eToro South Africa Review 2024

eToro is a well regulated online CFD broker. It allows trading on its proprietary trading platform with user friendly interface and convenient copy trading feature. eToro does not accept clients from South Africa.

eToro is an online broker that provides CFD trading services on various financial instruments and crypto investments. They offer a unique social trading platform where clients can conveniently copy trades of other traders around the globe. However, eToro does not accept clients from South Africa.

eToro is an online platform for trading stocks, cryptocurrencies, and more. It’s known for its easy-to-use interface and allows you to copy the trades of experienced investors.

eToro is a popular social trading platform known for its user-friendly interface, social trading features, and diverse asset selection. It offers innovative tools like CopyPortfolios and is regulated in multiple jurisdictions. However, users should be aware of potentially higher fees, and limited research tools.

eToro is an established broker with a proprietary trading platform. It is regulated by Several regulatory authorities in various jurisdictions. There are several pros and cons of choosing eToro for trading CFDs.

eToro South Africa Pros

- eToro is regulated by top-tier FCA and ASIC regulatory authorities

- User friendly proprietary trading platform is available for CFD trading

- The minimum deposit is $50

- More than 3000 trading instruments are available

- Cryptocurrencies can also be held as physical asset at eToro

- Copy trading does not involve any additional commission

- Clients with higher equity (>$5000) receive premium services

eToro South Africa Cons

- eToro Does not accept clients from South Africa

- Spreads are slightly higher than average

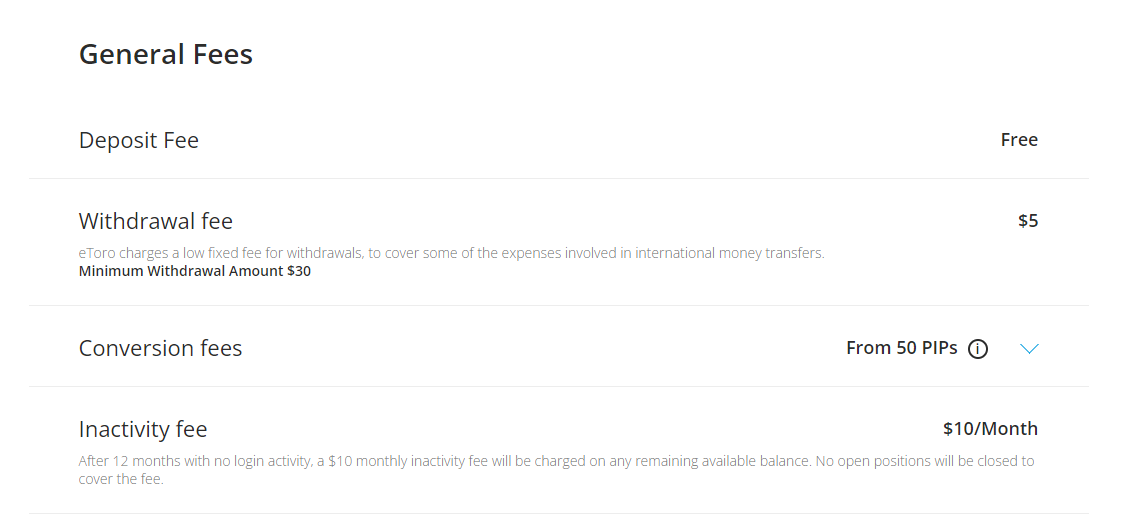

- Each withdrawal incurs a fixed commission of $5

- MT4, MT5, or cTrader trading platform are not available

- Inactivity fees ($10/month) are charged after 12 months of inactivity

- Local phone support is not available

We are committed to providing honest and unbiased reviews of forex and CFD brokers. Traders and investors must check and compare every aspect of the brokers before choosing any FSP.

Our review includes details of regulation, fees, account types, trading platforms, available instruments, and several other important factors.

Clients residing in South Africa must note that eToro currently does not accept new clients from South Africa.

Table of Content

eToro Summary

| Broker Name | eToro (Seychelles) Ltd |

| Website | www.etoro.com |

| Regulation | FSAS, ASIC, FCA, CySEC |

| Year of Establishment | 2007 |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:30 |

| Trading Platforms | eToro Proprietary |

| Trading Instruments | 3000+ CFDs on forex pairs, commodities, indices, shares, ETFs, cryptocurrencies |

Safety and Regulation

eToro Safety Pros

- Regulated by FCA, ASIC, and CySEC

- eToro is transparent with their financials

eToro Safety Cons

- eToro is not listed on any stock exchange

- eToro is not regulated by FSCA in South Africa

The safety of traders and investors with any financial service provider depends largely on the regulation under which clients are getting registered.

Following are the details of major regulatory licenses held by eToro globally.

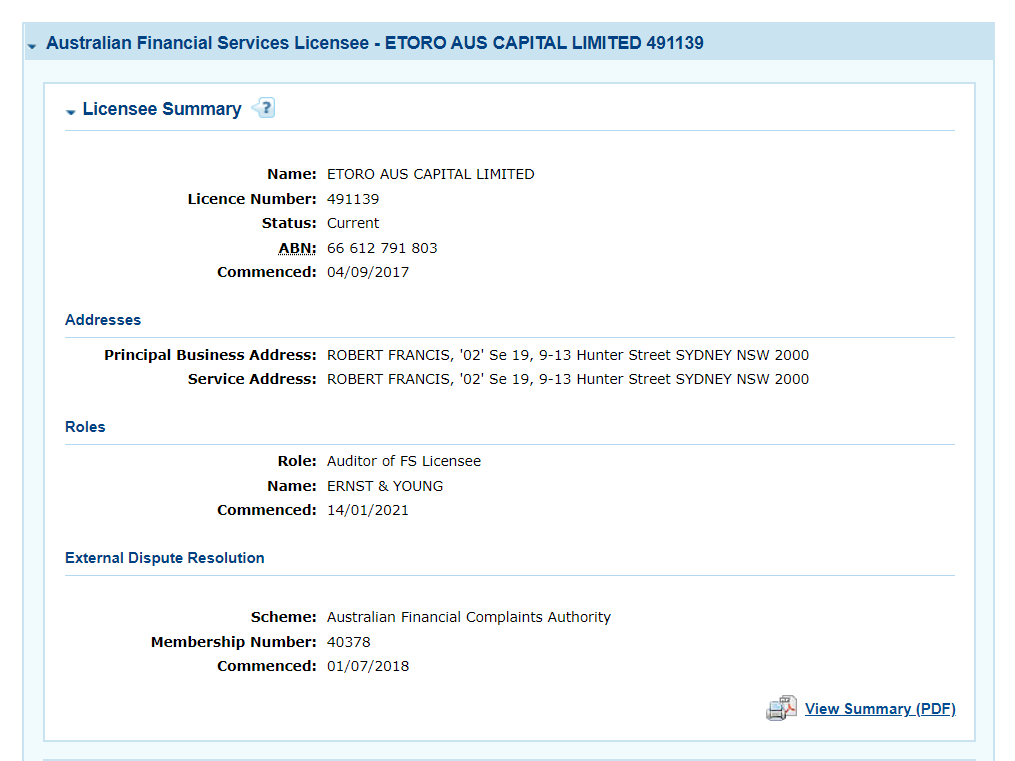

- Australian Securities and Exchange Commission of Australia

eToro acquired the regulatory license from the ASIC in 2017. The Australian Securities and Exchange Commission is a top-tier regulatory authority based in the jurisdiction of Australia.

eToro AUS Capital Limited is the legal entity of eToro that is regulated under ASIC with license number 491139 and ABN number 66612791. Only the clients residing in the jurisdiction of Australia are registered under ASIC regulation.

