FxPro South Africa Review 2024

FxPro is an FSCA-regulated broker in South Africa. It offers ZAR based account on MT4, MT5, and cTrader trading platforms. Check out all the pros and cons of choosing FxPro in South Africa.

FxPro is a London-based forex and CFD broker that operates in more than 170 countries. It is a well-regulated broker that offers a variety of trading instruments.

FxPro supports MT4, MT5, and cTrader trading platforms with ZAR as the base currency. There are various pros and cons of choosing FxPro in South Africa.

We have reviewed FxPro specifically for clients residing in South Africa. The review has been done based on more than 12 factors with an honest opinion. Check out our FxPro South Africa review before opening your account with FxPro.

Table of Content

FxPro South Africa Pros

- FxPro is regulated and authorized by FSCA in South Africa

- No non-trading charges exist except inactivity fees

- Free deposits and withdrawals through local bank transfer

- MT4, MT5, as well as cTrader platform supported

- 24*5 customer support through live chat

- ZAR is supported as base currency of account

- More than 2000 instruments available

- FxPro does not have a dealing desk

FxPro South Africa Cons

- Trading fees is slightly high

- Local phone support is not available

- cryptocurrency deposit not supported

- Not listed on any stock index

FxPro South Africa Summary

| Broker Name | FxPro Financial Services Limited |

| Website | https://www.fxpro.com/ |

| Regulation | FCA, FSCA, CySEC |

| Year of Establishment | 2006 |

| Minimum Deposit | R1700 |

| Maximum Leverage | 1:200 |

| Trading Platforms | MT4, MT5, cTrader |

| Trading Instruments | 2000+ CFDs on forex pairs, commodities, indices, shares, cryptocurrencies |

FxPro Safety and Regulation

The safety of funds largely depends on the regulatory licenses held by the broker. Following are the details of regulatory licenses acquired by FxPro till now.

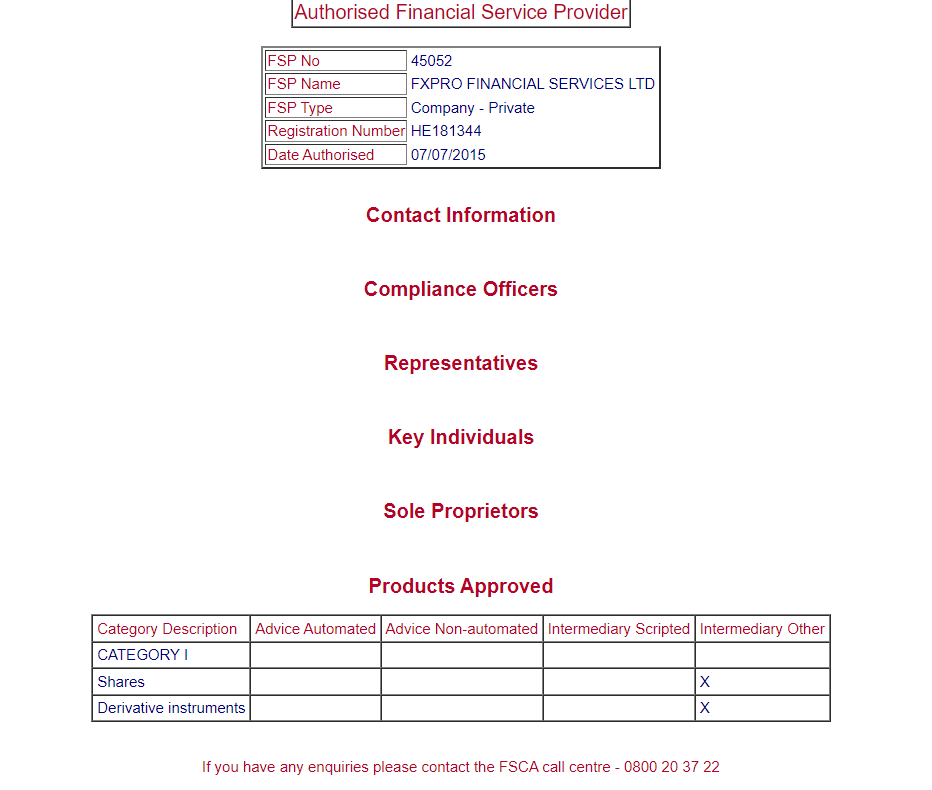

- FSCA of South Africa: FxPro is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under FSP number 45052 as a legal entity FxPro Financial Services Ltd. Clients residing in South Africa are registered under FSCA regulation at FxPro. The broker acquired the FSCA license in 2015.

