What Is Spread in Forex?

Forex trading is all about exchanging one currency for another with the motive of profiting. The fundamental of this trading is a currency pair represented by, for example, EUR/USD. The left is called the “base,” and the right is the “quote” currency.

In the example, EUR is the base currency, and USD is the quote currency. The currency pairs are also known by other names, such as “bid” and “ask” price or base and “counter” currency. And the difference between them is called a “spread.”

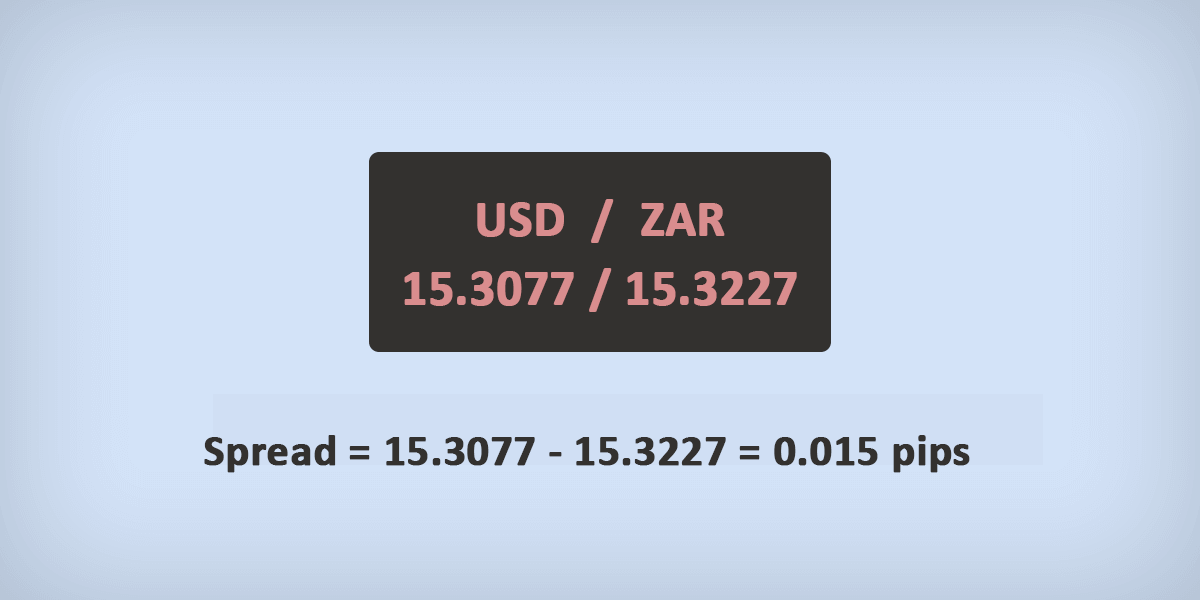

The spread is the price differential between the bid and asks prices. In Forex, it is usually expressed in pips- meaning one pip equals 0.0001.

Spread is crucial because it can help determine where to buy or sell a currency pair at a given time.

For example, if the spread is too broad, it could indicate an opportunity to buy or sell that currency pair at a lower price.

In general, spreads are typically wider when the market is volatile. So it would suggest that if volatility seems high, it may be time to look for opportunities to buy or sell the currency in question.

Spread is a method no commission brokers use to earn money, as currency pairs often don’t incorporate commission while trading. As a result, the quoted buying price will always be higher than the quoted selling price and include an in-between market price. The spread is used by Forex traders to cover transaction costs such as commissions and spreads on different financial instruments like stocks, bonds, and commodities.

How Brokers Make Money Using Spread?

Before understanding how forex and CFD brokers make money, it is important to understand the types of brokers. The money made by brokers depends on their fee structure and the execution method used by them. Traders must acknowledge the trade execution method to understand the concept of spreads. However, spreads directly depend on the broker regardless of the trade execution method.

Market Maker: Brokers with dealing desks are also called market makers. Market makers can match the clients’ trading positions and can also take the other side of the trade themselves. Hence, apart from the spread and commission, a market maker can also make revenue from the losses booked by the traders.

Spread is always the major source of revenue for forex and CFD brokers. A market maker generally offers a narrower spread than ECN/STP brokers but there can be exceptions.

Brokers with no dealing desks do not take part in trade orders placed by the clients. They pass on the trade orders to liquidity providers where the trade orders are matched through the exchange.

STP: In Straight Through Processing (STP) method, the trade orders are passed directly to a certain liquidity provider. Buying and selling are done through the same liquidity provider. A broker can incur additional spread over the spread charged by the liquidity provider.

ECN: Brokers that use Electronic Communication Networks (ECN) for trade execution pass the orders placed by clients to multiple liquidity providers. The orders are executed with the one that offers the best pricing. Buying and selling can be done through different liquidity providers and hence the spread is reduced. A broker can incur additional spread or trading commission to offer ECN execution.

For ECN/STP brokers, the orders placed by the clients are passed to the broker which is forwarded to the exchange directly. The exchange or liquidity provider will also incur a spread. However, this spread at the liquidity provider will be lower than the spread incurred by the STP/ECN broker. So the difference between the spread at the liquidity provider and the one incurred by the broker is the revenue for the broker.

Some of the most common currency pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF, wherein USD, EUR, JPY, GBP, and CHF stand for US dollar, Euro, and Japanese yen, British pound, and Swiss franc respectively.