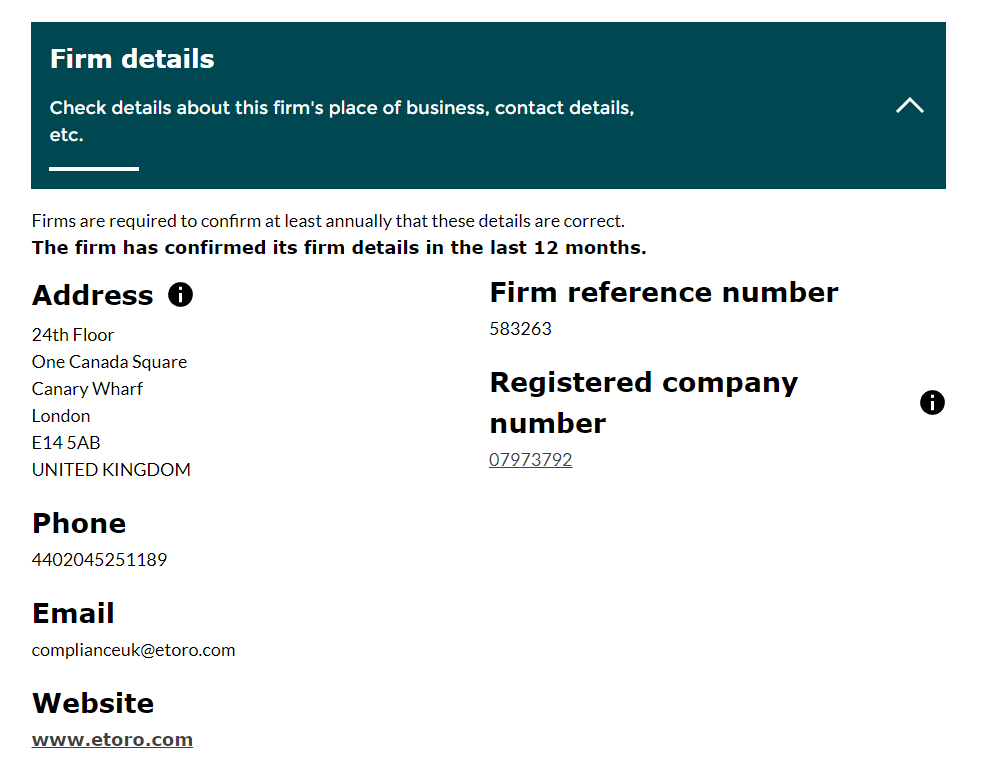

- Financial Conduct Authority (FCA) of the UK

eToro (UK) Ltd is the legal entity of eToro that is regulated under the Financial Conduct Authority in the UK. The FCA license of eToro is registered under FRN number 583263. eToro acquired the FCA license in 2013.

FCA is a top-tier financial regulator in the jurisdiction of the UK. Clients can cross-check the latest details of regulation from the official FCA website. Clients registered under FCA regulation are protected by up to £85,000 per client in case of an unsettled dispute or bankruptcy of the broker.

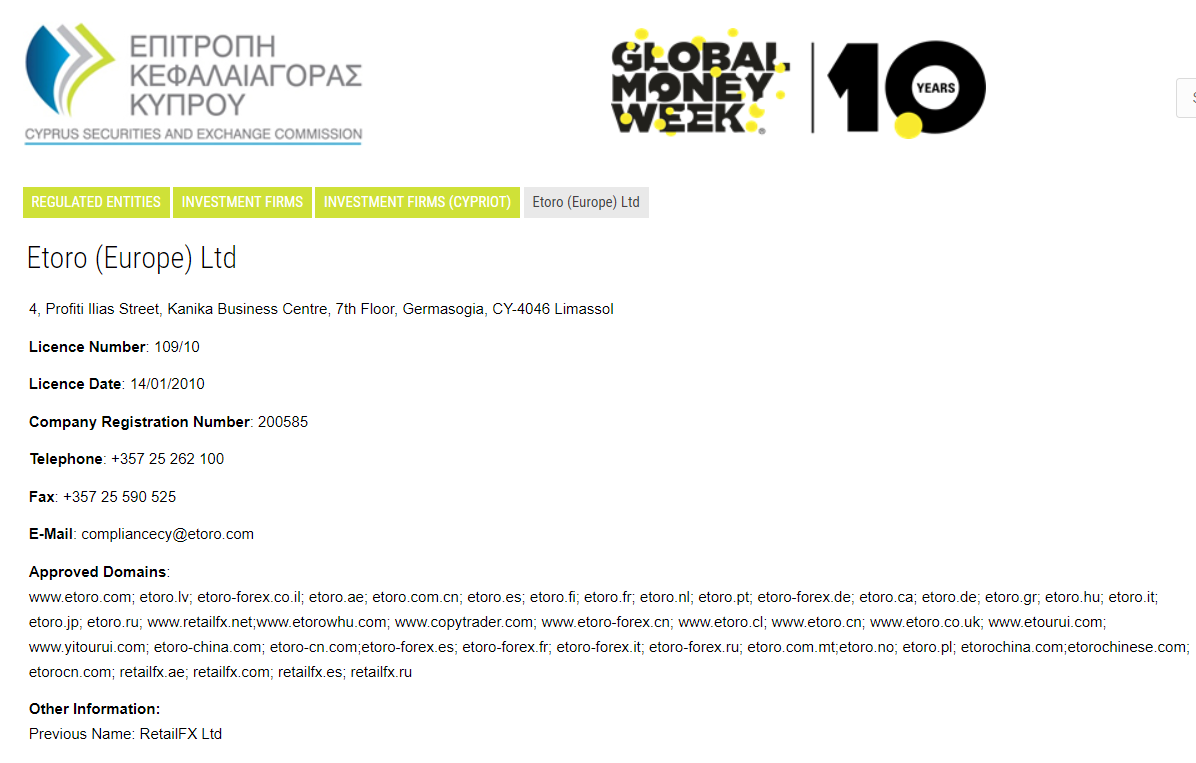

- Cyprus Securities and Exchange Commission (CySEC) of EU

eToro is regulated by CySEC with entity name eToro (Europe) Ltd and registration number 109/10. Client residing in the European Union are registered under the CySEC regulation. - Financial Services Authority Seychelles (FSAS)

eToro (Seychelles) Ltd. is the offshore regulated entity under which most of the international clients are registered at eToro. FSA of Seychelles is a lower-tier regulatory authority compared to FCA and ASIC. Clients registered under the FSA of Seychelles are not protected and are at higher risk.

eToro was initially incorporated in 2007 by co-founders Ronen Assia, David Ring, and Yoni Assia. It is a privately held firm and is not listed on any stock exchange.

The broker started its operation as an online forex broker with the name RetailFX. Later on, they added more financial products, and the name was changed to eToro. Currently, it is a well-regulated FSP that accepts clients from various countries.