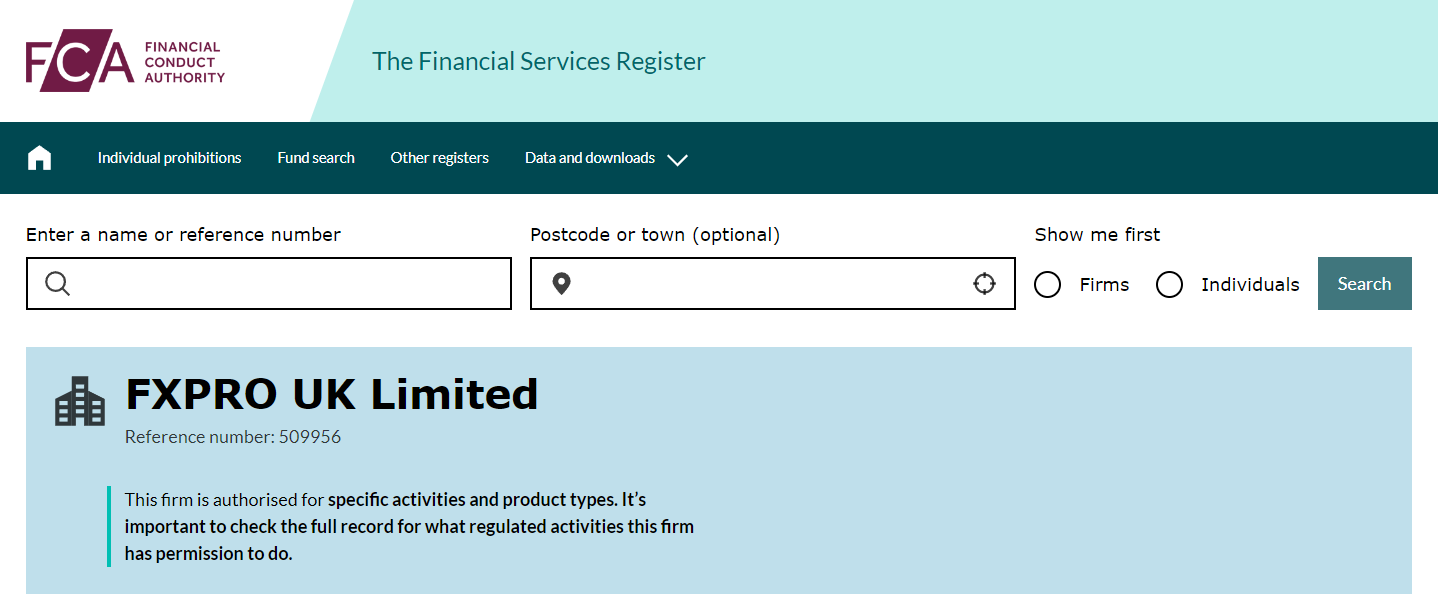

- FCA of the UK: The Financial Conduct Authority is a top-tier financial regulator in the UK. FxPro is regulated by FCA of the UK under license number 509956 as a legal entity FxPro UK Limited. FCA regulation increases the trust factor but South African clients are not registered under FSCA regulation.

