mobile Application

- Limited Screen Space: Smaller mobile screens can make it difficult to analyze charts and data effectively, impacting trading decisions.

- Connectivity Issues: Mobile trading depends on internet connectivity. Poor signal or connection issues can lead to delayed trades or missed market opportunities.

- Simplified User Interfaces: Mobile apps often have less functionality compared to desktop platforms, potentially limiting advanced trading strategies.

- Security Concerns: Mobile devices are susceptible to security risks like unauthorized access or malware. It’s vital to use secure networks and strong passwords.

- Increased Human Error: The smaller interface and potential distractions increase the risk of making mistakes in trades.

- Battery Dependency: Extensive use of trading apps can drain battery life, risking sudden shutdowns during crucial trading times.

- Limited Market Monitoring: Relying only on a mobile app can restrict continuous market tracking and quick reaction to changes.

- Lack of Advanced Tools: Some mobile apps may not offer comprehensive technical analysis tools necessary for in-depth market analysis.

- App Security: It’s important to download trading apps from reputable sources to avoid fraudulent applications.

- Market Volatility: Mobile trading in volatile markets might be challenging due to the reduced ability to react swiftly to fast price movements.

FAQs on Best Forex Trading Apps in South Africa

Which app is best for Forex trading?

According to our research, most of the FSCA-regulated brokers offer their Apps. Exness, AvaTrade & HotForex are regulated brokers in SA with good forex trading apps.

How to download a Forex Trading App?

You can download a forex app for Android or iOS from the broker’s website. Once you have completed the KYC, the broker will send you details with URL/link from where you can download the app or install it on your device.

What app do most forex traders use?

Majority of forex traders around the globe trade on MetaTrader 4 trading application. It is one of the oldest forex trading apps with a very simple design and fast execution. MT5 and cTrader are also chosen by a lot of forex traders globally.

Which forex broker is legit in South Africa?

MT4, MT5, and cTrader are legitimate forex trading apps. However, the accounts at any trading app will be managed by the broker. Hence, the broker must be regulated by FSCA in South Africa. Traders must ensure that the broker they are choosing is legitimate and regulated.

Do forex traders pay tax in South Africa?

Yes, profits booked in forex trading are liable for income and capital gain tax in South Africa according to prevailing tax rates. Currently, if a forex trader books profit of more than R75,000 the profits will be taxed at 28%.

Which bank is best for forex trading in South Africa?

Several banks in South Africa allow forex trading but they do not provide enough leverage. This makes it less feasible for retail traders. To trade on 1 standard lot of EUR/USD, traders may require capital of $100,000 without leverage. CFD trading is the best alternative for retail traders to trade on forex pairs with deposits as low as $10.

Which Trading Platform is the Best in South Africa?

MT4, MT5, and cTrader are most widely used trading platforms in South Africa. Proprietary trading platforms like Plus500 and AvaTrade offer their own trading platforms that have the user-friendly interfaces. According to our analysis, MT4 can be considered as best forex trading platform in South Africa.

Which forex trading app is best for beginners?

For beginners, the best forex trading app should have low spreads without trading commission and FSCA regulation. The app should have adequate research and education tools along with a demo account to assist the traders.

According to us, Exness and HotForex are the best forex trading app for beginners.

Which Forex App has the Lowest Fees?

We check the overall fees, which include non-trading & trading costs. Overall, Exness with their Standard Account & HotForex with Zero Account has low overall costs.