The top-tier regulation of FCA and ASIC makes eToro safe for trading.

eToro Fees

eToro Fees Pros

- Simple pricing structure with single account type

- Spreads are lower than many other brokers

- Cryptocurrencies can be held without any charges

eToro Fees Cons

- Commission based trading not available

- Can be costly for large volume traders

- Each withdrawal will cost $5

We have covered every part of the fees that can possibly be incurred from traders. Each component of trading and non-trading fees has been reviewed. Following are the components of fees charged at eToro.

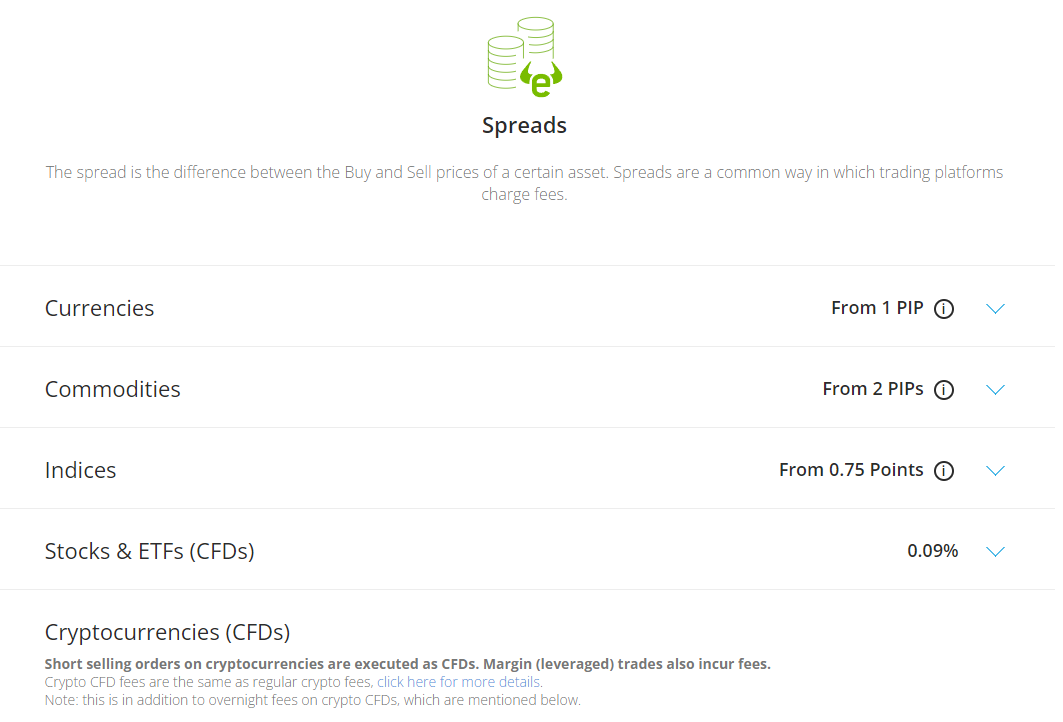

- Spread: This is the difference between the bid and ask price and also the major part of trading fees at eToro. There are no commission-based accounts with a lower spread. Hence clients must check the average typical spread for the preferred instrument before opening their account.

The average typical spreads for major currency pairs CFDs start from 1 pip and 2 pips for commodities CFD. The average spread for EUR/USD is 1 pip and for Gold is 45 pips.

The spreads are variable and can widen during volatile market conditions.

The following table compares the average typical spread of various instruments at eToro vs other well-regulated forex and CFD brokers in South Africa. The spreads in this table are with the Standard account type that does not involve any trading commission. Since there are no choices for account types at eToro, the spreads will remain the same for each retail client at eToro.

Trading Instrument FXTM eToro CMC Markets Pepperstone EUR/USD 1.9 1.1 0.70 0.77 GBP/USD 2 2.3 0.9 1.19 EUR/GBP 2.4 2.8 1.10 1.40 USD/JPY 2.2 1.2 0.7 0.86 USD/CAD 2.5 1.7 1.3 1.07 With the help of the table above, it can be assumed that the spreads at eToro in South Africa are lower than some brokers but it is not the lowest. There are a few regulated brokers in South Africa that offer lesser spread on forex and CFD instruments.

- Trading Commission: No trading commission is charged at eToro for any of the CFDs. Spread is the only trading fee for CFDs on stocks, indices, commodities, and currencies.

Cryptocurrencies can be bought and sold with ownership of the asset with a fixed commission of 1% of the total amount on each order. Short-selling orders on cryptocurrencies are executed as CFDs.

- Overnight Charges: This is the fee that is incurred when a position is kept open overnight. Each CFD instrument at eToro has a different swap fee for the long and short positions. The overnight charges for EUR/USD for a long and short position are $ -0.5343 and $ -0.1103 respectively.

- Non-Trading Commission: This includes all the charges that are incurred without executing trade orders. The account opening is free but eToro incurs an inactivity fee of $10 each month if no trades are executed for one year.

Deposits are free at eToro through all the accepted methods but a withdrawal fee of $5 is incurred for each withdrawal. If the clients are withdrawing in currency other than USD, a conversion fee will also be applicable for the conversion of the withdrawal amount.

There is no commission for copying the trade orders of other traders at eToro. Only the spreads and overnight charges (if applicable) will be incurred while copy trading.

Overall, according to our review and comparison with other CFD brokers, eToro has an average fee structure. There is no trading commission but buying cryptocurrencies as an asset (without CFD) will incur a 1% commission.

The spreads are moderate when compared with other CFD brokers. The non-trading fees are slightly high as $5 is incurred for each withdrawal along with the currency conversion fee (if applicable).

eToro Account Specification

There are no choices of account types at eToro with different trading conditions. Each client gets similar features and trading conditions.

USD is the only available base account currency at eToro. Any other currency cannot be chosen as the base account currency. All other currency deposits are automatically converted to USD according to prevailing rates.

eToro offers additional services to clients that hold more than $5000 equity in their account or portfolio. This grants access to eToro Club membership that has 5 different tiers.

The additional services with basic silver membership ($5000 equity) include customer success agent, daily market summary, live webinars, exclusive portfolios, 85% cryptocurrency staking, etc.

The number of services increases as clients are promoted to a higher tier of eToro Club. Clients can enjoy benefits like free withdrawals, crypto fee rebates, tickets to sporting events, subscriptions to financial publications, etc.

The eToro Club membership does not affect the fee structure or availability of financial instruments for trading and investment. The trading conditions are the same for all types of traders at eToro.