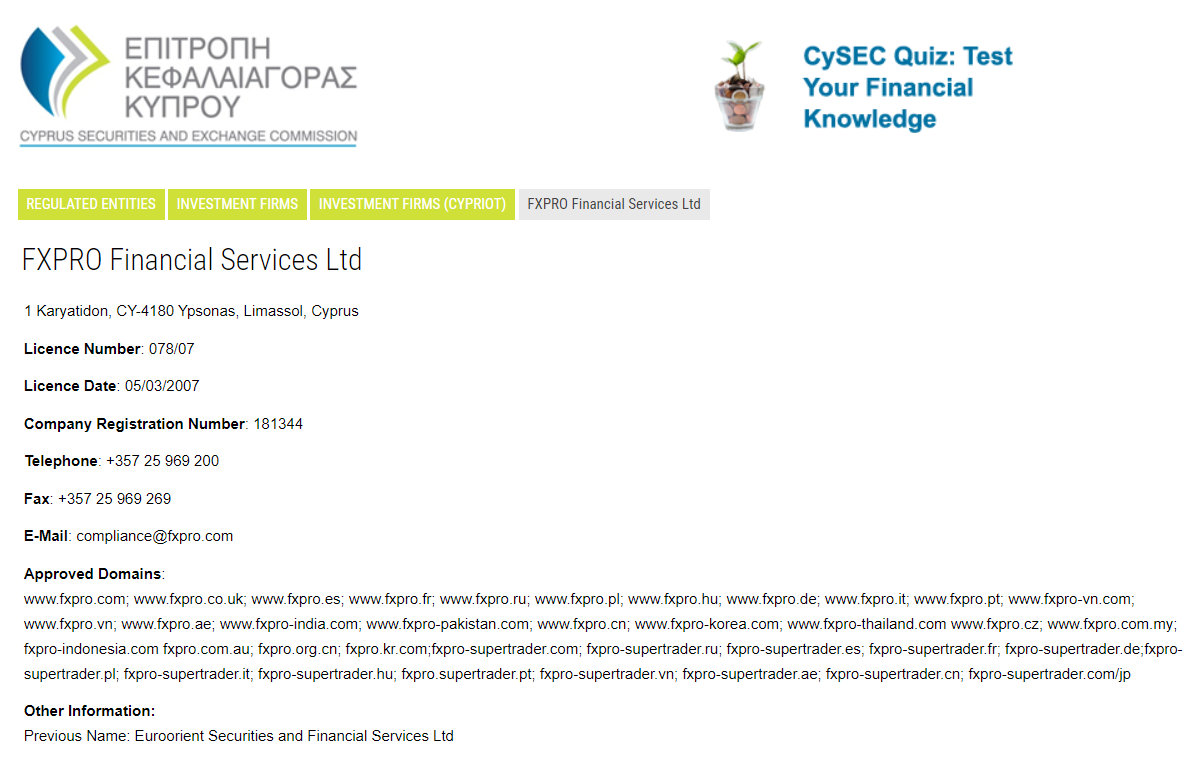

- CySEC of EU: FxPro is regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 078/07 as a legal entity FxPro Financial Services Ltd. The CySEC license was acquired by FxPro in 2007. It grants financial firms permission to operate in the European Union.

The FSCA regulatory license makes FxPro safe for traders residing in South Africa. It has a good track record since its inception in 2006. FxPro is an STP broker with no dealing desk. It does not take the opposite side of the positions opened by the traders. FxPro is not listed on any stock exchange but can be trusted due to FSCA regulations.

FxPro Fees

FxPro does offer multiple account types with different fee structures. The fee pattern slightly differs with the account type and trading platform chosen by the trader. We have separately reviewed each component of fees at FxPro. Following are the common methods in which CFD brokers generally charge their clients.