Pip or percentage in point is the unit for measuring the spread and is the smallest price movement up to the fourth decimal for most currencies, excluding JPY, for which it includes up to two decimals.

Wider spreads in the price of an underlying asset represent high volatility and low liquidity. On the other hand, a lower Spread indicates high liquidity and low volatility. Therefore, a tighter Spread would include a smaller Spread cost while trading. Moreover, the spread is either fixed or variable and varies once the bid and ask price change.

Eventually, the spreads will depend on the broker chosen by the clients. Hence it is very important to check and compare the spread and commission incurred by the broker and their trade execution method.

For example, the former requires low capital and provides cheaper alternatives. Moreover, transaction cost calculations through Fixed Spread become predictable. Meanwhile, a Variable Spread eliminates “requote” experiences because the Spread factor relies on market scenarios. Additionally, Variable Spreads offer transparent pricing, mainly due to competitive liquidity providers. However, these two Spreads also have significant disadvantages.

For example, broker “requotes” constantly occur with Fixed Spreads. Moreover, the broker can’t widen Spreads during volatile market conditions or rapid price changes. Thus, under most requote circumstances, the price is worse than the order. Another disadvantage of Fixed Spread is Slippage, i.e., a broker’s inability to maintain a fee after the trader enters as it differs from the entry price.

Likewise, scalpers won’t find Variable Spread ideal as a widened scenario can significantly diminish profits and even enlarge enough to become unprofitable. Therefore, the spread should depend on market scenarios, and traders should look out for high or wide Spreads in the market.

How Traders Are Affected and Should Look Out for High Spread?

Large buy and sell price quotes are used for Spread calculation. The amount is paid upfront while Spread betting or CFD trading. Also, the commission is paid while trading share CFSs upon entry and exit. Therefore, traders get a better value with a tighter Spread.

For example, the bid and ask price for EUR/USD are 1.36739 and 1.36749, the spread based on the difference, and the last digit is 1.0.

Emerging market pairs have a high or wider spread than significant currency pairs. A higher than usual spread could even indicate low utility due to out-of-hours trading. Moreover, the spread often becomes higher during or before news events like Brexit and the US elections. On the other hand, low Spreads are preferred during significant forex sessions.

Traders and large liquidity providers should look out for high spread because the outcome of a news event on the bid and ask price is unknown. Moreover, the market timing is uncertain, and sporadic economic calendars shake prices rapidly. The reason for having a high Spread is to offset the risk. The time of the day and volatility are other significant factors driving forex spreads.

For example, Euro and Asia trade open at morning and night hours, respectively. Therefore, if the former is booked during the latter’s session, it will create a higher or broader Spread and even become a costlier affair than if the booking happened during the Euro session. The reason is the lack of traders during resulting in diminished liquidity. However, the scenario would not exist during a regular trading session.

A non-liquid market means more miniature trading, and therefore, brokers broaden the spread to manage the risk of loss if they reach a position. Similarly, extreme volatility is a stage wherein the fluctuation of exchange rates is wild. Therefore, forex brokers avoid the risk of loss under event-driven volatility periods by making the spread wider.

Furthermore, dramatic Spread widening can lead to margin call or liquidation. A margin call refers to a scenario wherein the trader can no longer avail free margin. Therefore, leveraging the limit of the account is the best method of safeguarding against a widening Spread. Optionally, you can even hold on to Spread-widening until it becomes tighter or narrowed.

Traders receive margin call notifications whenever account value diminishes below 100% of the margin value. At this point, a trader can no longer meet the trading requirements, and all positions liquidate whenever the margin value is below 50%. The size of forex trade is often greater than shares. So, it is essential to decide the forex leverage and positioning size.

If you’re looking to start forex trading, this ultimate guide (hyperlink) is excellent for beginners.

Two helpful tips for beginners to minimize your spread cost

Choose favorable trading hours

As you get more experienced with forex trading, you would notice that particular times of the day are more favorable for forex trading. Why? Because when different forex markets (such as Asian or American) overlap, more traders are bidding on currency pairs. As the number of players increases, the demand created by buyers and sellers also increases. During those times, market makers often lower their spread to attract more traders. In short, trade during those hours when the competition is higḥ.

Choose major currencies

You will notice that most traded currency pairs usually have a lower spread.

For example, GBP/USD or EUR/USD have most often very low bid-ask spread. But if you choose to trade with exotic pairs like AUD/MXN or EUR/TRY, you may find broader spreads because there are a limited number of forex traders dealing with these pairs. That also means lower liquidity and more risk. So until and unless you’re a pro, stick with major currency pairs.

Summing up:

- Spread = bid price – ask price

- The forex spread is measured in pips, and choosing a broker with a lower spread is vital for everyone, especially if you’re a novice in the complex world of currency trading.

- Low spreads should not be the only factor to consider for a forex broker

- Some fake brokers may offer substantially low spreads to attract new traders and get their deposits

- Traders must check the authenticity of the regulatory authority that is regulating the forex broker

- Regulation details are generally mentioned in the footnote of the broker’s official website

In addition, traders should have an eye on the factors that influence the forex spreads, such as time of the day, trading platform, market volatility, important events (economic/financial news), etc. Also, remember to trade with major currency pairs and avoid exotic spreads which have larger spreads.