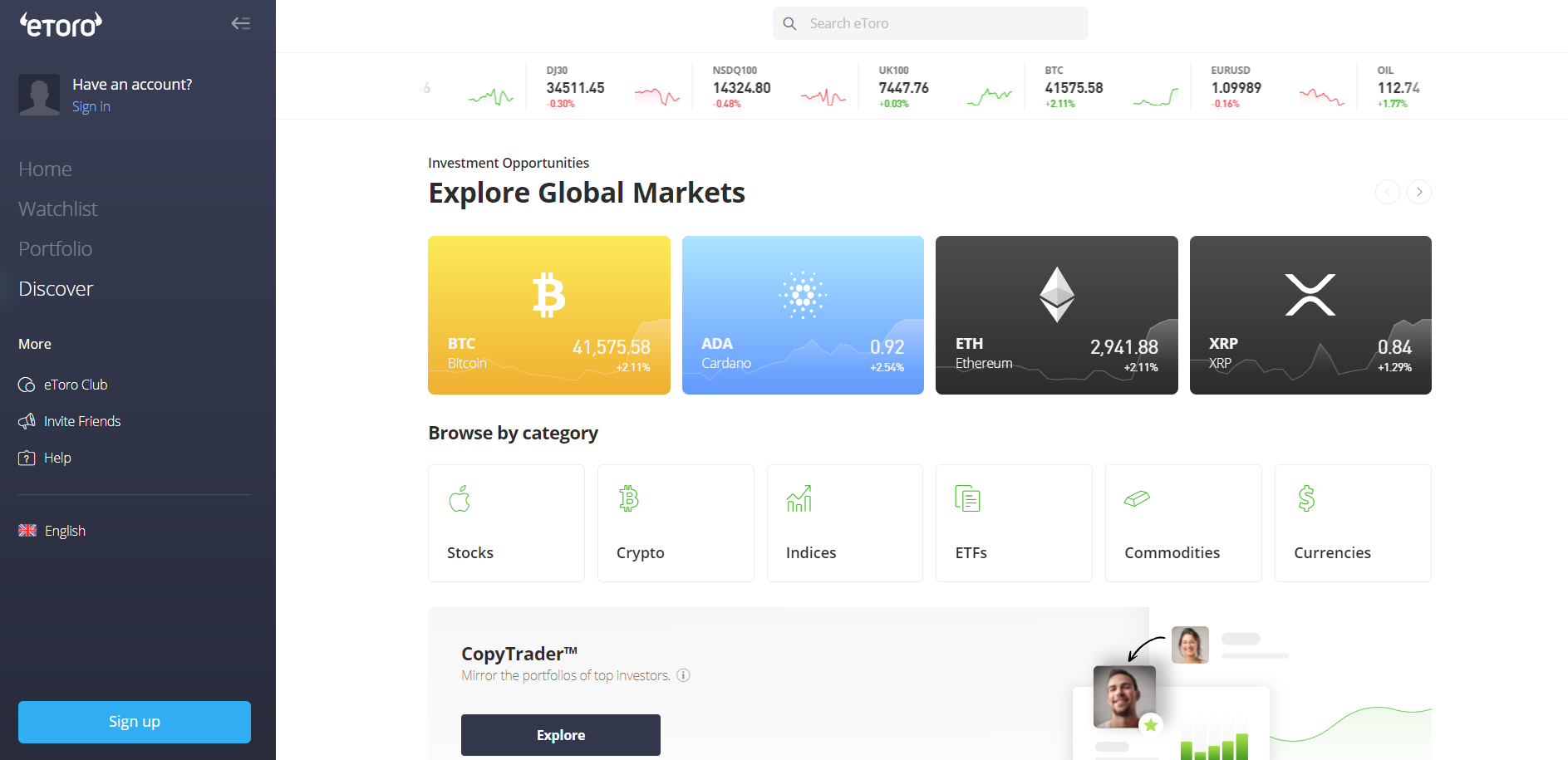

How to Open an Account at eToro

The account opening process is simple and fast at eToro. A new account can be opened and verified within a day.

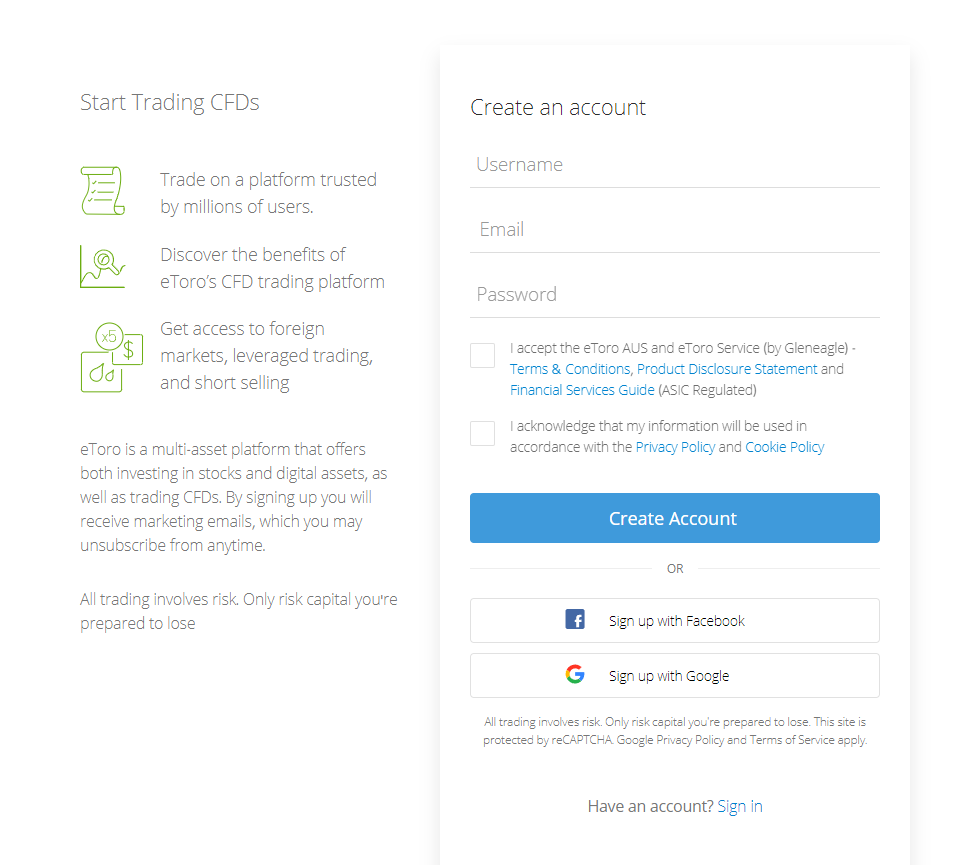

Step 1: Username and e-mail

The first step after you click on “sign up” on the official website of eToro is to select a unique username and enter the email address. Clients also need to select a password before moving further.

Step 2: Complete Profile

Once you enter the email and password, you will be redirected to the web trading platform of eToro where you can see trading instruments and get familiar with the platform. On the top left corner below your username, there will be an option to “complete profile”. The real or demo account can also be selected from here.

Once you click on “complete profile”, the first step is to enter your full name, gender, and date of birth. Make sure to enter the same details as on the national ID.

Step 3: Address

The next step in completing the profile is to enter the address along with the country and National Insurance number.