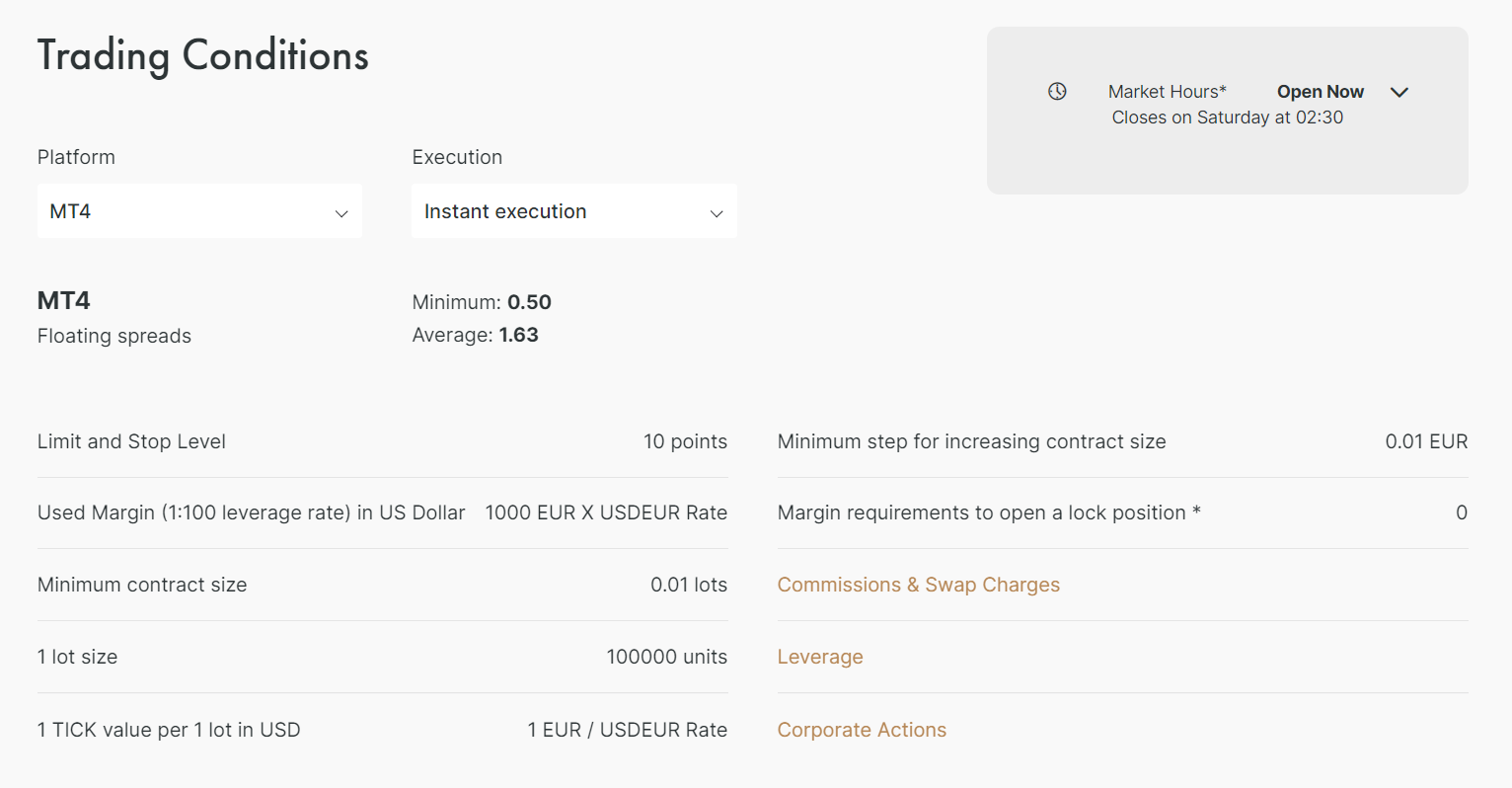

- Spread: The spreads at FxPro are slightly higher than the average of FSCA-regulated brokers in South Africa. We also found that the spreads at FxPro are different with each trading platform.

The average typical spread on EUR/USD with the MT4 platform is 2.3 pips while the same with the MT5 platform is 2.0 pips. The best spreads are offered with the cTrader platform i.e. 0.46 pips on average for EUR/USD. However, trading with the cTrader platform also involves a trading commission.

The following table describes the spread incurred for different instruments at FxPro in South Africa.

Trading Instrument Average Spread with MT4 Account Average Spread with MT5 Account Average Spread with cTrader Account EUR/USD 2.3 2.0 1.09 GBP/USD 2.9 2.54 1.6 Gold/USD 31.55 75 10.22 US Crude Oil 39.37 225 39.37 US Tech 100 167.14 350 142.14 BTC/USD 9900 9900 9,233.11 GER40 170.36 350 196.89 UK100 180.58 230 174.67 USA30 228.56 300 215.80 USA500 87.92 150 75.78 FxPro also offers fixed spread accounts and commission-based Raw accounts with the MT4 platform.