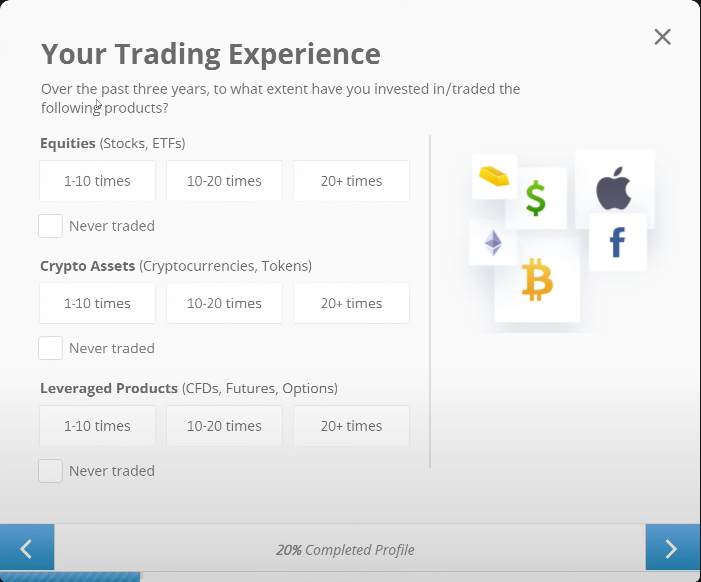

Step 4: Trading Experience

eToro will take a quick survey of your trading experience by asking questions related to your personal trading experience. After this, your mobile number needs to be entered which will be verified via OTP to move further in the account opening process.

Step 5: Deposit Funds

After completing the above steps, clients can deposit funds using their preferred methods. The minimum deposit amount is $50 at eToro.

The amount deposited in any currency will be converted to USD according to prevailing conversion rates.

After the deposited amount gets reflected in the account balance, clients can place trade orders on any of the available instruments through the trading platform.

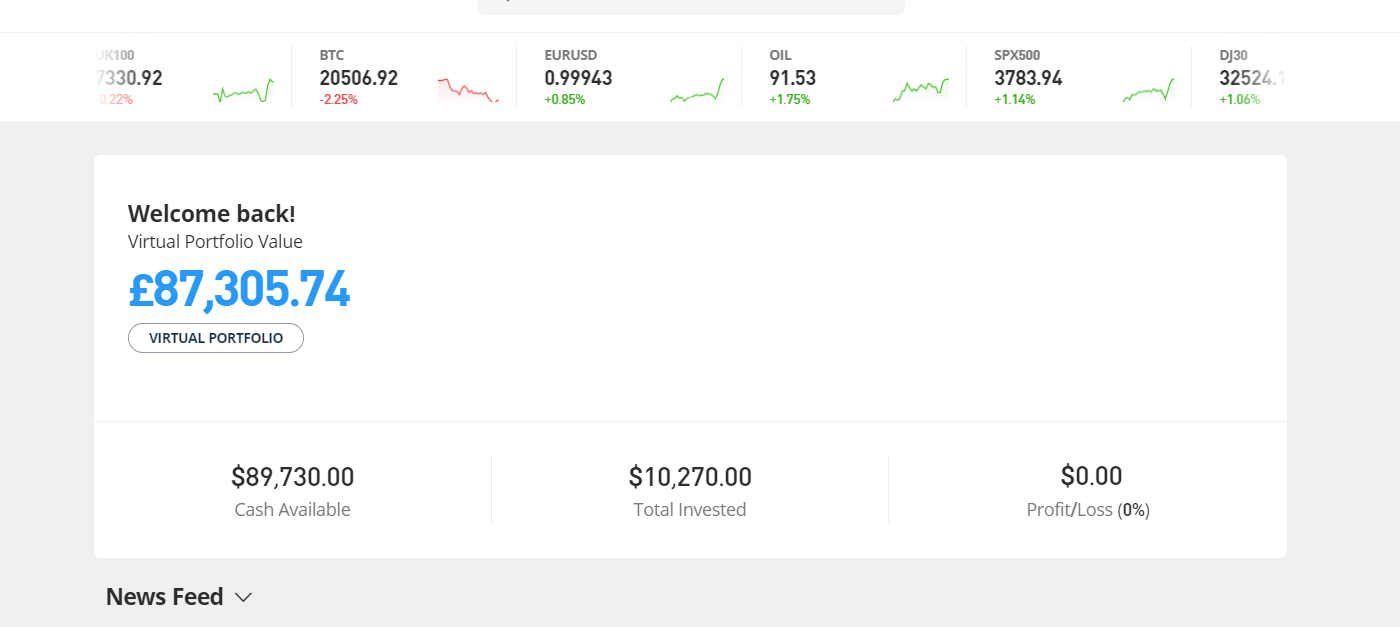

eToro Demo Account Review

The demo account at eToro can be opened within a minute by anyone. Traders do not need to provide personal details or verify documents to open a demo trading account. A demo account at eToro can be opened only by providing the email address and choosing an available user name.

After redirecting to the dashboard, the demo account can be opened by clicking on the switch to virtual. The virtual account or the demo account initially gives $100,000 in USD. The currency of the virtual account can be changed to GBP, EUR, and other currencies but the value will remain the same as the amount will be converted to the chosen currency.

Once the virtual account is opened, clients can open and close trading positions on all the available instruments. All the features for research and education can be used through the virtual portfolio or demo account at eToro.

The virtual account can be highly advantageous for beginners who wish to learn and practice their trading strategies. The profits and losses on the virtual account will be virtual and cannot be withdrawn from the demo account.

eToro Deposits and Withdrawals

eToro Deposit/Withdrwal Pros

- Multiple Deposit Methods: eToro offers a variety of deposit methods including bank transfer, credit/debit cards, PayPal, NETELLER, and SKRILL, among others, providing flexibility for users globally.

- Instant Deposits: For most methods like credit/debit cards and online wallets, deposits are instant or completed within a few hours, allowing quick access to funds for trading.

- No Deposit Fee: eToro does not charge any fee for deposits, although users may incur charges from their bank or third-party services used for the transfer.

- eToro Money Account Benefits: UK eToro Club members with an eToro Money account can enjoy benefits such as instant withdrawal, zero USD-conversion-fee deposits, and a free debit card with no setup or monthly fees.

eToro Deposit/Withdrawal Cons

- Withdrawal Fees: eToro charges a $5 fee for withdrawals, which is a fixed cost regardless of the withdrawal amount or method used.

- Currency Conversion Fees: Since all eToro accounts are denominated in USD, users will incur a currency conversion fee for deposits and withdrawals in other currencies, which could increase the cost of transactions.

- Withdrawal Processing Time: Withdrawals can take up to 2 days to be processed, and depending on the method, it may take up to 10 business days for funds to be received.

- Minimum Withdrawal Amount: The minimum amount you can withdraw from eToro is $30, which might be inconvenient for users looking to withdraw smaller amounts.

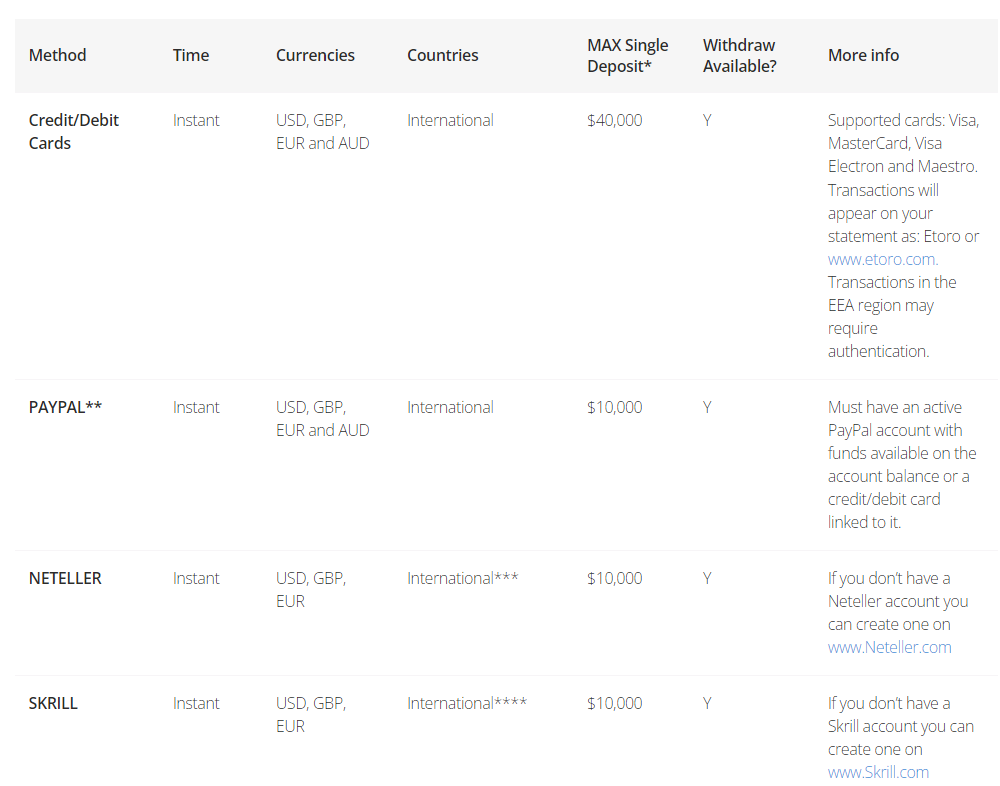

eToro accepts multiple methods for deposits and withdrawal. We have reviewed all the methods through which clients can transact.

The minimum amount for the initial, as well as the subsequent deposit, is $50. The minimum deposit amount through wire transfer is $500. The minimum withdrawal amount at eToro is $30.

The deposits through all the accepted methods are free of additional commission. Withdrawals through all the methods will incur a fixed commission of $5 on each withdrawal.

- Credit/Debit Card: The deposits through cards are reflected instantaneously in the account balance. Visa, MasterCard, Visa Electron, and Maestro cards are supported for transactions at eToro. The maximum deposit amount through this method is $40,000 at one time.

- E-Wallets: The deposits and withdrawals can be done instantly through e-wallets like PayPal, Neteller, and Skrill. Transactions are processed instantly and the maximum limit for each transfer is up to $10,000.

- Wire Transfer: The minimum deposit amount through bank wire transfer is $500. The deposits and withdrawals are processed between 4 to 7 days. Only USD, EUR, and GBP are accepted through wire transfer.

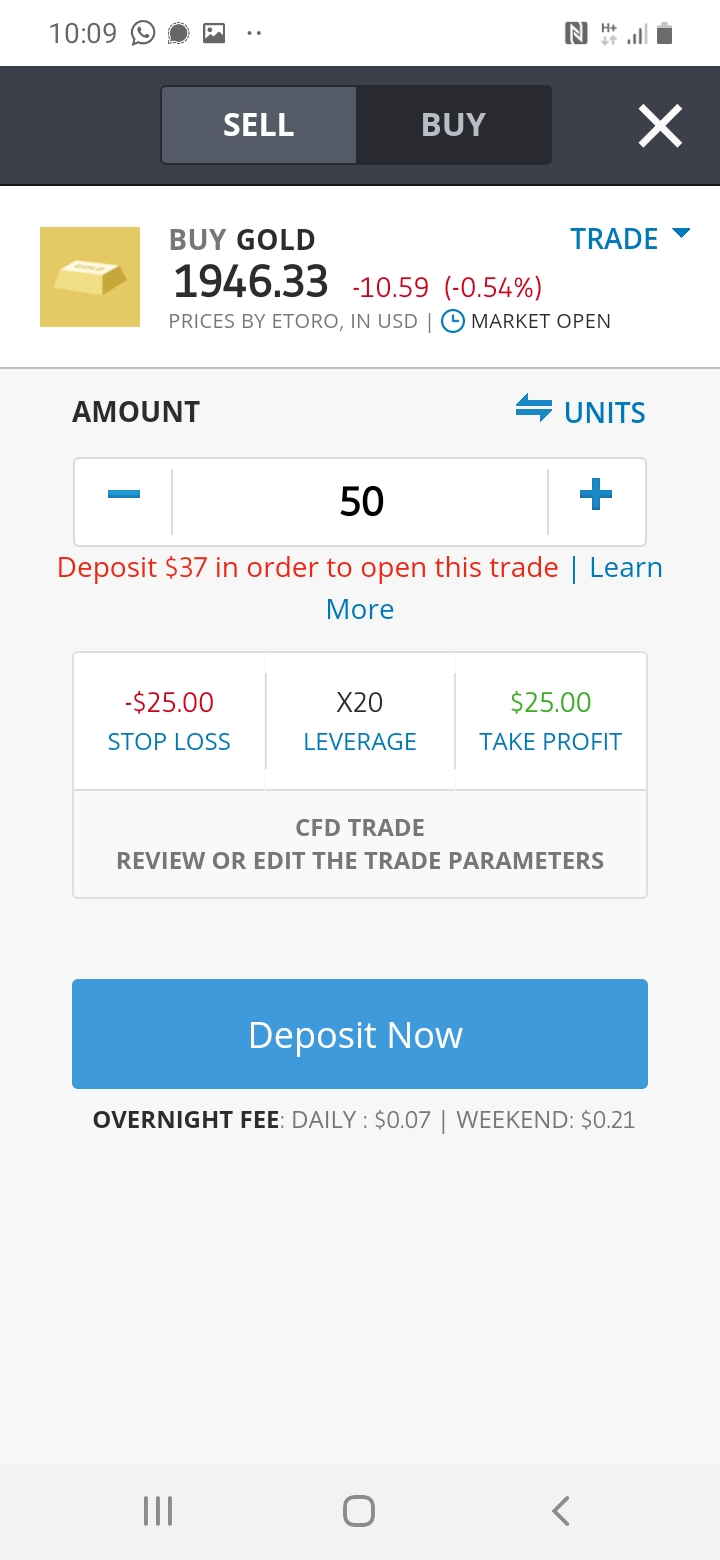

eToro Trading Platforms

Clients at eToro can only trade with their proprietary trading platform. eToro does not offer MetaTrader or cTrader trading platforms.

We have separately reviewed the trading platform at eToro for web, mobile, and desktop.