The fixed spread account on MT4 involves an average spread of 1.8 to 2 pips on EUR/USD which is higher than the average spread on the vanilla MT4 account. - Trading Commission: The trading commission is incurred only on the cTrader platform account type. No trading commission is incurred with MT4 and MT5 trading platforms.

The trading commission with the cTrader platform is $3.5 per standard lot of USD traded depending on the quote currency traded.This means that if 1 standard lot of GBP/USD is traded with the cTrader platform the commission will be $4.59.

- Swap Fees: The swap fees at FxPro are slightly lower than the majority of CFD brokers in South Africa. It is only applicable when a position is kept open overnight. The swap fees for each instrument can be calculated using the calculator available at the official FxPro website and application.

- Non-Trading charges

FxPro does not incur deposit and withdrawal fees for any of the supported methods. They do charge an inactivity fee of $5 per month if no trades are executed for 3 consecutive months.

Following table compares the trading commission on the commission based account types with popular brokers in South Africa.

| Broker Name | Commission for Single Side Trade | Commission for a Round Trade |

|---|---|---|

| FxPro | $3.5 | $7 |

| HFM | $3 | $6 |

| IG Markets | $3.5 | $7 |

| Tickmill | $2 | $4 |

| FXTM | $2 | $4 |

| FBS | $10 | $20 |

| IC Market | $3.5 | $7 |

| Pepperstone | $3.5 | $7 |

Following table compares the inactivity fees at popular forex and CFD brokers in South Africa.

| Broker Name | Inactivity Period | Monthly Inactivity Fees |

|---|---|---|

| FxPro | 3 Months | $5 |

| HFM | 6 Months | $5 |

| FXTM | 6 Months | $5 |

| Tickmill | NA | NA |

| Pepperstone | NA | NA |

| Plus 500 | 3 Months | $10 |

| IG Market | 2 Years | $10 |

Overall, according to our analysis and comparison, FxPro offers multiple pricings structure but it is not the most cost-efficient broker in South Africa. Brokers with FSCA regulation and STP execution with MT4, MT5, and cTrader platforms like Pepperstone and IC Markets incur slightly lesser fees compared to FxPro.

IG Markets Account Types

FxPro offers multiple account types with different pricing structures. However, apart from the trading platform and pricing, there is no major difference between account types.

The MT4 trading platform offers floating, fixed and Raw spreads while the MT5 only involves floating spreads. The cTrader platform involves spreads as well as commissions.

ZAR is supported as the base currency of the account along with EUR, USD, GBP, AUD, CHF, JPY, and PLN.

The maximum leverage on forex pairs is 1:200 in South Africa. The max leverage on CFDs of indices, metals, and commodities is 1:50. Shares CFD can be traded with 1:25 leverage while CFDs of cryptocurrencies can be traded with a 1:20 leverage ratio.