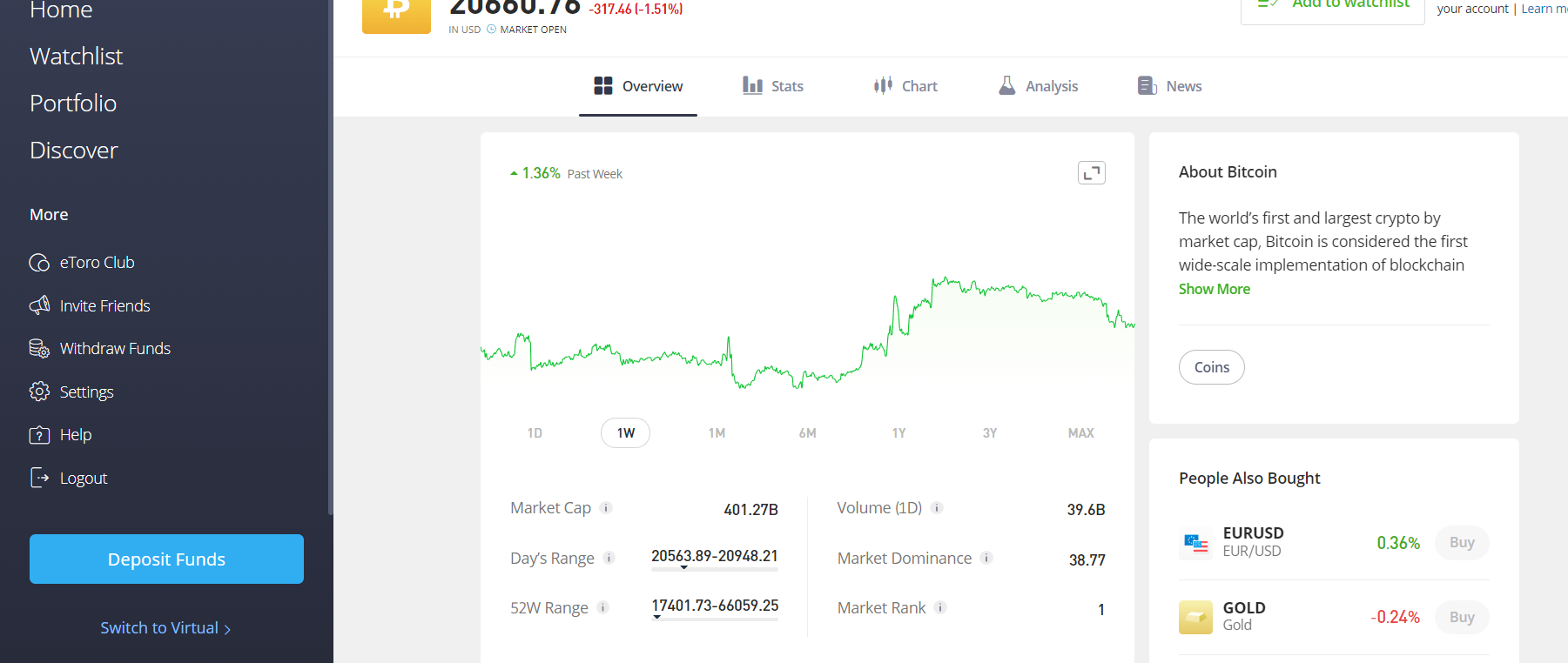

eToro Web Trading Platform

eToro web trading platform is user-friendly and can be a good choice for beginners. Each available instrument at eToro can be accessed for trading, analysis reports, a live news feed, and charts through the trading platform.

Each instrument at the eToro web trading platform has a separate feed where clients can connect and interact with each other. The eToro platform has better social media connectivity than MT4 or MT5 platforms.

The statistics, basic details, market trends, price trends, and history of each instrument are available on the proprietary trading platform of eToro.

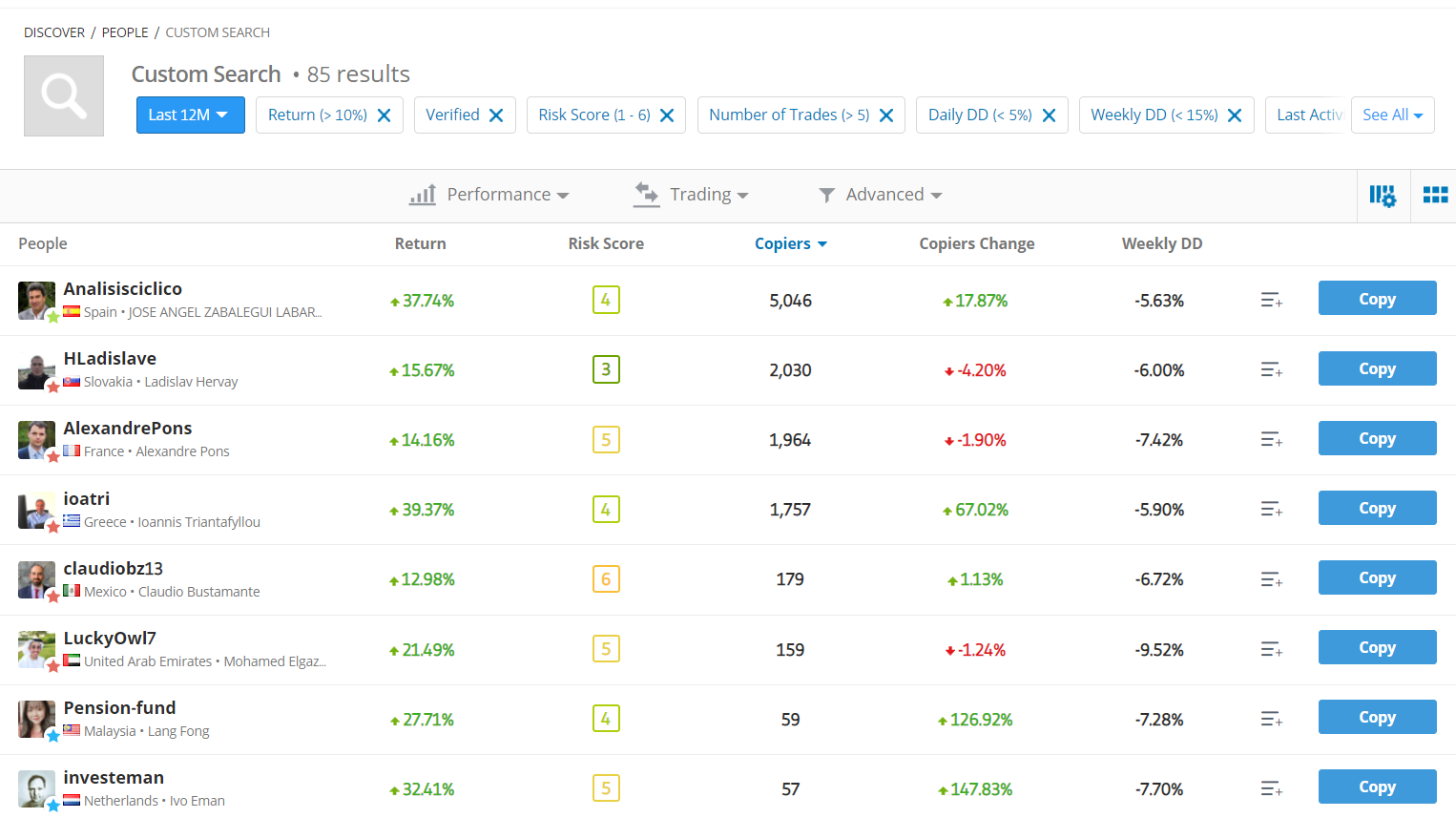

The trade and investment orders of any client using the eToro trading platform can be copied by other clients. No additional fees or commission is charged for copying any of the traders. The pricing structure remains the same as that without copying for each instrument.

Any trader or investor can make their profile public. This allows other clients to copy your trade orders. eToro separately rewards the top traders and investors that are most copied. The historical returns, portfolio, most traded instrument, and other detail can be checked for any public profile before copying it.

The eToro web trading platform is ideal for beginners as it has a clean design with useful features. The web trading platform is available in 21 languages and has an optional two-step login feature for increased safety. Market, Limit, Stop-loss, and Trailing stop-loss orders can be placed through the eToro web trading platform. The portfolio report and fee report are also available to the traders.

eToro Mobile Trading Platform

The eToro mobile trading platform has similar features to the web trading platform but on a smaller screen. The eToro mobile trading platform can be downloaded on Android and iOS devices. It has 2 step login and traders can also log in through fingerprint and facial recognition.

eToro Mobile trading platform is also available in 21 languages. Swiping left and right allows easy access to the portfolio and placing trade orders. Mobile trading apps generally have limited features but the eToro mobile trading platform allows traders to access and work upon charts with multiple time frames and useful features.

eToro mobile trading platform is among the best forex trading apps available for Android and iOS devices in South Africa.

Desktop Trading Platform

eToro does not offer any trading platform for desktop devices. This means that traders can only trade through web trading platforms and mobile trading platforms of eToro. The eToro trading platform cannot be downloaded on Windows and macOS desktop devices.

Overall, the eToro trading platforms are user-friendly and ideal for all types of traders. They offer useful tools for traders and allow convenient copy trading without any additional cost. The trading platform at eToro is a major reason to choose eToro over other brokers. MetaTrader, cTrader, or any other trading platforms are not available at eToro.

eToro Customer Support

The customer support service at eToro is different for existing clients and visitors. The visitors can only raise queries by raising tickets at the website. The existing clients can connect through a live chat with the support executives.

Compared to most of the other regulated CFD brokers, we found support services to be limited at eToro. After opening the account, the clients can connect via email and live chat support.

However, if the account equity is more than $5000, clients get the silver eToro Premium Club services. This includes a personal relationship manager that can assist the traders at any instance while trading.

Local phone support is not available at eToro for clients. However, there are plenty of FAQs that can resolve major queries of traders.

Available Instruments

Opening an account with eToro grants access to trading on a variety of instruments. The maximum leverage that clients can use is restricted as per the regulatory regimes of ASIC.

Following are the instruments that can be traded at eToro.

- 49 Currency pairs: A total of 49 currency pairs can be traded as CFD. The spreads and overnight charges can be checked on the trading platform before executing trade orders. The maximum leverage for the currency pairs is 1:30.

- 32 Commodities: Precious metals, energies, and natural commodities can be traded as CFD. The prices of each commodity are quoted in USD.

- 264 ETFs: Exchange Traded Funds can be traded as CFD for long as well as a short position. A wide range of ETFs from all over the world is available for trading at eToro.

- 13 Indices: Indices like NAS100 and UK100 can be traded for long as well as short positions via CFD.

- 127 Cryptocurrency: eToro offers a variety of cryptocurrencies for holding as an asset as well as CFD. Clients can buy and hold cryptocurrencies as an asset in their eToro Money wallets. Cryptos held in the wallet can be used for speculating, sending, and receiving.

Buying cryptos as an asset will incur a fixed commission of 1% on each transaction. For short positions, cryptocurrencies are traded as CFD at eToro with spreads and overnight swap fees.

- 2500+ Stocks: Stocks from different exchanges of the world can be traded as CFD. eToro offers to trade on stocks from NASDAQ, NYSE, Frankfurt, London, Paris, Madrid, Milan, Zurich, Oslo, Stockholm, Copenhagen, Helsinki, Hong Kong, Lisbon, Brussels, Saudi Arabia, and Amsterdam.

| Asset Class | Number of Instrument | Maximum Leverage |

|---|---|---|

| Currency Pairs | 49 | 1:30 for majors, 1:20 for Minors |

| Indices | 13 | 1:20 |

| Commodities | 32 | 1:20 for Gold, 1:10 for others |

| Shares | 2500+ | 1:5 |

| ETF | 264 | 1:5 |

| Cryptocurrencies | 127 | 1:2 |

It must be noted that apart from cryptocurrencies, all other assets can only be traded as CFD. This means that there is no physical buying or selling of the underlying asset. Only the price difference between the opening and closing of the position is settled via cash.

eToro Research and Education

Beginners in forex trading must always look out for the brokers that offer good quality content to educate the traders and assist them in research. eToro offers various tools that can be very useful for clients in learning about forex trades.

eToro Research Tools

eToro offers a good variety of research and education tools to assist the traders in making informed decisions in forex trading. Each financial instrument has a separate research section apart from the charts and specific news feed.

- Market Analysis: eToro provides market analysis and updates on various financial instruments, including stocks, forex, cryptocurrencies, commodities, and indices. This analysis often includes insights from market experts and covers significant market events and news.

- Copy Trading: One of eToro’s unique features is its social trading platform, which allows users to copy the trades of experienced and successful traders. This feature is beneficial for beginners or those looking to diversify their trading strategies.

- Economic Calendar: eToro usually offers an economic calendar that displays upcoming economic events, data releases, and important announcements that may impact the financial markets.

- Webinars and Video Tutorials: eToro provides educational resources such as webinars and video tutorials covering various trading topics, strategies, and platform tutorials.

- Trading Guides and Articles: Traders can access written guides and articles on trading techniques, risk management, and other relevant topics.

- Practice Accounts: eToro typically offers demo accounts that allow users to practice trading with virtual funds. This feature is useful for beginners to get familiar with the platform without risking real money.

- Social News Feed: eToro’s social trading platform often includes a news feed where traders can interact, share insights, and discuss market trends.

- eToro Academy: eToro’s Academy is an educational hub that offers a variety of articles, videos, and tutorials on various trading topics. It covers everything from basic trading concepts to more advanced strategies.

- Community and Discussions: eToro’s social aspect encourages users to interact with each other. Engaging in discussions, sharing insights, and learning from other traders can contribute to the educational experience.

- eCourses: eToro might offer eCourses or online courses designed to guide users through different aspects of trading and investing. These courses can be interactive and provide a structured learning experience.

Do We Recommend eToro?

Yes, eToro is a well-regulated CFD broker. It has a user-friendly trading platform and a unique copy trading feature that is free of added commission. eToro can be among the best choices for copy trading. It can also be an ideal choice for beginners as the trading platform is convenient to use compared to MetaTrader or cTrader.

The customer support services are below average for the clients that have lesser equity. eToro can also be costly for some clients as ZAR is not available as the base currency and each deposit involves a currency conversion fee. Withdrawals also incur a commission of $5.

eToro South Africa FAQs

Does eToro Accept Clients from South Africa?

No, due to regulatory requirements and business decisions based on risk management considerations, eToro does not accept new clients from South Africa currently.

What is the minimum deposit for eToro?

$50, the minimum initial and subsequent deposit amount at eToro is $50. The minimum deposit amount through bank wire transfer is $500.

Can you Make Money on eToro?

Yes, eToro is a CFD and crypto trading platform where clients can make money if they make profits on the trade orders. However, if losses are booked on trades, clients can also lose money. It is advisable for the beginners to trade via demo account before using the real account to gain some experience. More than 70% of the beginners lose money while trading CFDs.