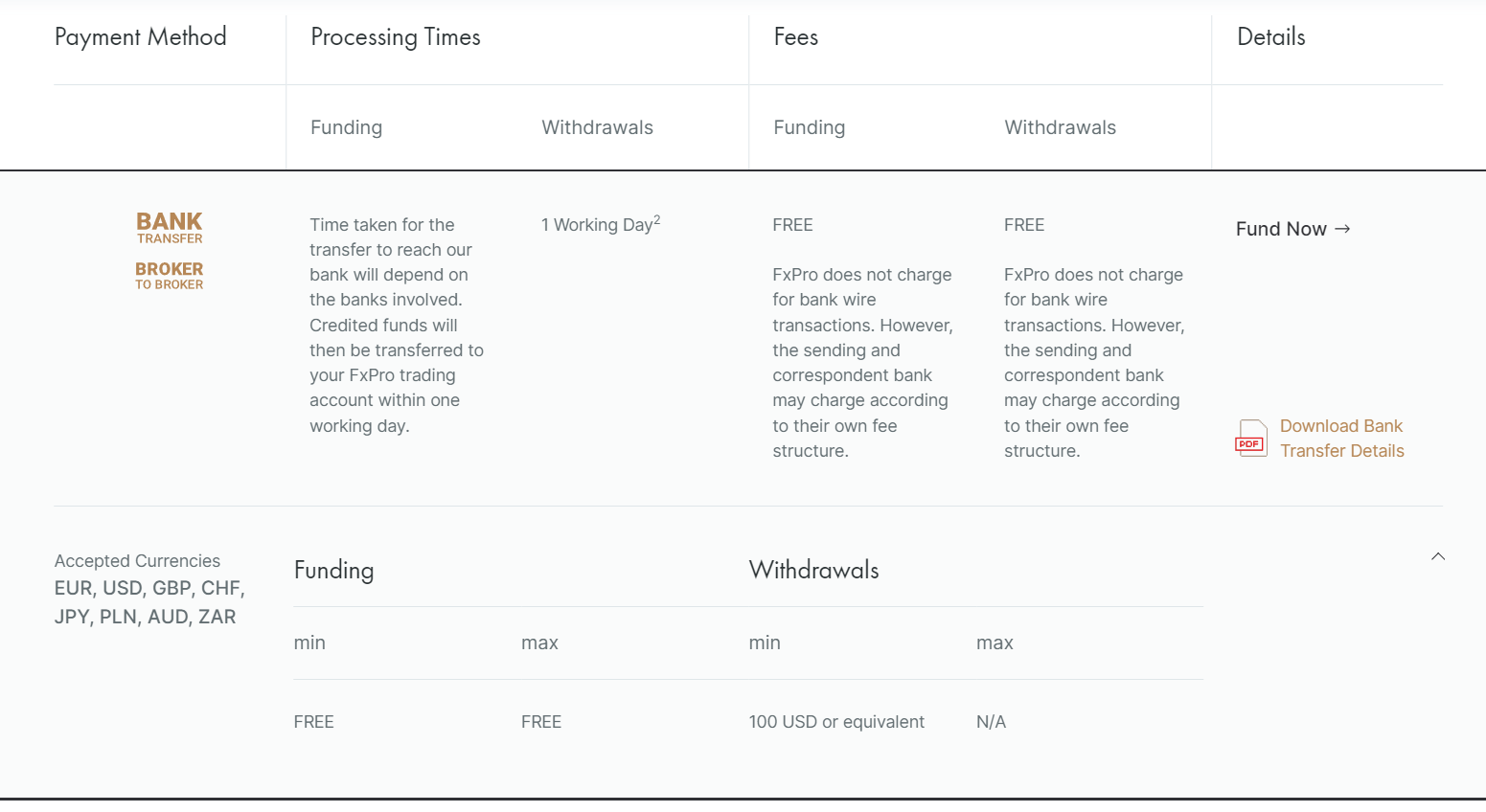

FxPro Deposits and Withdrawals

FxPro offers free-of-cost deposits and withdrawals through multiple methods. The minimum deposit amount is $100 or its equivalent in ZAR i.e. ~ R1700. However, the broker recommends depositing $1000 or R17000 to avoid the auto-closing of a position.

Following are the methods that be used to deposit and withdraw at FxPro in South Africa:

- Bank Transfer: Local bank transfer is the most convenient method for most traders in South Africa. The deposits as well as withdrawals through bank transfer will be processed within 1-3 working days at FxPro in South Africa. For international bank accounts, the bank may incur additional processing fees but FxPro does not charge anything.

- Credit/Debit Cards: The deposits through credit/debit cards are much faster than bank transfers and are processed within 10 minutes. Withdrawal may take 1-3 working days to reflect in the bank account.

- E-Wallets: PayPal, Skrill, and Neteller are the available e-wallets that can be used to deposit and withdraw funds at FxPro in South Africa. The deposits are processed within 10 minutes while withdrawals can take up to 24 hours.

The deposits and withdrawals at FxPro are convenient for South African clients. However, the broker lacks cryptocurrency deposits and withdrawals.

FxPro Research and Education

FxPro’s educational materials are somewhat basic, making it a decent spot for newcomers to start learning about the trading world. They offer an assortment of articles and a few videos that cover the essentials of Forex trading, different trading approaches, and how to manage risks, all of which are great for those just dipping their toes into trading.

On the flip side, FxPro really shines with its research tools and trading platforms. They’ve got something for everyone – from FxPro Edge with its sleek design and user-friendly features for those who prefer a straightforward approach, to the more robust MetaTrader 4 and 5 for traders who like to dive deep with copy trading and automated strategies.

FxPro Edge stands out for its ease of use and flexibility, allowing you to trade directly from your browser and customize it to your liking. Meanwhile, MetaTrader 4 is the go-to for more technical traders, packed with advanced features and detailed charting capabilities.

FxPro Customer Support

The customer support services at FxPro are decent and are not available on weekends. Clients can reach out to the support staff at FxPro through the following methods.

- Live chat: The live chat window at FxPro is useful to resolve queries but the response time is higher than the majority of CFD brokers. We raised multiple queries at different times of the day and received a relevant response in 15-20 minutes on average.

- Email Support: Clients can write to [email protected] to resolve their queries through email. Email support is useful when an exchange of documents or written proof is required. They generally respond within 24 hours.

- Phone Support: FxPro does not offer local phone support in South Africa. Clients can either call on their international helpline number or request a callback through their official website and application.

The customer support service at FxPro is useful. However, the response time is slower than the majority of FSCA-regulated brokers in South Africa. The unavailability of local phone support can be an issue for South African traders.

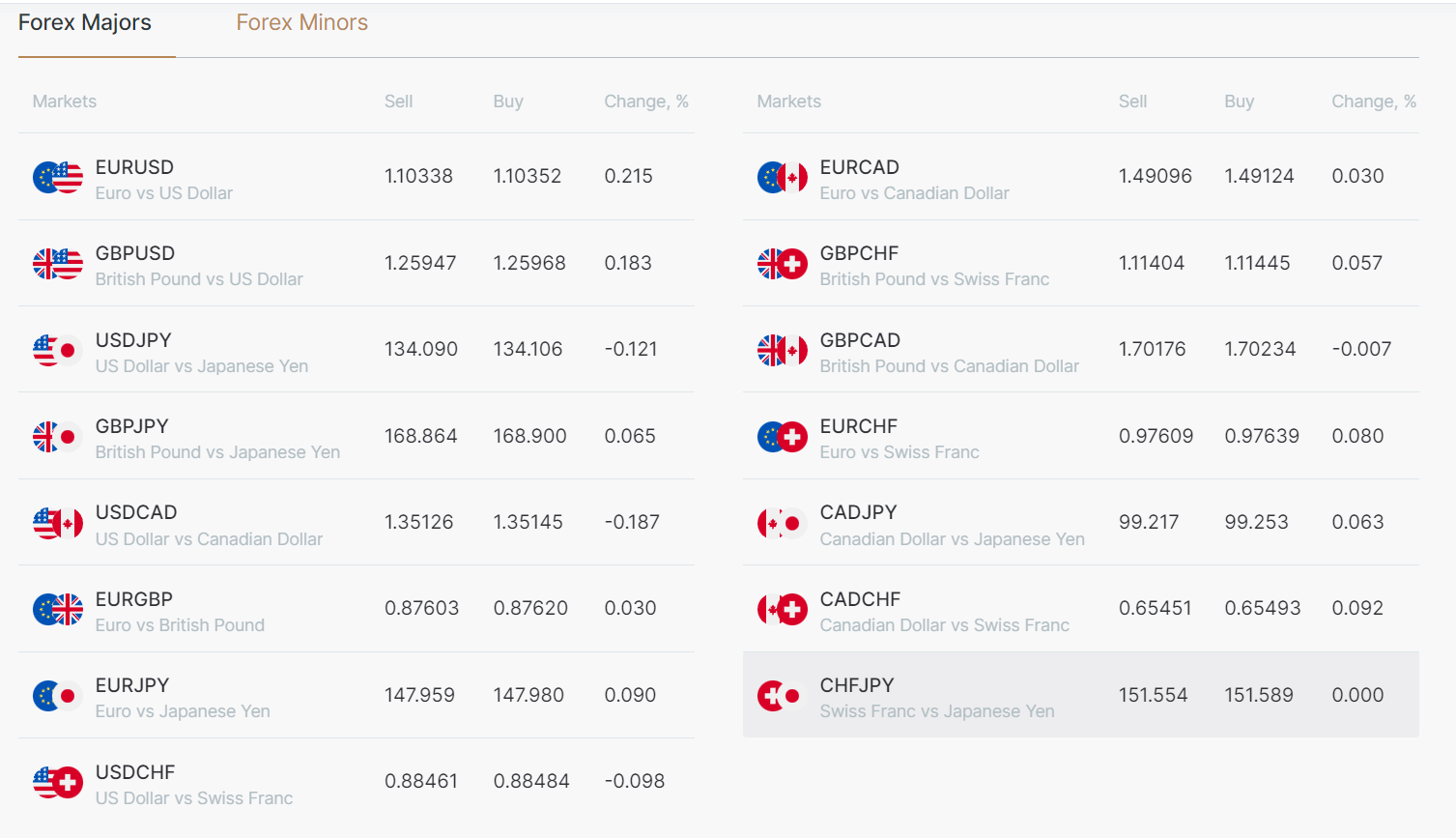

Available Instruments

Following are the details of instruments that can be traded at FxPro in South Africa. It must be noted that FxPro is a CFD broker and all the instruments are only available as CFDs. There is no physical buying and selling of the underlying instruments, only the price difference between opening and closing positions is settled with cash.

- 70 Currency Pairs: FxPro offers trading 70 forex pairs including major and minor pairs with a maximum leverage of 1:200.

18 Indices CFD: Major stock indices from different top markets of the world can be traded at FxPro as a CFD with a maximum leverage of 1:50. - 2000+ Shares CFD: Shares can be traded without commission (spread-based trading) as a CFD at FxPro in South Africa with a maximum leverage of 1:25.

- 12 Metals CFD: Precious metals including gold, palladium, silver, etc can be traded with a maximum leverage of 1:50 at FxPro

- 3 Energy CFD: Clients can trade on WTI Oil, Brent Oil, and Natural Gas on the spot market as CFDs with a maximum leverage of 1:50.

- 8 Cryptocurrencies CFD: Some of the most traded cryptocurrencies with high liquidity are available to be traded at FxPro only as a CFD with max leverage of 1:20. The leverage on crypto CFD is higher than the majority of CFD brokers.

Overall, the variety of available instruments is excellent at FxPro with good choices of leverage ratio. The number of available instruments is not the highest but excellent in South Africa. All the instruments are available with all three trading platforms namely MT4, MT5, and cTrader.

Do We Recommend FxPro

Yes, FxPro is an FSCA-regulated CFD broker in South Africa that is also regulated by the FCA of the UK. It offers a good variety of pricing structures with attractive pricing. It is a non-dealing desk broker that supports MT4, MT5, as well as cTrader trading platforms.

ZAR is supported as base currency and local bank transfers are also available at FxPro. However, it does not offer the best pricing in South Africa but offers a variety of pricing structures. The unavailability of local phone support is a disadvantage but overall, FxPro can be a good choice to trade forex and CFDs for suitable traders.

IG Markets South Africa FAQs

Is FxPro a trusted broker?

Yes, FxPro is an FSCA-regulated and authorised broker in South Africa. The broker holds the FSCA license to offer leveraged derivative instruments and CFDs in South Africa. FxPro is also regulated by FCA of the UK which is another top-tier regulatory authority.

How long does FxPro withdrawal take?

The withdrawals through local bank transfers and credit/debit cards can take 1-3 days to reflect in the bank account. Withdrawals through e-wallets like PayPal, Skrill, and Neteller are generally completed within 24 hours.

How much is the minimum ZAR deposit for FxPro?

The minimum deposit amount at FxPro in South Africa is R1700 or $100 equivalent in ZAR. However, the recommended deposit amount by the broker is R17,000 or $1000.